Crypto Fear and Greed Index plunges back to neutral levels https://t.co/UBTRORZfsh

— MindFrozenTime #BTC #Bitcoin (@mindfrozentime) January 15, 2024

A

A

Cryptos in Crisis? Investor Interest Wanes!

Mon 15 Jan 2024 ▪

3

min read ▪ by

Getting informed

▪

Trading

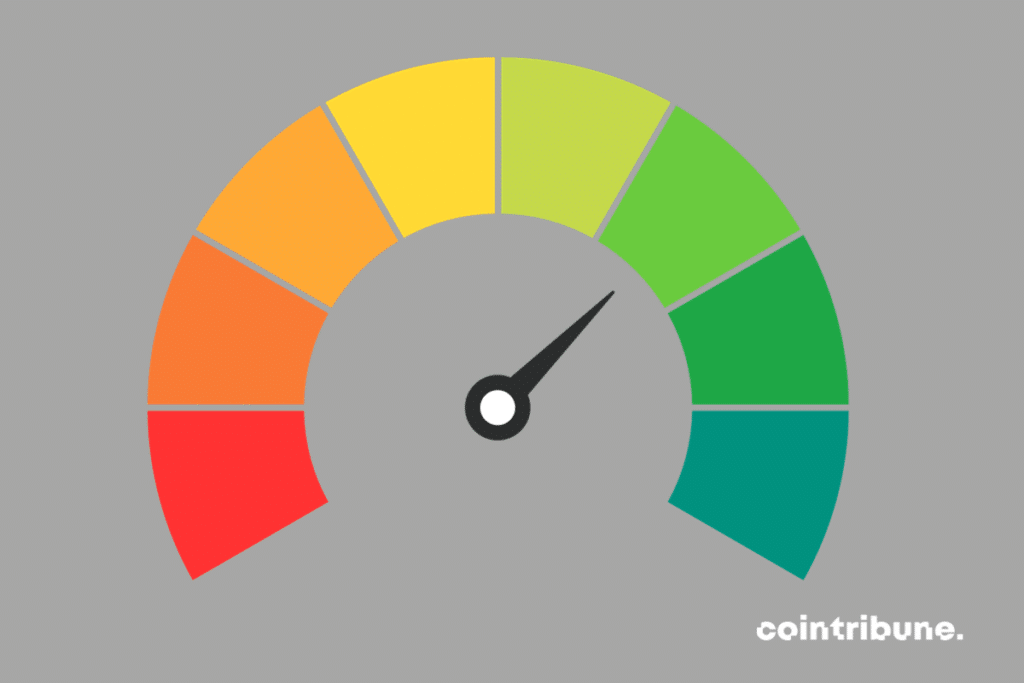

Thanks to the Crypto Fear and Greed Index, crypto analysts are able to gauge the market participants’ perceptions of the dynamics of this industry. The latest news indicates that this crypto indicator is showing unusually mixed performances.

The Crypto Fear and Greed Index and Market Perception

The Crypto Fear and Greed Index is a tool for assessing the crypto market’s perception. Indeed, it provides insights into the emotions of the market participants by assigning scores to reflect the level of fear or greed among investors.

It happens that according to recent information compiled on the matter, the Crypto Fear and Greed Index is at a neutral level. This represents a dynamic that has emerged after a significant recent drop in this indicator.

As reported by Alternative.me this Monday, January 15, the index has fallen to levels last seen in October 2023. This decline occurred just days after the approval of the first Bitcoin ETFs (BTC) in the United States.

Therefore, in the current market perception circumstances, the Crypto Fear and Greed Index is showing a score of 52 out of 100. This performance represents the lowest point reached by this indicator since October 19, 2023.

A Neutrality That Raises Questions?

It’s interesting to note that the index recently reached an extreme greed level of investors at 76 out of 100. This level was achieved while the market was eagerly awaiting the green light from the SEC for Bitcoin ETFs.

During this period, bitcoin (BTC) traded at an average daily price of about $31,000. Currently, the flagship crypto is trading at around $42,600 after a weekly decline of 3.15%.

Let’s specify that several key factors are taken into account when determining the Crypto Fear and Greed Index at any given time. Overall, there are six of these elements. These include market volatility and dynamics coupled with trading volume.

These indicators account for 25% each in determining the Crypto Fear and Greed Index. Social media activity (15%), survey data (15%), BTC dominance (10%) and trends (10%) also contribute to it.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.