"While Bitcoin is catching its breath after a mining sprint, some miners are playing the capitalist ants. Not fools: produce, hold, and wait for it to soar. A strategy... not so cryptic."

Theme Bitcoin (BTC)

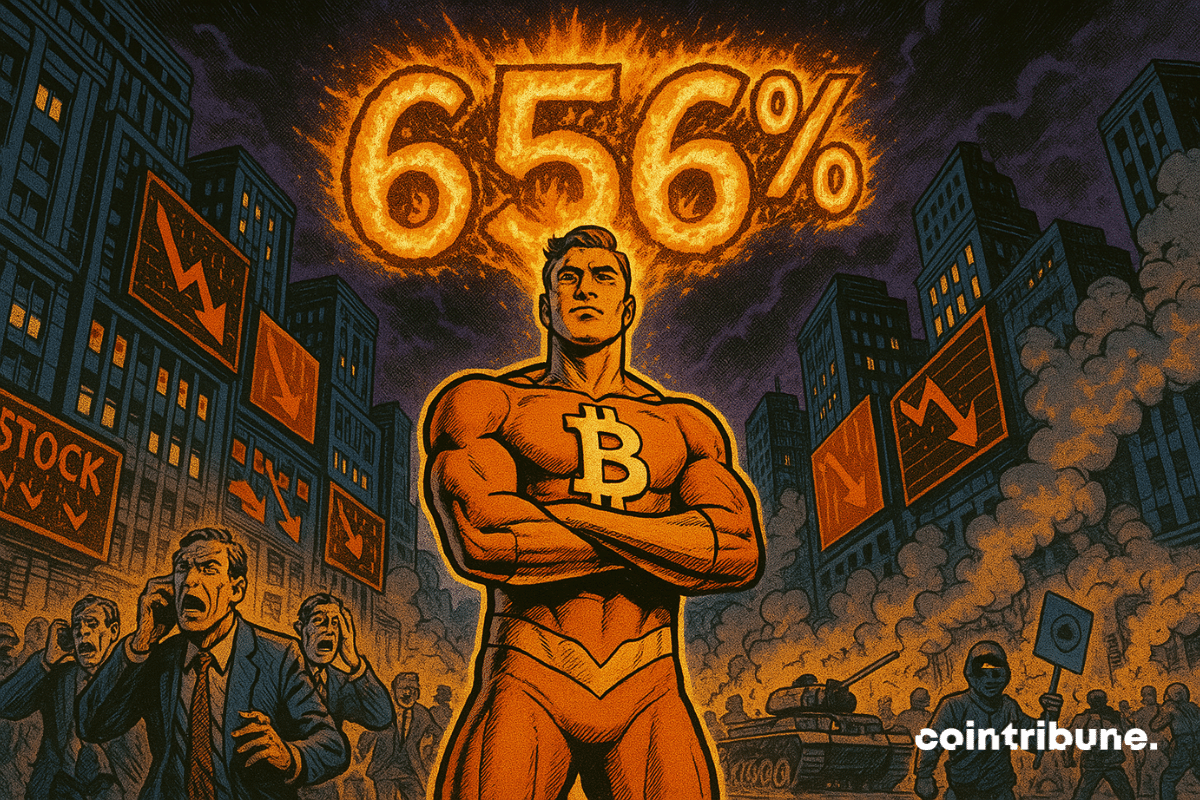

As geopolitical tensions shake traditional markets, Bitcoin continues to demonstrate its resilience with remarkable cyclical performance. According to Glassnode, the leading cryptocurrency has shown a gain of 656% since 2022, a progression that draws the attention of analysts.

June 13, 2025 marks a turning point in the Iran-Israel conflict. Massive Israeli strikes targeted the heart of the Iranian military infrastructure. Iran retaliated later that evening with 300 ballistic missiles, crossing a new threshold in this long-standing war.

