"America First" roars Trump, hammering taxes and drilling like a refrain. The Green New Deal expires, the economy trembles, the euro wonders.

Chine

The dance stops for American TikTokers. Between Chinese threats and political pirouettes, TikTok is stretching itself thin. Trump promises, but ByteDance resists. The suspense continues.

The BRICS project to create a common currency is generating growing interest among economists and analysts, as it could redefine global financial balances. For decades, the US dollar has dominated as the main reserve currency, giving the United States substantial economic and geopolitical power. During their summit in 2024 in Kazan, Russia, the leaders of the BRICS intensified their discussions on establishing an alternative called "Unit," designed to facilitate exchanges within the bloc. This project fits into a broader strategy aimed at reducing their dependence on the dollar, in the context of increasing geopolitical tensions and economic sanctions. At a time when many countries are seeking to diversify their reserves and bypass the constraints imposed by the current monetary system, can this initiative truly shake the dollar's supremacy?

Global economic relations are evolving under the influence of geopolitical tensions and the strategic repositioning of major powers. In this context, China and Russia are strengthening their trade partnership, which is set to reach a historical record of 240 billion euros in 2024. This growth illustrates a strategic rapprochement bolstered by Western sanctions against Moscow and Beijing's desire to expand its influence. More than just an economic alliance, this cooperation sends a clear signal to the United States and the European Union, which aim to limit their dominance on the global stage. Thus, the surge in trade flows, increased use of the yuan in transactions, and the restructuring of international financial circuits now raise the question of the long-term consequences of this Sino-Russian agreement.

ByteDance forced to sell TikTok US? Is Elon Musk positioning himself for a $50 billion buyout? Analysis.

The global economic landscape, long dominated by Western powers and supported by the preeminence of the dollar, seems on the brink of change. In the face of a financial system centralized around the United States and Europe, many nations are expressing a growing desire to turn to alternatives. This trend is accelerating with the recent announcement: more than twenty countries from several continents have officially submitted their candidacy to join BRICS in 2025. If this project comes to fruition, the expansion of the formed bloc could enhance its economic weight but also redefine the balance of power on a global scale.

The Chinese economy is wavering between stagnation and decline, revealing lasting structural flaws. In December, the consumer price index only increased by 0.1% year-on-year, confirming intensifying deflationary pressure despite the government's repeated attempts to revive growth. The drop in food prices (-0.5%) and consumer goods (-0.2%) illustrates the lack of dynamism in domestic demand, as households remain cautious and businesses hesitate to invest. Thus, the real estate crisis, coupled with the ineffectiveness of previous stimulus measures, fuels uncertainties. This slowdown goes beyond a cyclical phase. It calls into question the resilience of the Chinese economic model and its short-term outlook.

