2017 : Larry Fink (BlackRock) qualifie le bitcoin d'"indice du blanchiment d'argent"

— Raphaël Bloch 🐳 (@Raph_Bloch) August 6, 2022

2022 : BlackRock va permettre à ses clients d'investir dans les cryptomonnaies

A

A

BlackRock sees Bitcoin as gold

Fri 07 Jul 2023 ▪

10

min read ▪ by

Invest

▪

Invest

It’s not the first time that financial giants have made optimistic statements about bitcoin. But this time, the CEO of the world’s largest asset management company openly declared his preference for bitcoin “over investing in gold, […] bitcoin is an international asset”. In the wake of this statement, bitcoin is on the verge of a bull market. As stock market indices consolidate, bitcoin is on its highest levels of the year. But is bitcoin “digital gold”? And what are the aims of this financial giant?

Machination or conviction?

In 2017, Larry Fink, CEO of BlackRock, declared that bitcoin was a money-laundering tool. This is in stark contrast to his recent comments. In addition, BlackRock had made indirect investments in the cryptocurrency. In particular, the company had invested $24 million in FTX. A brilliant failure… From now on, BlackRock’s repeated comments show a clear stance towards cryptocurrencies. This position has been welcomed by the market.

I think the role of cryptos is to digitize gold, in many ways. Instead of investing in gold as a hedge against the onerous problems of a particular country. Let’s be clear: bitcoin is an international asset.

Larry Fink (2023)

This statement also comes on the heels of BlackRock’s announcement that it intends to create a bitcoin ETF. However, this proposal requires the approval of the SEC. But it is clear that this opening up in management would have a considerable impact for finance and cryptocurrencies.

In December 2022, BlackRock’s CEO also declared: “I believe the next generation for markets and next generation for securities will be tokenization of securities”. This is not a neutral statement. Indeed, some start-ups are already offering tokenization of bonds and other securities. The future of finance probably lies in Blockchain and the exchange of securities on a network of a different order. But the Blockchain network is not comparable in traditional finance to bitcoin, whose image is completely different.

Why bitcoin is and isn’t digital gold…

This is an important theoretical question. Indeed, bitcoin (BTC) is often represented by a gold coin. This gold coin bearing the bitcoin seal is indicative of the ambiguity in the public mind. Can bitcoin replace gold? What are the differences and similarities between the two assets?

What do gold and bitcoin have in common?

What gold and bitcoin have in common, at least in theory, is their “limited quantity”. Gold is available in limited quantities underground. Similarly, the quantity of bitcoins in circulation is limited and defined in advance.

Nevertheless, we’ve never mined as much gold as we do today. And we’ve never mined as few bitcoins as we do today. The quantity of gold available underground is difficult to estimate, and mining companies have significant production capacities. They account for 80% of supply. The limited quantity of the two assets is therefore an unjustifiable point in common.

On the other hand, the fact that both assets require regular mining is quite common. Mining defines the minimum price at which a unit can be sold, assuming that the quantity demanded exceeds the quantity offered.

Bitcoin velocity is often highest during bitcoin’s downtrends. This reflects the idea that the market is approaching the “right price”, or at any rate, the lowest price determined by the miners’ cost of production. Any sale below the production cost of BTC would lead to difficulties on the network, and thus ultimately to a systematic return to this level. The now negligible influence of miners is therefore not the cause of the high production cost.

In both cases, therefore, there is a link between the cost of mining and the price observed over the long term.

Differences between Gold and Bitcoin

Nevertheless, bitcoin is still too closely correlated with stock market indices to be “independent”. Our last article clarified the following.

The correlation between bitcoin and the indices persists over time, as the speed of bitcoin’s circulation evolves according to the phases of the market. In other words, as long as bitcoin remains speculative (subject to frequent trading), the role of liquidity is central, and the correlation with indices remains very high. Conversely, the gold price shows a lower correlation to indices, as its velocity also seems lower.

