Billionaire investor Tim Draper predicts Bitcoin could reach 250K USD within six months, citing rising adoption and supportive policies.

Crypto News

According to ARK Invest's projections, the value of tokenized assets could climb to 11 trillion dollars by 2030, compared to a current market estimated around 22 billion. In other words, ARK is not talking about a gadget, but about a plumbing change for finance.

The boundary between traditional banks and crypto could soon disappear. In Davos, David Sacks, White House crypto advisor, stated that these two worlds will soon form just one. Indeed, the CLARITY Act, a decisive bill for the future of the sector in the United States, is at stake. Behind the debates on stablecoin yields, a complete reconfiguration of the financial industry is emerging amid political tensions, power struggles, and strategic ambitions.

XRP is once again worrying analysts. A rare technical signal, identical to the one that preceded a 68% drop in 2022, has reappeared. As tensions return to the crypto market, this alert strengthens fears of a major pullback. At the same time, massive XRP ETF outflows increase the pressure on Ripple's crypto. Is history repeating itself?

Bitcoin just broke a key threshold below $90,000, reigniting doubts about the market's strength. Between massive profit-taking by long-term holders and liquidity inflows from whales, selling pressure intensifies. Buyers struggle to contain the drop amid this shock. The balance is fragile, as speculative appetite faces increasingly vulnerable technical supports.

The recent surge in activity on Ethereum might be less a sign of euphoria and more a malicious background noise. A security researcher, Andrey Sergeenkov, believes that part of this increase resembles an "address poisoning" campaign, a variant of dusting that takes advantage of transaction fees that have been very low since December. "Activity retention" nearly doubled in a month, around 8 million addresses, while daily transactions reached a record close to 2.9 million.

At Davos 2026, Scott Bessent reaffirms Trump’s Bitcoin vision: a strategic reserve to assert American crypto leadership. But behind this reaffirmation, doubt persists. Is it a show of strength or an admission of a lack of real progress in crypto innovation?

The US Commodity Futures Trading Commission (CFTC) is strengthening its leadership as it prepares for a potentially expanded role in overseeing digital asset markets. Chair Michael Selig has appointed two senior advisers, signaling the agency’s focus on crypto regulation as lawmakers consider legislation that could grant the CFTC broader authority over the sector.

While the crypto market is going through a downturn phase, Solana (SOL) drops below $130, sowing doubt among investors. However, behind this sharp drop, the on-chain data outline a very different scenario. Whales buying, supply free-falling on exchanges, network activity booming: the fundamentals remain solid. A marked divergence between price and network reality, which could reshuffle the cards faster than imagined.

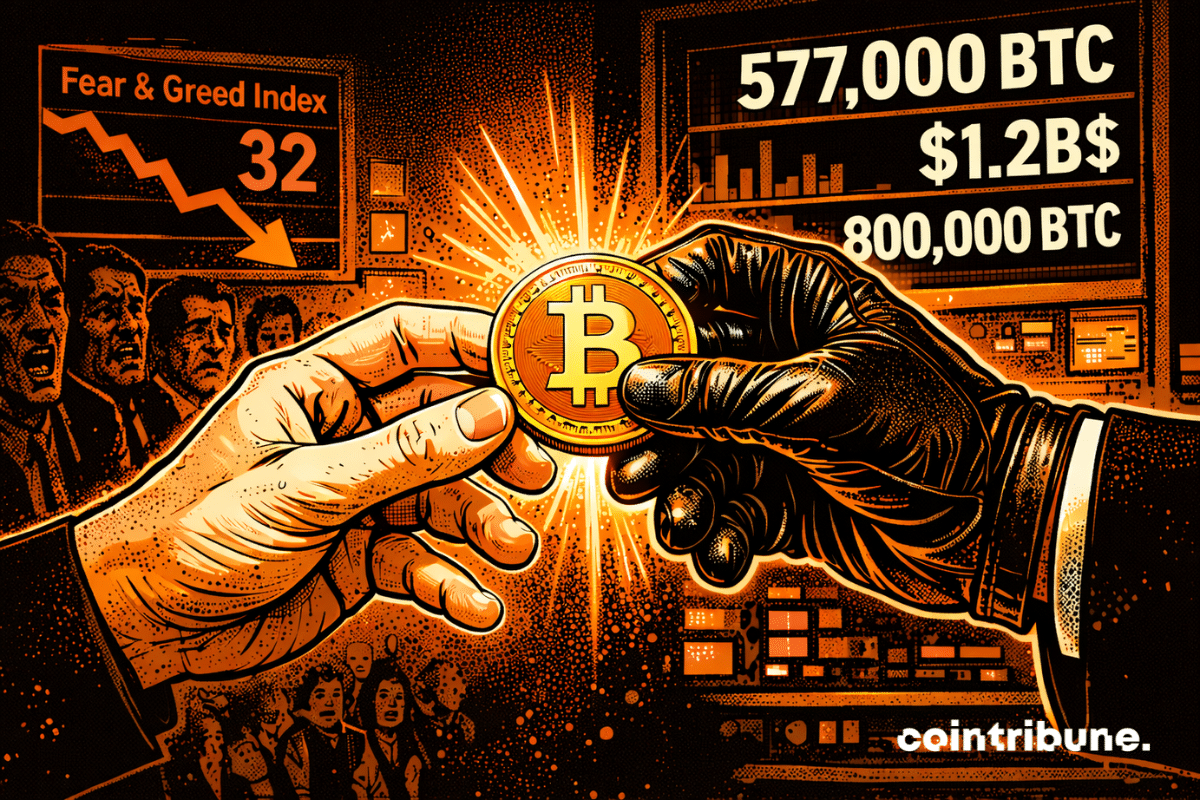

Bitcoin: Institutional accumulation explodes. Here are the figures confirming massive accumulation.

