In 2025, China continues to demonstrate its resilience under international economic pressures, particularly those exerted by the future Trump administration. Despite attempts by the new American president to hinder China's economic rise, it persists in its openness, marking a significant victory in the war between the two superpowers.

Finance News

As digital innovations profoundly transform our habits, Elon Musk is preparing to take a significant step with the launch of X Money. This payment system, directly integrated into the X platform (formerly Twitter), could redefine the standards in the realm of digital payments. A recent code leak, revealed by a researcher, has reignited rumors of an imminent launch, well ahead of the officially announced date for this year, 2025. If this information is confirmed, X Money promises to introduce unprecedented features, particularly the potential support for cryptocurrencies like Bitcoin and Dogecoin. Through this project, the X platform aims to become a key player in digital transactions, raising questions about its economic and regulatory impact.

Since January 1, 2025, the French real estate sector is entering a new era. The changes go beyond a simple revision of previous rules. They reflect a political will to strengthen ecological requirements and adapt the tax framework to an uncertain economic context. The ban on renting energy-rated G housing, for example, embodies this priority given to the energy transition. At the same time, major fiscal upheavals, such as the end of the Pinel scheme or the postponement of the Zero-Rate Loan, are redefining incentives for investors and households. Finally, the continuation of the "anti-Airbnb law" and the stability of notary fees complete this picture of reforms, where each measure shapes the delicate balance between the expectations of property owners, the needs of tenants, and environmental imperatives. These adjustments, far from being anecdotal, herald a profound transformation of the real estate market.

Decentralized finance (DeFi) continues to demonstrate its potential, and Aave is today one of the most eloquent examples of it. Indeed, the platform has reached $33.4 billion in net deposits, surpassing the record levels of 2021, which marked a major turning point for the crypto sector. This staggering figure is not just a simple statistic, but a reflection of an ever-evolving dynamic. The DeFi ecosystem, driven by technological innovations and growing adoption, is transforming into a credible alternative to traditional financial institutions. In this context, Aave is redefining standards by diversifying its markets and strengthening its offerings, attracting both investors and developers. This performance illustrates the platform's robustness, but also the growing maturity of a sector in search of expansion and security.

In 2025, Americans anticipate a rise in the stock markets and an intensification of international conflicts. This duality could influence financial and crypto markets, making the current year both promising and uncertain for the United States.

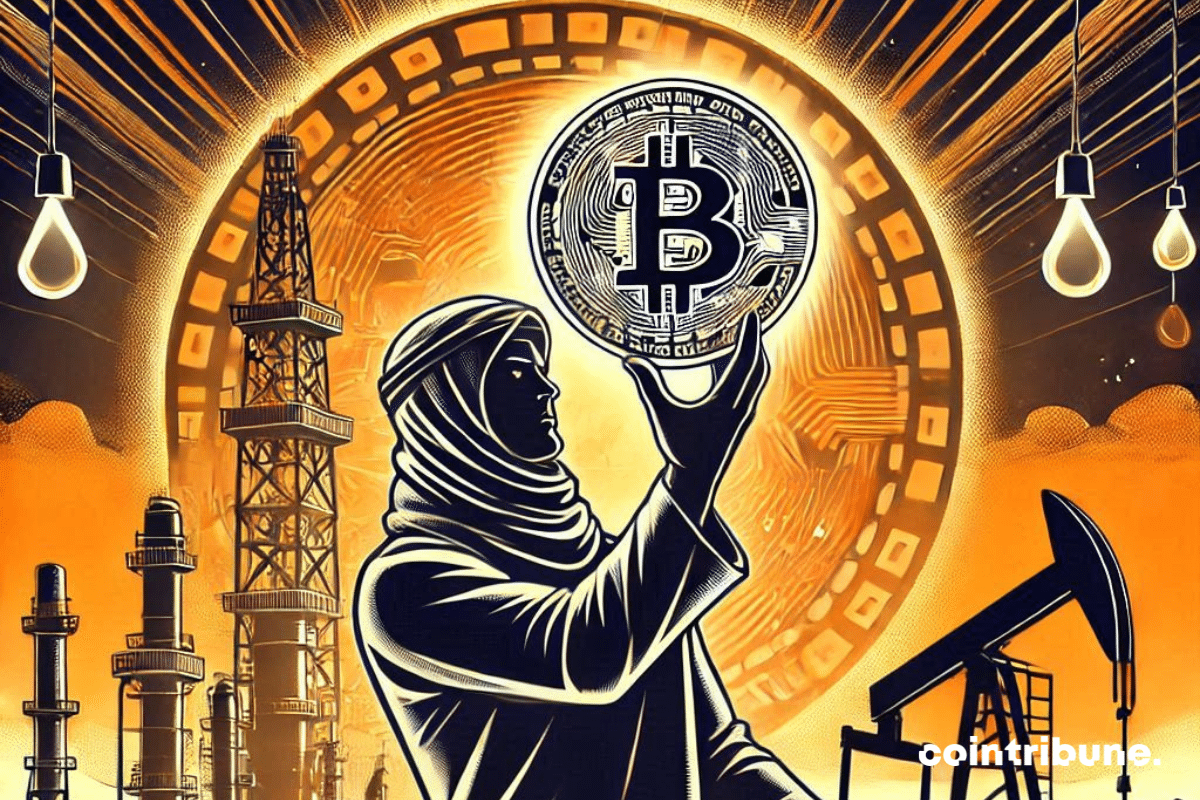

Bitcoin is Donald Trump's plan B if he fails to persuade the BRICS to stop their rebellion against the dollar.

