When Bitcoin takes off, Saylor pulls out his millions. 601,550 BTC later, the gentleman persists, signs, and turns his tweets into digital gold. Who can say better?

Finance News

Crypto ETPs are breaking records in flows and assets. We deliver all the details in this article!

While the little ones toil to mine, BlackRock quietly rakes in millions of Ethereum. Centralization, you say? What if the crypto revolution changed owners…

Pump.fun raises 500 million in a flash, while denying liking presales. Behind the bots, rug pulls are piling up. But who is really pulling the strings of the great crypto circus?

As global balances are being redrawn, the BRICS summit in Rio outlined the contours of a more pronounced multipolar influence. Behind the notable absence of Xi Jinping and Vladimir Putin, discussions led to concrete proposals: reform of international institutions, enhanced climate cooperation, and regulation of artificial intelligence. Less spectacular, but more strategic, this edition sheds light on the ambitions of the global South, while revealing the latent tensions that weaken the coherence of a bloc in search of credibility.

Ahead of its initial coin offering (ICO), Pump.fun has secured its first-ever purchase by acquiring a Solana-based wallet tracker, Kolscan. According to the company, this latest rollout features an aggregated ranking of key opinion leaders (KOLs) based on their trading performance, allowing users to closely observe and analyze the strategies of top investors within the Solana network.

Trump slams the door on the G7 and brings out his tariff weapons. Canada suffers, the economy wavers, and copper prices soar. What is the star chef of protectionism really cooking up?

When ETFs fill up like broken pockets and bitcoin breaks through the ceiling, traditional markets wonder: have cryptos become acceptable to the suit-and-tie crowd?

Donald Trump's announcement of 10% tariffs on BRICS countries reignites a strategic debate: are the United States risking, in their bid to defend their leadership, to accelerate de-dollarization? Behind this commercial offensive lies a deeper rift, where emerging powers seek to break away from the dominance of the greenback. As geo-economic tensions intensify, the question arises: is Washington not hastening the questioning of the monetary order it strives to preserve?

The founder of Tron announces a purchase of 100 million dollars in TRUMP memecoins. This is not a risky bet. It is a political maneuver and a clear message sent to the crypto ecosystem.

When Dubai marries traditional finance with tokens, it is not a desert mirage, but a very real… and perfectly regulated fund, please!

Tokenization is growing fast, with major firms investing and new platforms launching. This trend could soon impact cryptocurrency prices.

A star shines brighter than the others in the saturated arena of neobanks: Revolut. In London, ambitions are no longer hidden. With a funding round of one billion dollars in preparation, the company aims for a colossal valuation of 65 billion dollars. And at the heart of this ascent? One word: crypto. Because it's not just a diversification, it's a strategy. A conviction. A compass.

The world of tokenized real world assets (Real World Assets - RWA) is undergoing transformation as it gradually aligns with the real economy. In this context, Credefi has experienced continuous evolution, moving from an experimental project to a functional infrastructure. With the launch of Credefi 3.0, the platform reaches a new milestone: it fully integrates modules designed to connect decentralized finance and tangible assets. All tools are now available online.

While crypto ETFs are hitting record highs, volumes are evaporating. Blackrock and Fidelity are leading the influx, but the market seems to be holding its breath. Boom on the surface, empty underneath?

Crypto venture capital, once thought to be on the brink of collapse, is making a spectacular comeback. In the second quarter of this year, over $10 billion flowed into the ecosystem, a level not seen since the peak in early 2022. In just three months, investors have rejuvenated a market that was considered frozen, reaffirming their appetite for blockchain innovation.

At the opening of the BRICS summit in Rio, Donald Trump reignited trade tensions, threatening to impose surtaxes on any country aligned with this emerging bloc. Facing a coalition that challenges American hegemony, the confrontation goes beyond tariffs to affect global power dynamics. The BRICS are intensifying their break from…

Crypto venture capital is showing signs of slowing, but key startups in AI, DeFi, and blockchain infrastructure continue to attract major investments, signaling ongoing innovation in the space.

What if finance was no longer a privilege reserved for those who know the market hours and the workings of traditional banks? Kraken shakes up the codes with xStocks, an innovation that allows users to hold tokenized American shares on the Solana blockchain. No more waiting for the opening of Wall Street or hidden fees: investment becomes fluid, fractional, programmable, and compliant with regulations. With BackedFi as a regulatory anchor, Kraken opens a new path that combines financial discipline and technological freedom. A new era begins for those who want to grow their wealth according to their own rules.

France's economy recorded a trade deficit of 7.6 billion euros in May. A concerning trend for investors.

Larry Fink endorses bitcoins faster than miners can produce them. While staking is making its appearance, the ETF is turning BTC into a nice, juicy pawn.

When an Asian soup brand turns into a bitcoin vault... DDC buys, cashes in, and starts over: 368 BTC later, the markets are hungry for a new model.

Since the beginning of July, investors have been lending to Italy at a lower rate than that demanded for France. Indeed, the curve has inverted for the first time since 2005, weakening Paris's position in the hierarchy of sovereign risk in the euro area. Yet, France maintains a better rating. This paradox points to a perceptible reality: markets are doubtful. And in this hesitation, alternative assets are gaining ground.

The economy is at risk of a commercial earthquake: the suspended tariffs could come into effect in August. The details here!

