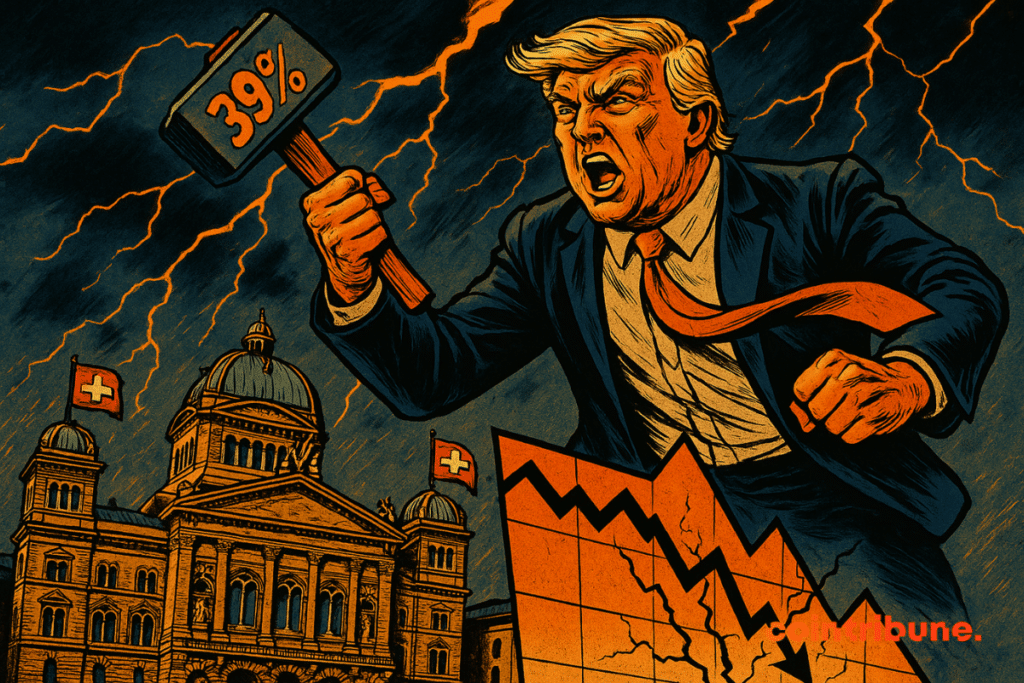

Donald Trump Unleashes Economic Shockwave on Switzerland with New Tariffs

In Bern, the announcement had the effect of a shock: Donald Trump hits hard by imposing 39% customs duties on Swiss products, relegating the Confederation to the status of an economic target. Citing an “intolerable” trade deficit, he accuses Switzerland of “stealing” from the United States. A frontal attack that shakes Swiss neutrality and plunges the government as well as the markets into uncertainty. But behind this brutal offensive, a question arises: how far will the economic war led by Trump go?

In Brief

- Trump imposes 39% taxes on Switzerland: a trade war shaking Europe.

- Neutrality trampled, markets shaken: Switzerland takes the Trump shock.

- This economic power play marks a harsh turning point in transatlantic relations.

Trump renews the trade war and Switzerland suffers

While his administration has just published a strategic report on crypto affirming its openness to innovation, Trump hits Switzerland with a customs attack, citing a trade imbalance of 40 billion francs. A decision that fits less into an economic logic than a protectionist retreat consistent with his nationalist rhetoric: no one is safe.

The Swiss reaction was quick. The Federal Council expresses its “deep regret” and tries to obtain a reprieve before the sanctions take effect, scheduled for August 7.

Meanwhile, Swiss companies are wondering: how to absorb a surcharge of such magnitude without losing their footing in the American market? This unilateral decision marks a new escalation in the trade crisis between Trump and Switzerland, whose stakes go far beyond the simple tariff dispute.

The first victims of the trade offensive launched by Trump are already appearing. In the front line, the watch industry, a national jewel, is preparing for a dark year. The 39% tax imposed by Trump on exports to the United States could wipe away months of post-Covid recovery.

Machine tool manufacturers are also sounding the alarm. Their margins, already fragile, risk collapsing under the pressure of Trump’s economic decisions. Finally, on the stock exchange, the reaction was immediate. From the opening, indices plunged 2%, a clear sign of market nervousness.

The economy under tension: the domino effect to expect

Behind this harsh measure lies a much larger risk. Switzerland, long supported by steady growth and strong exports, sees its economic model wobble.

Several economists are already sounding the alarm. Annual growth could drop from 0.3% to 0.6%. A hard blow for a country so dependent on the international scene. And if the pharmaceutical industry, still spared, were also to be affected, the contraction could rise to 0.7%, or even beyond.

What worries the most is the uncertainty. With Donald Trump, nothing is ever certain. A decision may fall on a simple whim, a statement enough to shake the markets. In this climate of permanent unpredictability, Swiss companies struggle to anticipate, to organize, and above all to protect their future.

Europe, although it threatens Washington with an unprecedented economic war, remains surprisingly silent. Yet the issue goes far beyond the bilateral framework. It raises an essential question: if Switzerland, neutral and conciliatory, can be treated this way, who will be next? The domino effect could well redraw the rules of international trade in the Trump style.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.