Bitcoin's price has been stuck in a narrow range as capital flow slows, leading to a period of consolidation. Experts predict continued sideways movement until market conditions shift.

Theme Bitcoin (BTC)

Bitcoin, born as a decentralized currency, could become a key player in the global economy by 2050. According to a study by VanEck, one of the leading crypto asset managers, the value of bitcoin could reach 2.9 million dollars as it establishes itself as a settlement currency in international trade and as a reserve for central banks. This bold scenario raises questions about the future of traditional currencies and bitcoin's place in the global financial system.

Nexo reinvents itself and announces zero interest crypto loans. The crypto finance market finally seems to turn the page on post-FTX chaos. Beware of getting too excited.

Crypto in orbit? Not so fast! Three grains of sand could well jam the rocket... What if Wall Street or the US Congress hit pause?

Chen Zhi, mastermind of a historic crypto scam, has just been arrested after stealing 12 billion dollars in bitcoins. Between forced labor and "pig butchering," his network manipulated thousands of victims. Discover the key figures, the methods used, and why bitcoin remains the preferred asset of fraudsters.

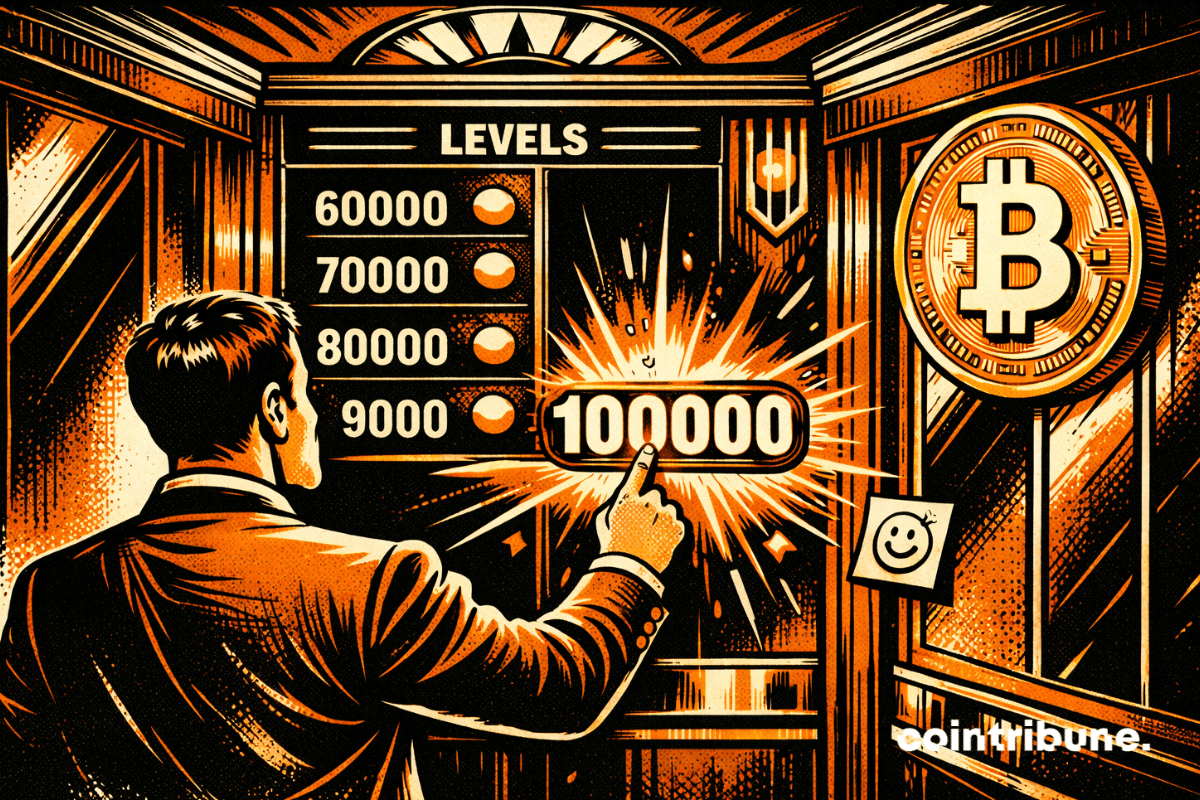

Options traders are betting big: Bitcoin could target $100,000 as soon as this month. Complete analysis in this article.

Beneath its capricious star appearance, bitcoin hesitates, retreats, but watches for the perfect moment to bounce back better… What if the whales know something we don’t?

Bitcoin ended 2025 down 6.36%. A modest performance, but enough to revive a statistical pattern observed for nearly a decade. After every negative year, the crypto has systematically rebounded. As 2026 begins, this statistical regularity intrigues. Can past data still guide the market's future?

The Bittensor TAO token soars 10% after the launch of the Grayscale Bittensor Trust (GTAO). Between halving and institutional adoption, this crypto linked to decentralized AI attracts investors. Why could this project revolutionize the market?

At the beginning of this year, a technical indicator draws attention: liquidation data on Bitcoin futures contracts reveal a marked imbalance. This signal, rarely observed at this level, suggests that a simple price movement could trigger a series of chain liquidations. For some analysts, this configuration could propel BTC towards 100,000 dollars.

Tether has just launched "Scudo", a tiny unit indexed to its tokenized gold XAUT. The ambition is summed up in one sentence: to make gold as manageable as Bitcoin. Not by changing the nature of the metal, but by changing its mental format.

