Read2Earn is based on a simple principle that turns each reading into a potential gain. The reader progresses through quests and earns points that unlock access to a wide selection of rewards. The Marketplace plays a central role in this ecosystem, as it gathers all the available goodies, digital Assets, and contests. Every point earned brings you closer to a real reward. This article explains how to unlock the Marketplace, how to use your points, and how to purchase the offered rewards. The goal is to provide a clear guide to fully benefit from the Read2Earn system offered by Cointribune.

Fundamentals

Whether you’re a curious beginner or an enthusiast looking to deepen your knowledge, this resource is designed for you.

We explore fundamentals principles such as how blockchain works, the role of miners, cryptography, smart contracts, and much more. Understanding these elements is essential to grasp the potential impact of blockchain across various sectors, from finance to logistics.

Dive with us into this fascinating universe to build a solid foundation of knowledge that will enable you to navigate the ever-evolving world of decentralized technology.

The Read2Earn of Cointribune opens the door to a new way of interacting with information. The principle is based on a simple system. The user reads content, completes quests, and receives rewards convertible on a dedicated marketplace. This mechanic creates a motivating experience where each action offers a tangible advantage. To fully enjoy the program, account setup plays an essential role, as it unlocks access to quests and points. This guide explains each step of the registration to help the user enter the Read2Earn ecosystem without blockage and with a clear understanding of the journey.

Read2Earn is based on a simple idea that turns reading into an interactive experience. Users progress through a structured journey and earn points thanks to the quests offered by the platform. These quests play a crucial role in the ecosystem as they create a direct link between learning and personal progress. The system provides a strong educational dimension and enhances community engagement around the content. Every step counts to move forward and discover all the possibilities of the program. This article aims to explain how the quests work, their validation, and the best methods to progress quickly.

Read2Earn offers a new approach where each reading creates measurable value for the user. Cointribune transforms a simple action into a clear earning system through a mechanic inspired by blockchain and gamification codes. The goal is to offer a smooth and motivating experience. This model truly places the reader at the center. This guide presents the essential elements of the program. It explains the role of the dashboard, how quests work, the purpose of daily points, and the usefulness of the Marketplace. It finally details the types of rewards and the progression logic.

