Sam Bankman-Fried Blames Lawyers for FTX’s $100B Collapse, Claims Exchange Was Never Insolvent

Bankruptcy

Three years after the FTX collapse, Sam Bankman-Fried breaks his silence again from his cell. The fallen former billionaire, convicted for massive fraud, delivers an unexpected confession. His biggest mistake, according to him, was not the reckless management of funds... but entrusting the leadership of FTX to John Ray III, just before the bankruptcy. A choice he now considers the point of no return in the collapse of his crypto empire.

As the bank failures of 2023 continue to shake the markets, economist Peter Schiff is fueling fears of a total collapse of the American financial system. Known for his attachment to gold, he warns that a recession of historic proportions is underway and that all banks are destined to fall. Thus, this radical diagnosis, issued in an already tense context, reignites the debate over the strength of financial institutions and the viability of economic policies pursued since the 2008 crisis.

As the crypto ecosystem held its breath for Ethereum's Pectra update, an anonymous actor disrupted the Sepolia test network. A subtle attack, exploiting an unexpected vulnerability, revealed weaknesses that raise as many questions as they provide insights. Decoding an incident that lies halfway between a technical bug and psychological warfare.

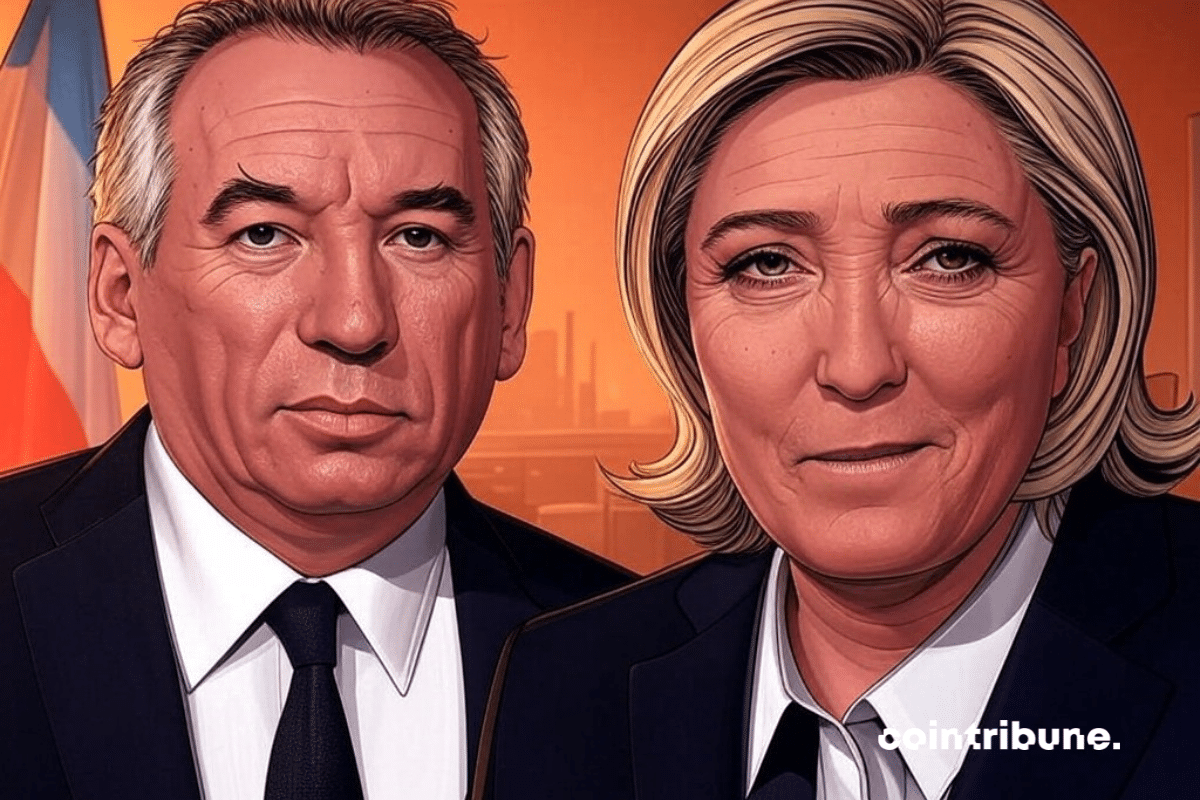

France is going through a pivotal period. On one hand, public debt has reached historic highs, exceeding 3 trillion euros. On the other hand, a profound transformation of institutions is disrupting the traditional balance of the Fifth Republic.

