Frenzy in the crypto market: the Greed Index reaches a historic peak!

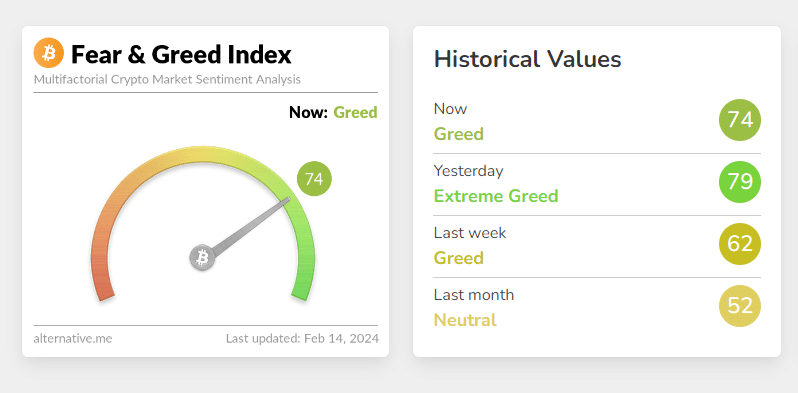

The Crypto Fear and Greed Index, which measures the sentiment of the crypto market, has reached its highest level since November 2021. This extreme greed reflects the optimism of investors regarding the continuous rise in prices but could also presage a future correction.

Euphoria Driven by Spot Bitcoin ETFs

The Crypto Fear and Greed Index attained a score of 79 on February 12th, its highest level since Bitcoin set its all-time high at $69,000 in November 2021. This score, labeled as the “extreme greed” zone, indicates that investors are highly optimistic about the continuation of the rising trend in the near future.

Several factors explain this spike in greed. On one hand, the price of Bitcoin has exceeded $50,000 and has shown a 13% growth since the beginning of the year. On the other hand, the launch of the first spot Bitcoin ETFs in the United States has had a significant impact.

These funds have attracted major financial actors like BlackRock and Fidelity, daily drawing the equivalent of 2,000 BTC according to their net accumulation statistics. This influx is particularly welcome in light of demand, estimated by Michael Saylor as exceeding the daily production of Bitcoin miners by tenfold.

The Crypto Greed Index has remained above the threshold of 70, considered a high level of greed, since October 2021. Only the approval of Bitcoin ETFs in January briefly caused the index to drop to 50 due to profit-taking.

An Index That Inspires Caution

While the Crypto Greed Index can be used to gauge market morale, it can also serve as a warning signal. An extreme level of greed like today’s might suggest that the market is overvalued and might experience a correction soon.

Additionally, as the crypto market is extremely volatile, it can change direction quickly, regardless of the level of the Greed Index. Therefore, it should not be the sole factor considered in investment decisions but rather one of several indicators.

Conversely, an extreme fear index may signal that investors are panicking, thus creating interesting buying opportunities. The Greed Index thus serves as a contrarian signal that should be interpreted with caution.

Although the current optimism is a good sign for the prospects of the crypto market, irrational excess could lead to a correction. Investors are therefore advised to be cautious and take into account all technical and fundamental factors in their decisions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.