Is XRP preparing for a spectacular comeback? Patient crypto investors may soon reap the rewards of their wait.

Exchange Traded Fund (ETF)

The hope for sustainable institutional adoption through spot Bitcoin ETFs meets a harsh return of volatility. Praised in 2024 as vectors of stability, these products have just recorded over 680 million dollars in net outflows in the first week of 2026. This sudden decline, in a climate of monetary uncertainties and geopolitical tensions, calls into question the solidity of their anchorage in traditional finance and raises doubts about the market's ability to absorb shocks in the long term.

Bitcoin is nearing 90,000 dollars, but the main action is happening elsewhere. While ETFs suffer massive outflows, institutional investors are beginning a strategic repositioning. This double movement, discreet but structuring, reveals a market in transition, where capital flows no longer respond solely to price logic. Behind the apparent euphoria, a rigorous selection of assets is taking place, a sign of a new maturity in the crypto ecosystem.

Bitcoin's price has been stuck in a narrow range as capital flow slows, leading to a period of consolidation. Experts predict continued sideways movement until market conditions shift.

On January 7, 2026, XRP ETFs broke their 36-day streak of net inflows with $40.8 million in outflows. A strong signal for the crypto market, as Bitcoin and Ethereum face similar flows. Why this reversal? Analysis of causes, players, and consequences for investors.

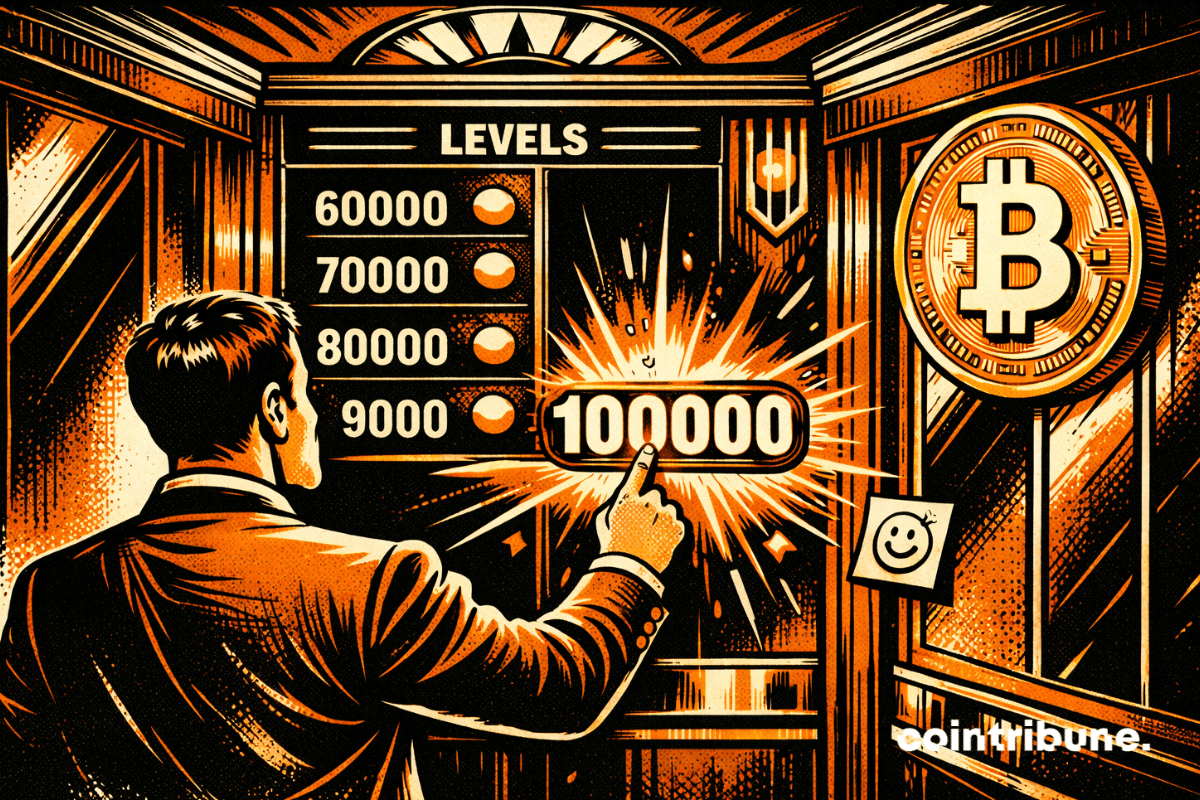

Options traders are betting big: Bitcoin could target $100,000 as soon as this month. Complete analysis in this article.

