Open interest in bitcoin reaches a record $72 billion. Discover how this could propel BTC to new heights.

Theme Bitcoin (BTC)

Bitcoin takes a decisive step: states are increasing their exposure via Strategy, circumventing regulatory barriers. This growing institutional adoption fuels the projection of a bitcoin at 500,000 dollars by 2029, heralding a major revolution for financial markets and the role of BTC in the global economy.

Bitcoin moves forward, stumbles at times, but never fails to intrigue. Today, Jack Dorsey, co-founder of Block, challenges a belief set in stone for 15 years: the place of satoshis. Supporting the controversial BIP 177, he aims to rename the smallest unit of bitcoin and abolish the endless decimals forever. The goal: to make crypto payments as intuitive as a tap on a smartphone.

The Chinese printer manufacturer Procolored has allegedly distributed drivers infected with malware that steals Bitcoin. This information was reported this week by the press in the Asian country and indicates that 9.3 BTC were stolen. The manufacturer stated that it has removed the infected drivers, but they were made available for global download. This issue is said to have been discovered through the insistence of a YouTuber.

Bitcoin could surpass $110,000 this week, propelled by several key signals indicating a rapid increase. This crucial threshold rekindles hopes and tensions, where every movement from investors will determine whether the market soars or experiences a sharp decline. Is a new ATH underway for BTC?

After a notable recovery, Bitcoin is testing a key threshold again. Find our complete analysis and the current technical outlook for BTC.

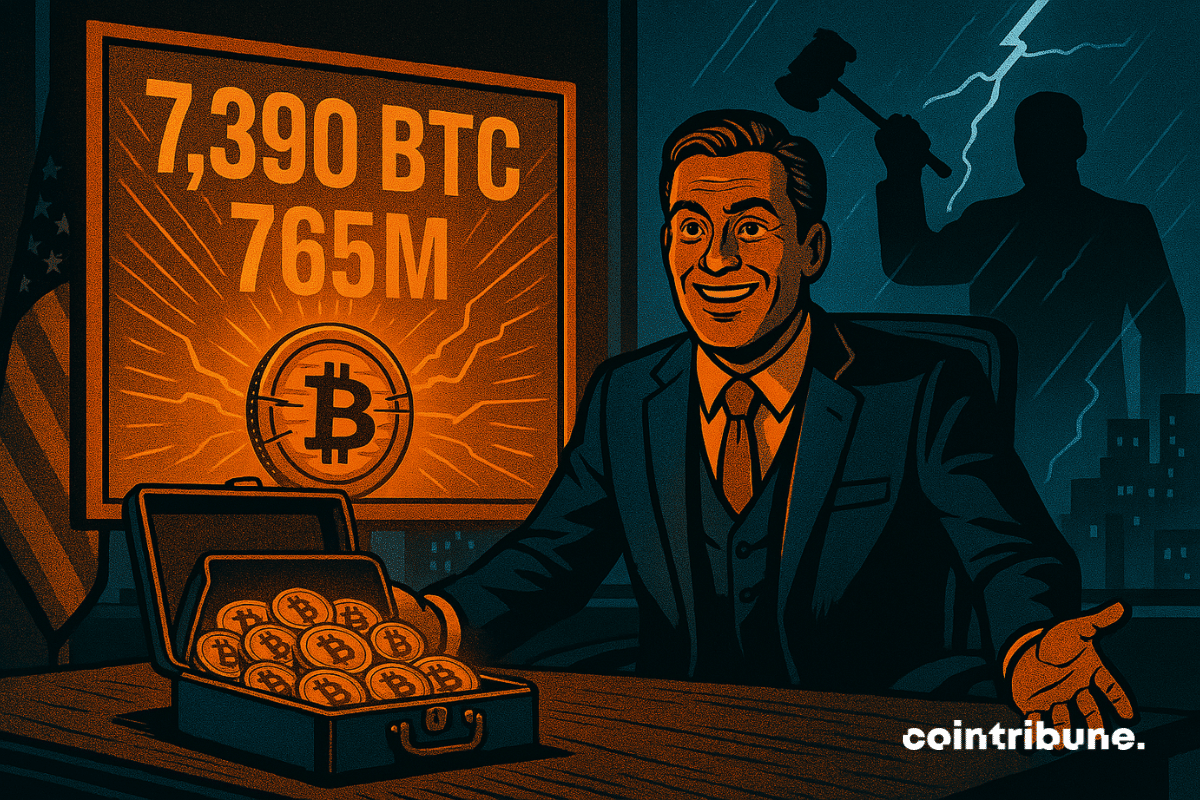

A key figure in institutional bitcoin, Michael Saylor now sees his legitimacy challenged. The co-founder of Strategy (formerly MicroStrategy), who has made BTC the core of his business strategy, is facing a class action lawsuit. Investors accuse him and his executives of misleading the market by concealing key information about the financial viability of their massive bitcoin accumulation policy. This represents a potential judicial setback for one of the staunchest advocates of the queen of crypto.

