Crypto: 80% Less Revenue for Pump.fun, Traders Are Worried

The leader in memecoin launches on Solana is shaky. In July 2025, Pump.fun recorded its lowest monthly revenue of the year! A tangible sign of investor disengagement and a broader exhaustion in the crypto ecosystem.

In brief

- Pump.fun sees its monthly revenues drop from 130 million $ to 24.96 million $, an 80% decrease in six months.

- The number of active crypto traders falls by 62%, while LetsBonk takes the lead in the market.

- Memecoin market capitalization drops from 85 to 65 billion $, a sign of a global sector slowdown.

Revenue in free fall: Pump.fun loses 80% of revenues

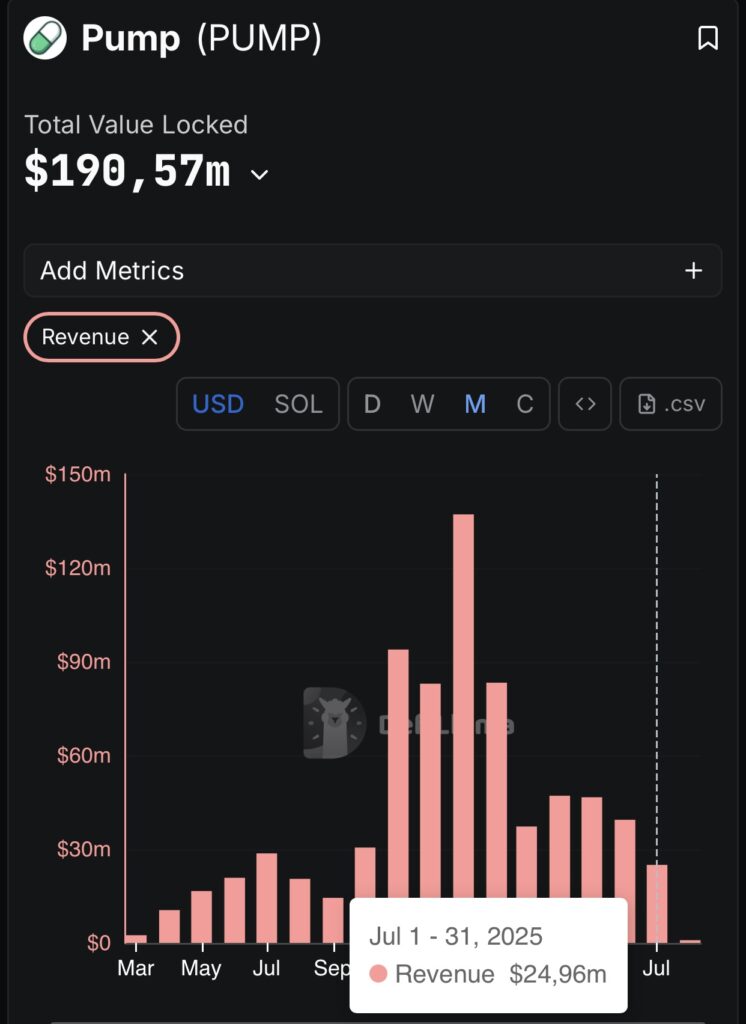

The Pump.fun platform, emblematic of the memecoin wave on Solana, saw its monthly revenue drop to 24.96 million dollars in July, compared to over 130 million dollars in January. This sharp decline represents an 80% decrease over six months, as shown by this crypto chart.

While the Total Value Locked (TVL) remains high at 190.57 million dollars, the contrast with revenue dynamics highlights a drastic drop in actual activity on the crypto platform. Pump.fun, designed to enable instant token creation, now struggles to convert this liquidity into real economic value.

Crypto users desert Pump.fun: LetsBonk takes the prize

Besides Pump.fun’s monthly revenues hitting their lowest since 2025, the number of active traders on the platform also plunged by 62%! A clear sign of growing disinterest in the crypto community. Conversely, the competing platform LetsBonk now attracts the majority of flows, generating up to 1.04 million dollars per day, double its rival.

This migration illustrates a common dynamic in the memecoin universe: loyalty is never guaranteed. The fashion effect, coupled with extreme crypto volatility, reshapes the market landscape in a few weeks. Tokenized communities, drivers of these shifts, now seem more mobilized by the promise of quick profits offered elsewhere.

Memecoins in crisis: capitalizations and volumes collapse

Beyond Pump.fun, the entire memecoin sector is slowing down. Total market capitalization dropped from 85 billion dollars to 65 billion dollars, while daily crypto transaction volume contracted by 67%. These numbers reflect a decline in engagement, or even saturation of the purely speculative model.

This Pump.fun setback contrasts with the resilience of more established assets like bitcoin, whose valuation rests on a logic:

- Scarcity;

- Security;

- Gradual institutional adoption.

Where memecoin seeks immediate mass-effect performance, BTC stands as a safe haven asset in the crypto universe. This maturity differential recalls that not all tokens play in the same league. One is a bet on collective attention, the other stands as a digital store of value.

Pump.fun is going through a downturn phase that raises the question of the sustainability of platforms founded on speculative enthusiasm. In a constantly evolving crypto market, the future of these ecosystems will depend on their ability to reinvent their value proposition, beyond memecoins and the buzz.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.