The BRICS have been presenting themselves for several years as a credible alternative to hegemonic economic blocs such as the G7. In this context of increasing rivalries among powers, Russia has taken steps to expand this alliance. It then invited Saudi Arabia and Turkey to join its ranks. Moscow hoped to strengthen the bloc's influence on the international stage and to face the pressures from Western economies. However, these efforts encountered a rejection. This setback illustrates the divergent interests among these nations, as well as the challenges that the BRICS face in expanding their circle of influence in a world where geopolitical balances are becoming increasingly complex.

Bitcoin is Donald Trump's plan B if he fails to persuade the BRICS to stop their rebellion against the dollar.

Amid hypnotic figures and enchanting tweets, Michael Saylor lines up BTC like stars, transforming MicroStrategy into a digital galaxy worth $41 billion.

Amid revolutionary announcements, technological advancements, and regulatory turmoil, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic challenges. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The year 2024 marks a major shift for the French real estate market. Indeed, the dynamics that have structured this sector for decades are gradually fading, giving way to profound changes. The massive decline in transactions, the hesitant restart of real estate purchasing power, and the growing importance of energy criteria are reshaping the priorities of buyers and sellers. These transformations go beyond the numbers: they reflect the cumulative impacts of the crisis that began in 2022 and economic uncertainties. Through their 2024 Real Estate Report, the Notaries of France shed light on these contrasting developments. Their analysis goes beyond mere observation. It explores short-term perspectives and opens pathways for a potential recovery in 2025. These projections illuminate immediate challenges, as well as the necessary adaptations to face a market in full transformation.

The U.S. Secretary of the Treasury, Janet Yellen, recently warned that the U.S. debt ceiling could be reached as early as mid-January 2025. According to her statements, the Treasury expects to hit this new limit between January 14 and 23, at which point extraordinary measures will need to be taken to avoid a default.

The US dollar is establishing itself as the leading currency of 2024, dominating the foreign exchange market without competition. While many global economies face challenges such as rapid inflation and geopolitical uncertainties, the greenback is showing its best performance in nearly a decade. This remarkable progress is based on several solid pillars: a robust US economy, attractive bond yields, and a monetary policy skillfully orchestrated by the Federal Reserve. Additionally, there is a global context characterized by the weakening of competing currencies, such as the yen and the euro, which are unable to compete with the supremacy of the dollar. This rise reflects the resilience of the United States but also highlights the economic fractures shaking the rest of the world.

Ukraine halts Russian gas transit starting in 2025. Discover the major consequences for the European economy!

In the tumultuous arena of crypto, the bloodless Bitcoin ETFs find an unexpected resurgence after Christmas, like a benevolent wink from Santa Claus.

China, long seen as the unwavering engine of the global economy, is currently undergoing a major crisis. Years of double-digit growth, which symbolized its rapid ascent, have given way to a period of deep economic uncertainties. The fragility of its economic model, primarily based on investment and exports, is becoming increasingly evident. Issues such as the rise of public and private debts, the collapse of the real estate sector, and the emergence of the specter of deflation are exacerbating internal economic tensions. These dysfunctions raise a fundamental question: after decades of development often described as miraculous, can the Middle Kingdom still sustain its role as a pillar of global growth?

After a period marked by intense fluctuations, Bitcoin seems ready to enter a new decisive phase. Recent data from Binance reveals a steady increase in purchase volumes, a strong signal that fuels hopes for an imminent rebound. This trend comes as the market digests the corrections that occurred after the historical peaks reached this year. In a context where investors' attention remains focused on key indicators, the latest developments confirm the growing interest in the flagship cryptocurrency, reinforcing the idea of an imminent recovery. While these numbers reflect increased buying pressure, they also fit into an economic landscape where signals of recovery alternate with the risks of future corrections. This setup makes Bitcoin a central player in discussions about the outlook for digital markets in 2025.

The real estate market is at the center of concerns in 2025, attracting attention from investors as much as from first-time buyers and economists. This evolution of mortgage rates, a true indicator of economic and financial health, plays a decisive role in this dynamic. Between 2023 and 2024, rates saw a significant decrease. Thus, they dropped from 4.5% to 3.23%, a change that illustrates both the effects of the European Central Bank’s flexible monetary policies and the banks' strategy to stimulate access to property ownership. This decline is not just a simple statistic. It has already increased the borrowing capacity of thousands of households, creating an unprecedented opportunity to revive an already fragile market. In a context marked by increased competition among financial institutions, this trend could intensify in 2025, potentially ushering in a new phase of growth for real estate.