Bitcoin is nearing $105,000, but this surge fuels both enthusiasm and division. While some analysts anticipate the exhaustion of the bullish cycle, others see it as a simple step towards new records. This symbolic threshold crystallizes the tensions between caution and euphoria, where every movement in the price becomes a closely scrutinized indicator. Uncertainty reigns, and the upcoming trajectory promises to be more decisive than ever for investors.

Jamie Dimon, CEO of JPMorgan Chase, announced that the bank will allow its clients to invest in bitcoin, while reaffirming his personal skepticism towards crypto. This paradoxical position of the banking giant comes as several U.S. states incorporate bitcoin into their strategic reserves. How far will this institutional adoption go that even the biggest detractors can no longer ignore?

Bitcoin starts the week close to 107,000 dollars, but caution remains necessary. Between recent liquidations, macroeconomic uncertainty, and technical signals, here are 5 key points to watch to anticipate movements and seize opportunities in this rapidly evolving market.

Strategy is buying bitcoins hand over fist, but a lawsuit attacks it for "concealing" risks. Is Saylor at risk of being checkmated in his strategy? Find out more.

While Bitcoin is napping around $103,000, institutional funds are buzzing like ants around a sweet $600 million ETF.

Metaplanet intensifies its bitcoin accumulation strategy with the purchase of an additional 1,004 BTC. This initiative strengthens its position among the largest global holders. In Asia, its approach astonishes and intrigues, marking an unprecedented strategic turning point for a publicly traded Japanese company.

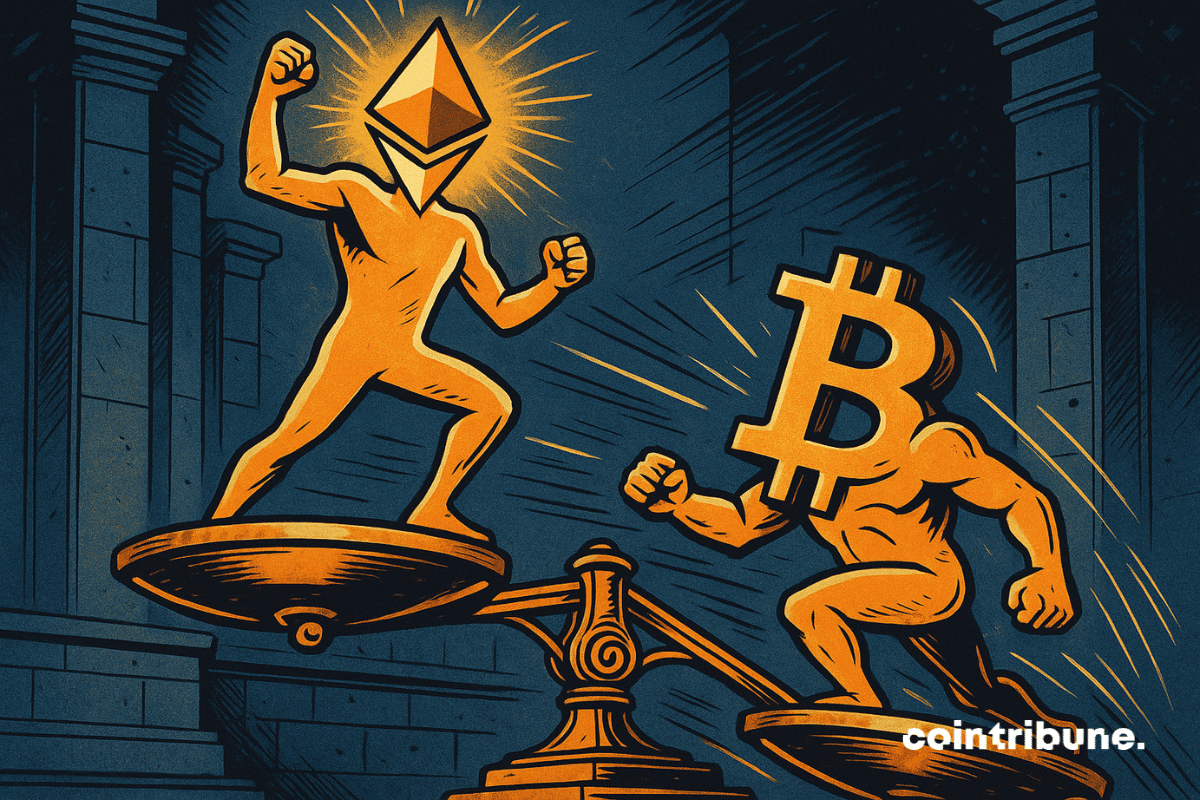

Ethereum may have reached a decisive turning point against Bitcoin, according to a recent report from CryptoQuant. The ETH/BTC price ratio surged by 38% last week after hitting its lowest level since January 2020. Could this remarkable development herald the long-awaited beginning of a new "altcoin season"?

