Stablecoins continue to gain a stronger foothold across global crypto markets. This growth now appears not only in supply figures but also in transaction activity across blockchains. In Europe, momentum is building around euro-linked tokens, while USDC continues to expand across multiple networks. Recent data points to a shift toward transaction-driven expansion rather than passive issuance.

Ethereum (ETH)

Crypto transactions are becoming more common due to their borderless nature. And with the festive season here, some are looking to gift digital assets to their loved ones. For beginners, however, the whole process of sending these modern Christmas presents might feel a bit complex. This article explains the main ways to gift crypto and how various jurisdictions regulate such transactions.

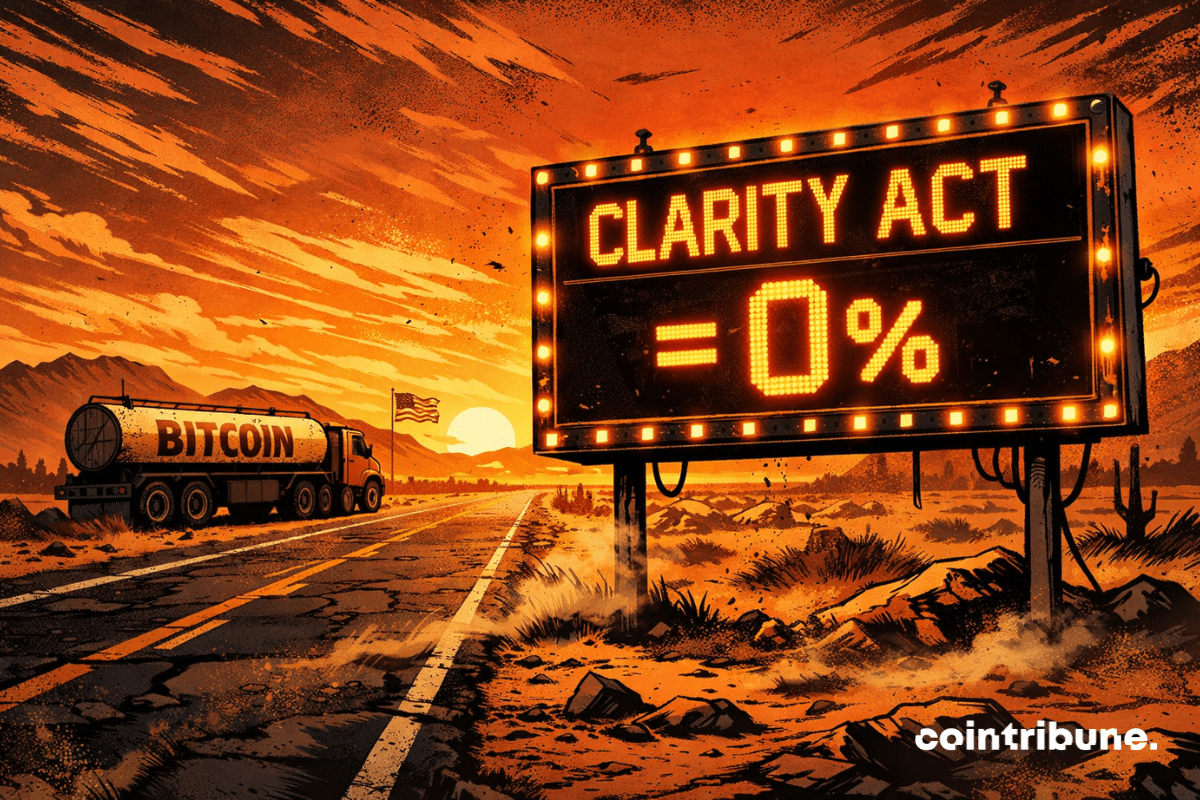

While Washington refines its Clarity Act, bitcoin is falling. Regulation on display, volatility behind the scenes: what if the real shock came from somewhere other than laws?

The Christmas season often raises the same question each year: what gift will have lasting value? For people involved in crypto, interests extend far beyond standard tech gadgets. Crypto users form a global community focused on digital ownership, financial independence, and long-term participation in blockchain networks. And as such, selecting a crypto-related gift shows awareness of these priorities. This article presents practical, beginner-friendly crypto gift ideas suited to different interests while remaining useful long after the holidays.

When Grayscale tells us everything is fine for bitcoin, Naoris draws its anti-quantum shield. What if the enemy is not who we think it is?

The Bank of Japan tightens the screws, cryptos fall, but Bitcoin, that old trickster, attracts big fish. Social panic, full ETFs: explosive cocktail or flash in the pan?

Financial products backed by XRP have just crossed the one billion dollar mark in assets under management. For several weeks, inflows have accelerated, driven by renewed institutional interest. In a market dominated by Bitcoin and Ethereum ETFs, the growth of Ripple's asset surprises by its consistency. This movement contrasts with capital outflows observed elsewhere, signaling a discreet but firm repositioning of investors towards an asset long kept in the background.

Crypto 2025: invisible hackers, billions lost, a rogue state involved... What if your wallet was the next silent victim?

