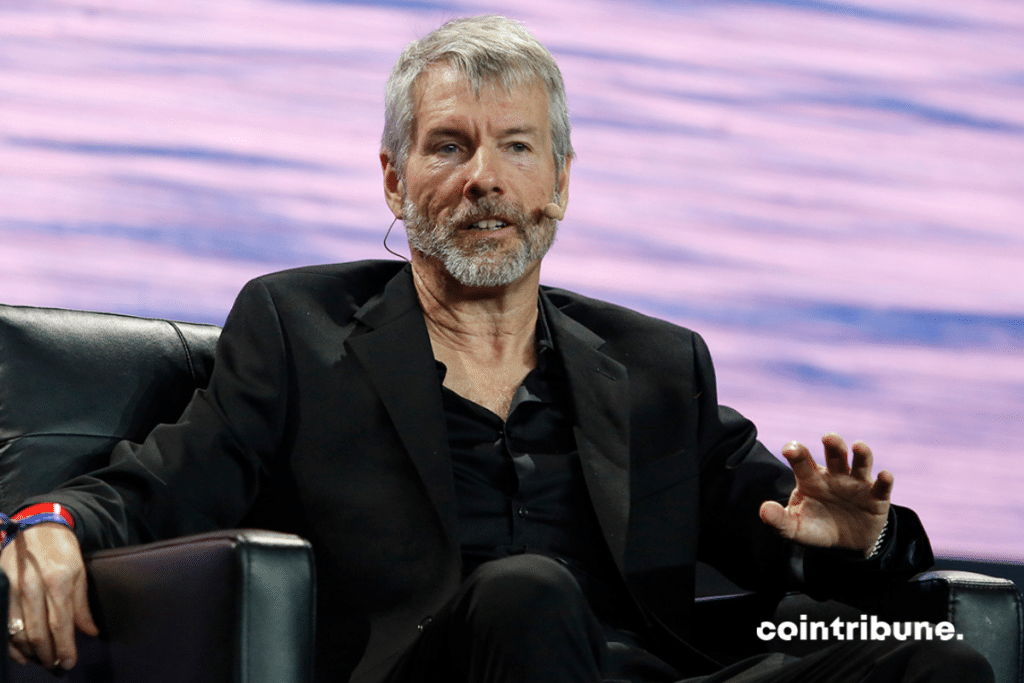

In my recent interview with Bloomberg HT I discussed the appeal of #Bitcoin for global citizens seeking wealth preservation while struggling with the challenges of political volatility, currency debasement, bank instability, & counterparty risk in countries like #Turkey. pic.twitter.com/iYwGk5mFmq

— Michael Saylor⚡️ (@saylor) June 18, 2023

A

A

Saylor: "We need three currencies"

Thu 22 Jun 2023 ▪

5

min read ▪ by

Getting informed

▪

Investissement

Michael Saylor made statements on Bloomberg that stand in stark contrast to what we have been hearing from “Austrian” economists.

Saylor doesn’t see Bitcoin replacing fiat currency

The journalist’s question:

Bitcoin must prove itself as a stable means of payment. Its price is very volatile. How could a “commodity” whose price is fixed in US dollars solve current problems?

Michael Saylor’s response:

“I think it is important to keep in mind that all citizens of the world need three types of currency. They need a local currency, such as the Turkish lira, to pay their taxes and buy local products. They need a global currency, the US dollar, to purchase products internationally. And they need an asset that they can pass on to future generations and that will last for 30, 60 or 100 years.

Bitcoin is that asset. The US dollar represents the global reserve currency, and your local currency is determined by the jurisdiction in which you live and in which your local taxes and expenses are denominated.

There is no need to replace the local currency; that will not happen. [Bitcoin] will also not replace the dollar. What it replaces is that real estate, stock, or gold bar in which you would invest.

And compared to gold bullion, which doesn’t increase in value in real dollars, bitcoin is a hundred times more valuable, if not more so. So bitcoin represents a long-term asset, not your everyday checking account or local payment method.”

“These statements can be compared to those made at the Bitcoin conference in Prague: ‘No country can stop inflation. No one can stop inflation. I can put you in charge of the world, and you still wouldn’t be able to stop inflation.’”

Bitcoin as the only currency?

Michael Saylor doesn’t seem to think that a world with a single currency in an absolutely fixed quantity is the best formula.

Yours truly agrees, for two main reasons:

- How can large projects be financed without the tool of debt?

- How can interest be paid?

An advanced civilization needs the tool of debt to finance its infrastructures, which are much more complex than before.

France plans to build four nuclear reactors soon, at a cost of 50 billion euros. Without the tool of debt, it would require finding 5 million French people willing to lend 10,000 euros each for a minimum period of 10 years. Good luck with that.

Furthermore, it is mathematically impossible to collect interest on a fixed money supply. Why? Because the money corresponding to the interest is not initially in circulation in the economy.

Paying interest on the entire money supply is only possible by increasing the money supply. Banks ensure this by lending a little more each year than the previous year (lower interest rates, longer loan terms, and an increase in the population eligible for loans).

It’s a Ponzian process, but essential from an accounting point of view. Unfortunately, without productivity gains (increased output per hour worked), this monetary inflation translates into a lower standard of living.

The fiat system is neither good nor bad. It’s simply the best system for growing as fast as possible. Everything’s fine as long as we can produce more and more energy to feed the machines on which our productivity depends.

Inflation will be even higher the faster we go down the energy ladder. The peak of oil (potentially reached in November 2018) will be the most inflationary event of our generation.

Bitcoin offers an absolute store of value to all those who aren’t rich enough to invest in real estate, art, etc. It doesn’t need to replace fiat currency to be worth millions….

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.