Bitcoin remains king, but its throne is shaking. Its dominance is gently slipping, allowing for a resurgence of altcoins. Leading the way are Ethereum and XRP, as challengers regain ground.

Ethereum (ETH)

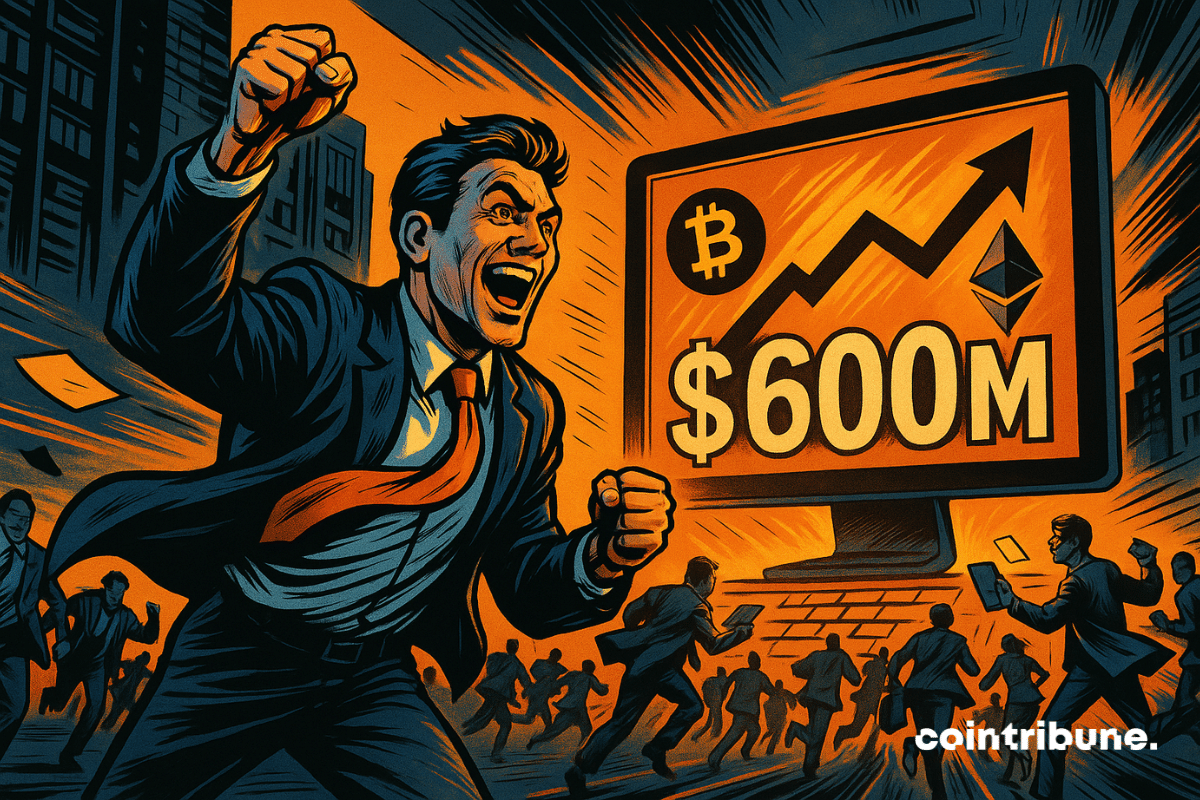

Ether ETFs have just dethroned Bitcoin ETFs by recording $602 million in inflows in a single day, compared to $523 million for BTC. This record day, when crypto ETFs attracted $1.1 billion, reflects strong confidence from major financial players, who see ETFs as a secure and regulated way to expose their portfolios to the crypto sector.

The crypto market has just crossed the symbolic threshold of 4 trillion dollars in capitalization, a level unmatched since the bull run of 2021. However, this push goes far beyond a simple speculative rebound. It reflects a reallocation of capital towards major assets, a renewed confidence among investors, and a silent transformation of exchange infrastructures. More than just a strong comeback, it seems that the crypto ecosystem is entering a new phase of maturity.

While some are watching for the slightest sign of a pullback, Bitcoin and Ether-backed ETFs continue their triumphant march. In a single day, these financial products attracted nearly $600 million, a sign of institutional appetite that shows no sign of weakening. This wave of enthusiasm outlines the contours of an increasingly assertive adoption of cryptocurrencies within traditional portfolios.

Ethereum climbs 20% amid Bitcoin's decline. Is the crypto market changing its leader? Full analysis here.

Ethereum suddenly emerges from its lethargy. By breaking through a strategic price zone, the asset marks one of its sharpest movements in weeks. Increased volumes, aligned technical signals, and a resurgence of volatility: all the markers of a market awakening are present. This unexpected sequence repositions Ethereum at the center of attention, amidst the liquidation of short positions and the return of speculative appetite. Such a surge raises as many questions as it intrigues, as the ecosystem still struggles to regain a clear direction.

Standard Chartered has taken a major step in crypto by launching a fully regulated spot trading service for Bitcoin and Ethereum, specifically targeting institutional clients. This move makes it the first globally systemically important bank to offer direct access to dollar-paired crypto spot trading, opening the door for corporates, investors, and asset managers to gain exposure to digital assets under the umbrella of a trusted banking institution.

The market for tokenized real-world assets (RWA) is experiencing a spectacular redistribution in 2025. Solana has shown a growth of 218% since January, eclipsing the progress of Ethereum which is limited to 81%. Could this rise redefine the hierarchy of blockchains in this strategic sector?

