While traditional markets slow down between Christmas and New Year, the digital derivatives ecosystem is preparing to absorb a major technical shock. Indeed, this Friday will see the expiration of 27 billion dollars worth of options on Bitcoin and Ethereum, concentrated on the Deribit platform. A crypto version of Boxing Day, both feared and closely watched.

Crypto News

In an unstable crypto market, Strategy, one of the largest holders of Bitcoin, raised $747.8 million by selling shares, while suspending its BTC purchases. This decision highlights a desire to secure its finances amid market volatility. A strong signal for the crypto ecosystem, which could influence other companies adopting similar strategies.

Bitcoin markets are sending mixed signals as price weakness meets rising trader confidence. While the asset remains under pressure after months of declines, activity in derivatives markets continues to point to steady dip buying. Data from Bitfinex shows traders increasing bullish exposure, even as sentiment across the broader market remains cautious.

Binance has exceeded 300 million registered users, eight years after its launch. In crypto, this milestone matters as much for the symbol as for what it reveals. It tells a story of a liquidity machine, solid technical execution, and the ability to survive storms.

In December 2024, memecoins were leading the trends. Their capitalization flirted with unprecedented highs. And then, in 2025... everything collapsed. Who would have thought that only one year would separate the spotlight from oblivion? Digital fortunes melted away. Beloved tokens disappeared. What could possibly have happened? Volatility, scams, saturation, or mutation? An analysis of a sharp turn in the ruthless world of the most bizarre cryptos. Nothing hinted at such a reversal for such a popular crypto market.

Memecoin trading on Solana is under new legal scrutiny after investors accused several crypto firms of operating an unfair trading system. A federal lawsuit alleges private messages show coordination between blockchain engineers and a popular memecoin platform, putting retail traders at a disadvantage. A judge has allowed the case to proceed with expanded claims.

While bitcoin seems frozen around 88,000 dollars, the apparent calm masks growing tension in the markets. Between hopes for a rebound and fears of a brutal correction, investors position themselves at daggers drawn. This polarization intensifies as volumes on Binance reveal tactical movements, and technical indicators flirt with key levels. The market holds its breath, watching for the signal that will decide between a bullish continuation or a sharp return to much lower thresholds.

Michael Saylor rekindles the suspense: a new bitcoin purchase is looming, while MSTR is collapsing and regulators threaten Strategy. With 671,000 BTC at stake, can this bold strategy withstand market pressure? Analysis of the stakes, key figures, and risk scenarios for 2026.

While bitcoin continues its decline, an anomaly intrigues: fear does not dominate. Unlike the troughs marked by panic selling and widespread pessimism, current signals remain surprisingly moderate. No emotional tidal wave, no real capitulation is looming. This relative calm, out of sync with the bearish dynamic, raises questions: is the correction really over, or is the market still holding its breath before a sharper retreat?

Stablecoins continue to gain a stronger foothold across global crypto markets. This growth now appears not only in supply figures but also in transaction activity across blockchains. In Europe, momentum is building around euro-linked tokens, while USDC continues to expand across multiple networks. Recent data points to a shift toward transaction-driven expansion rather than passive issuance.

In 2025, Brazil writes a new page in financial history with a 43% explosion of the crypto market. Between historic records, massive adoption, and revolutionary investment strategies, this boom redefines the rules. Why such growth?