The bankruptcy of FTX has been a real earthquake in the history of the cryptosphere. It has deeply shaken investor confidence and revealed significant structural flaws within the industry. Nearly two years after its collapse in November 2022, the bankrupt exchange is back in the spotlight with an ambitious reorganization plan, recently validated by the American judiciary. This plan includes an unprecedented repayment to creditors, which will begin on January 3, 2025, with a promise of restitution of up to 118% of the declared debts. To orchestrate this operation, FTX relies on well-known players in the sector. Kraken, experienced in such procedures after having played a key role in managing the Mt. Gox case, and BitGo, an expert in secure crypto custody, have been chosen to handle the repayments. Their involvement offers both security and transparency, two essential values to regain the trust of the creditors and ease the persistent tensions.

The French Republic is experiencing a new institutional upheaval with the forced appointment of François Bayrou as Prime Minister.

An unprecedented crisis is shaking the global economy today: large companies, often seen as pillars of stability, are faltering under the weight of record failures. In the third quarter of 2024, 127 companies, each reporting revenues exceeding 50 million euros, declared bankruptcy. This statistic far exceeds the averages observed before the pandemic, revealing a critical acceleration of economic vulnerabilities. Such a phenomenon is set against a backdrop marked by the aftereffects of the health crisis and a rapid rise in interest rates, two factors that have put significant strain on companies' cash flows. At the same time, the end of the support measures put in place during Covid-19 has exposed many companies to increased costs and unavoidable restructuring. These failures, particularly concentrated in Europe, raise questions about the structural limits of certain sectors and the ability of companies to face a rapidly changing economic environment.

France is undergoing an unprecedented budget crisis. The deficit is likely to exceed 6% in 2024. France now risks bankruptcy, which would plunge the entire euro area into the abyss.

French public finance is in the spotlight with debt reaching historic highs. But where does the Hexagon really stand compared to other nations?

Promise, sworn, spit! FTX creditors recover their funds... finally, just 10%. The rest? For the shareholders, of course!

Is Europe doomed to economic decline? This is the question that haunts minds as the Old Continent loses ground against the United States in terms of productivity. A much-anticipated report from Mario Draghi, former Italian Prime Minister, paints an alarming picture of the situation!

Xi Jinping's major economic meeting has recently attracted attention. Indeed, Chinese leaders seem to be preparing for a slowdown in growth while reaffirming their commitment to "high-quality development." But what does this statement really mean and what impacts can we anticipate for the global economy? Let’s dive into the details of this meeting and explore the potential ramifications of this strategy for China's economic future.

FTX: the financial miracle that promises to repay more than it owes!

The 3rd largest economy in terms of GDP is on the brink of collapse with a colossal debt and a free-falling currency. If the trend continues, the problems will be terrible for the entire world...

Crypto: Should you flee or remain loyal to the KuCoin platform: between serious accusations and assurances from the CEO.

Bitcoin, the venerable pioneer, is facing a new challenge. Denial of Service (DoS) attacks, orchestrated, according to some, by young anime fans, and the threat of more sophisticated manipulations threaten the stability of the blockchain. But that's not all: a surge in transaction fees and a drop in prices are shaking the market. Let's take a closer look at this phenomenon.

The crypto speculative fever around GameFi has abruptly subsided, leaving behind a devastated landscape littered with abandoned projects. A recent study reveals that between 2018 and 2023, no less than 75.5% of GameFi initiatives have gone bankrupt. Of the 2,817 games launched, 2,127 did not survive more than a year.

Bitcoin has never ceased to fascinate, intrigue, or even perplex. Its ecosystem is vast and complex. The recent decision by the main developer of the Lightning Network, Antoine Riard, to reveal a vulnerability and step down sheds a harsh light on the challenges and dilemmas of this universe. Let's delve deeper into it.

The Terra storm heavily impacted the Bitcoin price and several crypto projects, including Celsius Network. In July 2022, the crypto lender formerly led by Alex Mashinsky declared bankruptcy, with a balance sheet burdened by over $4.7 billion in debt to its users. However, the Celsius team remained resilient during these challenging times. Recently, the bankruptcy court gave the green light for the execution of the financial restructuring plan for this crypto company. To top it off, Celsius acquired a Bitcoin mining site in Texas.

There will be some rumblings in the crypto industry in the next few days. Because if approved, FTX will liquidate a large number of its digital assets. There's talk of a plan to sell $200 million in cryptocurrencies. Something to keep an eye on!

PacWest Bancorp's last resort: to beg its youngest son? Yes, because the company never recovered from its crisis. After a massive outflow of depositors, things got so bad that it agreed to a merger with a smaller lender, Banc of California.

Following the bankruptcy of Silicon Valley Bank (SVB), which created shockwaves in the banking industry, numerous institutions began to feel the effects of this collapse. This is particularly the case for First Republic bank, which is going through a period of crisis and getting closer to the edge of the precipice day by day. Is the banking carnage just beginning in America?