FTX: The SEC Bans Caroline Ellison for 10 Years and Her Associates for 8 Years

The FTX-Alameda scandal enters a new phase following a major SEC decision. For the first time, the American authority strikes hard by confirming bans from leadership positions ranging from 8 to 10 years against former executives involved in one of the biggest financial frauds in crypto history. However, will these sanctions be enough to restore trust in a sector still marked by impunity?

In brief

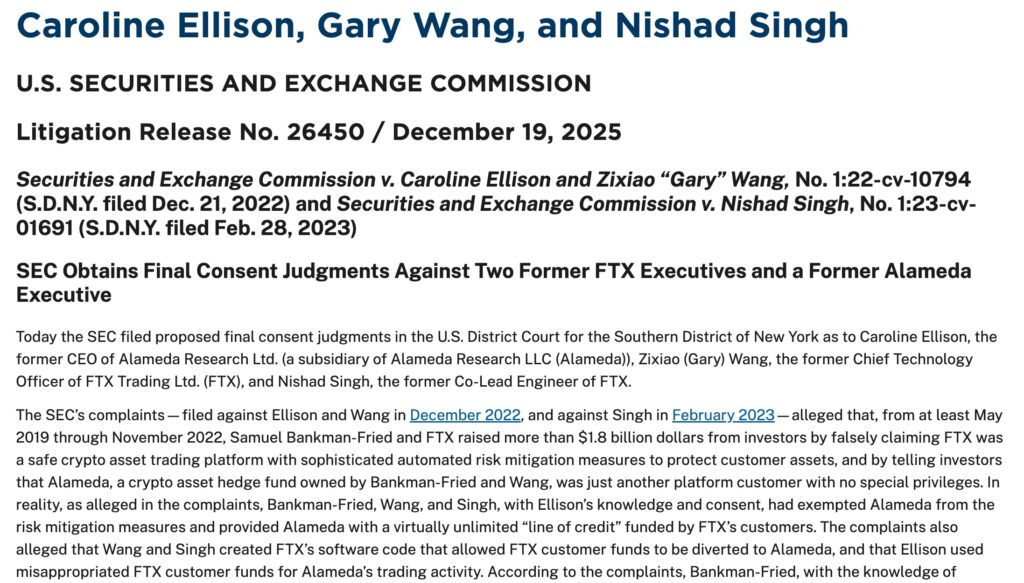

- The SEC has officially banned Caroline Ellison from leading for 10 years, and Gary Wang and Nishad Singh for 8 years, after their role in the FTX scandal.

- Caroline Ellison will benefit from early release in February 2026 due to her cooperation with justice, while Sam Bankman-Fried is serving a 25-year sentence.

- The defrauded investors will not be reimbursed at the current bitcoin price, but at its value at the time of bankruptcy, worsening their financial losses.

Crypto: the SEC confirms bans for Alameda executives

The SEC has officially banned Caroline Ellison, Gary Wang, and Nishad Singh from leading or serving on boards for 8 to 10 years. An unprecedented decision in the crypto world, aimed at protecting investors after the fall of FTX and the disappearance of billions of dollars. These bans send a clear message: the era of impunity is over.

Yet, some question the actual effectiveness of these measures. The penalties, although heavy, remain symbolic for actors involved in one of the largest crypto frauds in history. Ellison, Wang, and Singh have cooperated with justice, testifying against Sam Bankman-Fried. Has their collaboration mitigated their responsibility? The SEC shows its teeth, but will it be enough to restore trust in a sector still perceived as the Wild West?

Early release for Ellison, hope for clemency for SBF: double standards?

Despite the 10-year ban on corporate leadership, Caroline Ellison, former CEO of Alameda Research, is expected to be released in February 2026 after only 11 months in prison. Transferred to community detention in October 2025, she benefits from a sentence reduction for good behavior and cooperation. A favored treatment contrasting with the fate reserved for crypto magnate Sam Bankman-Fried, sentenced to 25 years in prison.

Bankman-Fried, meanwhile, is betting on an appeal and rumors of presidential clemency after financially supporting the Democratic Party. A risky strategy, as his refusal to cooperate with justice sealed his fate. Why such disparity? Does the American judicial system reward those who “play the game”? Judicial cooperation certainly reduces sentences but does not bring justice to the victims. For many, Ellison and Bankman-Fried should answer for their acts equally.

Bitcoin at the heart of the FTX conflict – will defrauded investors pay twice?

FTX victims will not recover their funds at the current bitcoin rate. According to liquidation rules, reimbursements will be based on BTC’s value at the time of bankruptcy, in November 2022. A decision that could be costly for investors, as the crypto queen’s price has greatly fluctuated since then.

For example, an investor who deposited 1 BTC at $60,000 in 2021 will only recover the equivalent of $16,000, the bitcoin price at the bankruptcy date. A direct loss raising questions about the fairness of the process. Victims’ attorneys denounce a system that punishes investors twice: first through crypto fraud, second through reimbursement rules.

The FTX-Alameda case and Caroline Ellison’s ban reveal the inequalities of a judicial system where cooperation may mitigate sentences but where victims are often forgotten. While the SEC tries to restore order, one question remains: how to protect investors in an ever-evolving crypto world?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.