Global trade is going through a period marked by increasing tensions, where diplomacy and economy intertwine in strategic rivalries. Indeed, China's opening of an anti-dumping investigation into European cognac imports signals a new front in the trade conflict with the European Union. This move, perceived as a direct response to European accusations against Chinese subsidies for electric vehicles, reflects an escalation of economic retaliations between two major powers. Such a case goes beyond a mere trade dispute. It raises fundamental questions about the balance of international exchanges and the role of institutions like the World Trade Organization in arbitrating these disputes in an increasingly complex rivalry context.

Under the shadow of sanctions, Moscow embraces Bitcoin, the digital gold. Siluanov dreams of free exchanges and a digital empire free from the dollar's grip.

The BRICS are ushering in a new economic era with a historic expansion planned for January 2025. This group, which unites some of the largest emerging economies, is set to welcome nine new partners, marking a decisive step in its quest for strengthening its position on the international stage. Such a move comes at a time when geopolitical rivalries are intensifying and traditional alliances are being questioned. Through the extension of their geographical and strategic reach, the BRICS aim to consolidate their influence, but also to provide a credible alternative to Western-dominated economic models. This shift reflects a reorganization of global economic powers, in response to growing demands for a more balanced and multipolar system.

Global economic uncertainties are forcing institutions to thoroughly rethink their investment strategies. In this context, decentralized finance (DeFi) is emerging as a credible and visionary alternative for reinventing traditional financial models. In recent years, major advancements have transformed DeFi into a sophisticated ecosystem, far beyond early technological experiments. Thus, the development of bitcoin staking, the tokenization of real assets, and the integration of autonomous artificial intelligences herald a new era for this rapidly expanding sector.

China is at a pivotal economic turning point. As the combined effects of weak consumption, an intensified real estate crisis, and high unemployment hinder its development, Beijing has just announced an ambitious budget policy for 2025. The stated objective is clear: to stimulate domestic demand and stabilize an economy under significant pressure. To achieve these ambitions, the government plans a significant increase in public spending, coupled with a revision of its fiscal priorities. These measures, detailed during a national conference, reflect a firm commitment to support local communities, expand social benefits, and strengthen resources for struggling businesses. Such a strategy, centered around innovation and strategic technologies, also aims to revitalize trade exchanges in order to adapt debt rules. With this comprehensive approach, Beijing intends to lay the groundwork for more resilient economic growth and to address the structural challenges that hinder its trajectory.

Tether is the crypto version of 2025: BTC for real life, private AI for discretion, and Rumble to dethrone YouTube. That’s all there is to it!

The crypto market, characterized by sustained volatility, continues to surprise with the failure of predictions. While massive sell-offs have dominated trading in recent days, a report published by CoinShares highlights a singular phenomenon: institutional investors have significantly increased their positions in crypto products. Indeed, with net inflows reaching $308 million in a week, these investments sharply contrast with the general downward trend. This institutional support, although counterintuitive in an environment of strong economic pressure, reflects a strategic confidence in the potential of cryptos. Concurrently, the data reveals marked divergences among products, reflecting a reconfiguration of investment priorities. This dynamic paves the way for an in-depth analysis of the motivations of institutions and their implications for the future of crypto markets.

On Wall Street, the rumor is growing: 2049, Bitcoin soars, the debt collapses. A grand bet, a shaken America.

As the year comes to a close, the bitcoin market finds itself at a decisive stage. Investors were hoping for a period of stability to end 2024 on a positive note after a series of significant fluctuations. However, several major technical indicators are countering these expectations and pointing towards a possible significant correction. Among these signals, the formation of a bearish pattern on the weekly charts and the erosion of critical support levels are raising serious concerns. Concurrently, macroeconomic conditions, marked by a decline in global money supply and a tightening of policies by the U.S. Federal Reserve, are increasing pressure on risk assets. These combined elements are fueling the most pessimistic projections. Thus, some observers even suggest that the price of bitcoin could drop by $20,000. A thorough analysis of these dynamics reveals both the challenges and the opportunities of a market in search of new certainties.

International economic dynamics always attract marked interest, particularly when coalitions like the BRICS are perceived as a threat to the hegemony of the American dollar. However, the recent statements from Russia, India, and South Africa have clarified their position. Indeed, these countries assert that no plan aims to weaken the American currency. They firmly reject the accusations of "de-dollarization" and emphasize their willingness to maintain stable relations with the United States.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic disputes. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Elon Musk is shaking Washington. Between his influence on social media and his hundreds of millions of dollars in donations, Elon Musk is increasingly establishing himself as the true master of the White House.