De-dollarization: A growing threat, according to Circle CEO

In a recent interview, Jeremy Allaire, CEO of Circle, emphasizes the urgency of taking the threat of de-dollarization seriously. More and more nations take steps to reduce their dependence on the US dollar. Allaire warns of the potential consequences of this growing trend.

A paradigm shift in the global monetary landscape

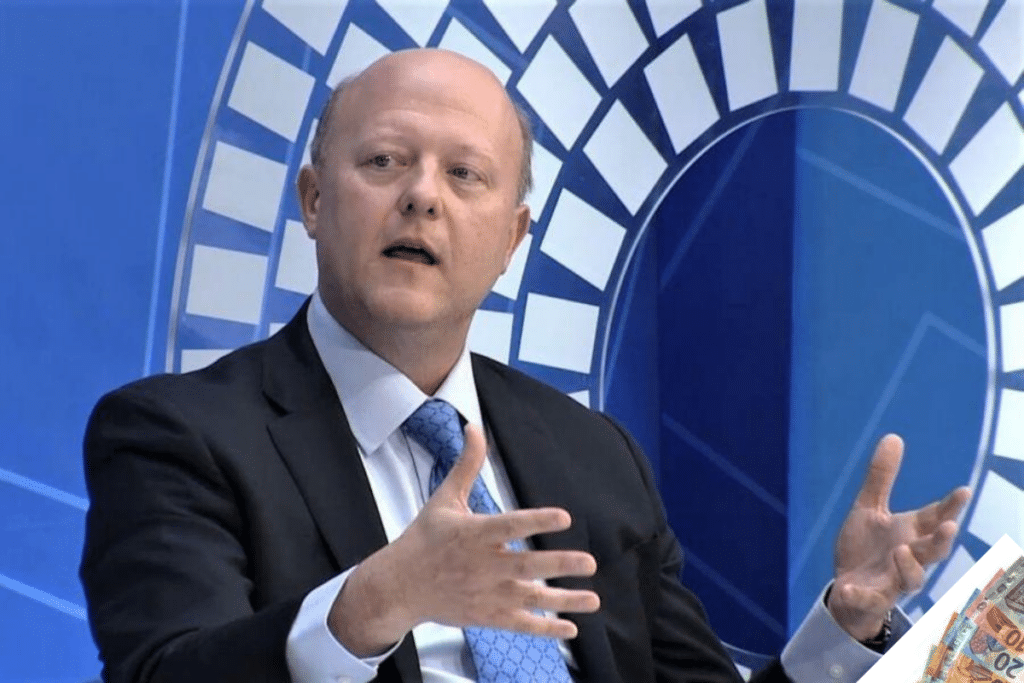

De-dollarization is a recurring topic that sparks numerous debates among economists and analysts. Recently, Jeremy Allaire, the CEO of Circle, made a striking statement on this subject. During his interview at the Currency in the Crossfire event organized by Foreign Policy magazine, Allaire highlighted that we are at a crucial turning point in this process.

There’s been this theme of de-dollarization for a long time, and people talk about it every 10 years. And people say it’s not going to really happen. And I think we’re now at a really different place. You cannot miss the news every day and hear about different initiatives to denominate different types of trade in alternative currencies or efforts to establish new alternative payment systems. And I think this is part of the multipolar world that’s emerging is there’s a desire to have autonomy outside the dollar…

Jeremy Allaire, Circle CEO

Indeed, initiatives to denominate commercial transactions in alternative currencies are multiplying, as well as efforts to establish new payment systems.

These changes are taking place in the context of a rising multipolar world. Especially where many countries seek greater autonomy from the dollar.

According to Allaire’s statement, several factors motivate this trend of de-dollarization. Firstly, increasing militarization and concerns about the consequences of an unfavorable position concerning the United States are pushing nations to seek alternatives.

Additionally, the US government’s debt raises concerns among Treasury bondholders, who are considering longer-term solutions. These changes are causing shifts in the reserve status of currencies and other financial instruments.

The need for strategic thinking and adoption of crypto assets

Jeremy Allaire emphasizes that de-dollarization is a process that spans decades. And it should not be exaggerated in terms of immediate impact. Nevertheless, he believes that the current changes are more significant than in the past. The ongoing political and economic realignment in the world is tangible, leading to more concrete efforts to create alternative systems.

From my perspective, digital dollars, having sound regulation around this industry and making digital dollars an export product to the internet and to the world is really critical from a competitiveness perspective right now.

The introduction of digital assets, such as the Circle USDC stablecoin, is one way to maintain the competitiveness of the US dollar, according to Jeremy Allaire. He emphasizes the importance of adopting regulated digital assets. Such as stablecoins, to maintain the dollar’s competitiveness and explore new opportunities in the global economy.

For some time now, emerging countries, notably those in the BRICS group like Russia and China, have been actively working to free themselves from the US dollar. They have already started a part of the project aimed at creating a common currency.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.