When bitcoin ETFs are making numbers like never before, investors are jigging while Wall Street rediscovers crypto, their eyes fixed on curves that rise steadily.

Exchange Traded Fund (ETF)

A Solana ETF that stakes, analysts rejoicing, and the SEC saying nothing... Could REX Shares be trying to make crypto dance on the regulatory floor?

The bitcoin market, usually quick to get excited at the slightest institutional whisper, seems today to be sending a clear message: long-term confidence is present. For 13 consecutive days, Bitcoin ETFs in the United States attracted nearly 3 billion dollars, an undeniable sign that major investors are no longer betting solely on a hype effect but on a solid trend.

For a long time reserved for bitcoin, the role of strategic treasury asset is now expanding to other cryptos. Upexi, listed on Nasdaq, is a concrete illustration of this: it has strengthened its treasury with 735,692 SOL, valued at over 105 million dollars. And that's not all: the company also announces the tokenization of its shares on the Solana blockchain.

Billions are flowing in, but Bitcoin remains stagnant. While spot ETFs recorded record inflows in June 2025, the leading cryptocurrency barely reacts. Just a 2% increase for the month is a trivial move in a market accustomed to violent surges. This unexpected calm, despite unprecedented institutional momentum, raises questions among observers. What does this inertia really reveal? Behind the visible flows, a new equilibrium is emerging in the crypto arena, far from the classic patterns of speculative euphoria.

The ceasefire in the Middle East triggers a new rise in bitcoin.

While Bitcoin struts its stuff, Ethereum is digging its furrow. Discreet but robust ETFs, stealthy rebalances, rock-bottom fees... what if the little brother became the darling of the big wallets?

Japan is wielding its fiscal sword: crypto ETFs on the horizon, lower taxes... and investor samurais soon converted to Bitcoin? In Tokyo, traditional finance shakes under its kimono.

Solana is gaining traction as ETF speculation intensifies. Rising CME activity, institutional filings, and growing public interest suggest the asset may be nearing a pivotal moment.

Despite the drop in Ethereum, whales are maintaining their positions. In this article, find an analysis of the key data to know.

While Bitcoin puffs its chest at 65%, altcoins are playing hide and seek with their fans. Altseason expected? Yes… but only in the wet dreams of sleepless traders.

BlackRock dominates Bitcoin ETFs with $69.7 billion. We provide all the details in this article!