Under regulatory pressure, MSCI makes a decisive choice. The index issuer announced on January 6 that it would maintain companies with significant crypto treasury in its global indices. A temporary decision, while the status of these companies, including Strategy, remained uncertain. This signal stabilizes their exposure in institutional portfolios and extends their integration into traditional markets, at a time when the gap between traditional finance and crypto continues to narrow.

Bitcoin carries a persistent label: that of an energy sink. And like all labels, it sticks all the better because it avoids details. This weekend, Daniel Batten, an ESG researcher, put the file back on the table in a thread on X, with a rare bias in this debate: going back to data, and especially to peer-reviewed studies. Nine “classic” criticisms would, according to him, be out of step with what the figures show at the level of electrical networks.

Altcoins may be positioning for a rebound after months of subdued price performance. Market data indicates that many tokens are trading above key support levels established in October. Analysts say these signals could point to a renewed appetite for risk across the broader cryptocurrency market.

Despite an accounting loss of $17.4 billion in Q4 2025, Strategy kicks off 2026 by purchasing 1,283 bitcoins for $116 million. As a global leader among institutional BTC holders, the company persists in its aggressive accumulation strategy, defying classic financial logic. This striking contrast between record loss and reaffirmed confidence raises the question: how far is Michael Saylor willing to push his bet on Bitcoin?

Bitcoin reaches 94,000 dollars, driven by the momentum of financial markets. The movement, clear and rapid, suggests a renewed confidence. However, fundamentals struggle to keep up. Volumes collapse, liquidity remains low. This rise intrigues as much as it reassures.

You don't need Bitcoin? You find it useless, abstract, speculative? Then you probably live in a functional rule of law. You can open an account. Receive your salary. Save without permission. Leave your country without losing your money. This comfort is not the norm. It is a historical exception. Only 11% of humans are born into a stable, democratic monetary system that protects property. The remaining 89% live elsewhere. In fragile, hyperinflationary, authoritarian, or arbitrary economies. For them, money is not a neutral tool. It is a filter. An identity test. A condition of obedience. Most economic discriminations are not moral. They are systemic. Bitcoin was not designed for speculation. It was born to operate without permission. Without identity. Without geography. This text proposes a simple thing: to look at Bitcoin not from the minority it enriches, but from the majority it protects from erasure.

Venezuela, plagued by record hyperinflation and an unprecedented political crisis, could well become the catalyst for a Bitcoin surge to $105,000 in a few days! Between massive adoption, economic sanctions, and political transition, crypto is establishing itself as the ultimate solution.

Bitcoin Core saw increased contributions, steady code updates, and strong network activity in 2025, supported by ongoing community and funding.

Venezuela, in the midst of a political crisis, sees María Corina Machado, Nobel laureate and pro-Bitcoin, emerge as a key figure of the transition. Could her commitment to cryptocurrencies redefine the country's economy and make it a model for nations in crisis? The future is now at stake.

The capitalization of memecoins jumped by more than 23% in early 2026, with a trading volume that almost quadrupled. In short, "hot" money is back, the kind that tests limits. According to data relayed around CoinMarketCap, the sector went from about $38 billion on December 29 to over $47.7 billion a week later, while volumes climbed towards $8.7 billion.

When the yen drowns, Metaplanet rows towards bitcoin: a strategy that makes Tokyo smile... except creditors. While Japan goes into debt, others stack BTC.

While crypto markets struggle to find direction, a key indicator has crossed a symbolic threshold: the Fear & Greed Index returns to the neutral zone for the first time since October. This reversal in investor sentiment follows months of extreme fear, marked by a violent crash and persistent volatility. In a still tense global climate, this signal could mark a psychological respite... but certainly not yet a recovery.

The dollar pulls the strings, Maduro falls, Kiyosaki philosophizes... and bitcoin rises! Simple coincidence? Not sure, but it's worth a little tour behind the scenes of oil.

Bitcoin has just crossed $91,000, driven by a wave of political instability in Venezuela. The arrest of Nicolás Maduro and Donald Trump's announcement that the United States intends to lead the country have revived speculation about the economic and energy future of the region. In a crypto market always hypersensitive to geopolitical tensions, this sharp price increase reflects both the ambient uncertainty and investors' appetite for decentralized assets.

Bitcoin and Ethereum ETFs attracted 645.8 million dollars on January 2. In a still hesitant market, this volume is surprising. It marks the strongest day of inflows in over a month for Bitcoin products and an unprecedented peak since December for Ether. While 2025 ended on a decline, this surge is striking.

Is Bitcoin bored? Not really. Between wild OGs, voracious ETFs, and complicit regulations, the beast calms down... but could bite again where it's least expected.

In 2026, cryptocurrencies are the subject of rare optimism on social networks, according to Santiment. However, traditional indicators remain cautious. Why this gap? Between social euphoria and market reality, discover what this unexpected signal hides for the crypto market.

Ilya Lichtenstein, involved in the theft of approximately 119,756 BTC on Bitfinex, says he was released from prison earlier than expected thanks to the First Step Act, a law passed under Donald Trump. He spent just over a year behind bars, although he had been sentenced to five years.

Crypto markets are showing a notable shift, with major altcoins recording solid gains. Bitcoin’s share of the overall market has weakened and is now nearing 59%. Capital rotation toward higher-beta assets has followed, renewing discussion around a potential altcoin-led phase.