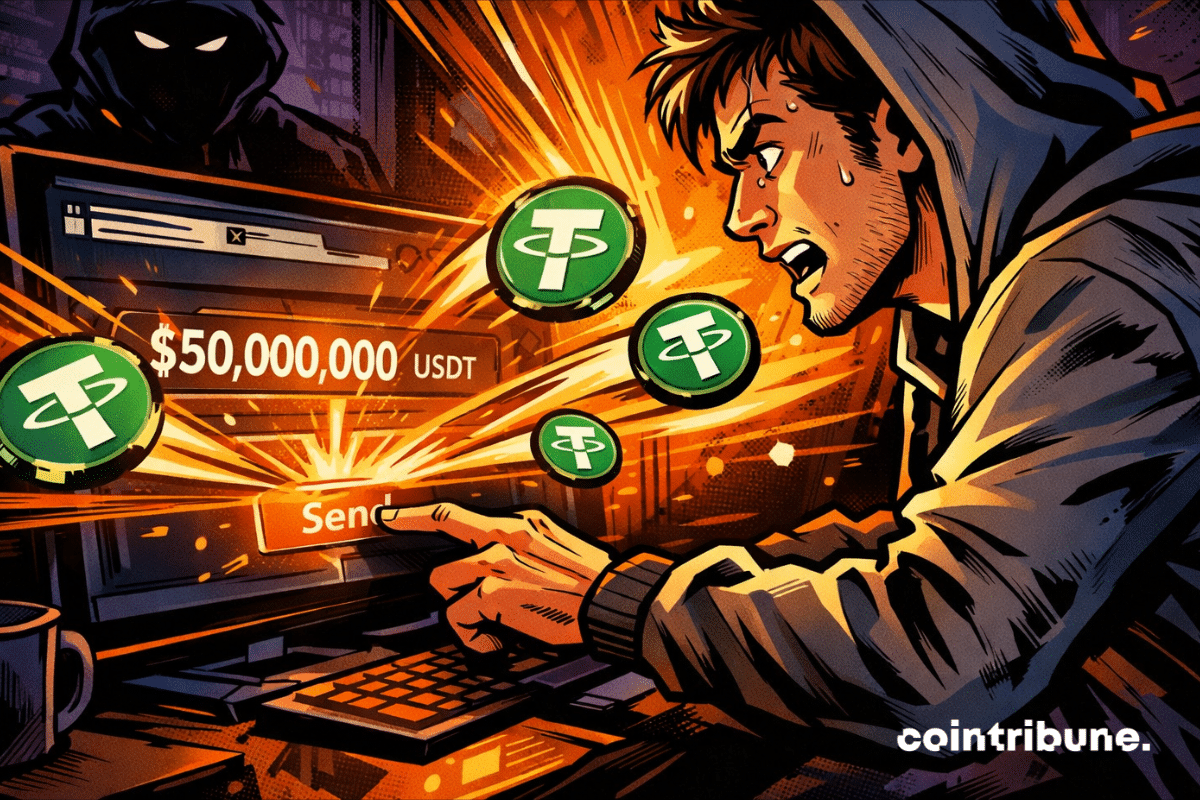

A small test transfer turned disastrous as a user sent nearly $50 million USDT to a scammer in an address poisoning attack.

Cardano collapses: -64% capitalization in 2025, a historic crash that raises questions. Between massive whale sell-offs and crypto user disengagement, ADA struggles to survive. Should we fear the worst or hope for an unexpected rebound? Exclusive analysis of causes and scenarios for 2026.

Bitcoin falters against gold. The BTC/XAU ratio has just dropped to a critical threshold: 20 ounces of gold for one bitcoin, a level never reached since early 2024. For analysts, this reflects a possible cycle turning point and revives the debate between supporters of a technical rebound and those fearing a new bear market. Between tension and hope, a key indicator resurfaces and could change everything.

After a 2024 marked by the influx of ETFs and institutional enthusiasm, signs of fatigue are multiplying. According to CryptoQuant, demand has significantly contracted since October, confirming the entry into a bearish phase. Between the outflow of incoming flows, breaking of technical supports, and investor hesitation, the market shows clear signs of tipping. A turning point that analysts are watching closely as the cycle could change pace.

