"On the eve of an extraordinary options expiration estimated at 20 billion dollars, the crypto market holds its breath. With bitcoin hovering around 107,800 dollars, every price movement becomes a battle between buyers and sellers. In this strategic duel, billions are at stake. The outcome will depend on the buyers' ability to lock in key levels before the outcome. Maximum pressure builds as the fateful deadline approaches."

Cmc RSS

In an economic climate marked by geopolitical tensions and a wait-and-see approach regarding the Fed's decisions, Morgan Stanley disrupts the consensus. The investment bank anticipates seven rate cuts in 2026, starting in March, with a terminal rate between 2.5% and 2.75%. This sharp projection, published on June 25th, contrasts with the prevailing caution and reignites debates about the U.S. monetary calendar.

While the market focuses on price curves, a key indicator of real activity has collapsed. Payment volume on the XRP Ledger has dropped by nearly 70% in just a few days. Behind this discreet withdrawal lies a deeper questioning of the network's vitality, its concrete adoption, and the robustness of its operational model.

Crypto reserve in Arizona: a bill passed despite criticism from the governor. Discover the details in this article!

In a Web3 landscape saturated with EVM blockchains cloning each other, Alephium stands out with a bold approach. This Swiss Layer 1 combines the security of Proof-of-Work, the scalability of sharding, a seamless user experience, and an innovative energy model. With Danube, its latest update, the project has reached a major milestone. To understand the stakes, we met with Maud Bannwart, a central figure in the team and a true bridge between technology and its uses.

When crypto takes to the track, Bitget makes a sharp turn with MotoGP. Speed and trading meet, at high speed and at zero cost for innovation.

Bitcoin is tightening its grip on the crypto market as institutional interest grows. Meanwhile, XRP climbs, and Ethereum and Solana face shifting investor focus.

Bitcoin climbed back above $105K after a sharp dip amid Middle East tensions. $700M liquidated as traders pull back ahead of a key options expiry.

Thanks to OptimumP2P, Ethereum increases the communication speed between its nodes.

Michael Saylor's company, Strategy (formerly MicroStrategy), could soon be included in the prestigious S&P 500 index. According to analyst Jeff Walton, it has a 91% chance of achieving this within the next 5 days. However, a crucial condition must be met: Bitcoin must remain above a critical threshold.

While Bitcoin struts its stuff, Ethereum is digging its furrow. Discreet but robust ETFs, stealthy rebalances, rock-bottom fees... what if the little brother became the darling of the big wallets?

Bitcoin is gaining altitude, energized by the ceasefire agreement between Iran and Israel. A new high is in sight.

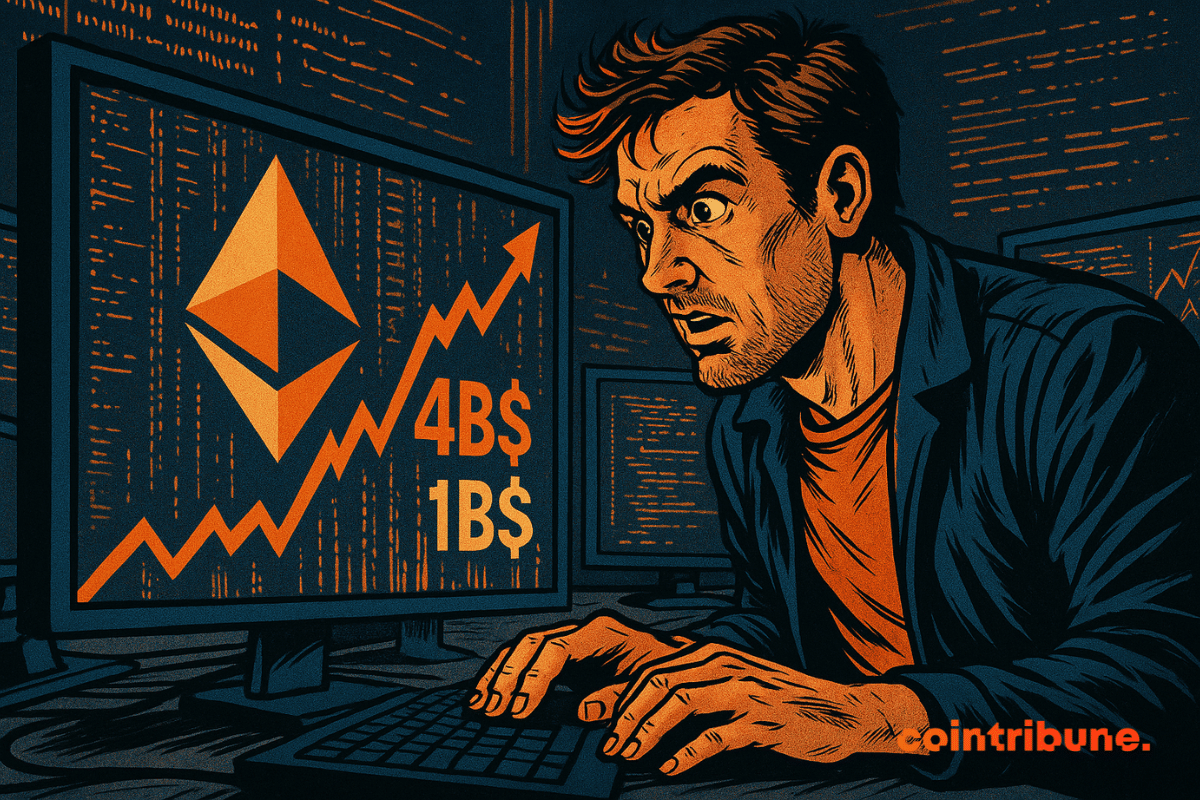

The investment giant BlackRock surprised the crypto market by resuming its massive purchases of Ethereum, just 24 hours after making a spectacular sale of over 8,000 ETH. Why this sudden turnaround?

