Crypto: Coinbase opens the doors to legal betting in 50 US states. We provide you with all the details in this article!

Exchange

Binance, the crypto giant, trades its wild escapades for the toga of Athens: Greek regulation, European ambition... and a well-timed snub to its old demons.

The crypto market evolves at a crazy pace, and Binance Wallet has just changed the game with three new AI tools: Topic Rush, Social Hype, and AI Assistant. Discover how these innovations help you anticipate crypto market movements and make informed decisions without wasting time.

Caroline Ellison released from prison. FTX returns to the heart of debates in the crypto ecosystem. All the details in this article!

France alerts: crypto companies ignore the MiCA regulation. Imminent shutdown? We tell you everything in this article.

While the market coughs, Tether, on the other hand, is gobbling up bitcoin… A frenzy of crypto-purchasing that intrigues, worries, and could well shake more than one stablecoin in a business suit.

In 2026, the crypto universe will change its face. Binance announces a historic shift driven by different factors. All the details here!

The supply of XRP on exchange platforms has fallen to its lowest level in eight years. This liquidity contraction coincides with a massive disengagement of short-term investors and a retreat to custody solutions. Thus, the prospect of a rally in 2026 reemerges, without a clear consensus.

Binance has suspended withdrawals via Visa and Mastercard for its users in Ukraine. The measure, linked to its fiat provider Bifinity, comes amid increasing regulatory pressures in Europe. This decision complicates access to funds for Ukrainians, already weakened by war and financial restrictions.

While the crypto market is struggling, onchain perpetual contracts are breaking records. A discreet but massive explosion that reshapes the backstage of an overheated DeFi.

Crypto-related losses surpassed the $2.5 billion mark in 2025, marking a turning point in the methods used by cybercriminals. Now, social engineering is established as the preferred technique to steal funds, according to a recent industry report.

Despite a historic agreement with US authorities in 2023 and strict commitments against money laundering, Binance reportedly failed to block suspicious accounts. These accounts transferred colossal sums, raising serious questions about the real effectiveness of the controls in place.

When Trump dreams of a crypto-compatible America, he appoints a former SEC member to the CFTC. Endorsed by Web3 stars, Michael Selig promises rules, not slaps. To be continued...

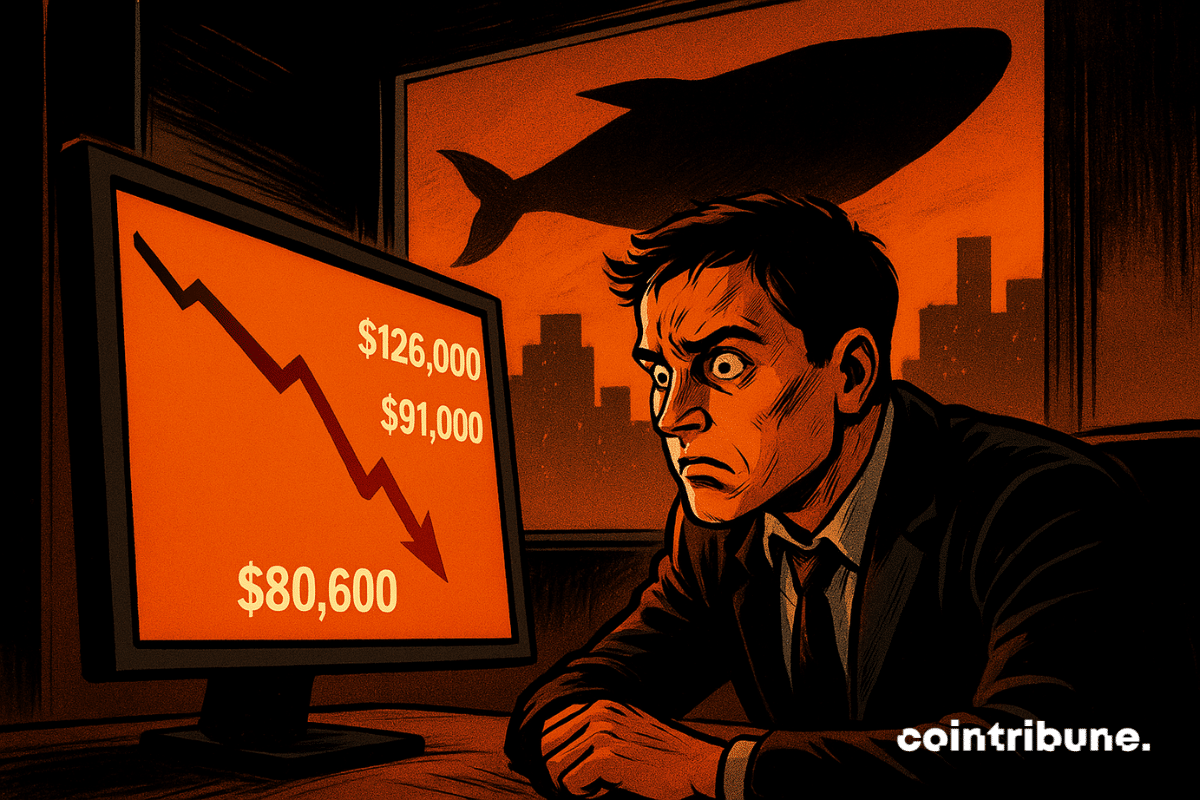

Bitcoin markets are sending mixed signals as price weakness meets rising trader confidence. While the asset remains under pressure after months of declines, activity in derivatives markets continues to point to steady dip buying. Data from Bitfinex shows traders increasing bullish exposure, even as sentiment across the broader market remains cautious.

