Results show that global payments leaders are dissatisfied with legacy rails for cross-border payments.

— Ripple (@Ripple) July 28, 2023

Learn why 97% believe #blockchain and #crypto will transform the way money moves in our latest whitepaper with @Faster_Payments. https://t.co/qacuAAzZrR pic.twitter.com/ForjM05Wbb

A

A

Blockchain could save financial institutions $10bn by 2030

Mon 31 Jul 2023 ▪

4

min read ▪ by

Getting informed

▪

According to a recent report by Ripple in partnership with United States Faster Payments Council (FPC), blockchain technology offers the prospect of saving financial institutions nearly $10 billion by 2030, by reducing the costs associated with cross-border payments.

The economic potential of blockchain

Experts unanimously agree: blockchain technology is spearheading faster, more efficient payment systems. But that’s not all! Thanks to its decentralized and secure nature, it can transform the finance, healthcare and many other sectors. By eliminating costly intermediaries, it reduces transaction costs and speeds up processes.

According to a recent report published by Ripple, the digital payment network, in collaboration with the United States Faster Payments Council (FPC), blockchain could save financial institutions around $10 billion in cross-border payment costs by 2030.

The study surveyed 300 financial professionals in 45 countries, covering various sectors such as fintech, banking, media, consumer technology and retail. Of these participants, 97% remain convinced that blockchain will play a key role in facilitating payment systems over the next three years.

What’s more, almost half of the participants stressed that crypto’s main strength lies in its ability to reduce payment costs, both nationally and internationally.

“In the survey, over 50% of respondents believe that lower payment costs — both domestically and internationally — is crypto’s primary benefit,” the report notes.

Towards a revolution in the global financial sector

With the rise of e-commerce and a focus on international markets, cross-border payments are set to grow significantly between now and 2030. According to the report, global international payment flows are expected to reach $156,000 billion, with a compound annual growth rate of 5%.

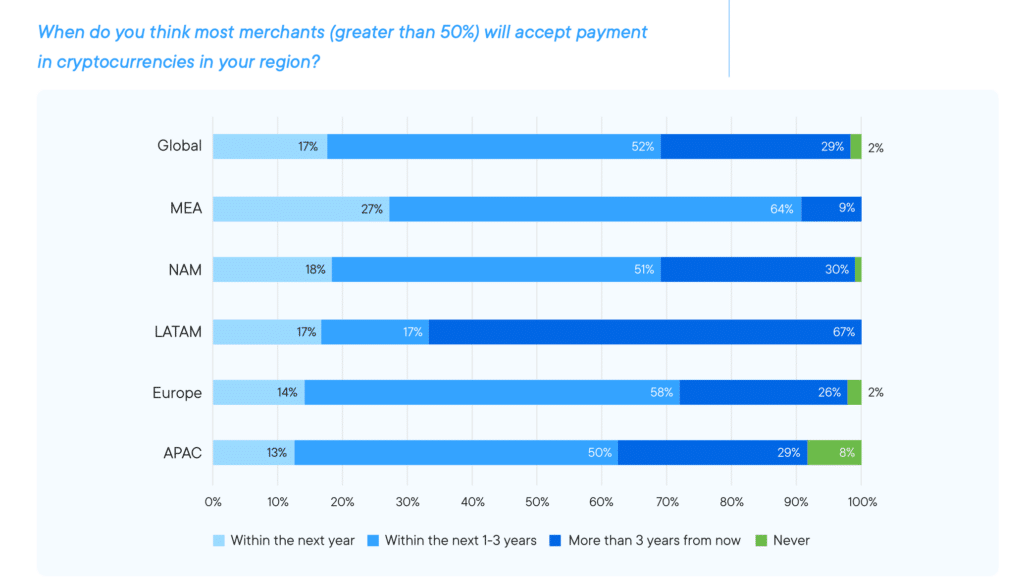

However, despite general optimism about the future role of digital currencies, survey participants had mixed views on when a majority of merchants would adopt crypto payments.

Around 50% of those surveyed expect most merchants to accept these payments within the next three years. In contrast, the Middle East and Africa show greater confidence in adoption as early as next year.

Ripple’s report comes at a time of growing interest in Central Bank Digital Currencies (CBDCs). According to recent research by the Bank for International Settlements (BIS), up to 24 MNBCs could be in circulation within the next six years.

As the e-commerce landscape continues to evolve, the growing adoption of cryptos becomes inescapable. With the potential to save up to $10 billion by 2030, blockchain is set to shape the future of the international financial sector.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.