BitMEX research shows BRC-20 tokens dominate Bitcoin activity, while ordinal images shape storage and node performance differently

Article long

A tidal wave of bitcoin is pouring into company treasuries and things finally seem to be clearing up in France.

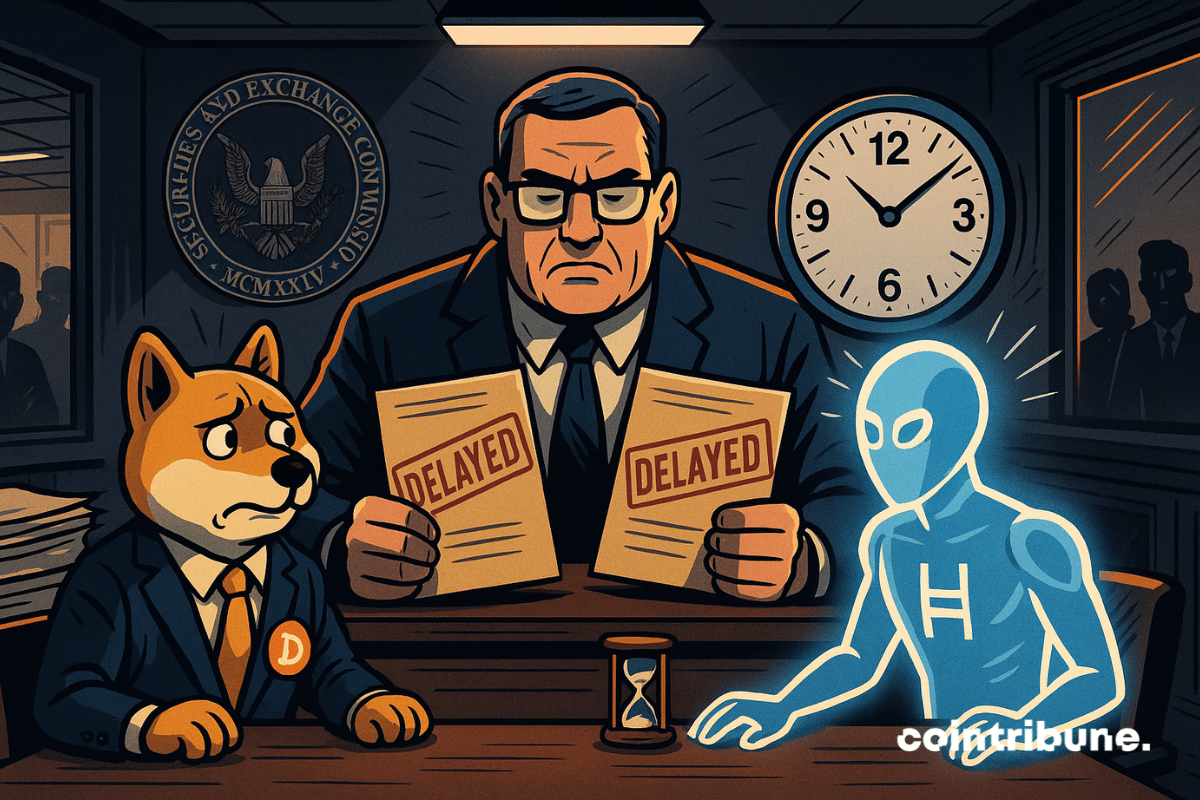

The U.S. Securities and Exchange Commission (SEC) has once again postponed its decisions regarding two highly anticipated crypto ETFs. The Bitwise Dogecoin and Grayscale Hedera ETFs will have to wait until November 12 to learn their fate.

XRP returns to the forefront, boosted by speculation around an ETF. After a long phase of inertia, Ripple's crypto makes a leap by briefly crossing $3, driven by an approval probability estimated at 95% by Bloomberg. This sudden resurgence of activity places XRP back at the center of discussions, between speculative frenzy and questions about the strength of its fundamentals.

As economic tensions intensify between major powers, a dissenting voice challenges the dominant narrative in Washington. According to Boris Kopeikin, chief economist at the Stolypin Institute, the US trade deficit with China is not the result of a BRICS strategy, but rather a structural weakening of the American economy. This interpretation reignites the debate on the root causes of American imbalances in a world undergoing major reconfiguration.

The hierarchy of European sovereign debts has just shifted. On Tuesday, September 9, France borrows at a higher rate than Italy on ten-year bonds. Less than 24 hours after the fall of the Bayrou government, the markets have decided: the French signature is no longer a refuge. This reversal, unprecedented in over a decade, marks a loss of confidence affecting the State's budgetary credibility.

A hijacked NPM account was at the center of a major supply-chain breach, putting the JavaScript ecosystem and crypto users at risk.

Pump.fun rejoices, Solana celebrates: PumpSwap dethrones its rivals. Crypto record at $878M, but already, criticisms and rug pulls darken the memecoins sky.

The crypto platform Finst officially enters the French market on September 9, 2025, promising to shake up cryptocurrency investing with ultra-competitive rates and a transparent approach. Founded by former DEGIRO executives and regulated by the Dutch Financial Markets Authority (AFM), this Dutch platform aims to democratize access to crypto-assets in France.