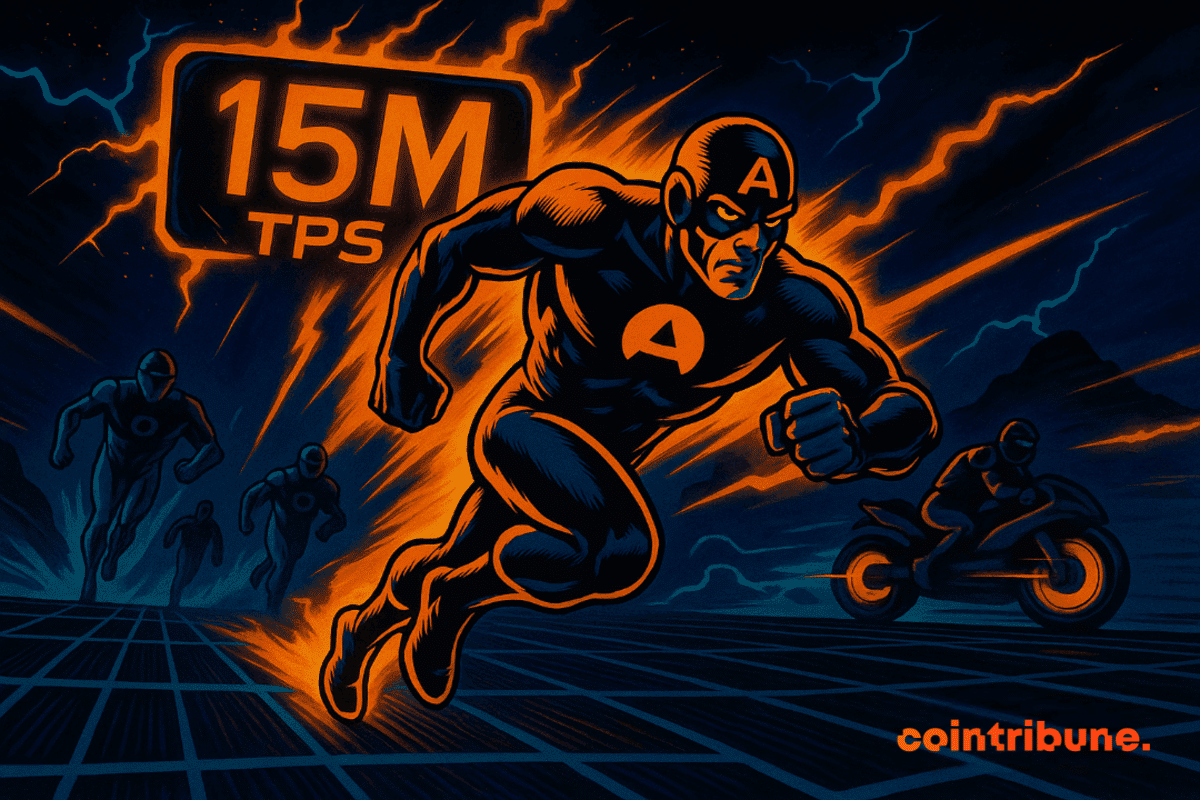

On April 22, 2025, Qubic performed a public stress test on its live Layer-1 network and reached the incredible score of 15,520,000 transactions per second (TPS). The whole was independently verified in real-time by CertiK, one of the most respected security auditors in the industry.

Deep learning labs showcase models with a trillion parameters and mountains of GPUs, but each new breakthrough always demands more electricity and money. Qubic's Aigarth project raises a provocative question: what if the road to artificial general intelligence (AGI) did not go through ever larger data centers, but through millions of ordinary CPUs working together and evolving by themselves?

Qubic strives to transform its ultra-fast and fee-less Layer 1 into a dynamic economy of dApps, bridges, and DeFi primitives. But code doesn't write itself, and founders can't live on enthusiasm alone. To accelerate innovation, the project launched two distinct funding paths: one for profit-seeking startups, the other for public-interest infrastructure. Think of them as two parallel lanes on the same highway: both lead to Qubic’s mainnet, but each has a different engine, fuel, and technical team.

How an emerging blockchain reinvented mining, outperforms Monero in profitability, and paves the way for decentralized AI, all explained in simple terms for beginners.

Fifteen years ago, Bitcoin introduced Proof-of-Work (PoW): miners burned electricity solving mathematical puzzles; the fastest won new coins and, by extension, secured the ledger. It was brilliant, but the world has changed. Energy prices are rising, regulators monitor carbon footprints as much as blockchains, and AI labs complain about the lack of affordable computing power. In this context, the original PoW feels a bit like burning fuel to run an empty engine. Qubic offers a simple solution: since the electricity bill is already paid, let’s use that energy for tasks useful to society. The Useful Proof-of-Work (uPoW) still protects the chain, but miners earn their living by training AI models and merge-mining Monero with real value, then directly reinject the earnings into the Qubic economy.

A simple introductory guide to read for anyone curious about Qubic, its Useful Proof of Work, and its on-chain Academy that turns newcomers into seasoned contributors.

While many projects chase ephemeral attention through quick contests, copy-pasted influencer partnerships, or hype-based campaigns, few take the time to build real sustainable community foundations. This is where Qubic breaks the mold. Rather than relying on superficial tactics, Qubic has designed a structured, long-term ambassador program, a true engine of growth, collaboration, and impact. It’s not just about accumulating followers but empowering builders, creators, and leaders to shape the future of decentralized AI.

In the world of crypto, the name Satoshi Nakamoto remains a source of intrigue. No one knows who is behind this pseudonym, but his legacy continues to fuel theories, fantasies, and passionate debates. This article revisits the birth of bitcoin, the mysterious disappearance of its creator, and the technological and ideological footprint he has left on the entire crypto world. You will also discover the most credible profiles behind the name Satoshi Nakamoto, the extent of his fortune in bitcoins, and how his anonymity has strengthened the spirit of decentralization at the heart of the Bitcoin network.