Ethereum’s long-term strength may depend on more than scaling and security. According to co-founder Vitalik Buterin, true trust in the network also requires a broader understanding of how it works. He argues that simplifying Ethereum’s protocol is essential. Without it, users must rely on a small group of experts rather than verify the system themselves.

Ethereum has never progressed through spectacular leaps. Its evolution rather resembles a series of fine-tuning adjustments, sometimes invisible to the general public, but crucial in the long term. And January could mark a new stage of this patient strategy. Protocol developers are indeed considering increasing the gas limit per block to 80 million, compared to 60 million today.

Cryptos falter, whales buy quietly, and small holders watch their tokens melt away like snow in the sun... Suspense guaranteed until summer 2026?

The crypto market was hit by a wave of heavy corrections as a rough weekly outing triggered cautious sentiment among investors. During the downturn, heavy liquidations were recorded as some whales took profits while others moved to limit losses. On-chain data shows increased activity from large Bitcoin and Ethereum holders. In fact, U.S. spot Bitcoin and Ether ETFs recorded combined outflows of over $580 million on Monday, extending a broader trend of capital exits. As these heavy outflows persisted, market watchers observed whales rotating capital into a new game-based memecoin project.

Amid a falling market, BitMine strikes big: + $140 million in Ethereum added to its crypto treasury, defying the downward trend. A risky strategy or a visionary bet? Dive into the analysis of this bold move that could redefine ETH's future and inspire institutional investors.

For the third consecutive week, crypto ETPs have attracted new capital, according to CoinShares. Last week, net inflows accelerated further, extending an already strong sequence after the previous two weeks. In detail, the momentum is mainly American. The United States accounts for the majority of purchases, far ahead of Germany and Canada, while Switzerland stands out against the trend with net outflows during the period.

JPMorgan Chase is expanding its blockchain strategy with the launch of a tokenized money-market fund on Ethereum. The product is backed by $100 million in internal capital and targets qualified investors seeking daily yield through an on-chain structure backed by short-term debt. Market observers say the move reflects clearer regulation, rising client demand, and growing interest in tokenized real-world assets.

Tom Lee and BitMine strike hard: 320 million dollars in Ethereum added in one week, despite a volatile market. A risky or visionary strategy? While ETH is breaking transaction records, BitMine bets everything on its crypto treasury.

Ethereum just made a thunderous impact in the crypto world: 34,468 transactions per second, a record that shatters everything that existed so far. Thanks to Layer 2 and ZK-Rollups, the blockchain proves it is ready for mass adoption. But how will this record affect the price of ETH in 2026?

Ethereum faces short-term volatility but shows strong long-term potential, with intrinsic value projected to reach trillions as the network grows.

Tokenization of real-world assets (RWAs) is moving closer to mainstream finance, though its short-term impact on crypto markets may remain limited. NYDIG says longer-term value will depend on how open, connected, and regulated these assets become across blockchain networks.

Ethereum is stagnating: whales are accumulating, ETFs are flowing, but the breakout is on strike… Behind the scenes, there is movement, but the chart breakout still boycotts the party.

Bitcoin pauses in the balance sheets, but some actors buy more than ever. Here are the numbers worrying analysts.

A bug, a tweet, and here is Vitalik philosophizing while Ethereum wavers: could decentralization be a disguised monoculture? Prysm coughs, the blockchain sneezes... and doubt sets in.

Bitcoin is playing roller coasters: Powell sneezes, whales wave their fins, and traders shout "to the moon"... or crash. The economy, meanwhile, is tense.

Dogecoin struggles to convince institutional investors. Despite a strong capitalization and a media-covered launch, crypto-backed ETFs show volumes in free fall. In a sector where Bitcoin and Ethereum concentrate the bulk of flows, the disinterest in DOGE illustrates the limits of assets perceived as too speculative.

The NFT market collapses in 2025: with only $320 million in sales in November and a free-falling capitalization down 66%, the crypto winter hits hard. Which collections resist? Why is Ethereum shaking? Complete analysis of the numbers and upcoming risks.

BlackRock discovers Ethereum staking and joins the yield banquet. But who is really dining at the table? The investor, the institution... or the tax authorities watching?

The United States takes a decisive step in integrating cryptos into the traditional financial system. Caroline Pham, acting chair of the CFTC, has just authorized the use of bitcoin, Ethereum, and USDC as collateral in the U.S. derivatives markets. A decision that could well redefine the rules of the game.

What if Ethereum users could lock in the price of their future transactions in advance? This is the bold path opened by Vitalik Buterin. Facing the persistent volatility of network fees, Ethereum's co-founder envisions the creation of gas futures contracts, a hedging mechanism that could revolutionize economic planning on the blockchain.

These companies thought they were riding the bitcoin wave, but they are drowning in their own debts. The crypto king is nosediving, and the kings of leverage are getting slapped.

Ethereum has just reached a historic milestone: 6 million ETH burned, equivalent to $18 billion up in smoke. Yet, against all odds, its supply keeps increasing. How to explain this paradox that defies the logic of the crypto ecosystem?