Crypto: What July's Flows Reveal About The Upcoming Explosion

The month of July 2025 shook the crypto universe with profound developments in legislative, technological, and macroeconomic domains. Between the breakthrough of stablecoins, the drop in bitcoin reserves, and the rise of tokenized assets, these five key facts summarize a strategic shift in the sector.

In brief

- The stablecoin market gained $4 billion in July after the adoption of the GENIUS Act in the United States.

- Bitcoin reserves on exchanges fell to 14.3%, reinforcing a bullish momentum.

- Tokenized real assets exceed $25 billion, driven by BlackRock, Franklin, and Ondo.

- Three US states passed pro-crypto laws; Arizona dropped a binding project.

- Seven countries, including Hong Kong and Germany, grant licenses to crypto companies.

A $4 Billion Influx Propels Stablecoins with the GENIUS Act

Let’s start this series with the adoption of the GENIUS Act in the United States, which triggered a capital influx into stablecoins. In July, the total market capitalization rose by $4 billion to reach $250 billion, marking a comeback of institutional players. Tether (USDT) and Circle (USDC) remain at the forefront, but giants like JPMorgan, WisdomTree, and BlackRock are preparing to launch their own regulated crypto issuers.

This framework mandates 1:1 reserves, mandatory audits, and federal licenses. Crypto is now aligned with banking standards, marking a transition towards a more mature market integrated into traditional finance. The digital dollar establishes itself as the pivot of the decentralized monetary system.

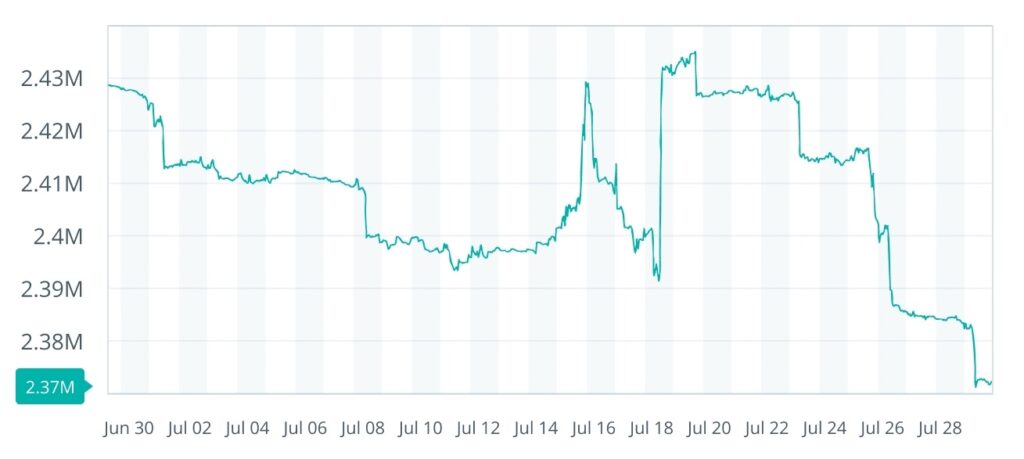

Bitcoin Reserves Collapse: A Confirmed Bullish Signal?

As shown by this graphical report on bitcoin reserves and stablecoins in July, data indicate a continuous 2% decline in bitcoin reserves on crypto exchange platforms. These decreases since January 2025 now reach 14.3% of the total supply, a historic low. This trend shows a massive withdrawal to personal wallets or cold wallets.

Generally, these movements are interpreted as bullish because they reduce the immediate liquidity available for sale. This may signal an anticipation of a price increase for BTC by long-term investors. Coupled with an increasingly limited supply due to halving, this dynamic strengthens the prospects of a bullish tension in crypto markets.

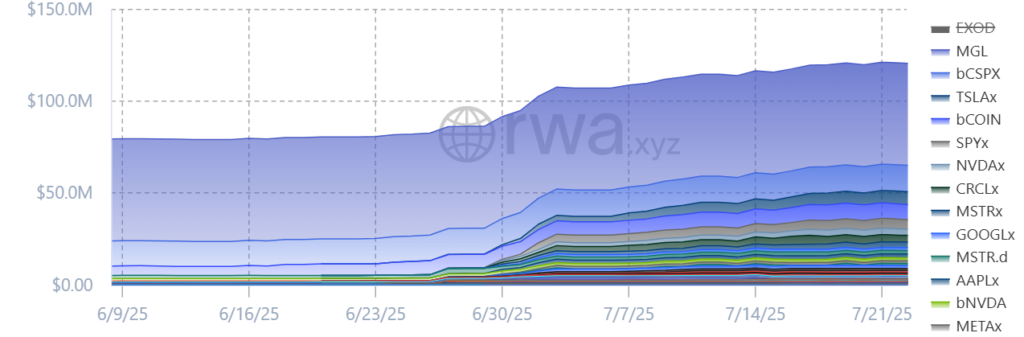

BlackRock and Franklin Bet Big: Tokenized Real Assets Explode

The tokenization of real-world assets (RWA) is experiencing explosive growth in the crypto sector. Indeed, this market now exceeds $25 billion with a 15% increase in July, driven by institutions such as:

- Franklin Templeton, with its tokenized fund shares on Ethereum;

- BlackRock, through its BUIDL fund backed by Treasury bonds;

- Ondo Finance, facilitating access to bond asset yields.