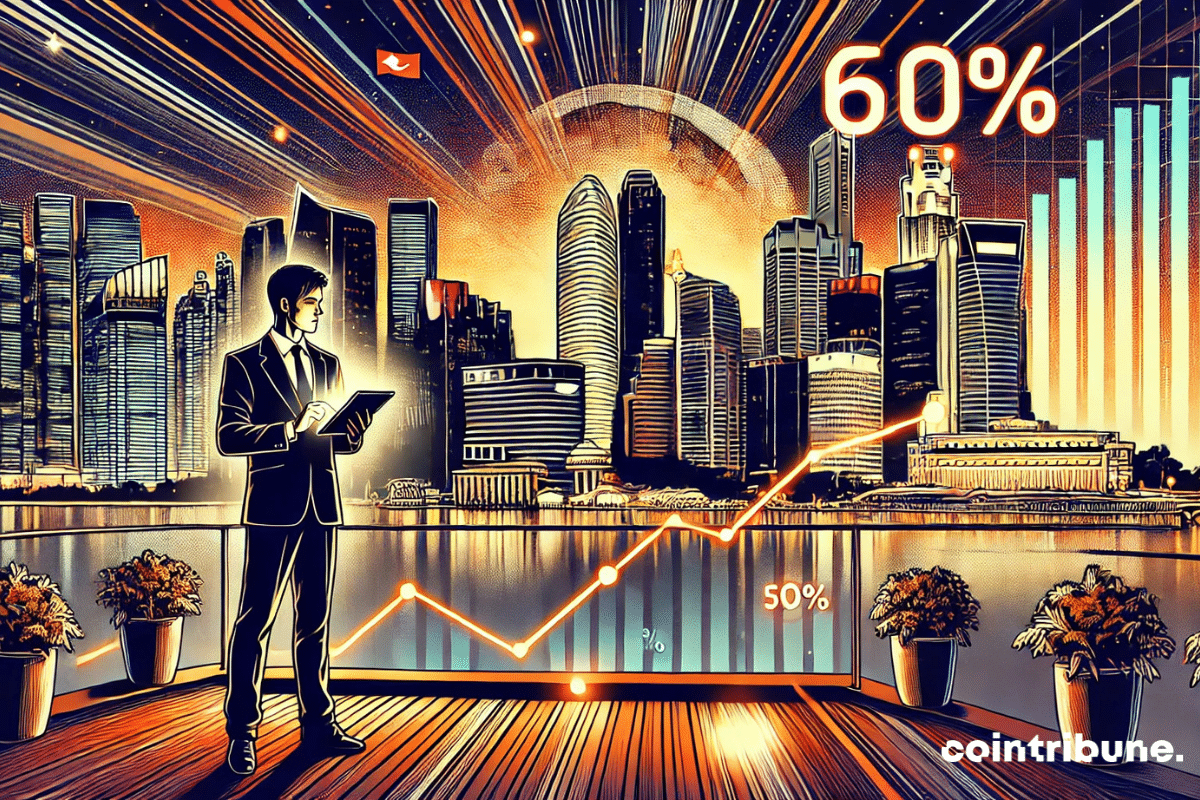

Despite regulatory restrictions, Asia is emerging as the global epicenter of crypto, capturing 60% of users worldwide. A recent study by Foresight Ventures and Primitive reveals that the Asian continent generates the largest share of global liquidity, with five Asian countries ranking in the top 10 of the global crypto adoption index in 2024.

Taiwanese youth are enjoying life as if nothing were happening. Yet, the threat of a Chinese invasion has never been more present. And when the Chinese Communist Party launches the offensive, we will officially enter a 3rd world war.

Financial markets are on the brink of a new cycle of monetary easing, marked by strategic decisions from major central banks. Following the American Federal Reserve, which began reducing its key interest rates last September, it is now the People's Bank of China (PBOC) that is preparing to take the lead. Beijing plans to lower its interest rates further to stimulate the economy and counter the heightened deflationary pressure on the yuan, a phenomenon that worries Chinese authorities and weighs on investor confidence. In light of this situation, Arthur Hayes, co-founder of BitMEX and macroeconomic analyst, anticipates a chain reaction in the financial markets. He asserts that the combination of a looser monetary policy in China and a favorable environment in the United States will enhance the appeal of alternative assets, particularly bitcoin and cryptocurrencies. According to him, this injection of liquidity, coupled with a reorientation of institutional capital, could trigger a massive rally in the cryptocurrency market during the year 2025.

The center of gravity of the global economy is gradually shifting towards new alliances. In the face of the waning influence of Western institutions, another bloc is consolidating its power. Since January 1, 2025, the BRICS have taken a new step by welcoming nine partner states. This expansion, decided at the Kazan summit in October 2024, reinforces their political and economic weight and broadens their grip on emerging markets. Now, the organization represents 51% of the global population and generates 40.4% of global GDP in purchasing power parity.

