While Americans pamper stablecoins, the Bank of France bares its teeth: crypto, dollar, and sovereignty do not mix well for the guardians of the monetary temple.

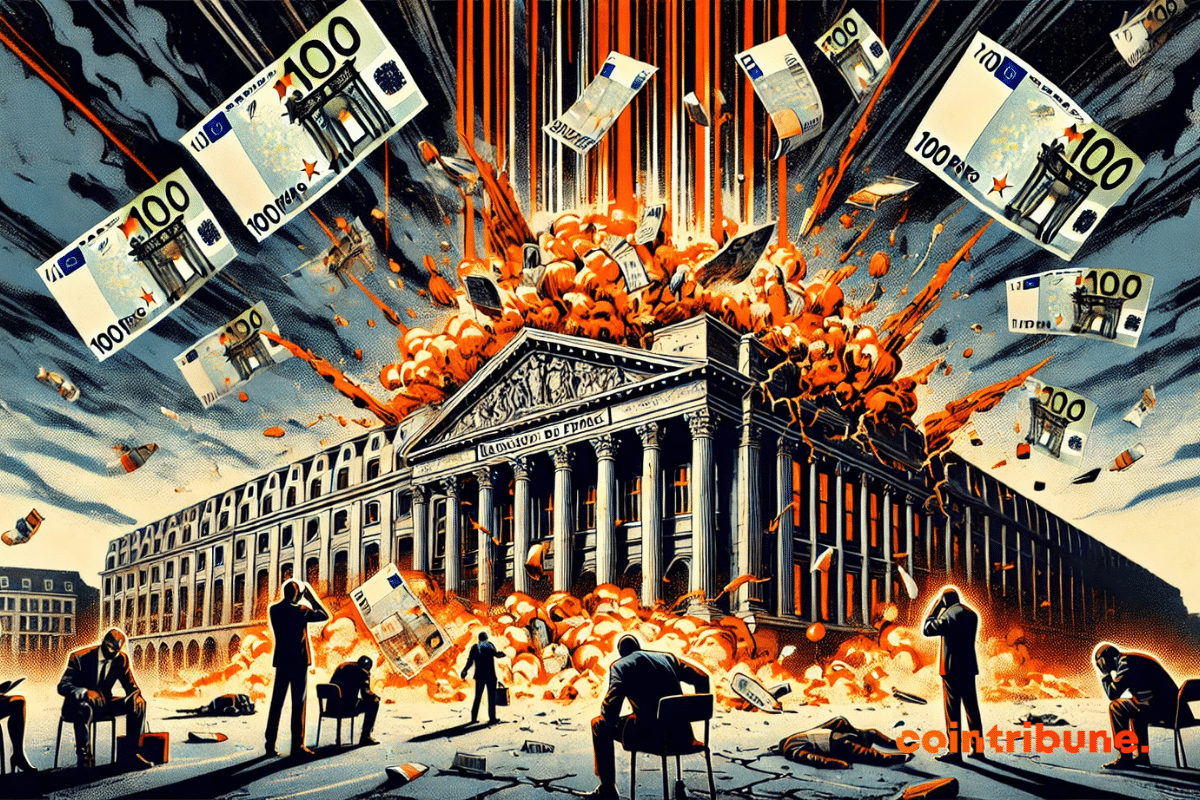

Banque de France

At 1.7%, the Livret A no longer inspires dreams. The LEP saves the furniture, while the youth flee to greener, or more volatile, pastures.

The Bank of France finds itself in 2024 facing an unprecedented financial situation with an operating loss of 17.7 billion euros. This loss, far from being anecdotal, highlights deep vulnerabilities within the European financial system, exacerbated by inflation, rising interest rates, and the management of public debts.

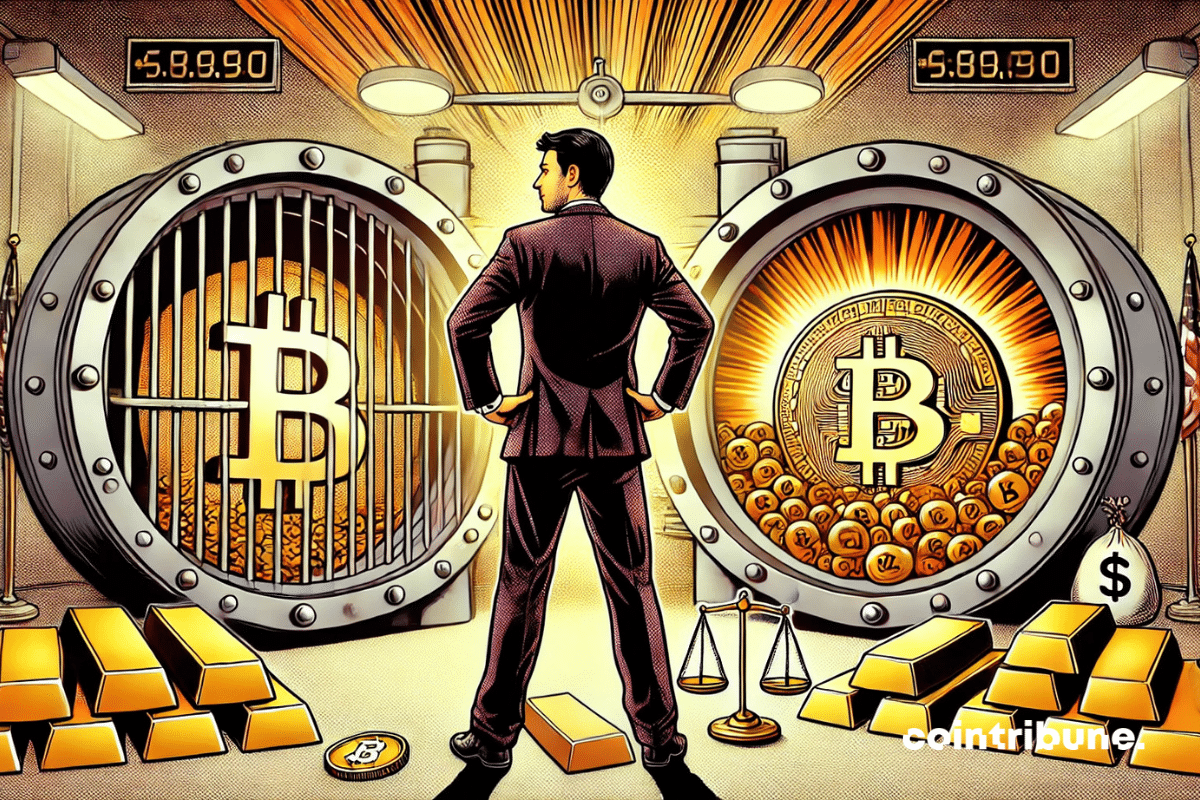

As central banks around the world run out of steam in an endless race of monetary printing, François Asselineau, president of the UPR, proposes a radical shift: integrating 5 to 10% of Bitcoin into the reserves of the Bank of France. An idea that shakes traditional economic certainties and questions our relationship with sovereignty. Behind this proposal lies an undeniable observation: Bitcoin is not just a simple cryptocurrency, but a tool of resistance against the erosion of financial freedoms.

French and Singaporean banking giants take a decisive step in the race for post-quantum security. The Bank of France (BDF) and the Monetary Authority of Singapore (MAS) have just achieved a world first: successfully testing a banking communication system resistant to future quantum attacks.