The debate on leaving the euro is resurfacing regularly in France. With new presidential elections set for 2027, a victory for the National Rally could lead to an exit from the euro. The French could very well come out of it ruined!

At a time when trade tensions are reshaping global power dynamics, Europe faces a direct threat: Washington has imposed a deadline of July 9 to reach a bilateral agreement. After this date, tariffs of up to 70% would hit European exports starting August 1. In this high-tension climate, Brussels is attempting to avoid a head-on clash with a U.S. administration determined to enforce its rules. An express negotiation is underway to prevent a shift to a tariff confrontation.

The drop in mortgage rates marks an unexpected pause. While the market was beginning to restart, the curves are freezing, diverging from forecasts. This turnaround intrigues both buyers and investors, caught between hopes and uncertainties. Why are rates no longer falling, despite a more flexible monetary context? This blockage raises questions about the financing dynamics in France and reveals deeper tensions, at the very moment when real estate is trying to emerge from its stagnation.

On the eve of July 4th, the U.S. Congress passed one of the most radical budget texts of the modern era. Championed by Donald Trump, this law reshapes America's economic priorities with massive tax cuts, social spending reductions, and a sharply rising debt. The vote, secured despite Republican fractures, marks a strategic turning point in the post-Biden era. More than just a budget, it is a political declaration that reshuffles the cards of power and reignites ideological tensions in Washington.

As the global geopolitical balance weakens, Rio will host a tense BRICS summit on July 6 and 7, 2025. Designed as a counterweight to the G7, the bloc struggles to embody the unity of the global South. Internal disagreements, Xi Jinping's absence, and Donald Trump's offensive comeback: the 17th edition illustrates less of a rise in power than a questioning of the strategic coherence among its members. In an era of multipolar ambitions, the BRICS are facing a crisis of legitimacy as much as a test of international credibility.

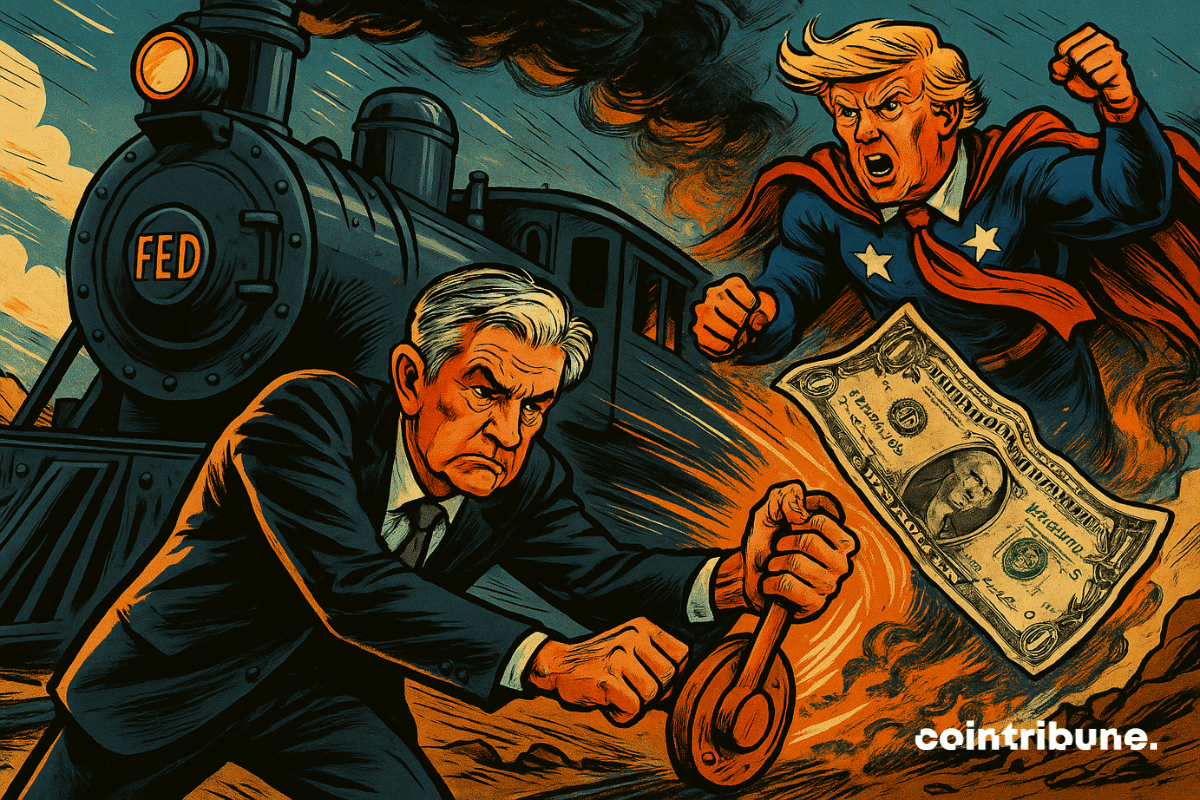

While the stock market progresses timidly, it is the dollar that falters, weakened by the dual pressure of the new trade taxes imposed by Donald Trump and the ongoing hesitation of the Federal Reserve. In this tense atmosphere, investors oscillate between the quest for yield and the caution dictated by the surrounding instability. The apparent calm conceals a palpable nervousness: that of a market that knows that everything can tip at the slightest jolt.