Global trade is going through a period marked by increasing tensions, where diplomacy and economy intertwine in strategic rivalries. Indeed, China's opening of an anti-dumping investigation into European cognac imports signals a new front in the trade conflict with the European Union. This move, perceived as a direct response to European accusations against Chinese subsidies for electric vehicles, reflects an escalation of economic retaliations between two major powers. Such a case goes beyond a mere trade dispute. It raises fundamental questions about the balance of international exchanges and the role of institutions like the World Trade Organization in arbitrating these disputes in an increasingly complex rivalry context.

The BRICS are ushering in a new economic era with a historic expansion planned for January 2025. This group, which unites some of the largest emerging economies, is set to welcome nine new partners, marking a decisive step in its quest for strengthening its position on the international stage. Such a move comes at a time when geopolitical rivalries are intensifying and traditional alliances are being questioned. Through the extension of their geographical and strategic reach, the BRICS aim to consolidate their influence, but also to provide a credible alternative to Western-dominated economic models. This shift reflects a reorganization of global economic powers, in response to growing demands for a more balanced and multipolar system.

Nokia, the Finnish telecommunications giant, is heading towards a new digital era with a patent dedicated to the encryption of digital resources. This project could mark a significant advancement in securing crypto assets and blockchain technology.

"Between technological shores and headwinds, Nvidia navigates. China strikes, not for a monopoly, but to challenge the hegemony of American chips. A fight where every chip counts."

At the Bitcoin MENA conference in Abu Dhabi, Changpeng Zhao (CZ), former CEO of Binance, stated that it is "inevitable" for China to establish a strategic reserve of Bitcoin (BTC). CZ emphasized that while China's stance on cryptocurrencies is difficult to predict due to the government's lack of transparency, it is likely that the country is secretly accumulating bitcoins.

Recently, the United States announced new sanctions aimed at restricting the export of semiconductor technologies to China. These measures are intended to hinder China's ability to acquire and produce advanced technologies necessary for its military modernization. China is reacting violently!

Buying Bitcoin in Asia has never been so easy: a major bank opens its digital vaults for you.

How could China stand idly by if the United States is building a strategic reserve of bitcoins?

Nvidia in the Dow? It's tickling Wall Street! Yet, not so big after all in the kingdom of portfolios...

New mandate for Trump: an explosive cocktail of a strong economy, with frantic drilling and impactful tariffs. The party begins!

Trump or not, the Chinese are working to save the economic structure... with billions flowing without brakes!

As China considers increasing its national debt by more than 1.4 trillion dollars, investors and economists around the world are turning to Bitcoin as a potential refuge against currency collapse. This interest, rekindled by the predictions of Arthur Hayes, co-founder of BitMEX, is reminiscent of the events of 2015, when…

Asian financial markets are plunging, and this shockwave is resonating far beyond the Pacific, reaching European and American stock exchanges. While China delays deploying sufficient stimulus measures, Wall Street is trying to recover, supported by the tech sector. But for how long? The global stock market is going through a…

More and more voices are being raised in favor of Quantitative Easing in China. An analyst from Goldman Sachs.

The escalation of trade tensions between the European Union and China regarding tariffs on electric vehicles threatens to shake the global economy. While Brussels has voted in favor of these measures, Beijing is preparing its response, casting a shadow of targeted reprisals over the European countries most supportive of this decision.

As Chinese stocks soar, Tether declines. It's not easy to play both sides at once!

Discover the risks of cryptocurrencies for global financial stability and China's concerns regarding Bitcoin ETFs.

Is Europe doomed to economic decline? This is the question that haunts minds as the Old Continent loses ground against the United States in terms of productivity. A much-anticipated report from Mario Draghi, former Italian Prime Minister, paints an alarming picture of the situation!

Over the past few months, Chinese stocks have experienced a real surge in global stock markets. This resurgence in activity is largely attributed to Beijing’s stimulus initiatives aimed at pulling the Chinese economy out of a slowdown that has worried more than a few investors. However, behind this sudden enthusiasm,…