The crypto market is experiencing a significant correction at the end of November 2024, with Bitcoin fluctuating around $93,400. This 6% drop since Monday comes as technical indicators signal a concerning bearish divergence. Meanwhile, Ethereum is showing signs of resilience near its key resistance.

Ethereum (ETH)

Ethereum is soaring and its futures are surging! Is the number 2 cryptocurrency gaining momentum for its big comeback?

Reply from King BTC? No panic: SAND inspires, XLM intrigues, and Ethereum, always the charming eternal rival.

Buying Bitcoin in Asia has never been so easy: a major bank opens its digital vaults for you.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic disputes. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The world of cryptocurrencies is in constant upheaval, but certain developments draw particular attention due to their scale and implications. Indeed, open interest in futures contracts on Ethereum has just crossed an unprecedented threshold, surpassing 20 billion dollars. This record is indicative of a renewed interest in the asset, as well as a bullish movement that redefines the short-term outlook for one of the most influential cryptocurrencies.

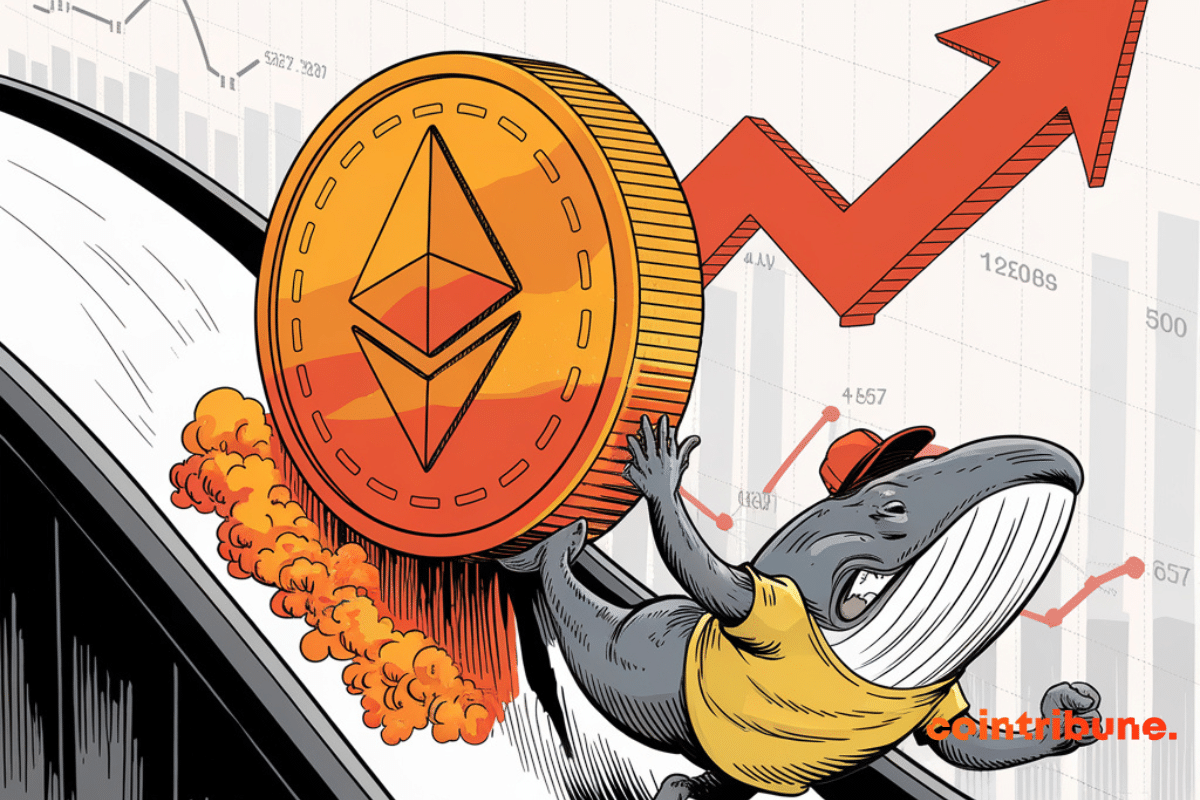

Ether challenges the laws of the crypto market. While massive selling pressures exert considerable weight on its price, the second-largest cryptocurrency by market capitalization appears unperturbed. Investors are witnessing a captivating scenario where even a colossal sale of $1.3 billion is not enough to curb its rise towards $3,700. But…

As the crypto market vibrates to the rhythm of Bitcoin's spectacular rises, a key player is preparing to play its trump card: Ethereum. While Bitcoin is currently making history with new peaks, Ethereum remains behind, which fuels the debate about its ability to surpass its rival. Technical signals and investment movements are now capturing the attention of experts, with the idea of a trend reversal.