Morgan Stanley strengthens its presence in cryptos. The American bank has filed a form with the SEC to create a spot Ethereum ETF, including a staking component. A first at this institutional level, which occurs as market interest in crypto products intensifies.

Altcoins may be positioning for a rebound after months of subdued price performance. Market data indicates that many tokens are trading above key support levels established in October. Analysts say these signals could point to a renewed appetite for risk across the broader cryptocurrency market.

Grayscale reaches a historic milestone. For the first time in the United States, a crypto ETF will pay its investors income from Ethereum staking. This unprecedented move disrupts traditional finance codes and paves the way for a new generation of investment products combining cryptos and on-chain yield. In a context where regulation is being structured and innovation becomes a strategic lever, this decision propels Grayscale to the forefront of a rapidly evolving market.

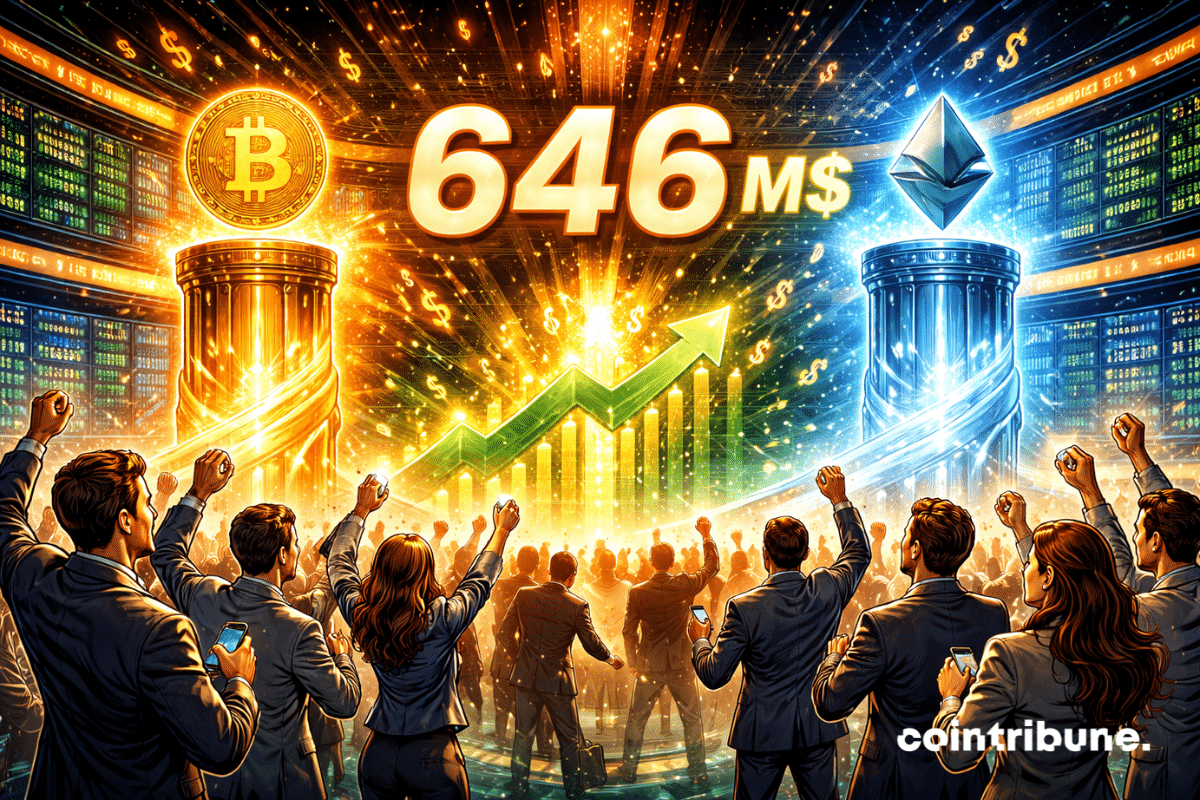

Bitcoin and Ethereum ETFs attracted 645.8 million dollars on January 2. In a still hesitant market, this volume is surprising. It marks the strongest day of inflows in over a month for Bitcoin products and an unprecedented peak since December for Ether. While 2025 ended on a decline, this surge is striking.