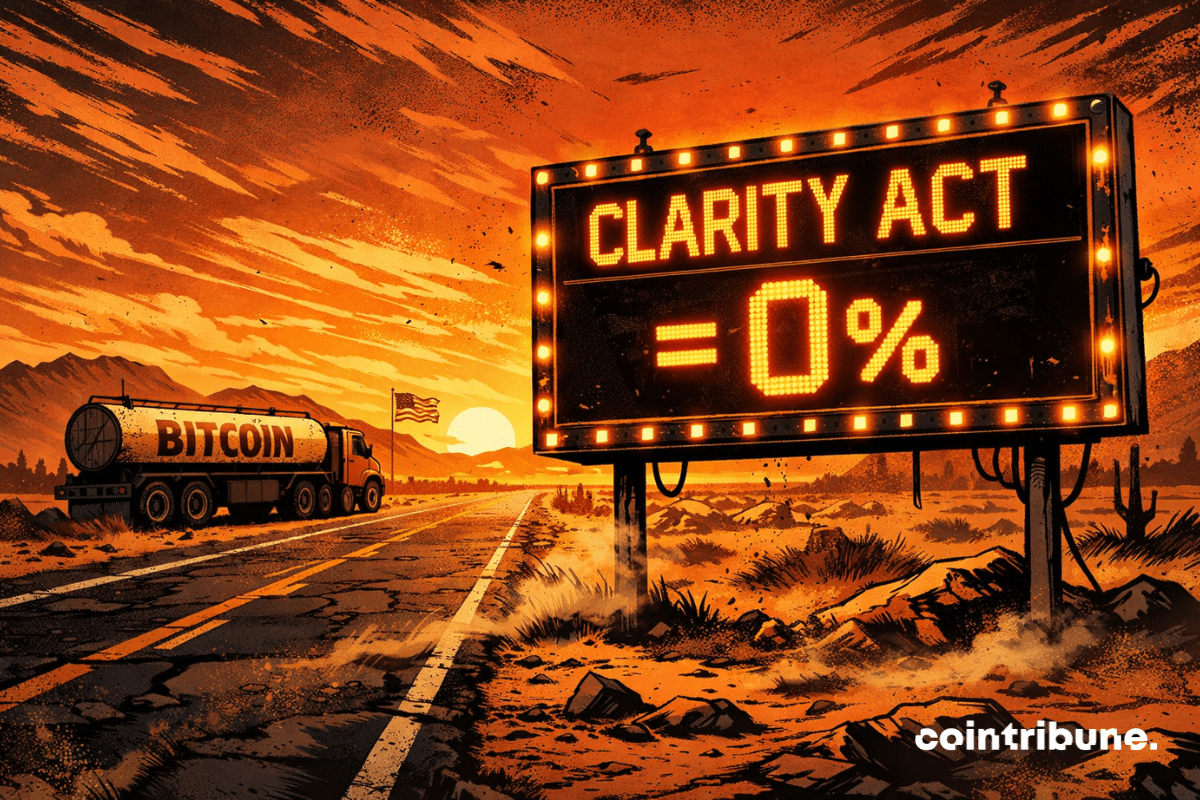

While Washington refines its Clarity Act, bitcoin is falling. Regulation on display, volatility behind the scenes: what if the real shock came from somewhere other than laws?

Bitcoin is not weakening due to its own limits, but because the global economic climate is reshuffling the risk cards. Between contradictory signals from the United States and monetary inflections in Japan, investors are reconsidering their priorities. Indeed, the flagship crypto, which has been a market driver in recent months, is retreating in portfolios. This shift says nothing about its intrinsic solidity, but everything about the prevailing nervousness in the face of a monetary policy that remains, for now, unpredictable.

Recent Bitcoin pullbacks are driven by stablecoin shorts and market dynamics rather than mass selling, with long-term holders remaining largely inactive.

Arthur Hayes views altcoin season as an ongoing cycle, but many traders missed out on key winners despite market gains.

The SEC has just dropped the hammer: Caroline Ellison, former CEO of Alameda, is banned for 10 years, while Gary Wang and Nishad Singh face 8 years of prohibition. A historic sanction after the fall of FTX.

The digital euro could change everything: instant payments, financial sovereignty, and an alternative to private cryptos. However, despite ready technology, European legislators block the project out of fear of privacy risks. Which crypto will disappear if the digital euro arrives in 2026?

The Polish Parliament has just defied its own president by reactivating a controversial crypto bill, despite a clear veto. Between forced alignment with European rules and fears of market strangulation, Warsaw is playing with fire. Why could this political standoff redefine the future of cryptos in Europe?

Until December 30, 2025, the MiCA-regulated platform offers a welcome bonus to new European users. Full breakdown.

While the crypto sector anticipates a prolonged bullish cycle, supported by the arrival of institutional investors and a maturing regulatory framework, a major voice disrupts this consensus. Jurrien Timmer, Director of Macro Research at Fidelity, speaks of a break in momentum. According to him, Bitcoin could pause in 2026, not at a peak, but around a technical pullback. A projection that challenges the prevailing euphoria and invites reconsideration of the medium-term market trajectory.

Bitwise, the asset manager specializing in crypto, has officially filed an S-1 form with the Securities and Exchange Commission (SEC) to launch a Sui spot ETF in the United States.

In 2025, institutional money flees Bitcoin and Ethereum to rush towards XRP and Solana, with record ETF flows exceeding one billion dollars. Why this historic turnaround? The data reveal an irreversible trend: investors now bet on crypto assets with concrete utility, not speculation.

The Bank of Japan tightens the screws, cryptos fall, but Bitcoin, that old trickster, attracts big fish. Social panic, full ETFs: explosive cocktail or flash in the pan?

New Trump splash: two pro-crypto figures take the reins of the CFTC and the FDIC. All the details in this article!

After years of regulatory uncertainty, the United States is about to reach a strategic milestone. The Senate will review the CLARITY Act in January 2026, a structuring bill aimed at clarifying the legal status of cryptocurrencies. The announcement, made by David Sacks, special advisor at the White House, finally places crypto regulation at the heart of the parliamentary debate. For a sector seeking stability, this step could sustainably redefine the rules of the game.

The topic of “bitcoin versus quantum” comes up in waves. This week, it is no longer just a debate among researchers. Part of the ecosystem is pushing to accelerate a concrete update. And another is resisting strongly, considering the alert premature.