Crypto funds have just recorded their fifteenth consecutive week of inflows, confirming a bullish momentum despite market volatility. Ether stands out significantly, attracting the majority of capital on its own. Bitcoin, on the other hand, shows a slight decline, giving way to the rise of altcoins.

Theme Altcoins

After a sharp surge, XRP and Dogecoin have just experienced a brutal correction, sending new entrants back to their uncertainties. This sudden turnaround highlights the fragility of unconsolidated rises and calls into question the strength of the rebound observed in recent weeks.

Ethereum is once again in the spotlight. While Bitcoin stabilizes, the second giant of the crypto market may be preparing for a historic breakthrough. Several crypto analysts anticipate a parabolic run towards a new peak. The path to $5,000 appears clear... but how far can ETH really go?

SharpLink shakes up the crypto market with a massive purchase of 77,210 ETH, surpassing the network's monthly issuance. This strategic move, combined with the excitement for Ethereum ETFs, could propel the price of ETH towards $5,000 soon.

Pump.fun’s PUMP token surged quickly but has tumbled under $1 billion in market value, stirring doubts even as optimism lingers.

Ethereum is regaining market attention as investors turn their eyes away from Bitcoin after weeks of record highs. At the time of writing, the global crypto market cap has climbed to $3.88 trillion, up 1.81% in the last 24 hours. Ethereum is trading at $3,743.91 with a 2.42% daily gain, while Bitcoin’s market dominance has slipped slightly to 60.53%.

While Ethereum is losing its whales, Cardano attracts them. But behind these mysterious comings and goings, the crypto ocean hides monsters and a barely concealed war of influence.

While the spotlight seemed to be focused elsewhere, BNB surprised the entire market by setting a historic record at $851.48. The surge, which occurred over the weekend, triggered a series of massive liquidations, revealing the extent of leveraged exposure. This sudden spike places Binance's crypto at the center of the action, amidst rising activity on the BNB Chain and institutional players beginning to stake their positions.

TAO, INJ, and FET are causing a stir on social media and capturing the attention of crypto investors. Driven by the rise of decentralized AI, these projects could reshape the Web3 landscape. Is it just a temporary hype or a lasting transformation? Discover the complete analysis of the key signals.

As the crypto market wavers in uncertainty, XRP defies expectations. After bouncing back from a dip below $3, the asset rekindles projections towards $4. This sudden surge, amid massive liquidations, places XRP back at the heart of speculative play. The $4 threshold, forgotten since 2018, becomes a credible target for bullish investors in a climate where few assets manage to reverse the trend with such strength.

Ethereum is on track for more gains, with analysts citing strong demand, limited supply, and growing treasury adoption.

Ethereum attracts billions $ via its spot ETFs, breaking a historic record with 17 consecutive days of inflows. This institutional wave propels ETH to the center of crypto investment strategies. Why this sudden enthusiasm? What are the long-term impacts?

Bitcoin is holding its breath under the pressure of $98,000. This critical threshold could trigger a flash crash or propel the asset to new heights. Technical analysis, accumulation zones, and market signals: everything you need to know before the next move.

The Ether Machine launches with 400,000 ETH, aiming to unlock Ethereum yield for public markets and drive institutional adoption.

XRP briefly crossed $3.65, its highest level in seven years, before plummeting to $3.09. This 15% correction raises questions about the strength of the rally in a context of increased volatility. Amid strategic portfolio movements, speculative pressures, and remnants of regulatory tensions, the market struggles to determine: is this a mere technical pullback or a signal of a deeper exhaustion?

As volatility shakes the entire crypto market, Ethereum stands out with unexpected stability. Even as Bitcoin and altcoins lose ground, ETH holds firm. This resistance is anchored in a robust technical setup, but above all, in a discreet accumulation led by strategic players. In the shadow of visible fluctuations, deep dynamics are taking shape, redefining the contours of a possible rally to come.

Solana’s core development team is preparing to significantly raise the network's computational capacity with a new proposal. The Solana compute unit limit increase aims to meet the growing demands of high-performance decentralized applications (dApps).

It’s been a full year since spot Ethereum ETFs went live in the U.S., and the market is celebrating with a strong streak of inflows and bullish sentiment. Despite being overshadowed by Bitcoin ETFs, these funds have quietly carved out a substantial presence.

New record for BlackRock: its Ethereum ETF climbs to $10 billion in 251 days. All the details in this article!

