New Trump splash: two pro-crypto figures take the reins of the CFTC and the FDIC. All the details in this article!

Commodity Futures Trading Commission (CFTC)

Crypto is shaking up the rules of the financial game. With a bold decision, the CFTC opens a breach that could change everything. Is traditional finance in danger? Who will come out victorious in this battle? Discover an exclusive analysis of the issues and prospects.

While Wall Street digests its ETFs, Paul Atkins unwraps an unexpected gift: crypto becomes emancipated, ICOs resurrect. A cooler SEC than ever?

The United States takes a decisive step in integrating cryptos into the traditional financial system. Caroline Pham, acting chair of the CFTC, has just authorized the use of bitcoin, Ethereum, and USDC as collateral in the U.S. derivatives markets. A decision that could well redefine the rules of the game.

The CFTC has approved spot cryptocurrency trading on U.S. exchanges, opening a new era of regulated digital asset markets under federal oversight.

Polymarket has entered a new phase of expansion as its US relaunch begins after years away from the domestic market. According to recent reports, the platform is moving quickly to bring waitlisted users into its updated app, starting with sports event contracts. Regulatory clearance arrived earlier this year, opening the door for a compliant return.

Kalshi is pushing prediction markets further into the crypto space as global demand accelerates. Rising interest in event-based trading has prompted the platform to tokenize event contracts on Solana, giving users more in sensitive markets. Analysts say this shift could position Kalshi to challenge competitors and keep pace with the industry’s rapid growth.

After three years of forced absence, Polymarket finally returns to the US market. The predictive betting platform, banned in 2022 for regulatory non-compliance, obtains the long-awaited authorization from the CFTC.

Under Atkins, the SEC pulls out the highlighter to sort tokens. Congress, meanwhile, is stalling. And crypto projects? They are sharpening their passports for more stable skies.

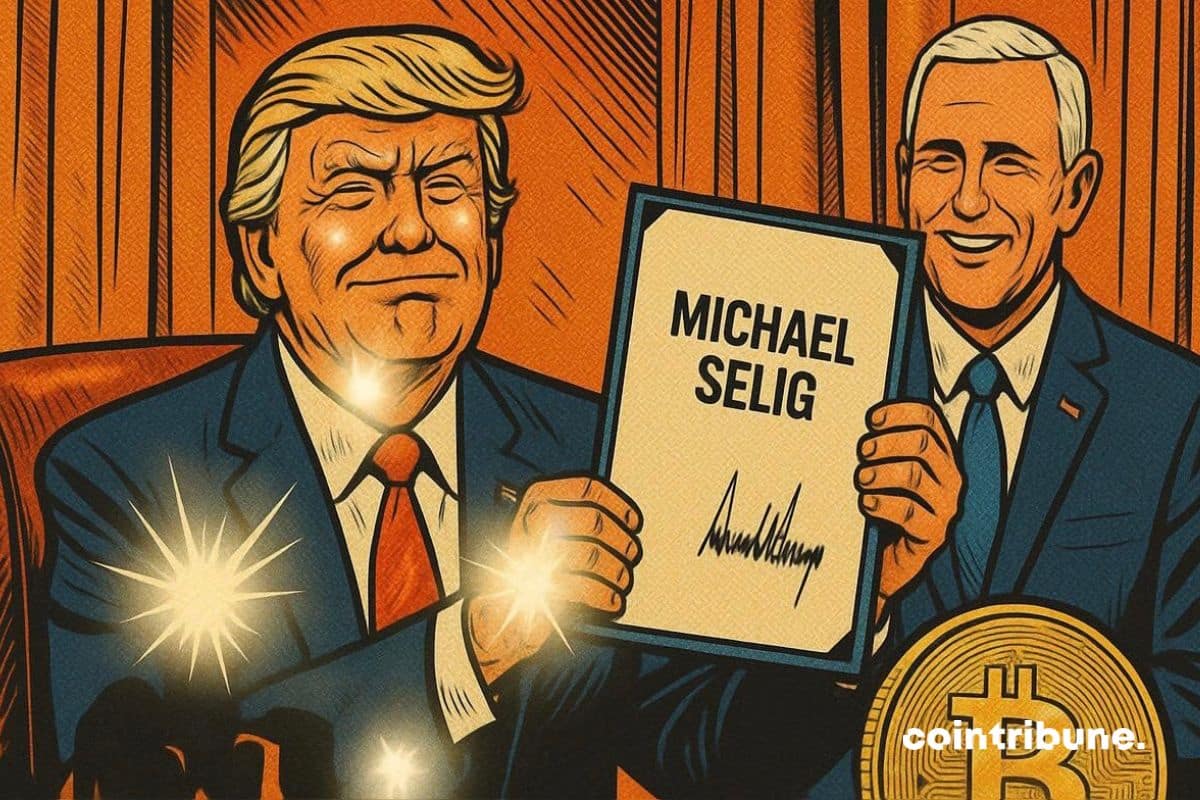

Michael Selig, nominated to lead the CFTC, will face his Senate confirmation hearing on November 19 as lawmakers review his approach to crypto regulation.