Spring 2025 may be mild, but the Bitcoin blockchain is heating up like never before. On Sunday, the price of BTC brushed against $106,000 again, awakening old FOMO instincts. However, the noisiest indicator isn't the quote, but these micro-amounts that add up: transaction fees. With a moving average of $2.40 — one dollar more than at the beginning of the month — they are already breaking the annual record. Behind this seemingly trivial detail lies an unfiltered X-ray of the network's state and the psychology of holders.

This weekend, the crypto community was shaken by an exceptional revelation: a leading trader on Hyperliquid took a long bitcoin position with 40x leverage, with a notional value of around 392 million dollars. This bold initiative, with a liquidation threshold around 95,000 dollars, raises important questions about the outlook for the crypto market.

Under pressure in a feverish crypto market, Bitcoin is approaching a key technical signal: the Golden Cross. This chart pattern, where the 50-day moving average crosses above the 200-day moving average, is often seen as a precursor to sustained bullish momentum. Still uncertain, this signal gains credibility each day, fueling traders' expectations. As the curves draw closer, the market holds its breath, ready to interpret this potential crossover as a major turning point in the current BTC cycle.

Bitcoin has once again shaken up the market. By surpassing the $105,000 mark, the iconic crypto has returned to levels it hasn't seen since January. This surge, accompanied by a rise in the major altcoins, reignites speculation: is it just a technical rebound or the start of a new bullish cycle? In a rapidly changing geopolitical context, as investors regain their appetite for risk, signals are multiplying... but their interpretation remains uncertain.

While Bitcoin gets cluttered with JPEGs, an economist waves the mop. Filters, insults, monetary ideals: the community is tearing itself apart. What if the real spam was us?

Amid a reconfiguration of global economic balances, the Central Bank of Russia surprises everyone. In its latest report, it ranks bitcoin at the top of financial assets for 2025. This unexpected acknowledgment comes from an institution that has so far been cautious regarding cryptocurrencies. This turnaround highlights both the remarkable performance of the asset and its growing integration into investment strategies, even within a financial environment as controlled as that of Russia.

Bitcoin (BTC) dominance falls to 62.6%, a slight decline against the rise of Ethereum and altcoins. Zach Pandl from Grayscale believes that this dominance will soon stabilize despite an uncertain macroeconomic context that continues to influence investor behavior.

May 2025. Bitcoin is navigating beyond $103,000, but this seemingly dizzying figure may just be a warm-up. Behind the scenes, a structural imbalance is taking hold: supply is melting away like snow in the sun, while institutional demand is skyrocketing. Some already speak of a point of no return. Others, like Bitwise or Strategy, are betting on an explosion in prices — up to $200,000 before the end of next year. Myth or inevitable mechanism? What is certain is that the race is on, and the stakes are colossal.

Trump promised miracles, Moody's delivers slaps: the American economy is sinking, the debt is exploding, and the rating falls. Budget magic or just an electoral sleight of hand?

Bitcoin has stood the test of time. Buying bitcoins today is significantly less risky than it was 10 years ago, 5 years ago, and even 1 year ago.

While bitcoin remains above $100,000, a targeted accumulation phase emerges quietly. Far from the tumult of derivatives, it is the spot flows and on-chain data that shape the market's new tempo. Behind this recovery, strategic investors are strengthening their positions, operating within a precise price range. A discreet yet structuring dynamic that could well redefine the foundations of the next bullish cycle.

Long limited to its role as a store of value, Bitcoin is making a decisive breakthrough into DeFi. With the launch of the Peg-BTC (YBTC) token on the Sui network, Bitlayer introduces a "trustless" BitVM bridge that eliminates centralized intermediaries. This initiative marks a notable evolution. BTC becomes a fully usable asset within decentralized protocols, previously dominated by native tokens. A new chapter opens, that of an interoperable, mobile Bitcoin now active in programmable finance.

Addentax invests 800 million dollars in crypto to strengthen its strategic positioning. We provide you with the details in this article!

In Toronto, during Consensus 2025, Eric Trump revealed that a true global rush for bitcoin accumulation is underway. This statement comes as the Trump family becomes increasingly involved in the crypto industry, raising concerns among the Democrat camp, which denounces potential conflicts of interest and calls for an official investigation.

When Ukraine wants to create its Bitcoin vault, it resonates! But between pending laws and crypto-donations, the financial war has its new digital front.

After several years of hostility towards Bitcoin, Taiwan may soon reconsider its viewpoint given its precarious geopolitical situation.