Is Bitcoin bored? Not really. Between wild OGs, voracious ETFs, and complicit regulations, the beast calms down... but could bite again where it's least expected.

Crypto markets are entering 2026 with stronger structural support than in earlier cycles. Clearer regulation, expanding financial products, and closer links to traditional finance are reshaping how digital assets are adopted and perceived. Coinbase’s research leadership expects this momentum to persist rather than weaken.

Is bitcoin climbing? Or plunging? Between juicy injections, cautious politicians and Harvard funds, 2026 promises a well-spiced crypto saga... with guaranteed suspense on the regulation front!

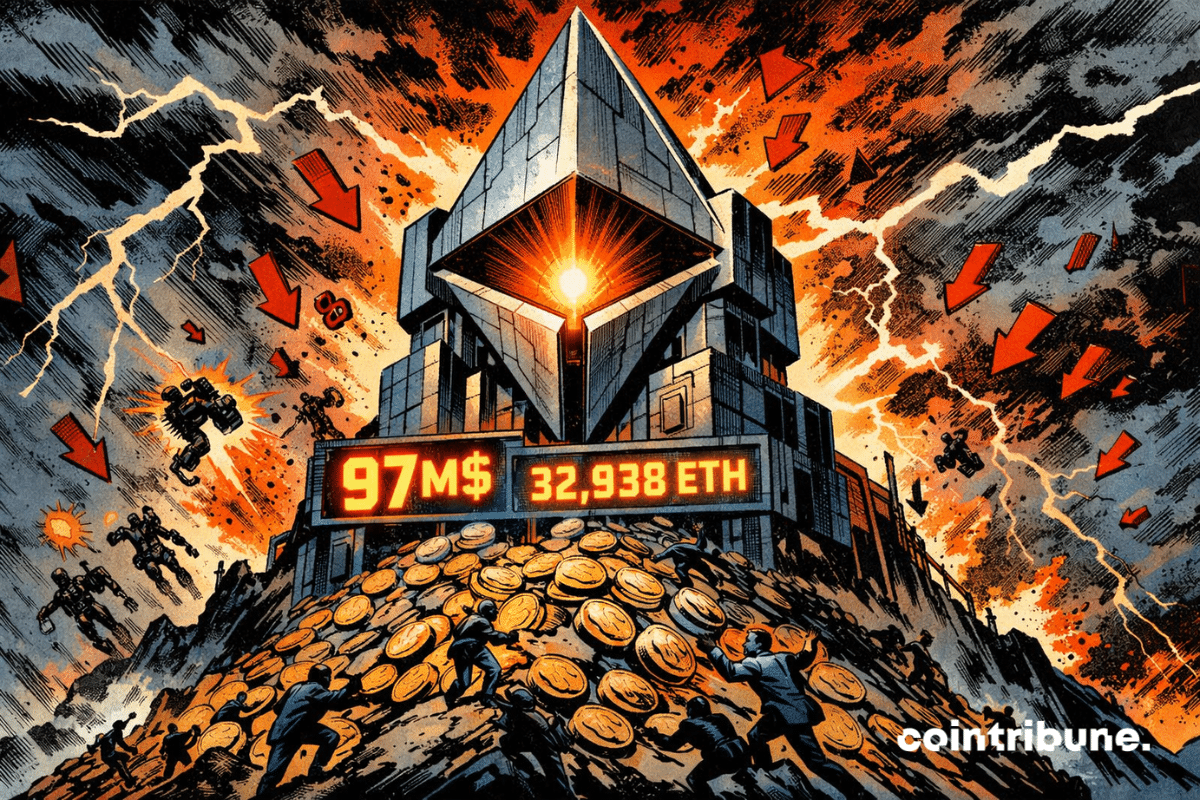

BitMine bets 97M$ on Ethereum in the middle of a bearish market. A risky bet or a calculated plan? Detailed analysis in this article.

