A Denver pastor and his wife have been indicted for allegedly running a $3.4 million cryptocurrency scam targeting their own faith community.

Getting informed

Ethereum attracts billions $ via its spot ETFs, breaking a historic record with 17 consecutive days of inflows. This institutional wave propels ETH to the center of crypto investment strategies. Why this sudden enthusiasm? What are the long-term impacts?

At Shanghai, China unveiled a major proposal: to create a global organization dedicated to the governance of artificial intelligence. In a speech with geopolitical undertones, Beijing denounces "fragmented" international regulation and aims to position itself as a strategic alternative to the United States. By betting on openness and dialogue with countries in the Global South, this initiative marks a step in China's ambition to shape technological innovation, as well as the norms that will govern its use on a global scale.

While traditional markets remain under pressure, bitcoin reaches a historic milestone: its realized capitalization exceeds 1 trillion dollars for the first time. This threshold, reflecting the capital actually engaged in the network, occurs at a moment when a Satoshi-era whale sells 80,000 BTC, or nearly 9 billion dollars, without shaking the price. A strong double signal, both technical and psychological, confirming the robustness of the market in the face of large-scale events.

When Trump plays the central banker by launching his own crypto, Warren sounds the alarm: regulate, yes. Offer a safe haven for billionaires, no. To be continued under the gilding...

Bitcoin is holding its breath under the pressure of $98,000. This critical threshold could trigger a flash crash or propel the asset to new heights. Technical analysis, accumulation zones, and market signals: everything you need to know before the next move.

Imminent financial crisis? Robert Kiyosaki reveals why he is abandoning ETFs to bet on bitcoin, gold, and silver. Discover his shock strategy to preserve your wealth before the system collapses.

A long-dormant Bitcoin wallet from the Satoshi era has sent shockwaves through the crypto market after offloading 80,000 BTC, with the sale facilitated by asset management firm Galaxy Digital. This sale ranks as one of the largest crypto transactions ever, as the market recorded a modest volatility during the trading session.

The Ether Machine launches with 400,000 ETH, aiming to unlock Ethereum yield for public markets and drive institutional adoption.

XRP briefly crossed $3.65, its highest level in seven years, before plummeting to $3.09. This 15% correction raises questions about the strength of the rally in a context of increased volatility. Amid strategic portfolio movements, speculative pressures, and remnants of regulatory tensions, the market struggles to determine: is this a mere technical pullback or a signal of a deeper exhaustion?

This week, BlackRock's Ethereum ETF (ETHA) recorded more capital inflows than its Bitcoin counterpart (IBIT), reversing a well-established trend. Institutional investors, who were once focused on the queen of cryptos, now seem to be turning towards an Ethereum seen as more promising, more profitable... and increasingly indispensable.

Bitcoin is playing hide and seek with $120,000: Galaxy is balancing tons, the market is panting, but the whales are sharpening their harpoons to come back stronger.

Just one week after the U.S. passed its first comprehensive crypto legislation, the stablecoin market has added over $4 billion in fresh supply entering circulation. The newly signed GENIUS Act is already changing the sector. By providing a federal framework for fiat-backed stablecoins, it gives banks, asset managers, and fintech startups a regulatory greenlight. It allows for new capital, new players, and a clear path forward for tokenized dollars.

In July, the market capitalization of non-fungible tokens (NFTs) reached an unexpected peak of $6.6 billion, representing a spectacular surge of 94% compared to the previous month. This rebound is no coincidence. It is indeed driven by iconic figures of Web3 such as CryptoPunks, along with a new wave of speculative and cultural interest.

Grok, Elon Musk's controversial AI, makes its entry into the world of predictive markets. Could this unexpected alliance between xAI and Kalshi, the financial betting platform valued at 2 billion dollars, revolutionize algorithmic trading?

Pay the national debt with a simple click on Venmo and PayPal: an absurd idea? Not for the U.S. Treasury, which is now allowing citizens to voluntarily contribute to the $36.7 trillion federal debt via PayPal and Venmo. Integrated into the Pay.gov platform, this unexpected measure combines consumer technology and macroeconomic management in a gesture that is symbolically significant but heavy with meaning.

As volatility shakes the entire crypto market, Ethereum stands out with unexpected stability. Even as Bitcoin and altcoins lose ground, ETH holds firm. This resistance is anchored in a robust technical setup, but above all, in a discreet accumulation led by strategic players. In the shadow of visible fluctuations, deep dynamics are taking shape, redefining the contours of a possible rally to come.

Less than a week after the approval of the GENIUS Act, two giants in the financial space, Anchorage Digital and Ethena Labs, have joined forces to launch a U.S. version of the offshore USDtb stablecoin. This digital dollar will become the first stablecoin to debut in line with the recently enacted stablecoin regulation bill.

