Coinbase, the well-groomed crypto exchange, is cooking up a Base token. JPMorgan sees billions there. Should we worry when banks applaud tokens they do not control?

Coinbase

JPMorgan upgraded Coinbase to Overweight, citing strong growth potential from its Base network, which could be worth up to $34 billion.

While cryptos are in turmoil, Elon Musk moves 133 million in bitcoin without a word: secret plan, space whim or just portfolio management? Mystery at the top.

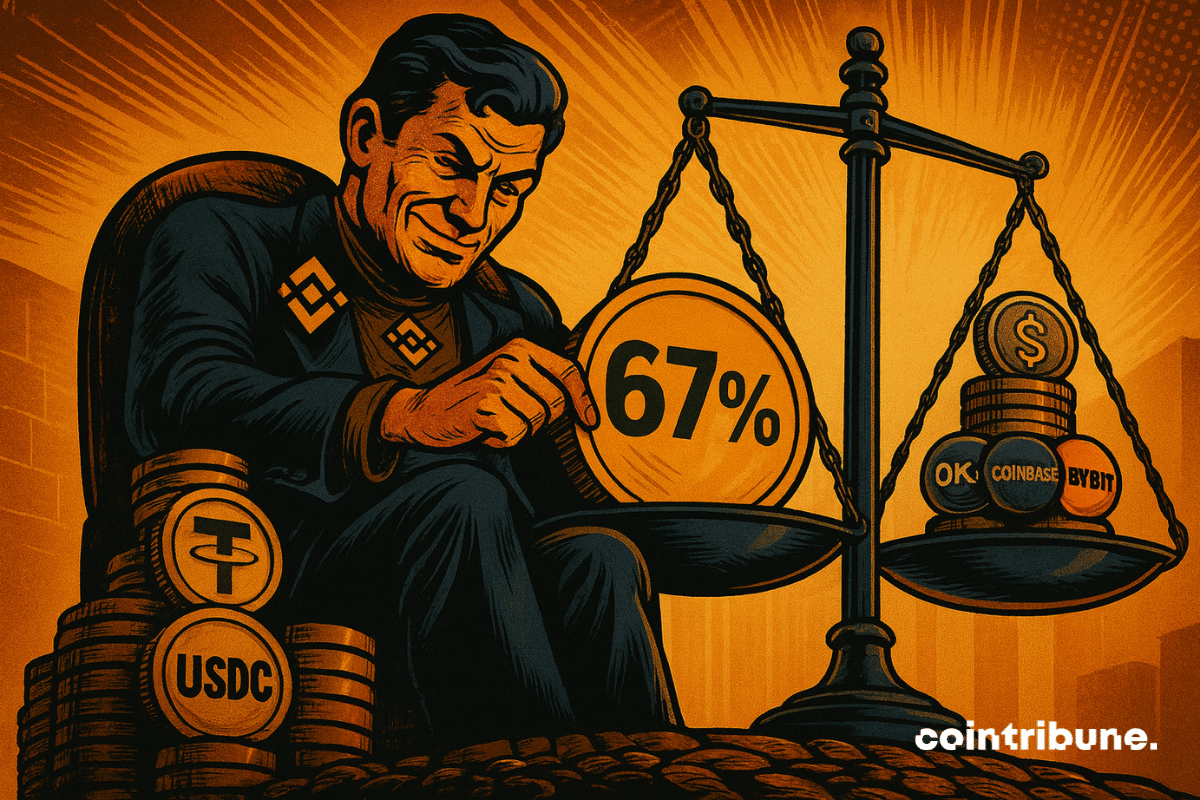

BNB, Binance's flagship crypto, finally makes its debut on two of the largest American platforms: Coinbase and Robinhood. Long excluded from the mainstream US markets, often for compliance reasons, the asset crosses a major strategic threshold. Now listed on platforms accessible to millions of investors, BNB gains formal recognition that contrasts with its past as an asset confined to the Binance ecosystem. This shift says a lot about the evolution of the American crypto market and the gradual normalization of certain long-controversial assets.

It's historic. Tomorrow, October 21 in Washington, the US Federal Reserve hosts the elite of the crypto sector for an unprecedented conference on payment innovation. Sergey Nazarov from Chainlink, the heads of Circle, Paxos, and Coinbase: all will be front and center. Stablecoins, tokenization, AI... An agenda that says a lot about the new era the Fed seems ready to embrace.

A major outage of Amazon Web Services paralyzed the main crypto platforms on Monday, revealing once again the paradoxical dependence of a sector that advocates decentralization. From MetaMask to Coinbase through Base and OpenSea, malfunctions multiplied throughout the day.