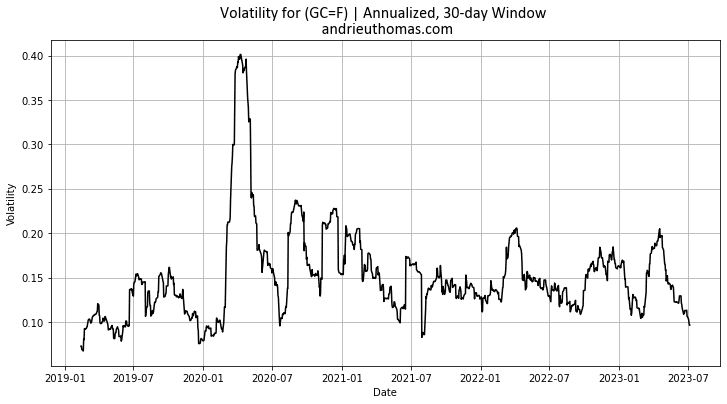

Although the price of gold is correlated with the indices, the level of correlation is lower than that of bitcoin over the long term. Consequently, in addition to being highly volatile, bitcoin is also highly sensitive to liquidity. In fact, the average volatility recorded for bitcoin is 53% since 2019. This compares with 15% for gold over the same period. In other words, bitcoin is 3.5 times more volatile than gold!

It follows that it’s unreasonable to regard bitcoin as a stable investment. It’s a conviction stock. The instability of bitcoin, and its high correlation with indices, means that it is divergent from the case of gold. Finally, gold has been around for thousands of years.

Gold is no longer an exchange value

If gold was the basis of the international monetary system, it has not been since 1971. This means that prices are no longer expressed or pledged in gold. Moreover, gold is no longer a medium of exchange, either between individuals or between nations that used to balance their trade. It is now perceived as a store of value, rather than a medium of exchange. In contrast, bitcoin is used as a medium of exchange.

This difference in the ownership of the two assets is reflected, as we have shown, in the statistics. In this respect, gold is a precious metal, which is even used (in part) for productive purposes. It is therefore completely devoid of any exchange purpose in the 21st century.

Bitcoin’s circulation speed is decreasing

The evolution of bitcoin’s circulation speed speaks directly to the question of whether bitcoin is a store of value or a medium of exchange. In a previous article, we estimated that in 2022, one bitcoin was exchanged on average 0.66 times. This figure is lower than the period 2010-2018, when the average bitcoin velocity was 1.4.

We will therefore specify that around 330,000 bitcoins were mined in 2022. At the same time, there was a global annual volume of $357.5 billion exchanged in bitcoins. With an average price in 2022 of $28,200, we deduce that the approximate number of bitcoins traded is 12.6 million. This means that bitcoin’s velocity will be close to 0.66 in 2022! In other words, bitcoin’s velocity is lower than that of traditional currencies.

Cointribune

While bitcoin’s reserve value is increasing, i.e., its volatility is decreasing, its exchange value remains significant.

The risk of bitcoin being speculative, not operative…

How can bitcoin (BTC) be useful for trading if bought via an ETF?

This is the question and the paradox behind the desire to create a bitcoin ETF. Indeed, bitcoin is intended to be outside the financial system (at least in principle). So, a priori, it makes no sense to buy bitcoin via an ETF. What’s more, if bitcoin is purchased via a financial product’s vehicle, then it no longer has any effective use. This is the risk of having a bitcoin devoid of its original meaning.

Consequently, BlackRock’s desire to democratize bitcoin is not consistent with bitcoin’s purpose. Nor are recent declarations to “replace” gold with bitcoin realistic. Bitcoin is undeniably distinct from gold, and neither history nor statistics bring them together.

On the other hand, the statement that “bitcoin is an international asset” is justified. Nearly 500 million people were using cryptocurrencies in 2022. In fact, cryptocurrencies are widespread in most countries around the globe. This is one of the reasons behind bitcoin’s success… It’s an international asset, a medium of exchange with no political or national label! Nevertheless, BlackRock’s boss seems more concerned about the democratization of bitcoin than its adoption. The nuance lies in the use to which bitcoin is put. A non-operational bitcoin would be the death of bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.