Ever struggled to understand how to securely manage your cryptocurrency? A crypto wallet doesn’t store digital assets like a bank account but safeguards private keys—cryptographic tools proving ownership of blockchain-based funds. This article unpacks how crypto wallets work, explores their security frameworks, and compares custodial versus non-custodial solutions, while addressing critical concerns like protecting assets from theft and ensuring seamless transactions across networks like Bitcoin and Ethereum. Discover how these tools bridge the gap between complex cryptography and user-friendly access to decentralized finance (DeFi), empowering both beginners and advanced users to navigate the evolving Web3 landscape with confidence.

The video game industry has undergone several economic evolutions. Traditional models relied on one-time purchases or subscriptions. The rise of digital has introduced microtransactions and free-to-play games funded by in-game purchases. With blockchain, new systems have emerged. Play-to-Earn (P2E) allows players to earn crypto or NFTs while playing, whereas Play-and-Earn (P&E) focuses on entertainment while offering optional rewards. These models are transforming the player experience and the economy of video games. This article explores their differences, advantages, and limitations. It also analyzes their impact on the industry and the challenges they must face.

Donald Trump's statements just days before his return to the White House have reignited tensions on the international stage. During a press conference, the elected president mentioned the possibility of annexing the Panama Canal and Greenland, strategic territories whose geopolitical significance far exceeds American borders. Far from being content with a mere statement of intent, he refused to rule out the use of force, provoking immediate reactions from the countries involved. As the world faces increasing geopolitical tensions, these stances raise many questions. Is Trump seeking to reshape international power dynamics, or is this a communication strategy aimed at influencing future diplomatic negotiations? What are the implications for relations between the United States and its partners? A look back at an announcement that certainly reignites fears of a return to an unpredictable American policy.

In a global economic context marked by successive upheavals, few sectors manage to maintain enduring stability. Long perceived as an unsinkable fortress, luxury, the quintessential symbol of prosperity and exclusivity, also faltered in 2024. Indeed, the fortunes of emblematic figures such as Bernard Arnault, Françoise Bettencourt Meyers, and François Pinault suffered colossal losses amounting to over 70 billion dollars combined. Such a decline finds its origins in a set of closely related factors: a slowing Chinese economy, national political tensions, and increased volatility in stock markets. These combined elements have shaken the pillars of the sector, revealing an unexpected fragility.

The American economy has crystallized tensions for several months between two deeply divergent political visions, embodied by Joe Biden and Donald Trump. On one side, the current president emphasizes stabilizing management, based on international cooperation and support for the middle class. On the other, Donald Trump promises radical reforms, focused on protectionist policies and tax relief for the wealthy. Thus, these oppositions go beyond national economic choices, but reflect orientations that could reshape global trade balances.

In a world facing increasing geopolitical tensions and sustained volatility in financial markets, the ultra-rich are reassessing their investment priorities. A recent study by UBS, titled "UBS Billionaire Ambitions," reveals that these billionaires are adopting defensive strategies to safeguard their wealth against constantly evolving risks. Among their preferred choices are traditional assets such as real estate, precious metals like gold, and even cash reserves. These trends, far from being trivial, reflect a desire for diversification and protection against global uncertainties.

In a new verbal escalation, Donald Trump, elected president of the United States, has shaken global markets. Indeed, he has threatened to impose 100% tariffs on the nations of the BRICS alliance. This statement comes in a tense economic context, where the dollar, a cornerstone of international trade, is increasingly being challenged by emerging powers. Such a challenge to the monetary status quo could well reshape the global geopolitical balance, but also lead to significant economic turbulence.

Since Elon Musk acquired Twitter, renamed X, the billionaire has made efficiency a mantra, even at the expense of disrupting the traditional structures of the company. His recent revelation of having reduced the workforce by 80% illustrates his unconventional vision of management and leadership. Thus, while this decision is shocking in its magnitude, it also opens the debate on the viability of such a model.