Caroline Ellison has left federal prison for community confinement after serving part of her sentence for her role in the FTX collapse, as legal proceedings and bankruptcy payouts continue.

Bitcoin’s Lightning Network has reached a new capacity record as major exchanges add more funds and developers roll out new tools. At the same time, an upgrade to Taproot Assets is pushing Bitcoin closer to supporting multiple asset types on its base ecosystem.

The case quickly took a diplomatic turn. After the hacking of Upbit, one of the largest South Korean crypto exchanges, Binance finds itself at the center of a controversy: some investigators in Seoul claim that the platform only froze a small portion of the stolen funds. Binance, on the other hand, strongly disputes this version and assures it acted immediately.

The crypto market continues to grow, attracting an ever-increasing number of curious or eager users to invest. Yet, faced with the complexity of technologies like blockchain, access to clear and reliable information remains a real challenge. In this technical environment, Kraken establishes itself as a strategic partner for both individuals and businesses. The platform is not limited to buying or selling digital assets. It offers you a true educational accompaniment. Thanks to a rich and structured resource center, as well as a responsive and available customer support at all hours, Kraken places education and assistance at the heart of the user experience.

Investing in digital assets now appeals to a much broader audience than just tech enthusiasts. Even cautious investors are turning their attention to this emerging asset class, seen as a serious alternative in the face of growing instability in traditional financial markets. Cryptocurrencies bring a new form of diversification built on innovation, decentralization, and growth potential. In this fast-evolving environment, Kraken stands out as a reliable bridge between traditional finance and the crypto world. This article explores why Kraken is a relevant tool to diversify your portfolio within a secure, educational, and structured framework.

Security remains one of the main concerns for investors in the field of cryptocurrencies. Recent scandals, large-scale hacks, and losses due to poor management of private keys have increased mistrust towards certain platforms. In this context, transparency and the robustness of the infrastructure become decisive criteria. Kraken stands out as a reference in the protection of digital assets, thanks to a rigorous approach and proven security measures. This article highlights the concrete mechanisms put in place by Kraken to guarantee the security of funds, while providing users with tangible and verifiable proof.

The crypto market is no longer limited to speculative trading alone. A new approach is attracting investors: staking, which allows obtaining regular returns without giving up assets. This method appeals to both long-term holders and savers seeking additional income. Kraken offers a simple, accessible, and secure solution with rates reaching up to 17% APY depending on the selected asset. The platform combines performance, reliability, and transparency to provide a staking experience suited for all profiles. Let's explore together the advantages of this strategy and the guarantees offered by Kraken in its regulated environment.

Crypto trading at a professional level relies on execution speed, precision of tools, and rigorous risk management. Many active traders, tired of the limitations imposed by generalist platforms, choose Kraken Pro to enhance their efficiency. This solution is intended for those seeking competitive fees, margin access, derivatives products, and high-level technical infrastructure. Kraken Pro combines performance, security, and adaptability to meet the demands of experienced investors. In this article, we analyze in depth the strengths of this platform and the reasons that encourage traders to adopt it in the face of sometimes disappointing competition.

In the crypto world, trust is an essential pillar. As scandals multiply, more and more users turn to platforms capable of guaranteeing the security of their funds and the transparency of their operations. Kraken stands out as one of the industry's references, alongside Binance, Coinhouse, or Bitpanda, while focusing on a rigorous and sustainable approach. This guide highlights Kraken's main strengths: a solid regulatory framework, proven security, a wide range of services, and recognized performance. The goal is to help each user invest in crypto-assets with peace of mind.

The world of cryptos is generating increasing interest among the general public, driven by the evolution of bitcoin and digital assets. However, for a new investor, making a first purchase can cause hesitation and confusion. Kraken offers a clear alternative to this complexity. Thanks to a streamlined interface, a quick registration process, and purchase options accessible from 10 euros, the platform paves the way for a calm first experience. Security, education, and simplicity are at the heart of its approach. This article guides beginners step by step who wish to acquire their first cryptos without obstacles or unnecessary jargon.

In a DeFi market seeking stability, the launch of StandX on November 24, 2025, does not go unnoticed. This new DEX, dedicated to perpetual contracts, introduces an automatic yield stablecoin, without staking action. Supported by a team from Binance Futures and Goldman Sachs, the project claims a community-driven and self-financed approach. Unlike classic models, StandX aims to establish itself in a sector still largely dominated by centralized platforms.

Bitcoin is soaring, Binance is struggling, shrimps flee, whales dance… and ETFs scoop up the stakes. Here's a crypto-comedy that would be funny if it weren't so serious.

Jupiter Lend clears up claims of 'zero contagion' and explains how vaults operate amid user concerns.

Binance redistributes roles: Yi He takes the stage. Should crypto investors rethink their strategy? Details here!

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.