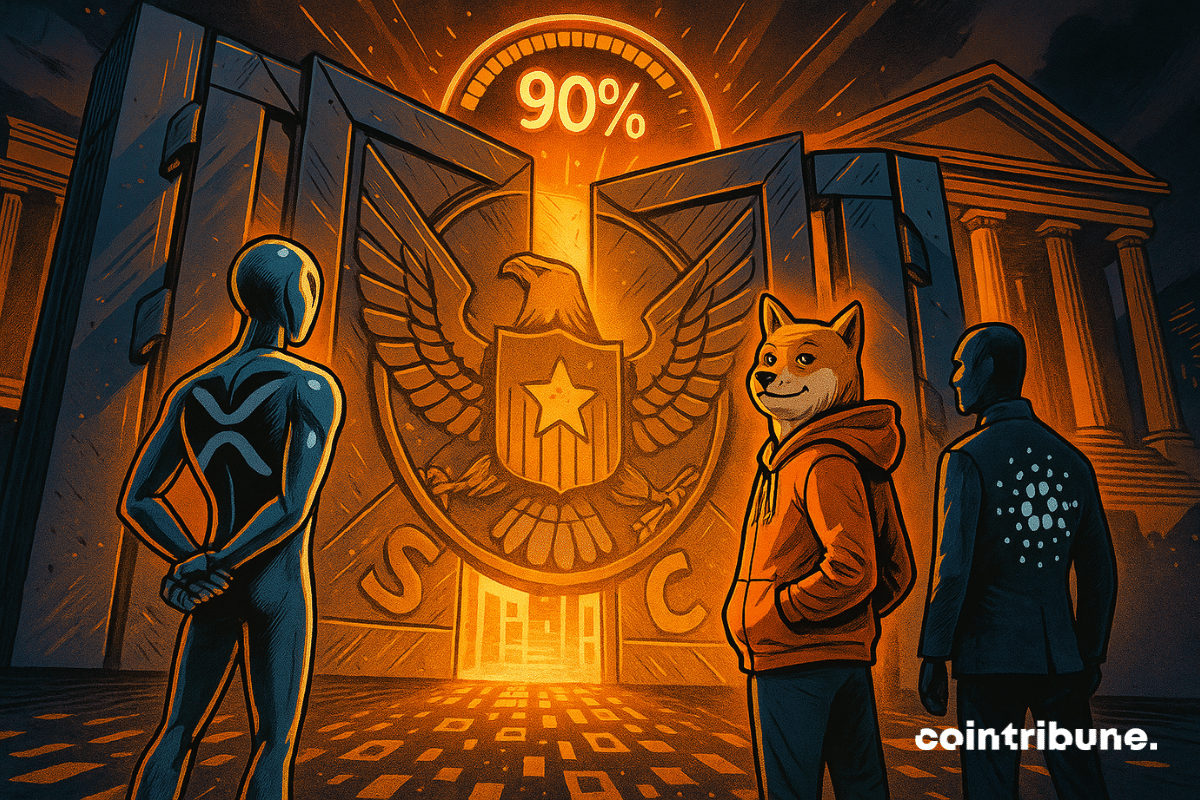

The regulatory lock on cryptocurrencies in the United States could soon be lifted. According to Bloomberg, the spot ETFs for XRP, Dogecoin, and Cardano now have a 90% chance of being approved by the end of this year. This is a first, as only Bitcoin and Ethereum had previously received the SEC's approval. Behind this shift is a clear signal: the American regulator is changing its tone. And altcoins, long kept at bay, are set to join the arena of traditional financial products.

Away from the spotlight, a massive influx is reshaping the landscape of crypto investment in the United States. In just eight days, spot Bitcoin ETFs have attracted $2.4 billion, despite a lackluster market. This sustained flow contrasts with the prevailing caution and reveals the growing anchoring of Bitcoin in institutional portfolios. Meanwhile, Ethereum, which has long been in catch-up mode, is showing signs of fatigue. Such a divergence raises questions about market priorities and upcoming strategies in the realm of digital assets.

Ethereum is breaking records with 35.35 million ETH staked. Is the accumulation preparing for a rebound? Full analysis here!

Wall Street's offensive knows no bounds. In less than a year, spot Bitcoin ETFs have captured a quarter of the global trading volumes of the flagship cryptocurrency. This spectacular breakthrough is reshuffling the cards between traditional finance and native crypto platforms, revealing a profound transformation in the sector.

CoinShares joins the growing list of firms filing for a Solana spot ETF as market interest builds.

The world is faltering, but Bitcoin holds strong. While missiles rain down in the Middle East and traditional markets hold their breath, an almost surreal dynamic is taking shape: investors are pouring billions into Bitcoin ETFs. Under normal circumstances, so-called "risky" assets flee at the slightest geopolitical tremor. But here, it's the opposite. It seems as if Bitcoin is in the process of changing its status: from speculative asset to emerging safe haven. This very real metamorphosis is rooted in a series of recent events that it would be reckless to ignore.

Seven giants align for Solana ETFs, the SEC plays the waiting game: suspense, thrills, and staking in the plush backrooms of the American regulatory temple. Stay tuned...

While the bombs are falling, Solana climbs, XRP gets excited, and ETFs stir the crypto pot. Should we see geniuses or arsonists behind these digital surges?

An avalanche of companies are set to make bitcoin their main cash asset and push bitcoin to rapid new highs.

Saylor assures us: the crypto winter is over. But when Bitcoin climbs to new heights, who picks up the shovels, and above all… who sells the picks?

In May, cryptos are surging, RWAs are skyrocketing, and Binance declares: "All is well." But behind the numbers, a creeping tokenization is quietly disrupting traditional finance…

When Michael Saylor proposes to Apple to exchange its shares for bitcoin, it's not a joke... or maybe a crypto revolution wrapped in an iPhone, who knows?