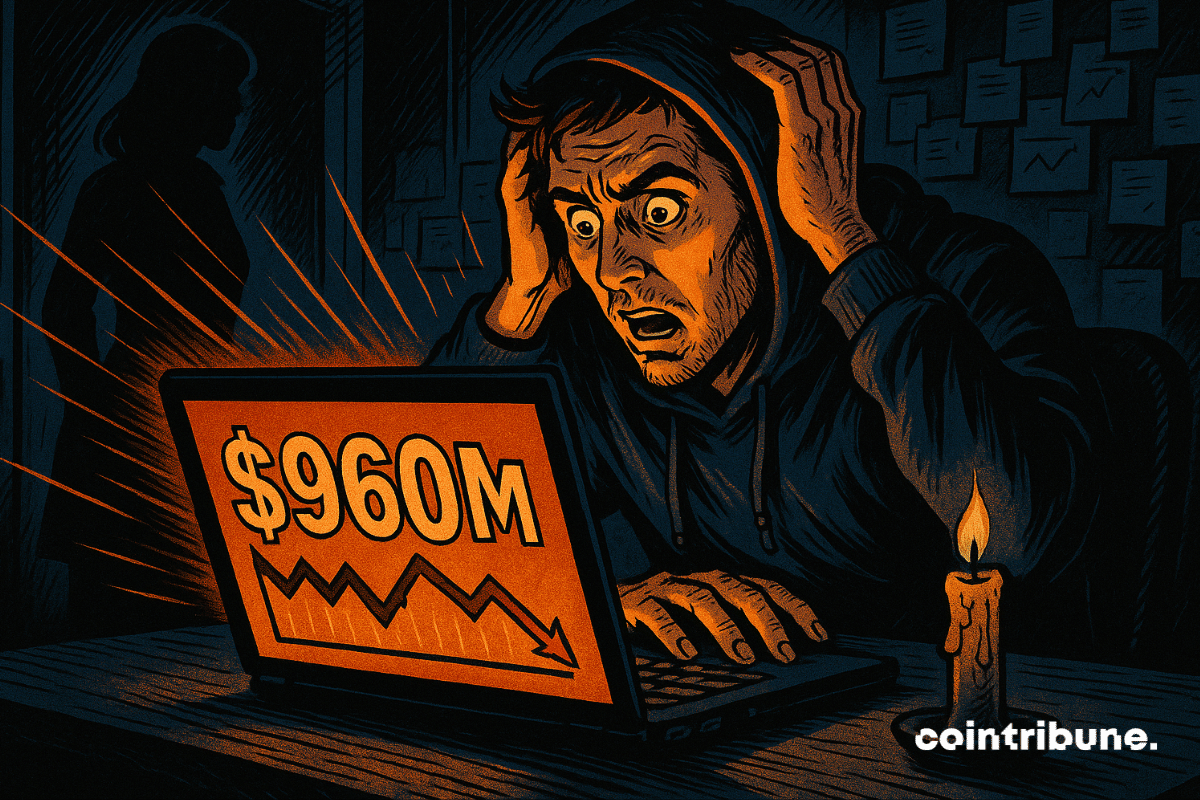

On July 24, nearly a billion dollars in leveraged positions were liquidated within a few hours, triggering a wave of sales on derivative platforms. XRP, Dogecoin, Ethereum, and Solana all plummeted, caught up in an overheating mechanism fueled by massive speculative bets. A dark day that reminds us how volatility remains the rule, not the exception, in the crypto universe.

For several sessions, the bitcoin market has been showing signs of increasing tension. An unusual accumulation of liquidity above the price and a rapid increase in its dominance are reigniting speculation. In the shadows of the charts, short sellers and eager buyers are engaged in a tactical duel. For several technical analysts, the stage is set: a massive short squeeze now seems inevitable.

Ethereum wavers between past profits and the cold sweats of summer: an explosive cocktail mixing variable rates, rapid predictions, and a DeFi that grits its teeth.

Chris Larsen, co-founder of Ripple, moves 175 million dollars worth of XRP at a high price. Could this massive movement signify a strategic dumping? Discover the implications of this action on the crypto market and the risks for investors.

Bitcoin’s rally is starting to cool, and eyes are now turning to altcoins. With volumes soaring, Binance is right in the thick of it.

Ethereum’s next major protocol upgrade, Fusaka, is scheduled for launch in early November. Developers aim to boost scalability and network resilience while trimming unnecessary features.

Altcoins suddenly plunge after a frenzied rally. Ethereum and XRP drop, but Bitcoin remains calm. Temporary correction or the beginning of a real reversal in crypto? Suspense.

Andrew Keys, co-founder of Ethereum-focused investment firm The Ether Machine, has reignited the ETH vs BTC debate. During his media rounds, Keys emphasized that Ethereum has significantly outperformed Bitcoin in returns over the last decade.

Every token unlock by Ripple rekindles tensions surrounding XRP. On August 1st, one billion tokens will be released from escrow, according to a well-established monthly schedule. Predictable yet always scrutinized, this movement fuels speculation about a potential market impact, as XRP attempts to breach a crucial technical threshold. In an ever-nervous crypto climate, Ripple's strategy raises as many questions as it reassures.

In a crypto market plagued by uncertainty, XRP surprises. While Bitcoin wavers and Ethereum experiences sharp fluctuations, Ripple's asset aligns bullish technical signals. Long burdened by its legal troubles, the crypto is now shaping a unique market structure, blending support stability with order book density. This atypical trajectory intrigues analysts and traders. XRP could well be gearing up for a powerful return to levels previously thought unreachable.

In just 13 days, Ethereum ETFs have captured over $4 billion. A record influx shaking up the crypto market and attracting finance giants. Discover why Ethereum could soon dominate the digital asset landscape.