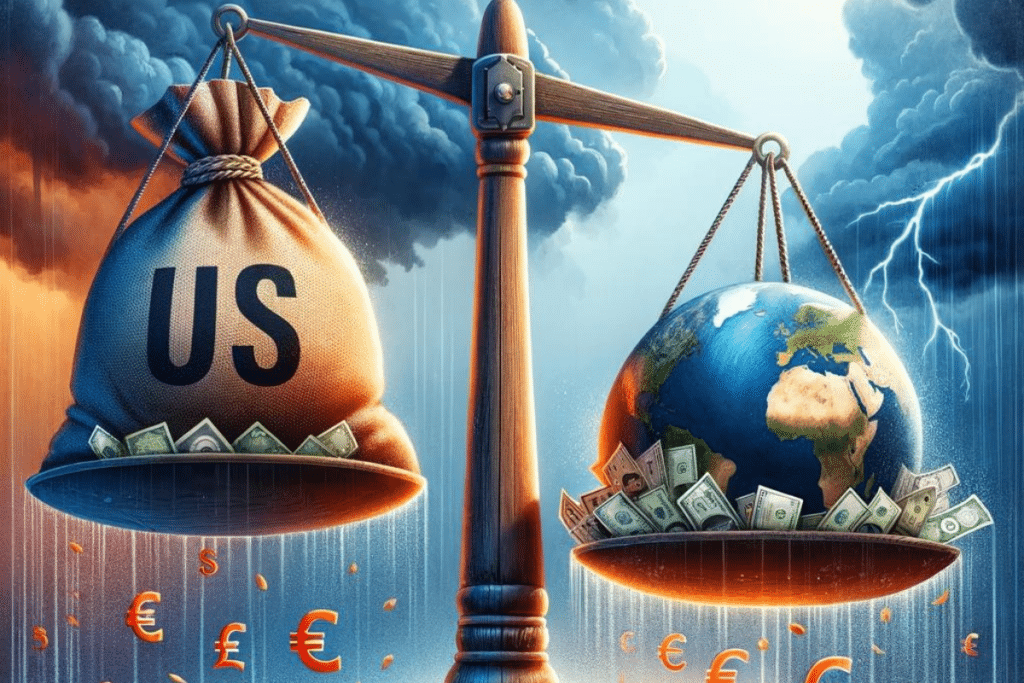

Imminent crisis: The astronomical debt of the United States and its shadow over the world.

At the dawn of an era marked by unprecedented fragility in global economic equilibriums, a specter haunts the world. This is the specter of a global crisis, fueled by the dizzying escalation of the United States’ debt. This indebtedness, far from being mere financial statistics, represents a concrete threat to global economic stability.

The Debt Explosion: A Race Against Time

The story of America’s debt is one of a frenzied race towards the abyss. By surpassing the threshold of $33 trillion last year, and continuing its mad dash with an increase of over $1 trillion in 2024, the United States seems to be playing with fire.

Prominent voices in the financial world, such as Jamie Dimon from JP Morgan, are sounding the alarm, evoking an imminent major financial crisis.

These gloomy predictions are not isolated. They are shared by key players such as Brian Moynihan from Bank of America and Jerome Powell, Chairman of the Federal Reserve, who all highlight an unsustainable fiscal trajectory.

Beyond American borders, the rising power of the BRICS is shaping the contours of a new economic world. This block, constantly expanding, advocates for monetary diversification away from the US dollar, anticipating future turbulence.

The US debt, by becoming a global concern, accelerates this rebellion of the global market. Jamie Dimon even speaks of a “cliff” toward which the United States, and by extension the world, is heading at high speed.

A Call for Change

In the face of this alarming situation, a consensus emerges: the urgency to act. The solution does not lie in the contemplation of the problem, but in the adoption of concrete measures to resolve it.

The United States’ debt is not just their problem; it has become a global affair. The decisions made today will determine tomorrow’s financial stability. It is a call for collective responsibility, a profound reform of fiscal policies, and awareness of the crucial importance of financial sustainability.

The world is at a decisive crossroads. Actions taken in the coming years can either mitigate the impact of a global financial crisis or plunge us into an uncertain future.

The US debt, a mirror of global economic imbalances, calls us to the necessity of a more balanced and thoughtful economic governance. International solidarity and better financial regulation appear imperative to navigate through the upcoming storms.

In this context, innovation and adaptability will be key. The announced crisis is not a fate. Indeed, it can be the opportunity for a renewal, a reorientation towards more resilient and inclusive economic models. The “World” has much to gain in rethinking its economic foundations, provided it acts with boldness and wisdom.

In conclusion, as the alarm bells ring, the time is for action and strategic reflection. The US debt, far from being an isolated challenge, is a symptom of a global system in need of rebalancing. Faced with this reality, the decision to consolidate one’s bitcoins becomes increasingly compelling.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.