Chainalysis Report: AI Is Fueling a New Era of High-Impact Crypto Scams

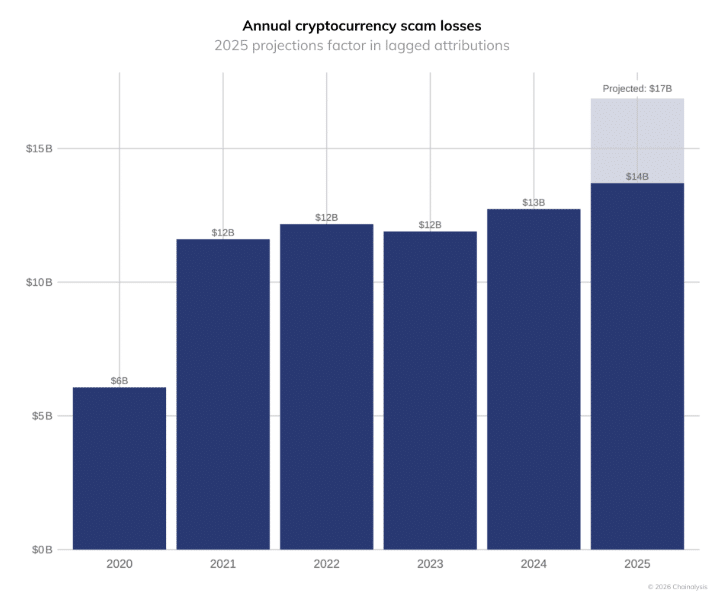

Crypto scams reached a new level of speed and scale in 2025 as artificial intelligence tools made fraud more convincing and harder to detect. A new report from blockchain analytics firm Chainalysis shows that scammers are stealing more money per victim while running cheaper and wider operations. Losses tied to crypto scams are now estimated at $17 billion for the year, the highest level ever recorded.

In brief

- AI-driven crypto scams now steal far more per victim, with average losses jumping 253% as automation boosts speed and credibility.

- Deepfakes and impersonation scams surged in 2025, helping criminals scale trust-based fraud across thousands of targets at once.

- Romance and pig-butchering scams remain the most damaging, extracting higher payouts by trading speed for long-term victim trust.

- Scammers increasingly avoid exchanges, using DeFi tools and AI-assisted identity fraud to move and cash out stolen crypto faster.

Chainalysis Finds AI-Linked Scams Earn 4.5x More Than Traditional Schemes

According to Chainalysis, the growth came not just from more scams but also from stronger execution. Average scam payments jumped to $2,764 in 2025, up from $782 in 2024, a 253% increase. Faster outreach, realistic impersonation, and automated messaging helped criminals collect larger sums in less time.

Eric Jardine, Head of Research at Chainalysis, said AI has changed how quickly scams gain traction. More than 70% of AI-enabled scams now sit in the top half of all crypto scams by transfer volume. Operations grow faster, look more credible, and extract more money from each interaction.

Scams connected on-chain to AI service providers earned an average of $3.2 million per operation. That figure stands roughly 4.5 times higher than scams without such links. Many of these schemes rely on face-swap software, deepfake videos, and language models sold by vendors in China, often marketed through Telegram channels.

Believability plays a central role. Once victims see familiar faces or figures of authority, trust rises. Criminals then scale these interactions across thousands of targets at once. Government impersonation scams show how effective this approach has become. Schemes using fake images or videos of officials grew more than 1,400% during 2025, with criminals posing as workers from public agencies, banks, and crypto platforms.

Romance Scams Still Deliver the Biggest Losses in Crypto Fraud

One of the largest phishing campaigns targeted U.S. residents with fake E-ZPass toll alerts. Chainalysis traced the operation to a Chinese group known as “Darcula,” also called the “Smishing Triad.” At peak activity, scammers sent as many as 330,000 text messages in a single day. Despite the scale, infrastructure costs remained low, with phishing kits likely priced below $500.

Different scam types balance reach and trust in distinct ways:

- High-volume phishing relies on cheap automation and broad targeting.

- Deepfake impersonation increases trust and payment size.

- Relationship-based scams trade speed for higher payouts.

- AI tools reduce time spent per victim.

- Low operating costs widen profit margins.

Long-running fraud schemes known as “pig butchering” remain among the most damaging. In these cases, scammers build personal or romantic relationships over weeks or months before encouraging victims to send increasing amounts of cryptocurrency. The name comes from the practice of slowly “fattening” victims before draining their funds.

Such scams often steal far more per victim than quick-hit giveaways or fake airdrops. Jardine noted that scammers constantly weigh scale against believability. Short scams reach more people, while relationship scams extract deeper losses from fewer targets.

One recent case shows how convincing these scams can be. In December, a woman in San Jose, California, used ChatGPT to confirm that a new romantic partner was part of a pig-butchering scheme. By that point, she had already lost nearly $1 million in crypto.

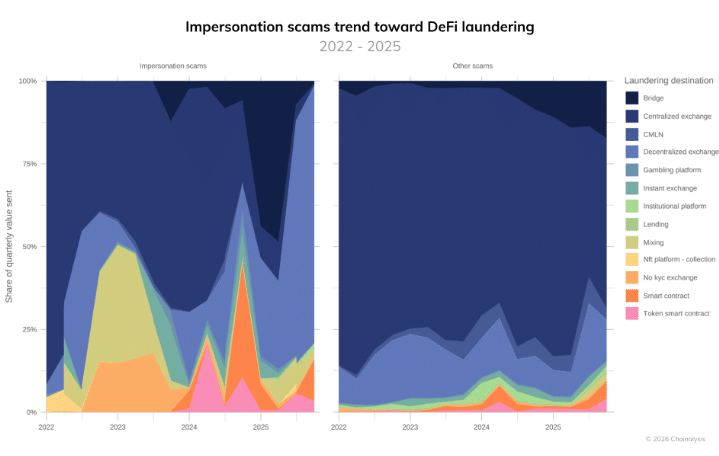

The movement of stolen funds is also changing. Many impersonation scams now avoid centralized exchanges and instead use decentralized exchanges, DeFi bridges, and on-chain protocols. Permissionless tools allow funds to keep moving with fewer checkpoints, making tracking and recovery harder.

Chainalysis: AI Is Reshaping How Crypto Scams Exit Into Fiat

AI still plays a limited role in on-chain transfers, where simple scripts often suffice. More advanced tools may instead appear at the final cash-out stage. Jardine said AI could help criminals create fake, KYC-ready exchange accounts in bulk, allowing smoother exits into traditional currencies.

Key trends shaping scam operations include:

- A shift from centralized exchanges to DeFi tools.

- Wider use of automation for fund movement.

- AI-assisted identity fraud at cash-out stages.

- Lower barriers to entry for large campaigns.

- Faster recycling of stolen assets.

Behind many of these scams lies a growing human cost. Across parts of Myanmar and Cambodia, scam compounds have turned pig-butchering into an industrial operation. Victims of human trafficking are often forced to run scams under threat or violence, while stolen crypto is laundered into luxury goods.

Chainalysis said recent enforcement actions show how deeply these schemes connect to organized crime. In December, the U.S. Department of Justice moved to shut down domains linked to a major scam compound in Myanmar. Authorities described networks that exploit both financial victims and trafficked workers.

As AI tools become cheaper and more accessible, Chainalysis warns that scam efficiency will continue to rise. Without stronger detection, user education, and cross-border enforcement, crypto fraud is likely to remain one of the industry’s most costly threats.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.