Family offices prefer AI over crypto, according to JPMorgan

Family offices are redefining their investment priorities. One figure stands out: 89% of them have no exposure to crypto, massively preferring artificial intelligence (AI). This trend reveals a growing gap between two worlds, one perceived as stable and promising, the other as speculative. Analysis of the challenges and opportunities for investors.

In brief

- 89% of family offices ignore crypto, favoring AI for its concrete applications.

- Average exposure to crypto remains low (0.4%), despite exceptions in Asia.

- AI is seen as a growth driver, while bitcoin remains a speculative or marginalized asset.

AI, the new star of family offices’ portfolios

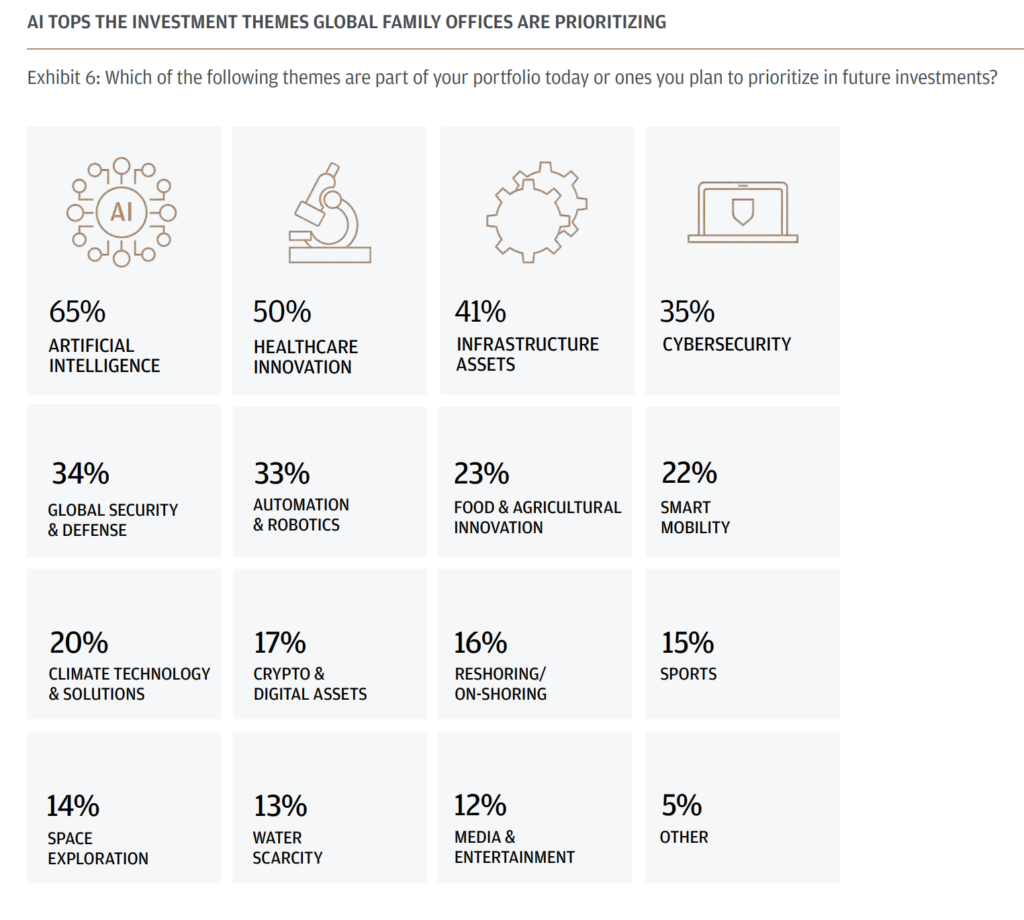

Artificial intelligence dominates the investment strategies of family offices. According to JPMorgan’s 2026 report, 65% of them already integrate AI into their portfolios, while 89% completely avoid cryptos. This preference is explained by AI’s ability to generate stable returns and provide concrete applications in key sectors such as healthcare, automation, and infrastructure.

Investments in AI-specialized startups are multiplying, with strategic partnerships between family offices and research laboratories. In Asia, players like SoftBank or Alibaba allocate billions to machine learning and data processing projects. AI is no longer an option but a central pillar of modern portfolios.

Crypto, a marginalized asset despite intact potential?

Despite its disruptive potential, crypto remains an underdog in family offices’ portfolios. With an average exposure of only 0.4%, it is largely outpaced by AI. Reasons? Persistent volatility, uncertain regulations, and persistent distrust from traditional investors. However, some Asian players, like VMS Group in Hong Kong, dare to invest up to 10 million dollars in crypto strategies.

Moreover, geopolitical risks and regulatory uncertainties slow down its adoption. In the United States and Europe, family offices prefer to avoid these assets, judged as too risky. In Asia, however, crypto is seen as a diversification opportunity, particularly against inflation and trade tensions.

Is bitcoin destined to sink against AI?

BTC, often presented as digital gold, struggles to convince. Despite technological advances such as the Lightning Network, its adoption remains limited. Family offices are surely waiting for signs of stability before engaging massively, currently preferring to bet on AI. If regulations clarify and institutional adoption accelerates, bitcoin could regain ground.

Central banks and states are already exploring digital currencies, which could legitimize crypto. In Asia, where financial innovation is strong, bitcoin could become a safe asset, complementary to AI. Experts remain divided. Some predict a gradual decline of BTC, stifled by AI’s rise. Others envision coexistence, where each asset would play a distinct role.

JPMorgan’s report confirms that crypto struggles to compete against AI’s momentum and now establishes itself as family offices’ preferred choice. Yet, technological and regulatory developments could reshuffle the deck. The question remains: can AI and crypto coexist, or is one doomed to overshadow the other?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.