Bitcoin clings to its $110,000 like an old sailor to his raft. While giants buy, whales sell, and traders sweat.

SwissBorg has just suffered one of the most striking hacks of the year. In a few hours, 193,000 SOL, or 41 million dollars, were siphoned off via a flaw in the Kiln validator API, a provider responsible for staking on Solana. It was not SwissBorg's infrastructure that failed, but that of a third-party partner. The incident reignites the debate on the security of external integrations in a sector where the slightest failure can be enough to bring down the entire chain.

Cloned Drake, TaTa invented by Timbaland, Grimes shares her voice... When AI thinks of itself as the new pop star, artists shout genius or scandal.

Bitcoin, does it take away or does it enrich? For Michael Saylor, it inflates the wallet: $7.37 billion gained despite a market drop. Proof that faith pays off.

The disappearance of a few thousand bitcoins from a balance sheet is enough to fuel controversies. This weekend, the issuer of USDT found itself at the center of a media whirlwind: did it secretly sell its BTC? Some saw a strategic shift there. However, behind the seemingly worrying figures, another reality emerges, much more nuanced, and above all, revealing the discreet movements of a giant in crypto finance.

Stripe, once skeptical, now has its own in-house blockchain. Officially for stablecoins, unofficially to outshine the crypto heavyweights. Engineers grumble, Collison celebrates.

Quantum computer and Bitcoin. Here is a hot series that is not about to fade, especially after IBM's latest experiment.

The tokenized real-world asset (RWA) market reaches a new milestone with Ondo Finance's groundbreaking announcement: the deployment of over 100 American stocks and ETFs directly on the Ethereum blockchain. This major initiative propels the ONDO token to new heights, flirting with the symbolic 1 dollar mark.nThe enthusiasm around Ondo Finance signifies a silent revolution redefining access to traditional financial markets. By eliminating intermediaries and offering 24/7 trading, tokenization fundamentally transforms how investors interact with traditional assets.nThis evolution is part of a broader movement where blockchain becomes the new standard for democratizing investment, from real estate with players like RealT to listed stocks with Ondo Finance. A breakdown of a sector that could well disrupt traditional finance.n

Crypto exchange Bybit officially launches its payment card in the European Economic Area with an exceptional welcome offer of 20% cashback. An aggressive strategy to conquer the European crypto payments market.

After trailing Bitcoin for most part of a decade, Ethereum has toppled the OG crypto in monthly and weekly spot trading volume on centralized exchanges. Market data ties this trend flip to recent trends, including increased institutional adoption of Ether, as well as capital rotation from BTC to ETH.

Analysts say Bitcoin could fall below $100K before recovering, with key levels and market trends guiding the outlook.

The world’s first DePIN grand event — DePIN Expo 2025 — successfully concluded at Hong Kong Cyberport! The expo brought together global industry leaders, scholars, and developers, focusing on decentralized physical infrastructure (DePIN), AI, and Web3 frontier applications. With over 20 innovative projects showcased, it highlighted Hong Kong’s strategic position as an international DePIN hub and opened a new chapter for real-world infrastructure and economic models.

The decentralized finance (DeFi) landscape continues evolving beyond traditional crypto-collateralized lending, with platforms like Credefi pioneering a revolutionary approach that bridges digital assets with tangible real-world collateral. This innovative platform addresses one of DeFi's most persistent challenges: the volatility inherent in crypto-backed lending protocols.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is advancing its European expansion. Bybit EU Group took this next step with the formal application submission for a license under the Austrian implementation act of the Markets in Financial Instruments Directive (MiFID II) through one of its Austrian entities, Bybit X GmbH.

In the great Trump crypto fair, Justin Sun goes from ally to suspect. His tokens frozen, his political friendship gone.

Coinbase puts its engineers on a dry diet: AI already codes 40% of the in-house software. Armstrong rejoices, skeptics grumble. Rapid layoffs for latecomers.

Is bitcoin approaching a decisive turning point? As signs of fatigue accumulate, a new analysis rekindles the specter of an imminent bearish cycle. According to a fractal modeling aligned with historical four-year cycles, October could mark the beginning of a deep correction. After the euphoria of the highs, the market enters a phase of uncertainty where every technical signal is scrutinized. This scenario, increasingly discussed among analysts, calls into question the strength of the current upward trend.

American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.

In July 2025, a Microsoft vulnerability exposed over 400 public organizations, including the U.S. agency that manages the nuclear arsenal. Hospitals paralyzed, schools ransomed, and a post-quantum deadline now set: 2025 reminds governments that they won't win the cybersecurity race with late patches and centralized architectures. Faced with this reality, one question emerges: how do we build a truly resilient trust infrastructure?

The President of the European Central Bank steps up against dollar-backed stablecoins. During a conference in Frankfurt, Christine Lagarde demanded "firm" guarantees for any foreign issuer wishing to operate in the EU. A strong signal of European fears regarding the growing influence of the greenback in cross-border digital payments.

September, long synonymous with a downturn for bitcoin, seems to be losing its curse. This historically unfavorable month for risky assets is starting, for the third consecutive year, a contrary dynamic. Supported by a flexible macroeconomic context and structuring institutional flows, the market is giving signs of maturity. The queen of cryptos no longer suffers the calendar: she redefines it.