The BRICS alliance is preparing their "Rio Reset" this July – exactly the challenge to dollar hegemony I've been predicting.

— Ron Paul (@RonPaul) June 3, 2025

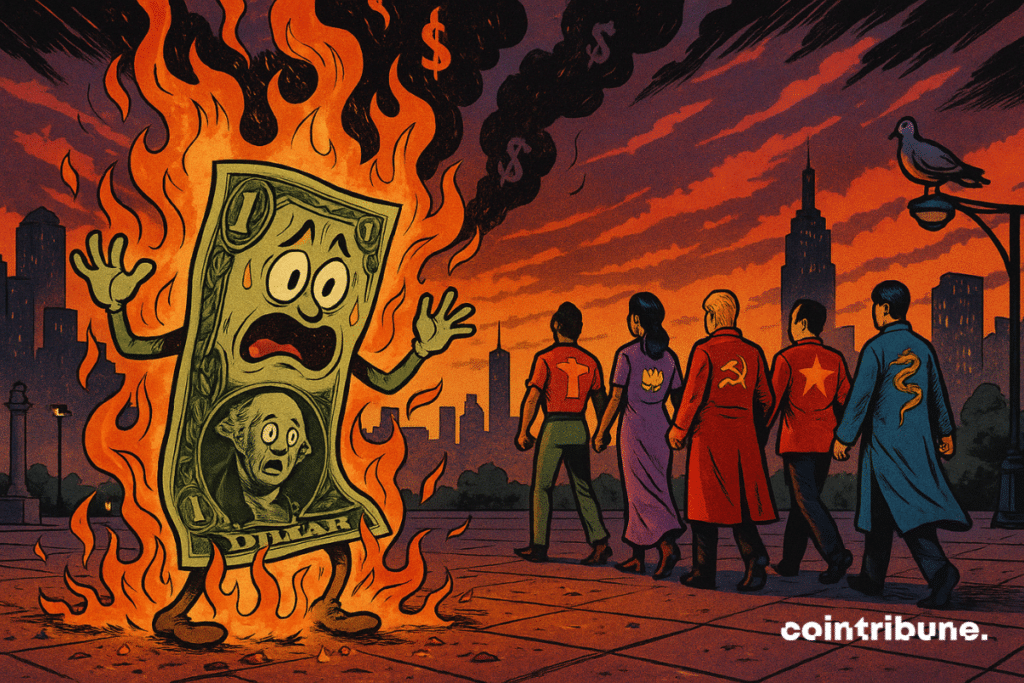

When fiat money faces competition, Americans discover the true cost of endless money printing.

Learn more from our sponsors: https://t.co/ix82exybbN

A

A

BRICS’ Rio Reset Challenges US Monetary Leadership

Tue 10 Jun 2025 ▪

5

min read ▪ by

Getting informed

▪

Payment

Summarize this article with:

As the BRICS summit in Rio approaches, Ron Paul sounds the alarm: a monetary shift is underway. The lawmaker mentions a “Rio Reset”, a coordinated offensive by emerging economies to marginalize the dollar in global trade. Behind this statement lies a broader dynamic: that of a multipolar financial order in the making. As monetary tensions intensify, the initiative led by the BRICS could hasten a paradigm shift with global consequences.

In Brief

- Ron Paul warns of a major BRICS initiative aimed at weakening the global dominance of the US dollar.

- The July 2025 BRICS summit in Rio de Janeiro could mark a turning point in the international monetary order.

- Ron Paul sees in this movement a systemic risk for the United States and a direct threat to the purchasing power of American citizens.

- In response to this development, Ron Paul recommends turning to gold as a safe haven against monetary erosion.

The “Rio Reset” : a direct challenge to the dollar’s dominance

As the BRICS accelerate their transition to local currencies, former US Congressman Ron Paul shook the global financial scene on June 3 by announcing on X (formerly Twitter): “the BRICS bloc is preparing its Rio Reset for July, exactly the kind of challenge to dollar hegemony I have predicted for years“.

Behind this term lies an initiative led by the BRICS group, which aims to initiate a transformation of global trade rules.

This strategy is expected to be unveiled at the summit planned in Rio de Janeiro on July 6 and 7, 2025, and aims to significantly reduce the use of the US dollar in international trade. According to Ron Paul, this initiative could challenge a monetary order based on the greenback for nearly eight decades.

The main outlines of the project, already sketched by the bloc’s leaders, show a clear desire to promote monetary sovereignty and rebalance global economic power relations :

- The central objective : to free BRICS trade from dependence on the dollar, favoring the use of national currencies ;

- The current state : according to Moscow, more than 65 % of intra-BRICS trade is now conducted in local currencies, compared to about one-third in dollars;

- The official position : BRICS do not currently envisage creating a single currency, but rather strategic coordination to strengthen their financial autonomy;

- The motivations : emancipation from geopolitical control instruments such as the SWIFT system or economic sanctions imposed through the dollar ;

- The summit leadership : Brazil, host of the meeting, would be at the forefront to orchestrate this “Rio Reset”, alongside China and Russia.

In a note published on Birch Gold Group, Ron Paul states: “In July, the nations of the BRICS will reveal their most ambitious plan to date : to create an alternative to the dollar-based financial system“.

This approach fits into a global dynamic of contesting the post-Bretton Woods financial order, without proposing a sudden rupture.

Ron Paul warns against a dollar crisis and a return to gold

In his statements, Ron Paul does not simply describe a geopolitical shift : he sees a systemic break, similar to the one that saw the British pound give way to the dollar after World War II.

He alerts to the internal repercussions that a loss of reserve currency status could cause : “When fiat currency is put into competition, Americans discover the true cost of endless money printing“.

He particularly fears a deterioration of purchasing power, erosion of savings, and instability of pension funds and social benefits in the United States.

Facing what he perceives as an imminent monetary crisis, Ron Paul returns to a historical spearhead : gold. According to him, central banks worldwide have anticipated this movement by increasing their gold reserves, which would reflect a growing loss of confidence in the dollar.

In this context, he encourages individuals to consider diversifying their assets through physical assets considered more stable, such as gold, which he describes as a “honest, real currency that cannot be manipulated or devalued“. He specifically mentions converting retirement accounts to gold-backed vehicles as a precautionary measure.

This gradual shift away from the dollar could also reinforce dynamics already at work in the crypto ecosystem. If the BRICS move away from the dollar system and the SWIFT infrastructure, digital currencies, particularly stablecoins and bitcoin, could benefit from a decentralized multipolar exchange space.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.