Bitcoin surpasses $105,000 and some investors are already thinking about selling. However, according to a recognized expert, there is no clear signal justifying this. A key indicator shows that bulls are still in the game. Here’s how to interpret this signal… and avoid giving in to panic.

Article long

There are days when markets scream, but few know how to listen. A sudden Bitcoin surge, a flood of institutional capital—and yet, most internet users miss the signal. Why? Because raw information isn’t opportunity until it becomes actionable. In this era ruled by ETFs and bots, one key question emerges: can you monetize these signals without being glued to your screen? The answer is yes—if you have the right tool and a strategy that reads between the lines of the order book.

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

American senators want to ban Donald Trump and senior officials from promoting or holding cryptocurrencies. The initiative, introduced amid tensions over stablecoin regulation, aims to counter potential conflicts of interest related to crypto projects supported by the current president. Will this political offensive mark the end of Trump’s influence on the crypto market?

Under the guise of progress, Paris is rolling out the red carpet for crypto lombard credit... but the banks couldn't care less, and Bercy is already pulling out the calculator to tax the bold.

While panic looms over small investors, the whales are resurfacing at Binance, depositing their digital gold, and patiently waiting for the storm to pass.

An exciting rumor is sweeping through Web3: Pokémon may land on SUI! Immediate result: the SUI token has skyrocketed by 60%, reigniting a glimmer of hope in the decentralized gaming universe. This sector, long hindered by archaic and off-putting interfaces, is being reborn like a digital phoenix. Thanks to optimized blockchains and the arrival of visually stunning AAA games, the future looks electrifying. In short, it's here: Web3 gaming is no longer a promise… it’s a reality to embrace right now. The journey is just beginning. And what about you, are you getting on board or staying on the platform?

Ripple Labs and the U.S. Securities and Exchange Commission (SEC) are close to concluding their long-running legal dispute. The two parties have reached an agreement involving a $50 million settlement payment. The case, which has spanned nearly four years, centered on whether Ripple’s sale of XRP constituted an unregistered securities offering.

A flagship asset of the 21st century, bitcoin fascinates as much as it divides. While its price already defies traditional financial standards, some experts predict a surge towards one million dollars. Long considered marginal, these projections are now gaining traction in economic influence circles. Financial institutions, renowned investors, and regulatory figures are sketching a future where BTC could become an essential store of value in a world shaken by inflation, monetary distrust, and a rapidly accelerating institutional adoption.

The U.S. Office of the Comptroller of the Currency (OCC) has confirmed that banks can now help customers buy and sell crypto assets held in custody. They are also allowed to provide and outsource cryptocurrency custody and execution services, provided these activities are backed by strong risk management.

The crypto greenback is waging its war: while rivals battle in plain sight, USD1 climbs the rankings, propelled by the Trumps and boosted by billions.

After its correction, SUI displays very encouraging technical signals. Find our complete analysis and the current technical outlook.

"A few hours before a key decision from the Federal Reserve, traditional markets freeze. In contrast, the crypto market comes to life. While Wall Street holds its breath, Bitcoin traders intensify their long positions, betting on a favorable scenario. This agitation goes beyond mere technical betting. It reflects an offensive strategy in a context of monetary uncertainty. As the Fed prepares to decide on its rates, the crypto market seems to have already taken its position, ready to capitalize on the slightest shift in economic discourse."

XRP consolidates after a significant increase. Find our complete analysis and current technical outlook.

With the rapid advancements in quantum computing, the threat to traditional crypto systems is now an undeniable reality. The so-called "Q-Day"—the day when quantum computers become powerful enough to break current cryptographic systems—is no longer a distant possibility. For the crypto world, this moment represents an existential threat. How can we prepare for this looming danger? The answer: Naoris Protocol, a cutting-edge solution designed to secure blockchain and Web3 technologies against the post-quantum future.

Ripple’s Chief Legal Officer, Stuart Alderoty, has criticized Elizabeth Warren, a United States Senator representing Massachusetts, for opposing key legislation aimed at regulating stablecoins in the United States.

While several economic powers consider integrating bitcoin into their reserves, the United Kingdom opts for a strategic break. No national reserve in crypto will come to fruition, the Treasury confirmed at the FT Digital Asset Summit in London. This decision sharply contrasts with the offensive approach of the United States under the Trump administration. What does this choice reveal about the British crypto vision? And what will be the implications for London’s position in the global digital ecosystem?

A troubling change in philosophy is at work among the Bitcoin Core developers who are turning a deaf ear to consensus.

Bitcoin takes a pause after a bullish surge: find our comprehensive analysis and the current technical outlook for BTC.

2025 marks a turning point for Real-World Assets (RWA) in decentralized finance. Long regarded as the missing link between the real economy and Web3, RWAs are finally gaining momentum thanks to blockchain infrastructures designed for the concrete use cases of trade financing. Among the pioneers of this convergence are Credefi and XDC Network, who are announcing a strategic alliance to democratize access to tokenized credit for European SMEs, with real guarantees, stable returns, and end-to-end regulatory compliance.

Altman turns his coat and pulls out his benefactor's cape: OpenAI swears allegiance to its non-profit soul, while Musk screams about the heist of artificial intelligence...