In the unpredictable world of cryptos, sometimes all it takes is a single catalyst to thrust a project into the spotlight. This week, it's Sei (SEI), a still discreet altcoin, that surged by 47% in just 24 hours. What sparked this rise? An unexpected announcement from Wyoming, which is considering leveraging the Sei blockchain to launch its state-backed stablecoin. A major turning point that could make Sei one of the crypto revelations of 2025.

As the lines between traditional finance and blockchain become increasingly blurred, Mastercard and Chainlink are crossing a decisive threshold. In a partnership announced this Tuesday, they unveil a fiat-to-crypto conversion solution directly on-chain, designed for Mastercard cardholders. This initiative, far from being anecdotal, redefines access to cryptocurrencies and lays the groundwork for a new era of hybrid payments between traditional finance and Web3.

Against the backdrop of years of regulatory ambiguity, Washington seems to want to take control of the crypto ecosystem. On June 18, Federal Reserve Chairman Jerome Powell surprised many by clearly supporting two landmark bills on stablecoins and the crypto market. In a changing political climate in the United States, this stance marks a potential turning point for the industry, which has long awaited a solid and predictable legal framework.

Despite a decline in profits, companies in the CAC 40 are increasingly attentive to their shareholders. In 2024, they maintain record payouts, contrary to traditional economic signals. In an environment marked by sluggish growth, rising inflation, and unstable markets, this strategy raises questions. Is it a sign of strength or a risky bet? While shareholder profitability remains a priority, the gap between distributed profits and actual performance raises doubts about the sustainability of this model.

Japan is wielding its fiscal sword: crypto ETFs on the horizon, lower taxes... and investor samurais soon converted to Bitcoin? In Tokyo, traditional finance shakes under its kimono.

Donald Trump's surprise announcement of a ceasefire between Iran and Israel has caused a real earthquake in the energy markets. Oil prices plunged by more than 5%, while global stock markets soared. Is this geopolitical calm sustainable?

Trying to time the crypto market is a nightmare for most investors. FOMO, sharp corrections, contradictory signals… Volatility brings both opportunity and anxiety. Fortunately, there’s a calmer approach already embraced by 59% of crypto holders: Dollar-Cost Averaging (DCA). What if you could enjoy it stress-free, without having to attend classes every day? Kraken offers a simple, automated, and ultra-flexible solution to help you build a crypto position over time, without obsessing over market dips.

Financial markets are going through a fascinating period, where the boundaries between traditional finance and cryptocurrencies are increasingly blurred. BNB, the native token of the Binance ecosystem, is taking a bold new step by becoming the cornerstone of an institutional initiative listed on Nasdaq, fueled by an impressive raise of 100 million dollars.

Solana is gaining traction as ETF speculation intensifies. Rising CME activity, institutional filings, and growing public interest suggest the asset may be nearing a pivotal moment.

Despite the drop in Ethereum, whales are maintaining their positions. In this article, find an analysis of the key data to know.

The crypto market exploded upwards on Monday evening, propelling bitcoin above $105,000 after Donald Trump announced a ceasefire agreement between Iran and Israel. This news instantly transformed investor sentiment. But is this euphoria sustainable in an ongoing fragile geopolitical context?

Bitcoin’s original promise was rebellion: digital gold, a hedge against inflation, a way out of the fiat system. But if the latest Binance Research report is any indication, it may be playing a different role today: not fighting the dollar, but backing it.

Trump rewards holders of his memecoin with a private dinner. Immediate reaction: Adam Schiff, a Democratic senator, draws up a law to regulate the use of cryptocurrency by political officials. A confrontation that mixes digital assets, conflicts of interest, and electoral calculations.

Trump Media dives into bitcoin with $2.3 billion. But behind the announcement, there is a colossal stock buyback and a strategy that is shaking up U.S. regulations. Will it take everything?

As an American strike targeting Iranian nuclear sites raised fears of a regional escalation, bitcoin briefly fell below $99,000 before making a swift rebound. In less than 24 hours, the asset erased its losses, defying usual panic logics. This sequence reveals a strategic mutation: bitcoin is no longer just a speculative asset; it is becoming an indicator of resilience against geopolitical shocks.

Is the crypto universe in danger? Trezor confirms an incident. A new attack method worries experts! Details here.

A simple emoji posted by Arthur Britto, co-founder of Ripple, was enough to reignite speculation about the future of XRP. Having disappeared from the radar for nearly fourteen years, the elusive engineer has broken his silence on X without a word. In an industry where every signal matters, this unexpected reappearance of a key player in Ripple's history raises many questions about his intentions and the role he might play in the ecosystem.