In a major advancement for the adoption of stablecoins in the financial sector, the Dubai International Financial Centre (DIFC) has officially recognized USDC and EURC as the first regulated stablecoins within its legal framework. This recognition marks a key milestone for Circle as it establishes itself against its direct competitor, Tether's USDT.

Circle

Kraken removes USDT from its platform in Europe and is considering a USD stablecoin. Discover this upheaval in the crypto market!

Can Tether still sleep peacefully? USDC rises to $56.3 billion, wipes out its losses, and makes its way to the table of the big players. Stablecoins are reinventing cash... and the battle is fierce.

The stablecoin market has just crossed a historic threshold, reaching a total capitalization of over $200 billion. This growth is largely dominated by Tether's USDT, which accounts for $142.9 billion in circulating assets.

Mastercard is putting cryptocurrencies on the map! Pay for your baguette in Bitcoin without going through the "euro" step, something never seen before!

While Bitcoin lags behind, stablecoins could well wake it up. But beware, nothing is ever certain.

Crypto: New MiCA standards for regulatory clarity in Europe

Concerns about the regulation of stablecoins by MICA are exaggerated. The truth here.

The crypto landscape in Europe has just undergone a major change with Circle's approval for the issuance of stablecoins by MiCA (Markets in Crypto-Assets Regulation). This decision marks a significant step in the regulation of digital assets on the old continent. But what does this approval really mean for the crypto market and what will be the impacts? Let's explore this development together.

MiCA promises to transform stablecoins, with Circle and Adan at the forefront to navigate these new regulatory requirements.

A new wave has just hit the shores of innovation and decentralized finance in the crypto sphere. Indeed, the announcement by Circle to stop issuing the USDC stablecoin on the Tron (TRX) blockchain has shaken the crypto archipelago.

The USDC lost its peg to the dollar yesterday. Instead of trading at 1 dollar, this stablecoin from Circle saw its value drop to an alarming level on Binance. This created a situation of panic within the crypto community.

Tether, the USDT stablecoin issuer, has taken the decision to freeze $2.5 million in USDT due to its connection to an alleged hack of the Multichain interchain router protocol. Tether thus aims to protect the funds involved and prevent any potential misappropriation or unauthorized access.

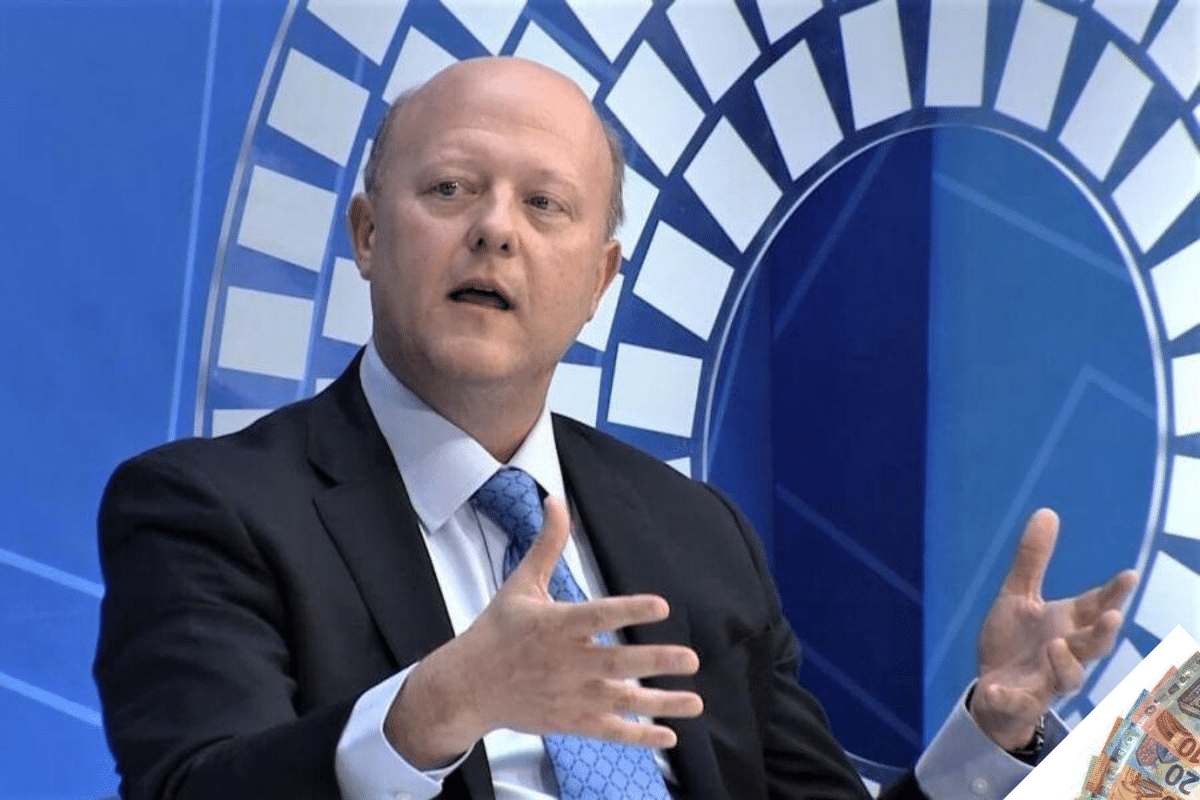

Jeremy Allaire, CEO of Circle, the company in charge of issuing the USDC predicts increased demand for various digital assets. These include Dogecoin, Bitcoin, Ethereum and Cardano. He points out that demand will mainly come from emerging markets, of which Hong Kong and China are central. It's worth remembering that despite some occasional rises, the cryptocurrency market in general is in decline.

In a recent interview, Jeremy Allaire, CEO of Circle, emphasizes the urgency of taking the threat of de-dollarization seriously. As more nations take steps to reduce their dependence on the US dollar, Allaire warns of the potential consequences of this growing trend.