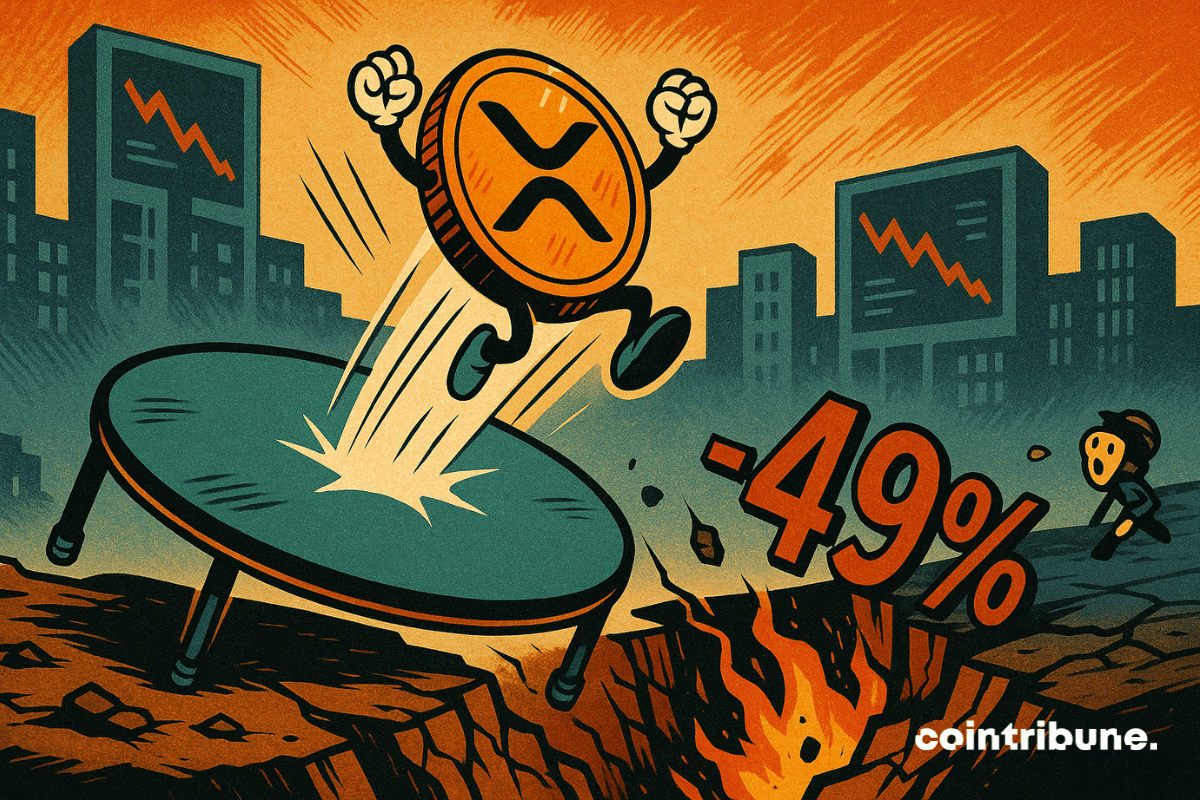

While the markets scrutinize the upcoming regulatory decisions, XRP experiences an unexpected surge. Now the fourth largest asset in the sector, it has seen a notable rebound after two sessions of decline, briefly instilling a renewed sense of optimism. However, behind this technical signal lies a more contrasted reality: trading volume has collapsed by nearly 49% in 24 hours. In a tense climate where every movement fuels speculation, XRP is once again becoming a barometer of the contradictions in the crypto market.

The crypto universe has never been short of spectacular events. But this time, it is the Ether ETFs that are stealing the spotlight. Far from being just a simple financial product, they crystallize an underlying dynamic: the institutionalization of Ethereum. With a series of capital inflows nearing a billion dollars, a wave of euphoria is sweeping across the markets. And this may just be the beginning.

JPMorgan, long hesitant about cryptocurrencies, marks a major turning point in the banking sector. The American bank announces the integration of Bitcoin ETFs as loan collateral, a decisive step towards the adoption of these assets. As regulation takes shape and institutional investor interest grows, this evolution could redefine the relationship between traditional finance and blockchain. This change signals a new era for financial products, placing cryptocurrencies at the heart of mainstream banking services.

WisdomTree already has its ETF, but the SEC wants to rethink the rules. Bitcoin in-kind? Possible. Behind this step towards innovation, the agency is sharpening its tools to maintain control.

While Bitcoin is napping above 100,000 dollars, Ethereum is filling the coffers. Funds are pouring in, ETFs are buzzing: who said that crypto is running out of steam?

And if the recent surge in Bitcoin had nothing to do with ETFs? Discover the true reason that is alarming the markets and driving investors to flee to the crypto queen… An invisible shock, but heavy with consequences.