Cloudflare has partnered with Visa, Mastercard, and American Express to help shape the future of digital payments through a secure foundation for “agentic commerce.” The collaboration aims to develop authentication systems that enable trusted software agents to make purchases and payments autonomously—while protecting merchants from fraudulent bots.

Coinbase is preparing to list BNB, the flagship token of its historic rival Binance. Such an unexpected gesture contrasts with past tensions between the two giants. In a climate of enhanced regulation and strategic repositioning, this decision could mark a turning point in the power dynamics of the sector. Calculated opportunism or signal of appeasement? This rapprochement intrigues as much as it raises questions.

Coinbase dreams of being the Robin Hood of crypto: $12,000 for poor young people, a banking license behind the scenes... and the future of banks shaking to the rhythm of stablecoins.

Samsung and Coinbase join forces to take a leap in crypto adoption. Asset purchases are now accessible directly via Samsung Wallet on Galaxy smartphones. From this initial phase, over 75 million American users will be able to access crypto without going through third-party interfaces. An unprecedented integration between a mobile giant and an exchange platform, which could foreshadow a global rollout and redefine the role of smartphones in the decentralized financial ecosystem.

BlackRock's IBIT Bitcoin ETF has reached a historic milestone by becoming the largest Bitcoin options platform in the world. With 38 billion dollars in open interest, it now surpasses Deribit, the well-known derivatives exchange platform recently acquired by Coinbase.

The U.S. exchange-traded product (ETP) market for digital assets is taking another step forward. With regulators broadening the framework for crypto funds, XRP has now been included in a Nasdaq-listed multi-asset spot crypto ETF, giving investors easier access to a wider set of cryptocurrencies.

While Aster is leading, Bitwise plays its joker: an ETF on a declining crypto. Should you bet on HYPE... or on the high hopes of financiers?

The tokenized dollar machine has been reignited. Following the 25 basis points cut decided by the Fed on September 17, Tether accelerated the issuance of USDT. In total, 5 billion minted in eight days, including an additional 1 billion on September 19 on Ethereum, according to Onchain Lens. The timing is no coincidence: when the cost of money falls, the thirst for liquidity in crypto markets rises instantly.

Kevin Durant, two-time NBA champion and recognized investor, has just regained access to a Bitcoin wallet that had been inactive for nearly ten years. Created in 2016, at a time when BTC was trading around 600 dollars, this forgotten wallet illustrates the decisive role of time in the valuation of cryptos. Its reactivation reveals a spectacular gain: a 195-fold increase of the initial investment.

Coinbase CEO Brian Armstrong says he has never been more confident that the Clarity Act will pass, bringing clear rules and growth to the US crypto market.

Banks are screaming disaster, Coinbase responds with numbers: stablecoins do not swallow deposits, but happily crunch the $187 billion in banking fees.

What if your software soon handled your payments without you? Google takes a step closer to this reality by launching an unprecedented protocol: its intelligent agents can now exchange money between themselves via bank cards and dollar-backed stablecoins. This project, supported by Coinbase and other companies, paves the way for an automated economy where AIs no longer just assist you... but act on your behalf.

Coinbase-backed layer-2 network Base could soon roll out a native token, according to the latest revelations by network creator Jesse Pollak. This development signals a shift in gear after the protocol initially stated that it had no intentions of launching a native token a few years back.

Capital Group’s crypto investment appears to have paid off, according to recent reports, with its $1 billion Bitcoin-related stock surging by over 400%. The American asset management firm entered the Bitcoin treasury market a few years ago, following significant investments in Metaplanet and Strategy.

When Galaxy spends 700 million on Solana, it’s no longer poker: it’s the smashing entry of a crypto altcoin into the gilded halls of traditional finance.

