At PEPE, memes were promised, not malware. The result? A hacked site, emptied wallets, and a resurrected hacking tool. Everything is swimming in crypto-cacophony!

Coin Stats RSS

In the crypto ecosystem, some cases keep coming back like boomerangs. The case of Do Kwon, founder of Terraform Labs, is one of those matters that leave a lasting mark. As his court appearance approaches, US prosecutors are demanding a harsh sentence: twelve years in prison. A request that, beyond symbolism, recalls the shockwave caused by the collapse of the Terra ecosystem.

Cantor Fitzgerald shakes the markets by lowering its target for Strategy (MSTR) by 60%. However, the bank dismisses fears of forced liquidation and maintains its confidence in bitcoin. An analysis that unpacks the stakes behind this surprise decision and its impact on crypto investors. Is MSTR's future being decided now?

A fake developer, real spies, and US tech trapped: arrested, Vong inadvertently revealed how Pyongyang hacks America without firing a single rocket.

What if everyone was wrong about Strategy? While speculation is rife about a potential bitcoin sale by the company led by Michael Saylor, Bitwise's Chief Investment Officer, Matt Hougan, steps up to methodically dismantle this panic scenario.

Bitcoin ETFs just experienced their worst day in two weeks, with $194 million in outflows in 24 hours. Between institutional disengagement and macroeconomic fears, should we expect a black December? Comprehensive analysis and outlook for crypto investors.

Meta is preparing to cut its metaverse budget by up to 30%, a sign of a major strategic shift. Three years after making virtual reality its top priority, the company is now redirecting its investments towards artificial intelligence and augmented reality. A significant change of course for Mark Zuckerberg, who questions the future of the metaverse and immediately boosted Meta's stock in the market.

Backed by its status as a benchmark in the crypto market, bitcoin faces a crucial question: can it reconnect with the euphoria of last January, when it broke $109,000 for the first time? Between macroeconomic uncertainties and structural advances, BTC's trajectory triggers as many expectations as doubts. Is the bull cycle already behind us or just on pause?

The social sentiment around XRP has just dropped to its lowest level since October, according to Santiment data. The crypto is going through what the platform describes as a "fear zone." This emotional downturn contrasts with past movements, where similar phases had preceded a marked rebound. In a tense crypto market, XRP could once again surprise.

After several weeks of waiting, Cointribune finally unveils the brand new version of its Read2Earn program: a redesigned, enhanced system entirely dedicated to rewarding your crypto curiosity. If you read Cointribune every day, this update will transform your experience: from now on, every article read has value, every step taken brings you closer to a reward, and every session becomes concrete progression in your Web3 adventure.

The Fusaka update nearly caused Ethereum crypto network finality to be lost. We give you all the details in this article!

Europe-based ETF issuer 21Shares has opened a new chapter for Sui-linked investment products in the U.S. after receiving approval to list the first exchange-traded product tied to SUI. The debut comes as crypto ETFs continue to roll out across major exchanges, attracting steady interest from both retail and institutional traders.

According to a study by the FINRA Investor Education Foundation, enthusiasm for cryptos has cooled. Indeed, only 26% of investors still plan to buy cryptos, compared to 33% in 2021. However, 27% still hold them, an unchanged level. There is less desire to buy more, but not necessarily a massive exit.

The CFTC has approved spot cryptocurrency trading on U.S. exchanges, opening a new era of regulated digital asset markets under federal oversight.

When a company named Strategy becomes the compass of bitcoin, even JPMorgan takes out its calculator. Bull run or crash? The answer lies between MSCI, reserves, and a few well-placed billions.

Alphabet is back in focus after a Bloomberg report indicated rising investor confidence in its in-house semiconductor strategy. Interest in the company’s tensor processing units (TPUs) is reshaping expectations for future revenue and altering market sentiment. Many investors now see the chip program as a potential long-term growth driver, not just a tool used within Google Cloud.

After weeks of volatility, Bitcoin is showing signs of settling, with analysts noting cautious optimism and the possibility of a year-end rally.

The GENIUS Act brings long-awaited clarity to U.S. stablecoins but deepens the regulatory divide with Europe, creating fragmented liquidity pools and raising concerns about cross-border stability and settlement friction.

Supported by record inflows into spot ETFs and favorable technical setup, Ethereum quietly outperforms bitcoin. As flows shift and retail interest rises again, a turning point is happening. Is the trend changing permanently?

The International Monetary Fund steps out of its usual reserve and publishes a detailed guide on stablecoins. As the market exceeds 300 billion dollars, the institution believes that regulation alone will not be enough. What strategy does it really advocate?

During Binance Blockchain Week, Peter Schiff was invited by Changpeng Zhao to authenticate a gold bar live. Unable to confirm its authenticity, the economist simply replied: "I don't know." A brief but revealing scene, which reignites the debate between physical gold and bitcoin, and raises questions about the verifiability of assets in a world increasingly oriented towards decentralization and blockchain transparency.

The European Union wants to entrust ESMA with a key role in crypto supervision. With MiCA, an ambitious reform is taking shape, balancing enhanced security and concerns about innovation. This extension of powers could change everything for investors and platforms. Essential details to know.