After three years under the yoke of sellers, Ethereum finally sends an unexpected signal. The "net taker volume" turns green again for the first time since January 2023, revealing a possible trend reversal. This sudden change in trader behavior on futures contracts intrigues analysts. Should we see it as the beginnings of a bullish recovery for the second largest crypto in the market?

Bitcoin loses its feathers while gold parades at the top perch. Temporary panic or true metamorphosis of a crypto market finally learning to breathe under pressure?

Michael Saylor scores another breakthrough. His company Strategy now holds more than 700,000 BTC after a massive purchase of 22,305 bitcoins for 2.13 billion dollars. An unprecedented milestone that confirms the company's committed transformation into a true Bitcoin company. In a tense market, this move strengthens Saylor's influence and repositions Strategy as a central player in the crypto ecosystem.

Gold and silver hit record highs as investors seek safety, while Bitcoin and other cryptocurrencies dip amid global uncertainty.

After a sharp drop, Bitcoin stabilizes and shows signs of recovery. Technical analysis and key scenarios for BTC.

Bitcoin steadied after a sharp sell-off earlier this week, finding support near the $92,000 level as traders reassessed risk. Market watchers say exchange-traded fund inflows continue to support a positive long-term outlook, even as global political tensions keep volatility elevated. Recent price action suggests buyers remain active despite broader uncertainty.

Crypto funds attract capital again. With more than $2 billion injected in one week, the sector records an unprecedented influx, dominated by bitcoin-backed products. While traditional markets falter, institutional investors redirect their strategy towards cryptos. This renewed interest propels crypto ETPs to the forefront, acting as a strong recovery signal and a tactical repositioning amid economic uncertainties.

Bitcoin sneezes, traders panic, whales scoop up everything. A drop without a shiver, a washout of leveraged positions, and presto! the market regains its Olympian calm.

Why has the Bitcoin hashrate just fallen below the symbolic threshold of 1 zettahash per second? Are miners abandoning the network for more profitable AI (artificial intelligence)? A silent battle is redefining the future of mining and blockchain.

Scaramucci warns that banning yield on stablecoins could make the US dollar less competitive globally as other countries offer interest on digital currencies.

Bitcoin options open interest has overtaken futures for the first time, marking a shift in how risk is held across crypto markets. By mid-January, options open interest climbed to about $74.1 billion, edging above roughly $65.22 billion in futures. The change points to a market relying less on short-term directional trades and more on structured positions that manage risk and volatility over time.

Steak ’n Shake is positioning Bitcoin as both a customer payment option and a long-term treasury asset, signaling a deeper integration of cryptocurrency into its business model. The fast-food chain reported that its corporate Bitcoin holdings increased by $10 million in notional value, fueled by customer payments and rising same-store sales.

Under regulatory pressure, the American crypto sector closely watched the CLARITY Act, intended to establish a clear legal framework for these assets. However, the bill was abruptly paused in Congress after Coinbase dramatically withdrew its support. Presented as a structural reform, the latest version of the project triggered sharp criticism, accused of threatening innovation. A political setback that reignites tensions between legislators and actors of an ecosystem still seeking recognition.

While the crypto ecosystem oscillates between uncertainty and consolidation, Solana attracts an unexpected wave of users. In the space of 24 hours, more than 8.9 million new addresses were created on the network, a record that reignites attention on this blockchain known for its speed and efficiency. Behind this sudden enthusiasm lies a more nuanced reality, where the enthusiasm of newcomers clashes with fragile technical signals.

In the world of cryptocurrencies, hacks have become events that are both frequent and dramatic. The main data is clear: nearly 80% of hacked crypto projects never fully recover, even after fixing their technical vulnerabilities. This means that most protocols experiencing a major attack remain permanently weakened — financially and in terms of trust.

Announced as a historic breakthrough, the strategic Bitcoin reserve desired by the United States remains at a standstill today. Nearly a year after the decree signed by Donald Trump in March 2025, no BTC acquisition has been made. Legal blockages and persistent administrative confusion are the causes. Officially a priority, the project is stalling, giving way to growing criticism from the crypto community, disappointed by the lack of concrete actions and the absence of a clear government strategy.

Brian Armstrong clarified that Coinbase’s talks with the White House remain constructive as the CLARITY Act faces delays over regulation issues.

While macroeconomic uncertainty weighs on traditional markets, bitcoin is once again establishing itself as a strategic asset for institutional investors. Spot Bitcoin ETFs are recording record inflows, reaching unprecedented levels for several months. This massive return of capital signals a clear repositioning of large portfolios, now more inclined to expose themselves through regulated vehicles. A change in tone that could mark a new phase of institutional adoption, but whose strength remains to be confirmed.

In Washington, crypto puts the Senate in a tailspin: Coinbase says no, the law collapses, and banks fear that open code will become uncontrollable.

Bitcoin is regaining the interest of institutional markets. This week, U.S. spot ETFs attracted $1.8 billion in inflows, a record peak since October 2025. Such a spectacular resurgence occurs in an uncertain macroeconomic environment, rekindling hopes of a new bull cycle. However, does this surge reflect a fundamental trend or just a technical rebound? As the $100,000 threshold fuels speculation, the market remains suspended on the consistency of these new funds.