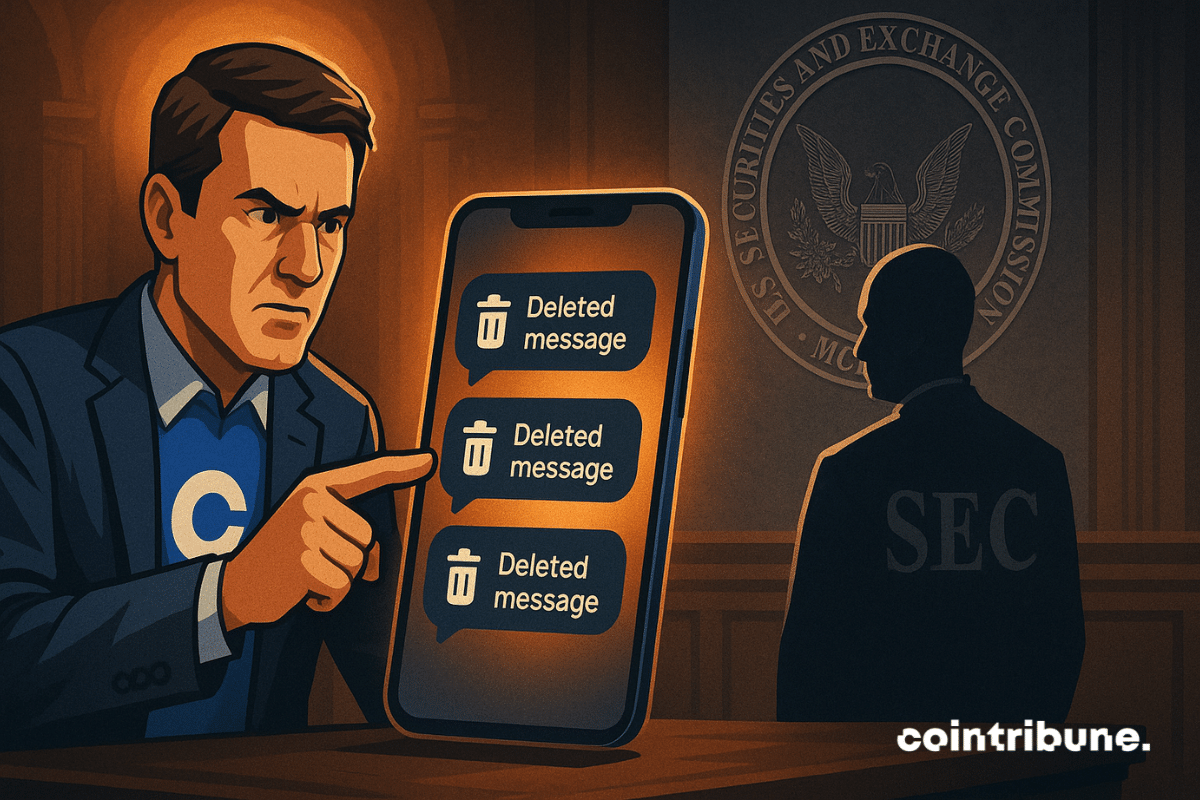

Coinbase relaunches the offensive against the SEC. The exchange asks the federal court to investigate the alleged deletion of a year of messages from Gary Gensler, former chairman of the financial authority. An explosive case likely to tarnish the record of a leader already known for his hostility towards the crypto ecosystem.

Nasdaq has officially filed a request with the SEC to authorize trading of shares and ETPs in tokenized form. A breakthrough that could disrupt Wall Street and accelerate the integration of blockchain into traditional financial markets.

The SEC changes its tone and no longer considers crypto assets as securities. Discover all the details in this article!

In the crypto arena, Binance sits like a central banker: 67% of stablecoins under lock. Historic record, guaranteed concern, and dry powder ready to explode.

Coinbase puts its engineers on a dry diet: AI already codes 40% of the in-house software. Armstrong rejoices, skeptics grumble. Rapid layoffs for latecomers.

Regulated exchange platforms can conduct spot cryptocurrency trading activities, according to a joint statement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on September 2, 2025. This policy clarification marks a key regulatory step that could help drive crypto trading and promote investor protection.

In South Korea, Tesla no longer embodies the dream of retail investors. According to Bloomberg, nearly 1.8 billion dollars vanished in four months, including 657 million in August alone, marking the largest outflow since 2019. Behind this disenchantment, a growing unease: lacking a new narrative around AI or autonomous driving, the manufacturer no longer captivates as much. Result: despite its status as the most held foreign stock, Korean investors are abandoning Tesla for bets considered more dynamic and quicker.

Crypto ETF issuers are just waiting for the SEC to release its stamp. They move forward, file, correct, refine. Like a conductor confident in his score, Grayscale continues to play its own regulatory symphony. And this time, it is Cardano taking the stage, ready to secure its ticket to Wall Street. The countdown is on, the lines are moving, and investors are already sharpening their order books.

The custody of cryptos shifts to a new era. Indeed, exchanges, long dominant, are giving ground to Wall Street giants. BlackRock, through its Bitcoin and Ethereum ETFs, now establishes itself as an essential custodian, directly competing with Coinbase and Binance. This massive asset transfer illustrates the rise of traditional finance in the crypto ecosystem and raises questions about the future of historic platforms, facing a gradual loss of their central role.