This rise signifies a turning point: crypto is no longer limited to native assets like BTC or ETH. It becomes a bridge between decentralized finance (DeFi) and traditional finance, facilitating liquidity, transparency, and portability of real-world assets.

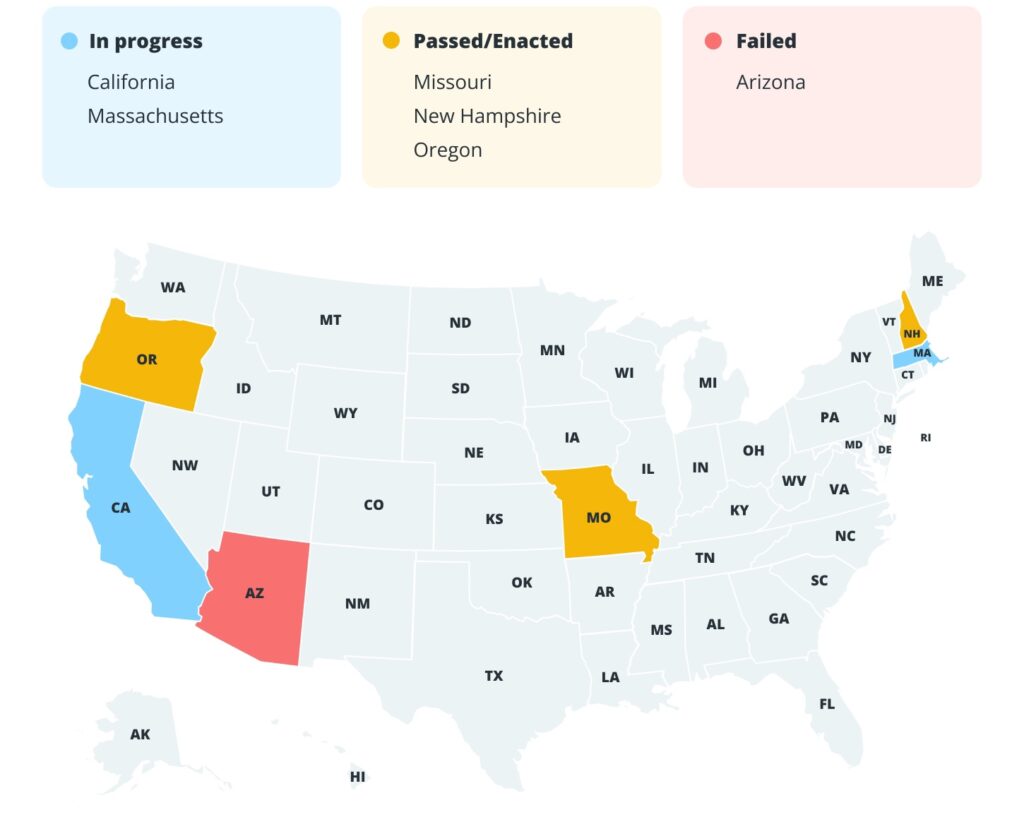

Crypto: 3 US States Accelerate While Arizona Slows Down

The US regulatory landscape is evolving rapidly. In July, three states — Louisiana, New Mexico, and New Hampshire — passed pro-crypto laws. These include:

- Tax exemption on income from staking;

- Legal recognition of smart contracts;

- Integration of blockchain into public services.

Conversely, Arizona abandoned a bill aimed at forcing banks to maintain physical reserves on crypto assets. This withdrawal was celebrated by local players as a victory against regulation seen as regressive. The federal dynamic remains fragmented, but the states’ interest in blockchain is evident.

Seven Countries Open Their Doors to Crypto Companies: The Global Rush

July also saw a wave of regulatory approvals in seven key jurisdictions. Crypto companies obtained licenses or authorizations in countries such as:

- Hong Kong: launches a registry for stablecoin issuers;

- France;

- Austria;

- Luxembourg: the new target of Ripple;

- Singapore: establishment of Bitstamp;

- United States;

- Germany: validates AllUnity.

This openness confirms that regulation is expanding beyond traditional strongholds. It creates a geopolitical domino effect where each state wants to attract talent, investments, and blockchain-related innovations. For crypto sector companies, these licenses are gateways to previously restricted markets. The sector’s internationalization is accelerating.

This July 2025 will remain a key milestone for crypto. With regulatory framework, institutional adoption through the record of 17 consecutive days of inflows into Ethereum ETFs, and global expansion, the industry is entering a new phase of structuring. The next cycle could very well be played on these foundations.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.