Qubic Hits 52.72 % Of Monero’s Total Hashrate

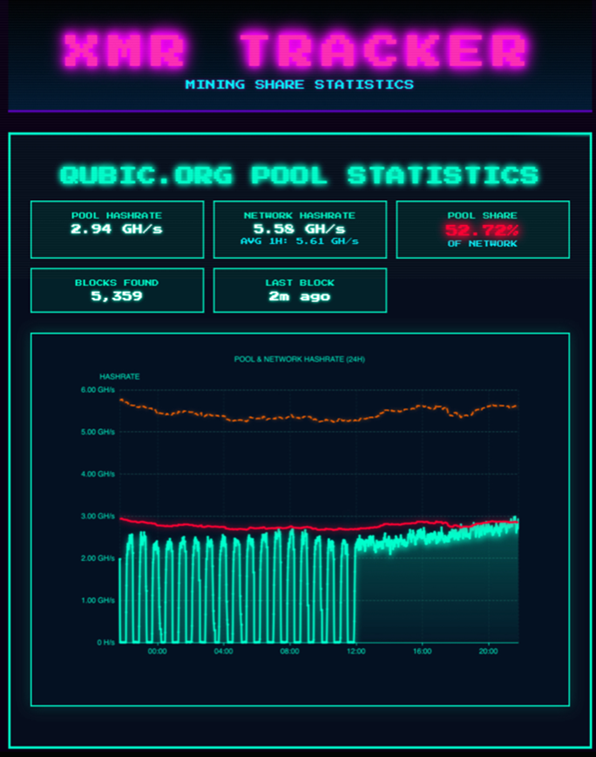

The Qubic network (QUBIC) surprised by temporarily reaching 52.72 % of Monero’s (XMR) total hashrate, with a computing power of 3.01 GH/s. This technical performance, although brief, shows the power of this project.

In Brief

- Qubic briefly reached 52.72% of Monero’s hashrate with 3.01 GH/s, demonstrating exceptional computing power.

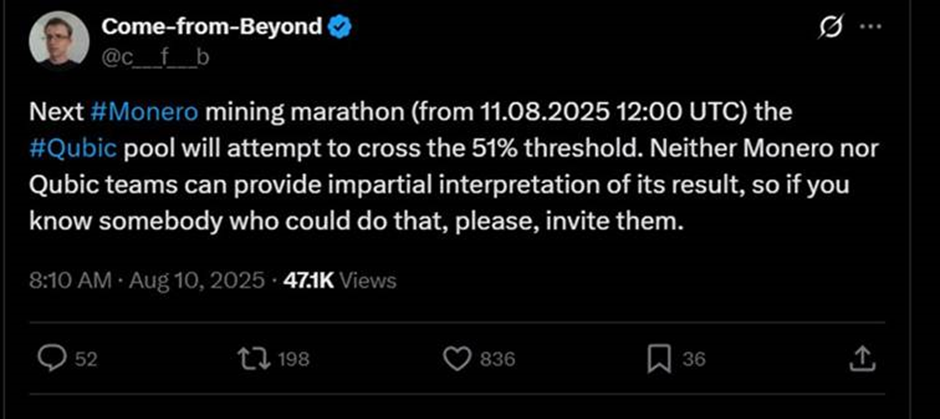

- The project aims to maintain more than 51% hashrate dominance between August 2 and 31, 2025 as part of a planned test.

- A technical collaboration between Sergey Ivancheglo and Shai documents results and addresses accusations of malicious attacks.

- Many Monero miners migrated to Qubic despite a DDoS attack temporarily reducing the pool’s power.

A hashrate peak that sparks debate

During a few critical minutes, the Qubic network demonstrated its ability to mobilize considerable computing power on Monero, on alert for several days. This peak at 3.01 GH/s represents a significant technical feat, especially since the network had previously reached 2.3 GH/s, accounting for more than 45% of Monero’s total hashrate.

This increase is part of a broader strategy announced by Sergey Ivancheglo, a leading figure of Qubic. Qubic plans to target over 51 % hashrate dominance during marathons between August 2 and 31 and maintain it stably to demonstrate its technical capabilities.

The method used by Qubic relies on economic incentive: by rewarding miners with QUBIC tokens, the project massively attracts mining operators to its pool. The mined Monero are then exchanged for stablecoins and then for Qubic, creating a viable economic ecosystem to maintain this computing power.

A technical collaboration under scrutiny

The discussions between Come From Beyond (Qubic’s leader) and Shai, former Kaspa (KAS) developer, reveal the collaborative aspect of this demonstration. These technical exchanges suggest an intent to document and scientifically validate the results obtained, beyond mere announcements.

This methodical approach contrasts with accusations of malicious attacks made by some Monero community members. Qubic presents this operation as a network stress test, aiming to identify potential vulnerabilities before they can be exploited by malicious actors.

Massive migration of Monero miners

One of the most remarkable phenomena observed during this period involves the spontaneous migration of Monero miners to Qubic pools. This reallocation of computing power illustrates the mining market’s sensitivity to economic incentives.

Earlier in the week, the Qubic mining pool reportedly suffered a distributed denial of service (DDoS) attack, causing the hashrate to drop from 2.6 GH/s to only 0.8 GH/s. This volatility demonstrates the fragility of power balances on cryptocurrency networks, which Qubic managed to counter by drastically improving its network.

Implications for Monero’s security

The temporary reaching of the 51 % hashrate threshold represents a major event in the crypto ecosystem. Theoretically, this level of control allows the blockchain to be reorganized, double spends to be created, or transactions censored.

However, Qubic claims this demonstration aims to strengthen Monero’s security rather than attack it. The first takeover test was scheduled for Saturday, August 2, 2025, suggesting a planned and transparent approach.

The economic model of Qubic in question

Qubic operates according to a Useful Proof of Work (UPoW) system, transforming mining energy into artificial intelligence computations. Qubic is the fastest blockchain ever verified by CertiK, with a peak of 15.52 million TPS.

This technical approach economically justifies Qubic’s Monero mining strategy. The revenues generated feed the QUBIC ecosystem while funding distributed computing operations. A model that challenges the traditional boundaries between different blockchain networks.

Outlook

This situation raises fundamental questions about the governance and security of decentralized networks. If Qubic can temporarily control more than 50% of Monero’s hashrate, other actors with significant resources could theoretically replicate this performance.

For Monero, this ordeal could catalyze protocol improvements or reflections on the evolution of the RandomX algorithm. The XMR community is already exploring solutions like P2Pool to improve mining decentralization.

For Qubic, the technical success of this operation strengthens the project’s credibility. The demonstrated ability to quickly mobilize considerable computing power positions Qubic as a key player in the sector.

FAQ

Did Qubic really attack Monero ? No, according to official statements, it was a planned stress test to identify vulnerabilities in the Monero network.

What does controlling 51 % of the hashrate mean ? Theoretically, it allows rearranging the blockchain, creating double spends, or censoring transactions, representing a major risk to network security.

Why are miners migrating to Qubic ? Qubic offers attractive economic incentives by rewarding miners with QUBIC tokens in addition to traditional mining revenues.

Is this situation temporary ? The experiment was planned for the period from August 2 to 31, 2025, but recent developments suggest an evolving situation.

What are the risks for Monero holders ? In case of prolonged takeover, temporary network disruptions are possible, but no loss of funds is expected for holders.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.