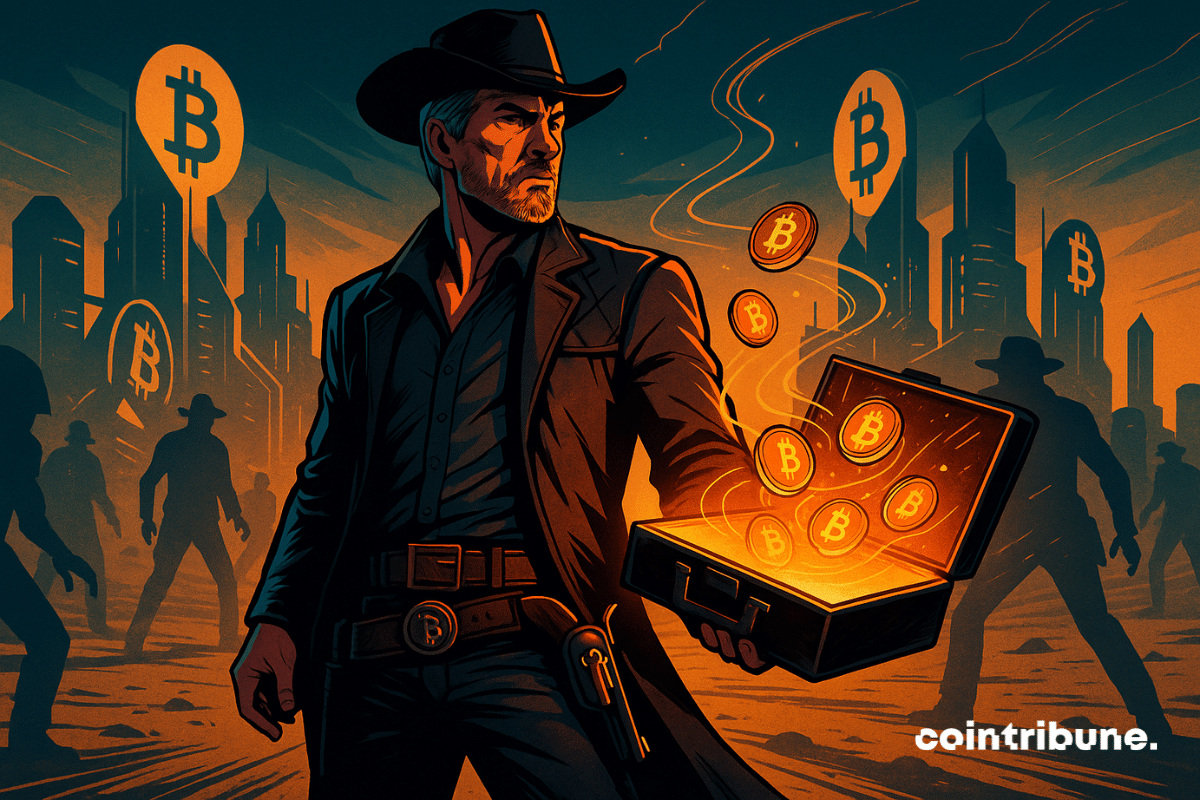

As tensions mount between Israel and Iran, Michael Saylor revives the machine. The co-founder of Strategy (formerly MicroStrategy), a fervent advocate of bitcoin, suggested this weekend a new massive purchase of BTC. This announcement comes in an explosive context, with targeted strikes in Tehran and risks of regional escalation. Against the grain of traditional markets, Saylor confirms his accumulation strategy, once again defying the logic of cycles and crises.

In a world where every geopolitical explosion shakes the financial markets, crypto seems strangely unflappable in the face of recent tensions between Israel and Iran. Yet, this apparent serenity may only be temporary. How long can greed, an irrational but powerful driver, keep the sector afloat?

Schiff gets carried away, gold soars, bitcoin wavers. What if behind the raging tweets lies a discreet farewell to the digital utopia?

The world is faltering, but Bitcoin holds strong. While missiles rain down in the Middle East and traditional markets hold their breath, an almost surreal dynamic is taking shape: investors are pouring billions into Bitcoin ETFs. Under normal circumstances, so-called "risky" assets flee at the slightest geopolitical tremor. But here, it's the opposite. It seems as if Bitcoin is in the process of changing its status: from speculative asset to emerging safe haven. This very real metamorphosis is rooted in a series of recent events that it would be reckless to ignore.

The announcement fell like a stone in a pond: Trump Media and Technology Group (TMTG) has taken a decisive step. The Securities and Exchange Commission (SEC) has officially approved the registration of its financial agreement related to Bitcoin. This approval gives the company a free hand to integrate crypto into its cash strategy. And like its founder, the initiative is anything but timid.

And what if the greatest store of value of tomorrow was no longer backed by a state, but coded into a protocol? In a world plagued by inflation and soaring sovereign debt, Bitcoin is increasingly establishing itself as a credible alternative to U.S. Treasury bonds. Hunter Horsley, CEO of Bitwise, argues that this transition is no longer a marginal theory, but a fundamental trend driven by growing adoption and disenchantment with traditional safe havens.

