India Reconfigures Energy Imports Amid BRICS Push

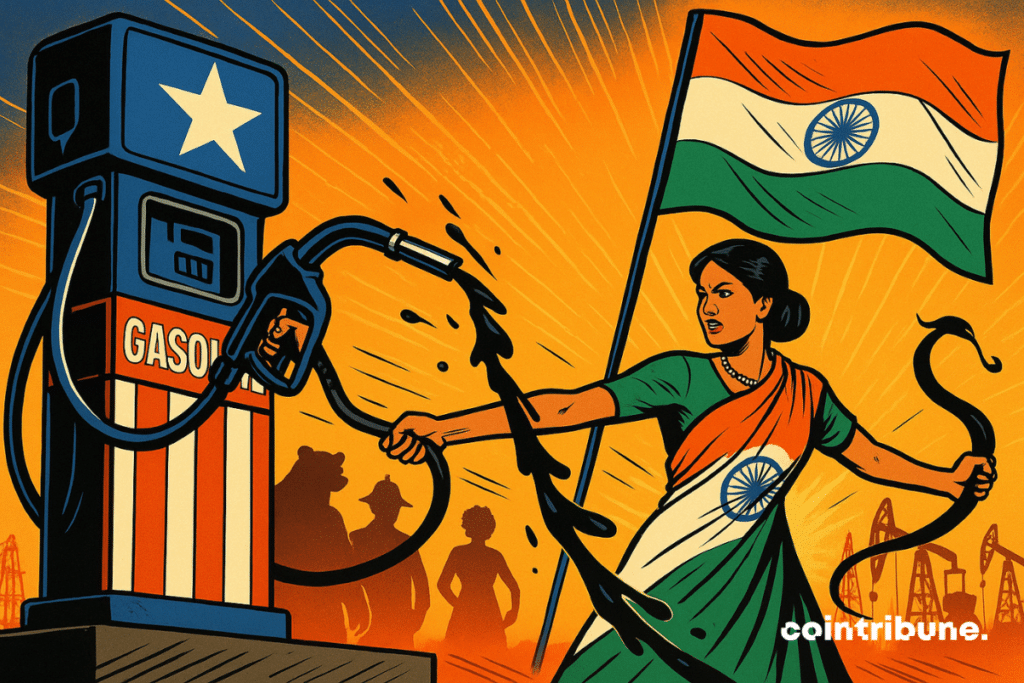

American crude is losing ground. This week, the Indian Oil Corporation (IOC), India’s leading public refiner, turned its back on shipments from the United States to refocus on the Middle East and West Africa. This logistical rebalancing, seemingly technical, reflects a strategic shift: the rise of energy alliances within the BRICS, the decline of the dollar in oil trade, and the assertion of a new economic order.

In Brief

- The Indian Oil Corporation intentionally excluded American crude in its latest tender, favoring shipments from the Middle East and West Africa.

- This choice is based on specific economic criteria, including tightened margins, freight costs, and price gaps between suppliers.

- India and China are gradually reducing their imports of American crude, favoring BRICS energy partners such as Russia.

- Beyond mere logistical arbitrage, this energy realignment reflects a transition marked by the pursuit of strategic autonomy within the BRICS.

An economic choice in appearance, but a strategic signal in substance

The decision of the Indian Oil Corporation (IOC), India’s main public refiner, not to include American crude in its latest order is a strong signal, while Russia and Saudi Arabia have chosen to increase their production starting October.

While it had bought five million barrels of West Texas Intermediate (WTI) the previous week, the IOC this time favored shipments from Abu Dhabi (Das) and Nigeria (Agbami and Usan). This adjustment may seem minor operationally, but it marks a strategic turning point.

Here are the key factual elements of this operation :

- American crude (WTI) was excluded in favor of barrels from the Middle East and West Africa, a voluntary decision by the IOC ;

- The arbitration towards Asia has closed : the rise in Murban and Dubai prices, combined with the evolution of freight costs, made alternatives more competitive ;

- The IOC’s decisions are based on strict economic calculations ;

- The change of suppliers is not temporary: the previous week, American crude was still part of the purchases, but not today ;

- This is not a diplomatic reaction, but a profitability choice, driven by margin imperatives and logistical simplification.

This series of elements shows a shift that goes beyond cyclical considerations. Indian energy supply is beginning to reflect a diversification logic where alignment with BRICS suppliers is becoming increasingly visible.

American crude, once seen as indispensable, becomes one option among others, subject to a crude profitability analysis.

A trend fueled by dedollarization and trade tensions

Meanwhile, China, another pillar of the BRICS, has almost stopped importing American crude this year, a collapse largely attributed to the multiplication of tariffs imposed by Washington. These tariff barriers destroyed margins, pushing Beijing to turn to less restrictive suppliers, notably Russia.

In India as well, American oil imports sharply declined in August, while Russian volumes gained ground.

Beyond trade flows, it is the very logic of oil transactions that is evolving. The usual framework of the petrodollar is challenged by exploring alternative mechanisms within the BRICS alliance: settlements in local currencies, independent clearing platforms, and an explicit intention to move away from the dollar in certain energy transactions.

Trump inadvertently brings BRICS closer together with his sanctions. Far from ideological boycott, the IOC’s approach fits into a context of strategic optimization. If economic and logistical conditions change, American crude may once again appeal. Meanwhile, the Asian market is exploring other alternatives, more direct, more flexible, and less politicized.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.