While the United States struggles to align on crypto regulation, the Senate breaks the deadlock. The Agriculture Committee has just unveiled an ambitious bill aimed at clarifying the roles of regulators, CFTC and SEC, and laying the foundations for a coherent legal framework. Led by Senators Boozman and Booker, the text also addresses key concepts such as DeFi, DAOs, and blockchain. This is a first step towards more readable regulation.

The CFTC is preparing to launch leveraged spot crypto trading as early as next month, introducing new oversight to protect investors and strengthen the market.

After three years of forced exile, the crypto prediction platform Polymarket could reopen its doors to American traders in the coming weeks. A major regulatory breakthrough that would radically transform the landscape of prediction markets in the United States.

Donald Trump has just appointed Michael Selig to lead the CFTC, a decision that could disrupt the future of cryptocurrencies. With a pro-crypto profile and a clear vision, Selig embodies the American ambition: to become the global capital of crypto.

A sweeping FBI operation that led to the arrest of an NBA player and coach last week has shaken both the sports and financial worlds. The incident comes as major leagues and betting platforms move deeper into prediction markets. Notably, the scandal has reignited debate over whether regulators are prepared to handle this new frontier of sports speculation.

Prediction platform Polymarket is broadening its reach into traditional finance with a new feature that lets users bet on stock and index movements. The move highlights the platform’s growing ambition to connect crypto-native speculation with mainstream financial markets, as investor interest in event-based trading continues to accelerate.

The SEC is preparing to introduce an “innovation exemption” that would give companies more flexibility to develop digital assets and emerging technologies. SEC Chair Paul Atkins said the proposal could be formalized as soon as the end of this quarter, despite challenges caused by the ongoing government shutdown.

Prediction markets have received a major vote of confidence after Intercontinental Exchange (ICE)—the operator of the New York Stock Exchange—announced a $2 billion strategic investment in Polymarket. The deal values the platform at roughly $8 billion, marking a stunning turnaround for a company that faced regulatory fire just three years ago.

The possibility of a U.S. government shutdown is dominating prediction markets, with traders betting heavily on the outcome. Platforms like Kalshi and Polymarket show a strong consensus that negotiations in Washington are unlikely to deliver a deal in time. Rising volumes and market probabilities above 85% suggest that participants see a shutdown as the most likely outcome.

Polymarket introduces annualized rewards for long-term positions, supporting accurate pricing in high-profile political and global markets.

When Trump roars "I am the boss", the Winklevoss texts remind him that the kings of Bitcoin crypto sometimes pull more strings than a president on stage.

Exit Gensler, here comes Atkins: the SEC shifts from the brake to the accelerator. "Innovation exemption", multi-crypto ETP, stablecoins… Washington finally discovers that blocking costs more than moving forward.

Washington goes back to the drawing board. The US Treasury opens a new comment window to transform the GENIUS Act, the future framework law on payment stablecoins, into applicable rules. The stated objective is to secure the use of tokenized dollars while maintaining a workable playground for crypto innovation. Let's get into the specifics.

Recent chatters within crypto chat rooms indicate that prediction platforms Polymarket and Kalshi are exploring ways to raise capital, with Polymarket aiming for a higher valuation than Kalshi. Interestingly, this comes as decentralized betting begins to catch the eyes of top firms within the crypto space.

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

Regulated exchange platforms can conduct spot cryptocurrency trading activities, according to a joint statement by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on September 2, 2025. This policy clarification marks a key regulatory step that could help drive crypto trading and promote investor protection.

Crypto-expats, come home! The CFTC unveils its magic FBOT passport to revive the American dream. Punitive regulation? A bad memory, sworn and promised...

Trump dreams of a crypto eldorado, the CFTC sprints, the SEC follows… but behind the speeches, who really regulates this digital rush westward? Regulatory suspense guaranteed.

Polymarket, the crypto platform specializing in predictive markets, is making its big return to the United States. To achieve this, it is betting on the acquisition of QCX, an exchange regulated by the CFTC. An ambitious move that could redefine the future of prediction on the blockchain.

In Washington, crypto is taking shape: laws are being passed, Trump rejoices, and the Fed must put away its digital dreams. Regulation is turning into a soap opera with distinctly American twists.