In the spotlight, Grayscale plays innovation: a reverse split that could redefine access to the crypto market.

In crypto, Ethereum is a bit like that talented marathon runner always stuck in its shoelaces at the starting line.

Ethereum crosses a key resistance and surpasses the symbolic threshold of $3,000. Let’s take a look at the future prospects for ETH. Situation of Ethereum (ETH) Price After experiencing a significant decline, the price of Ethereum has entered a consolidation phase in the form of an ascending triangle. After breaking…

Discover the forecasts for Bitcoin, Ethereum, and Ripple as they reach critical levels in the crypto market!

Ethereum ETFs have reached a new historical milestone with a weekly trading volume of $1.63 billion, representing a spectacular 44% increase compared to the previous week. This exceptional performance comes four months after their launch, eerily reminiscent of the trajectory observed with Bitcoin ETFs.

In a constantly evolving crypto universe, the competition among top tier blockchains continues to intensify. Ethereum, the undisputed leader for years, is facing a rise of challengers more determined than ever. Among them, Cardano is identified as the most serious contender to dethrone Ethereum in a poll conducted by Altcoin Daily.

In a raid mode, Goldman Sachs piles up 718 million in Bitcoin ETFs. And to think that just yesterday, it was all talk!

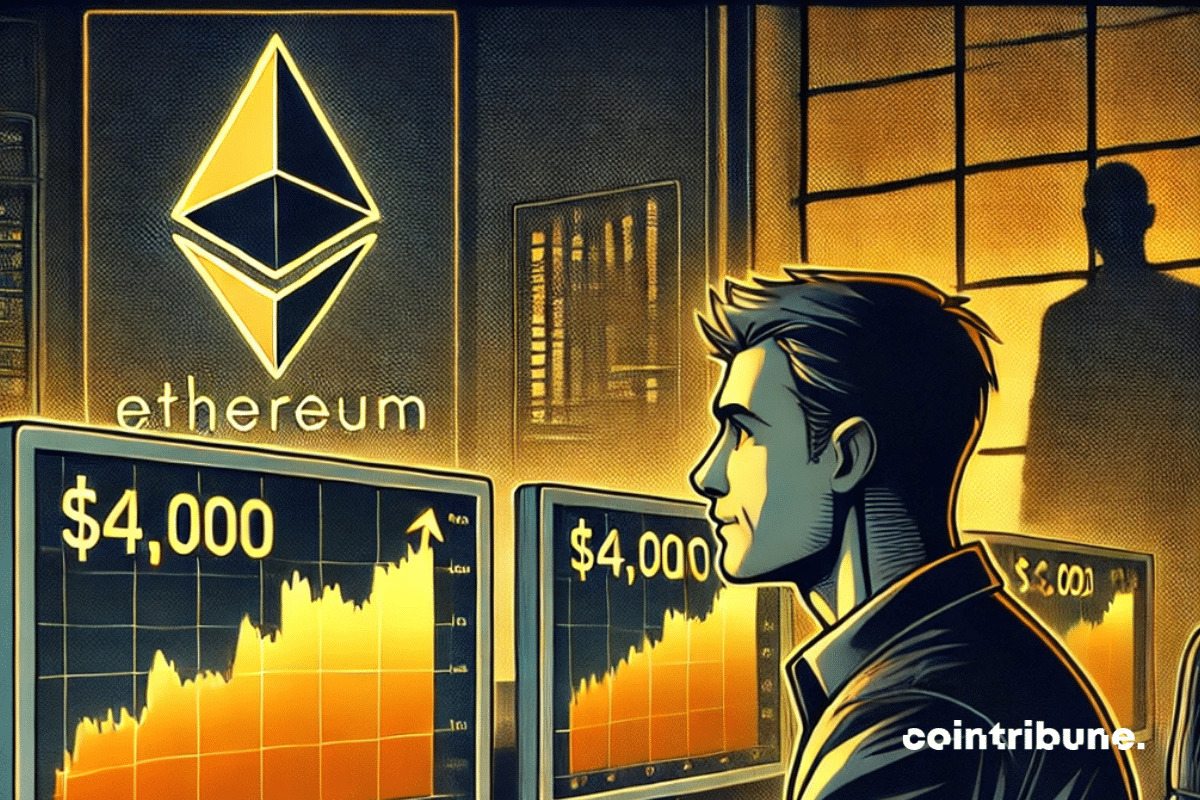

Ethereum could well reach a historic level. In the midst of an upward trend, the second-largest cryptocurrency in the market is showing signs of significant recovery, bolstered by a combination of positive market factors. Indeed, the appeal of derivatives for investors, a rapidly growing activity among blockchain users, and the increasing interest in Ethereum-focused ETFs underscore a clear bullish trend. These indicators, closely monitored by investors, outline a potential trajectory toward the $4,000 mark.

The price of Solana (SOL) has made a spectacular rise, reaching $214 this Sunday, its highest level since December 2021. This exceptional performance represents a staggering increase of 2,500% since its all-time low post-FTX, driven by optimism in the crypto market and technical advancements of the network.

Ethereum, fleeting king of gains? A whale relinquishes its fortune, sowing doubt in the crypto court. What a tide!

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic issues. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The world of traditional finance is shaking as the crypto world reaches new milestones. Ethereum, the second-largest cryptocurrency by market capitalization, has surpassed a financial giant, Bank of America. This symbolic milestone, reached with an ETH price peaking at $3,200 on November 10, reflects the shift of values towards cryptocurrencies as Bitcoin also hits historical highs of over $80,000. Thus, this breakthrough of Ethereum reflects a transformation in the appeal of decentralized assets and in the very structure of the global financial market.

Solana climbs, climbs, and soon touches the grail of 100 billion. Trump applauds, the crypto world holds its breath!