Quantum computing, often seen as a sword of Damocles hanging over blockchains, has fueled fantasies and speculations for more than a decade. In this universe of uncertainty, Vitalik Buterin, co-founder of Ethereum, presents a contrarian diagnosis: lucid, quantified, but above all, confident. For him, the arrival of machines capable of breaking current cryptographic foundations is not a fatality, it is a deadline. And Ethereum will be ready for it.

While Ethereum is often touted as a potentially deflationary asset, the reality of the protocol tells a different story. Nearly 4.6 million ETH have been burned since 2021, the equivalent of $13.5 billion, yet this has not stymied the growth of supply. This anomaly raises questions about the coherence and effectiveness of the economic model established since the London upgrade, and challenges certain certainties regarding the programmed scarcity of the asset.

For a long time, bitcoin reigned supreme as the uncontested master of the cryptocurrency realm, particularly in the area of exchange-traded funds (ETFs). But today, a turning point is taking place. Discreetly, methodically, Ethereum is beginning to nibble away at market shares and is capturing the attention of institutional investors. A recent report from CoinShares highlights this astonishing dynamic: ether is no longer just following; it is asserting itself. Behind the numbers lies a reality taking hold: the dominance of bitcoin in crypto ETFs is no longer so evident.

The crypto market has just crossed a symbolic threshold: $3.8 trillion in capitalization. This is more than Amazon's valuation, almost as much as the GDP of the United Kingdom. Far from a simple bullish cycle, this surge propels cryptocurrencies to the status of systemic players. A turning point that reshuffles the cards: this market is no longer peripheral; it now competes with major economic powers. While financial capitals observe, the cryptosphere sets its own pace and redraws the contours of the global economy.

The decentralized finance giant Aave has just crossed a symbolic threshold by surpassing 50 billion dollars in net deposits. This historic achievement solidifies the protocol's position as the undisputed leader in DeFi lending. A major milestone that reflects both the maturity of the sector and its growing attractiveness to institutions.

Eric Jackson of EMJ Capital predicts Ethereum could surge to $10,000 soon and even $1.5 million long-term. He highlights the potential impact of staking-enabled ETFs, shrinking ETH supply, and growing institutional demand as key drivers behind this bullish outlook.

Crypto ETPs are breaking records in flows and assets. We deliver all the details in this article!

While the little ones toil to mine, BlackRock quietly rakes in millions of Ethereum. Centralization, you say? What if the crypto revolution changed owners…

A Bullish wave is once again sweeping through all corners of the crypto market as Bitcoin reached new price levels and altcoins printed price climbs. Over the past week, the OG coin witnessed consecutive days of price increases, reaching an all-time high of $ 118,731 on July 11. Despite this remarkable feat, data shows that the apex coin’s dominance has faded slightly. Prominent market personality Matthew Hyland even asserted that altcoins may have a greater upside, as many currently surge independent of Bitcoin’s influence.

Ethereum is sprinting in Web3: zkEVM, secret clients, and proofs in 10 seconds… Meanwhile, rivals are taking a nap and Vitalik is adjusting his stopwatch.

BlackRock’s iShares Ethereum ETF led a major surge in ETH fund inflows this week, signalling rising institutional demand.

The discreet transfer of 10,000 ETH by the Ethereum Foundation to SharpLink Gaming, at a price below market value, raises eyebrows. This private deal, concluded before a spike in the price above $3,000, raises questions about the strategic management of Ethereum's reserves. In a context of record inflows into Ether ETFs, this operation may signify a turning point: ether is no longer a speculative asset; it is becoming a financial lever integrated into the treasuries of influential companies.

When ETFs fill up like broken pockets and bitcoin breaks through the ceiling, traditional markets wonder: have cryptos become acceptable to the suit-and-tie crowd?

The crypto markets are gearing up for a decisive day with the simultaneous expiration of over 5 billion dollars in Bitcoin and Ethereum options. This massive expiration comes as Bitcoin reaches new historical highs beyond 118,000 dollars. But what do these data reveal about investor sentiment, and what movements should we anticipate?

Ethereum has climbed back to $3,000, driven by rising institutional purchases and increased futures market activity, signaling renewed bullish momentum.

The crypto market is entering an important phase, with Shiba Inu, Ethereum, and Dogecoin all showing serious volatility. Traders are closely watching these coins as technical patterns hint at potentially explosive price moves, if the right conditions line up.

SharpLink is making bold moves with Ethereum—growing its holdings, staking all assets, and drawing investor attention as ETH gains momentum.

Polygon is about to reach a decisive milestone with Heimdall v2, a hard fork that Sandeep Nailwal describes as "the most complex since 2020". On July 10, the PoS network is deeply modernizing its infrastructure while consolidating its governance, now in the hands of its co-founder. This is a strategic operation as the battle intensifies on the front of layer two blockchains.

According to data from Token Terminal, over $6 billion worth of tokenized assets now live on the Ethereum blockchain. That’s not theoretical DeFi liquidity, but real-world funds, from some powerful names in global finance.

While crypto ETFs are hitting record highs, volumes are evaporating. Blackrock and Fidelity are leading the influx, but the market seems to be holding its breath. Boom on the surface, empty underneath?

As Bitcoin gallops ahead, altcoins are sharpening their weapons in the shadows... What if the king soon fell from his throne? Guaranteed suspense in the crypto arena.

While the media spotlight remains on Bitcoin ETFs and the fluctuations of Solana, a quiet yet massive concentration is occurring on Ethereum. Wallets holding more than 10,000 ETH, the famous mega-whales, are increasing their positions at an unmatched pace since 2022. Barely visible, this surge in accumulation hints at the beginnings of a bullish cycle.