The sharp rejection of the $93,500 threshold this Thursday cooled the enthusiasm of a market seeking bullish confirmation. This level was expected as a symbolic pivot before a key Federal Reserve deadline. Far from a simple technical pullback, this retreat triggers doubts about BTC's ability to start a sustainable rally, in a climate where every economic figure weighs on monetary expectations.

Grayscale's Chainlink ETF recorded $41 million in inflows on its first day, an impressive figure at first glance. Yet, experts are already talking about disappointment. Why does this launch, despite being solid, fail to convince? Analysis of a "blockbuster" that did not live up to its promises.

While Bitcoin is leading a new rally, Solana sends a much more puzzling signal: capital is exiting ETFs but continues to flow on the blockchain. On one side, 21Shares sees its TSOL crypto ETF lose $42M. On the other, over $321M redeploy directly on-chain on Solana. An apparent contradiction that says a lot about the real state of the market.

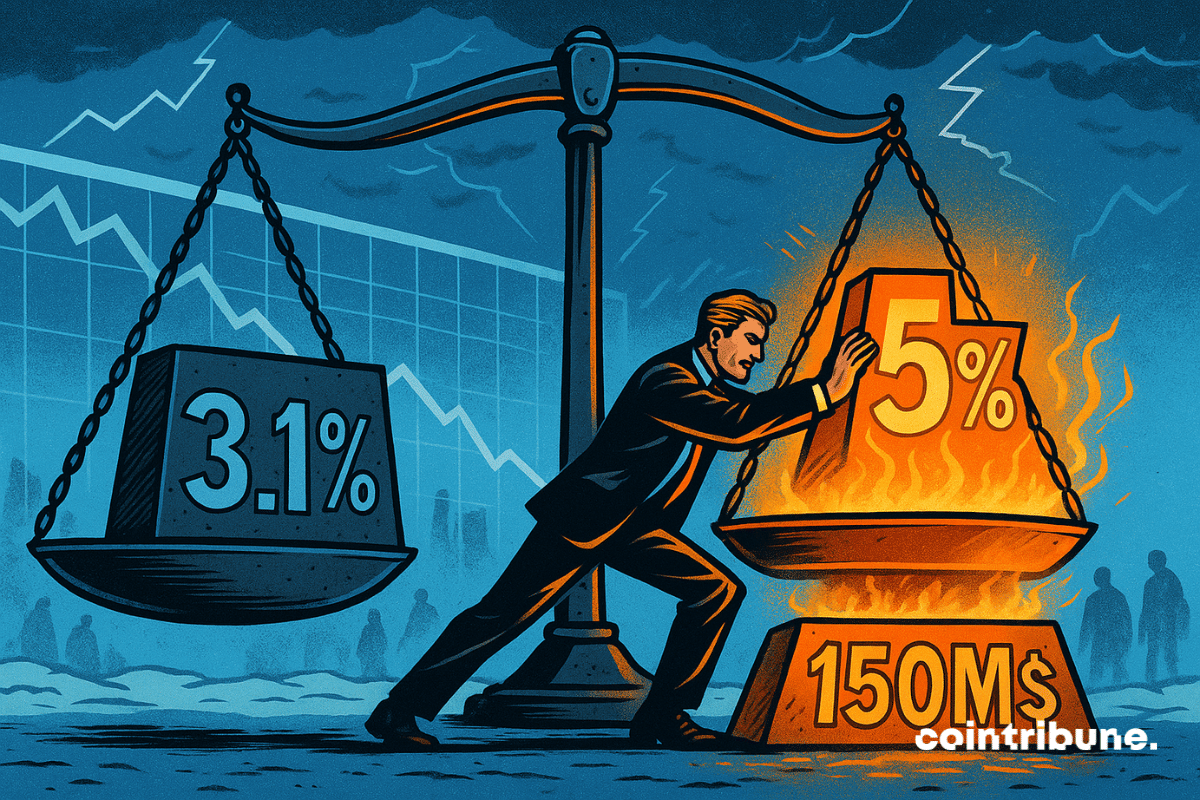

While the small holders sell, BitMine stuffs itself with ether: $150 million at once, aiming for 5%. Soon, Ethereum will be to Tom Lee what Twitter is to Musk.

As speculative frenzy once again takes hold of the cryptocurrency market, the SEC decides to put a firm brake on excesses. By targeting the most aggressive leveraged crypto ETFs, the regulator sends a clear signal: the era of "x5" products sold to the general public without genuine safeguards is reaching its limits. Between the desire to regulate innovation and the necessity to protect investors, a new red line is being drawn in the crypto ecosystem.

Connecticut has just taken strong action against three giants of digital finance. Kalshi, Robinhood, and Crypto.com find themselves in the authorities' sights for offering unlicensed sports betting. An offensive that could reshape the emerging online prediction market.

Crypto mergers and acquisitions reached $8.6 billion in 2025, with Coinbase, Ripple, and Kraken among the major firms expanding their operations.

Polymarket has entered a new phase of expansion as its US relaunch begins after years away from the domestic market. According to recent reports, the platform is moving quickly to bring waitlisted users into its updated app, starting with sports event contracts. Regulatory clearance arrived earlier this year, opening the door for a compliant return.