As Israel bombs, Iran fumes, and the markets stir, the old wolves of Bitcoin are shopping. Panic among traders, calm among strategists…

Polkadot wants to trade its tokens for bitcoin in the midst of a cryptocurrency storm. A bold maneuver that shakes purists... and makes lurking maximalists smile.

In just a few hours, cryptocurrencies have faltered under the weight of a major geopolitical event. Following Israeli strikes in Iran, over one billion dollars in positions were liquidated, taking with them the market's recent gains. This is not just a simple episode of volatility, but a tangible sign that these assets, which stem from a promise of sovereignty, remain exposed to real-world shocks.

When Novogratz reads into the bubbles, he sees a seven-figure bitcoin. Prophecy? Deception? Or just a calculated bet from a mogul well-positioned to pull the strings?

Missiles in the Middle East, markets in turmoil: while the economy catches a cold, some are making a fortune off barrels... and others prefer to flee into solid gold. Guess who is pulling the strings?

Treasury Secretary Scott Bessent has just made a shocking prediction: the stablecoin market could soar to $2 trillion within three years. This announcement comes as Bitcoin flirts with its historical highs.

Geopolitical tensions in the Middle East have once again shaken the crypto markets. Bitcoin sharply dropped below the psychological barrier of $105,000 after Tel Aviv claimed a series of attacks against Iran. This spectacular decline raises the question: does Bitcoin really deserve its status as a safe-haven asset?

Crypto in free fall: Dogecoin is howling, Solana is wobbling, while Bitcoin is acting smug. A waltz of numbers and tweets... but who will laugh last?

Venezuela and Argentina adopt cryptocurrencies. Discover how inflation has driven their adoption in Latin America.

An avalanche of companies are set to make bitcoin their main cash asset and push bitcoin to rapid new highs.

Bitcoin disappoints as it approaches its record. Ethereum might just steal the spotlight. All the details in this article!

Bitcoin: a massive confidence signal. 3.77 million BTC withdrawn, is the market entering a new bull era?

Saylor assures us: the crypto winter is over. But when Bitcoin climbs to new heights, who picks up the shovels, and above all… who sells the picks?

In May, cryptos are surging, RWAs are skyrocketing, and Binance declares: "All is well." But behind the numbers, a creeping tokenization is quietly disrupting traditional finance…

Bitcoin is back at around 110,000 dollars, galvanized by the rush of corporate treasurers and the teasing of White House advisor Bo Hines.

Bitcoin (BTC) is showing signs of a comeback, currently trading less than 3% below its all-time high. After hovering around $105,000 since late May, this price surge indicates growing momentum. It also reflects renewed confidence among investors, many of whom are eager to increase their Bitcoin holdings.

The promise of crypto was financial freedom. Today, it also attracts the most ingenious fraudsters on the planet. Fueled by artificial intelligence, their schemes are becoming undetectable and massive. In 2024, these scams caused $4.6 billion in losses, according to Bitget's anti-scam report. A staggering figure that forces the industry to rethink its priorities.

In a market where extreme predictions no longer intimidate anyone, Bernstein has nonetheless made a splash. The asset manager, boasting 800 billion dollars in assets under management, anticipates a bitcoin price of 200,000 dollars by the end of this year. Even more surprising: this target is considered "conservative" by its own analysts. A bold positioning, contrary to the climate of caution that dominates the markets, and which could well redefine expectations around the most scrutinized asset on the planet.

When Michael Saylor proposes to Apple to exchange its shares for bitcoin, it's not a joke... or maybe a crypto revolution wrapped in an iPhone, who knows?

What many thought unlikely is now becoming reality: American spot Bitcoin ETFs are set to surpass the symbolic milestone of $1 trillion in transaction volume. In less than 18 months, these financial products have transformed the stock market landscape, establishing Bitcoin as an essential asset in traditional markets. A meteoric rise driven by unprecedented institutional enthusiasm.

As financial markets grope in an uncertain geopolitical climate, bitcoin has once again crossed a key threshold: 110,000 dollars. This level, abandoned for two weeks, marks a technical break that goes beyond a simple rebound. Indeed, such a movement is part of a reconfiguration of the forces at work in the crypto market, where price dynamics, speculative positions, and institutional arbitrage seem to be entering a new phase.