Eclipse launches its mainnet, combining Ethereum and Solana for fast and cost-effective crypto transactions!

Ethereum, the undeniable giant of the blockchain, is making a new leap forward with the launch of the Mekong testnet, a name that resonates like a nod to the mysterious waters of the famous Asian river. At first glance, Mekong may seem like a simple addition to the Ethereum ecosystem.

Donald Trump's return to the White House is not limited to classic political issues. For the crypto industry, his election could redefine the contours of financial regulation, particularly for financial products linked to Ether (ETH), the second largest cryptocurrency by market capitalization. Indeed, the prospect of an ETF based on staked Ether could represent a decisive step for the sector. Thus, some analysts, like Edward Wilson from Nansen, believe that such a product could diversify investment options and also strengthen Ether's position as a strategic asset. This scenario, although conditioned by the political context, could change the dynamics of the crypto market in the United States and open unprecedented opportunities for investors.

While Ethereum is in a consolidation phase, Bitcoin’s ATH triggers a buying rebound on the crypto. Let’s examine the future outlook for ETH together. Situation of Ethereum (ETH) price After a drop of nearly 40% from the $3,600 mark, Ethereum has sparked renewed buyer interest, allowing it to enter a…

The Michigan state's retirement system strengthens its position in the crypto market. After its initial investment in Bitcoin ETFs, the fund is now adding significant exposure to Ethereum ETFs, demonstrating a growing confidence in digital assets.

Eleven years ago, a nineteen-year-old young developer named Vitalik Buterin published a document that would shake the foundations of blockchain technology. This "White Paper" of Ethereum, which first appeared in November 2013, laid the groundwork for a new era of finance and decentralization. Much more than just an extension of Bitcoin, Ethereum proposed an innovative vision: a programmable ecosystem that allows autonomous applications to operate without intermediaries. Today, as this document celebrates its 11th anniversary, it is crucial to reflect on the colossal impact of this initiative, its successes, and the challenges that still lie ahead in a constantly evolving sector.

Amid revolutionary announcements, technological developments, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic conflicts. Here is a summary of the most notable news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Sheetz customers will soon pay for their coffee with Bitcoin! Flexa ensures a hassle-free checkout.

Peter Brandt's pessimistic forecasts, one of the most seasoned traders on the financial scene, plunge the crypto community into palpable anxiety. Indeed, the price of Ethereum could well collapse to $1550, a level rarely seen in recent years. In a context of widespread correction in the crypto market, this prediction shocks as much as it raises concerns. Ethereum, often considered one of the cornerstones of the sector, is indeed mired in a pronounced downward spiral, with no signs of recovery appearing on the horizon.