Grayscale has just filed a dossier with the SEC to launch a Bittensor ETF, a first in the United States. This project could revolutionize access to decentralized AI for institutional investors. TAO, the flagship token of Bittensor, is preparing for massive adoption. A historic milestone for crypto and artificial intelligence.

We've seen louder trends pass by. But rarely such a corporate trend. In 2025, the CTAs, those companies that put Bitcoin or other crypto-assets at the heart of their treasury, multiplied at an almost suspicious speed. And already, some leaders in the sector are talking about 2026 as a narrow corridor where many will not pass.

They promised the moon, but XRP falls silently. Even robots are worried... What if the dreamed crypto became the forgotten anecdote of New Year's Eve?

Crypto is plunging, Google is coughing, and retail traders are running away. The market is now just a VIP lounge for insiders lacking an audience. When will the sheep return?

Bitcoin lost momentum during U.S. trading hours, keeping the broader crypto market confined to a narrow range. XRP followed the same pattern, slipping to $1.86 even as demand through spot exchange-traded funds remained steady. The gap between rising ETF assets and muted price movement suggests the market is still absorbing supply near key levels.

After siphoning off millions for a month, the XRP ETF coughs one day, stops... and everyone holds their breath: simple cold or crypto liver crisis?

In five days, Bitcoin ETFs listed in the United States lost more than 825 million dollars, according to Farside Investors. This series of withdrawals marks a clear decline in institutional demand approaching 2026. After a year marked by enthusiasm around BTC-backed funds, the trend reversed during this December.

Bitcoin and Ethereum are seeing ongoing ETF outflows as institutional investors pull back, signaling cautious sentiment and weaker market momentum.

Bitcoin plunges, IBIT takes off, and BlackRock cashes in. A contrarian strategy turning an ETF into a billion-dollar magnet. Skeptics laugh, but the numbers respond.

When Trump dreams of a crypto-compatible America, he appoints a former SEC member to the CFTC. Endorsed by Web3 stars, Michael Selig promises rules, not slaps. To be continued...

Global crypto exchange-traded products (ETPs) saw a sharp pullback last week amid a return to regulatory uncertainty. New data from CoinShares shows investors withdrew nearly $1 billion, ending a three-week streak of inflows. Delays around the U.S. Clarity Act played a key role in weakening sentiment, especially among U.S.-based institutions. Market activity also pointed to rising caution around large holders and near-term policy risks.

There are alerts that slam like a door. And then there are those that creak, slowly, until they become impossible to ignore. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, clearly places his message in the second category: for him, 2026 could resemble a big end-of-cycle decompression. Not just a “pullback”. A broader, dirtier, more contagious move.

Bitwise, the asset manager specializing in crypto, has officially filed an S-1 form with the Securities and Exchange Commission (SEC) to launch a Sui spot ETF in the United States.

In 2025, institutional money flees Bitcoin and Ethereum to rush towards XRP and Solana, with record ETF flows exceeding one billion dollars. Why this historic turnaround? The data reveal an irreversible trend: investors now bet on crypto assets with concrete utility, not speculation.

The Bank of Japan tightens the screws, cryptos fall, but Bitcoin, that old trickster, attracts big fish. Social panic, full ETFs: explosive cocktail or flash in the pan?

Financial products backed by XRP have just crossed the one billion dollar mark in assets under management. For several weeks, inflows have accelerated, driven by renewed institutional interest. In a market dominated by Bitcoin and Ethereum ETFs, the growth of Ripple's asset surprises by its consistency. This movement contrasts with capital outflows observed elsewhere, signaling a discreet but firm repositioning of investors towards an asset long kept in the background.

." class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png 1200w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png">

." class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png 1200w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/12/ZERO-ENTREE-ETF-XRP.png">