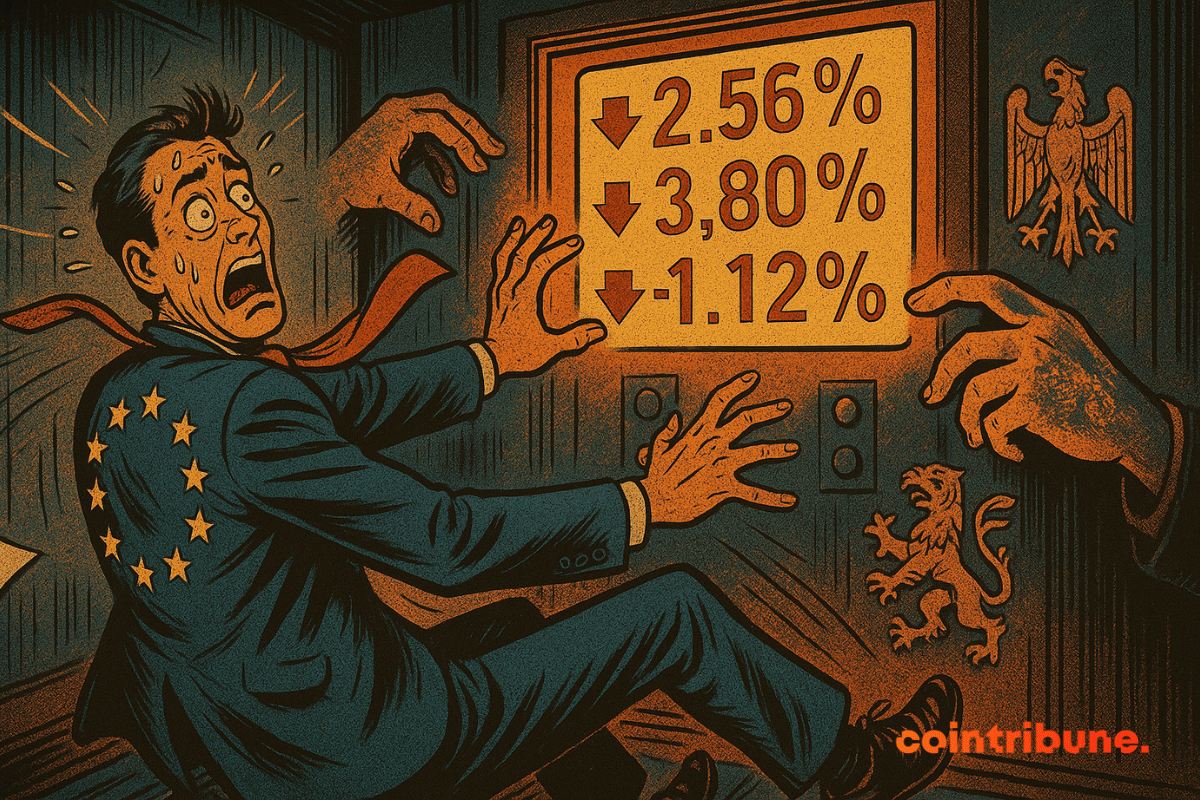

European markets began the week without a clear direction, caught between two major uncertainties: the upcoming decisions of central banks and fears of a global trade tightening. On Monday, May 5, the main financial markets show clear caution, illustrated by slightly declining indices and low trading volumes. Indeed, investors are anxiously awaiting the next announcements from the Fed and the Bank of England, in an environment where every monetary or diplomatic signal can shift the trend.

The crypto market sometimes holds surprises that shake up the usual references. This is the case with XRP, whose derivatives have just experienced a spectacular surge: +62.99% in volume over 24 hours, or $4.52 billion according to Coinglass. This is a significant jump that contrasts with the decrease in open interest, suggesting a speculative enthusiasm tinged with caution. This imbalance between excitement and restraint intrigues industry players and fuels speculation about the evolution of the Ripple ecosystem.

Bitcoin is holding its breath. In a context where every economic decision can shake the markets, the most coveted digital asset seems ready to reach a new milestone. Amid conflicting signals and feverish expectations, one thing is certain: here are 5 key factors that will make this week anything but ordinary.

The recent scandal surrounding Mantra (OM) has shaken the crypto sphere, rekindling deep concerns about governance and transparency in the realm of real-world assets (RWA). However, beyond the turmoil, some players like RealFin see in this crisis an opportunity: to demonstrate that another model is not only possible but necessary.

When Elon Musk plays politics with Trump, it's Tesla that stumbles at the start. Between free falls, a hesitant board, and angry tweets, the Empire of the tweet dangerously wavers.

In the crypto market, opportunities do not announce themselves. They explode. At a time when every pump can generate exceptional gains in just a few hours, missing these movements often means missing the essence. However, detecting and capturing these impulses in real-time is a true challenge, even for a seasoned trader. Hence the interest in automating one's strategy with Runbot and the SuperTrend indicator.

As oil prices plummet and demand remains sluggish, OPEC+ surprises by announcing a massive increase in its production starting in June. Eight members of the cartel break with recent caution and reignite uncertainty in an already tense market. Behind this turnaround lies a possible geopolitical and economic turning point, between a strategy of recovery and calculated risk-taking. This decision could reshape global energy balances.

Buffett leaves the ship in the middle of a storm, handing the helm to Abel and a fortune along the way. And he continues to preach discipline, even surrounded by flames, debts, and burning cryptos.

Vitalik wants to shave for free: no more gas factories, a return to a comprehensible Ethereum without a doctorate, with a RISC-V machine as the engine and a layer 1 as clean as a new penny.