Crypto is unstable, and young traders have understood this well. To better manage risks, 67% of them use artificial intelligence to tame volatility. This is revealed by a recent study from MEXC Research. Rather than reacting in urgency, Generation Z relies on automated tools to maintain control.

A whale is betting 23 million dollars on a bitcoin at $200,000 by the end of 2025. Could this ambitious strategy signal a new bull run for BTC? Discover the keys to this bet and what it reveals about the future of the market.

The next bullish cycle ("bull run") is already attracting new investors. Market indicators (Bitcoin at $120,000, Ethereum at $3,800, rising volumes, new ATHs on several altcoins, return of liquidity) show that the impulse phase has started: it is time to position oneself wisely.

Societe Generale has partnered with 21Shares to improve liquidity and expand access to Bitcoin and Ethereum crypto products for institutional investors across Europe.

Billionaire Mike Novogratz predicts Ethereum will outperform Bitcoin in the next few months. He also sees Bitcoin reaching $150,000 this year, fueled by growing institutional interest and strong ETF inflows.

Solana’s core development team is preparing to significantly raise the network's computational capacity with a new proposal. The Solana compute unit limit increase aims to meet the growing demands of high-performance decentralized applications (dApps).

It’s been a full year since spot Ethereum ETFs went live in the U.S., and the market is celebrating with a strong streak of inflows and bullish sentiment. Despite being overshadowed by Bitcoin ETFs, these funds have quietly carved out a substantial presence.

New record for BlackRock: its Ethereum ETF climbs to $10 billion in 251 days. All the details in this article!

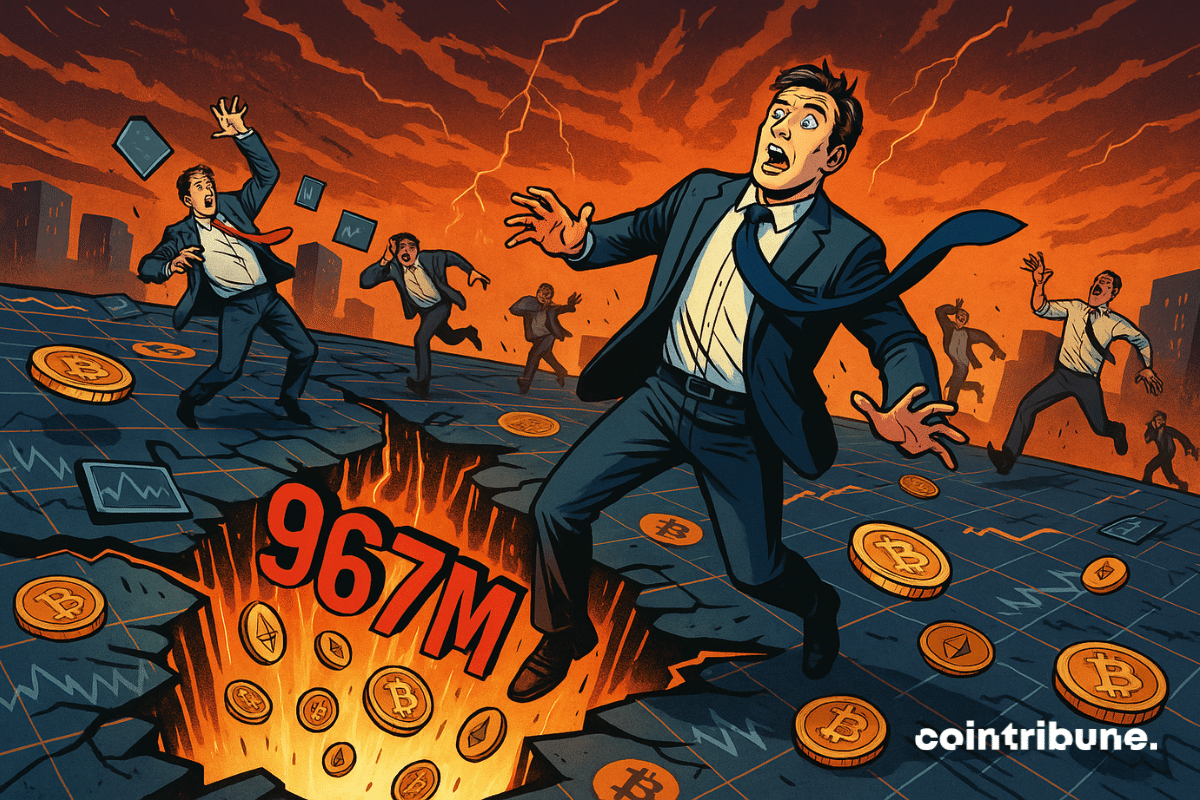

On July 24, nearly a billion dollars in leveraged positions were liquidated within a few hours, triggering a wave of sales on derivative platforms. XRP, Dogecoin, Ethereum, and Solana all plummeted, caught up in an overheating mechanism fueled by massive speculative bets. A dark day that reminds us how volatility remains the rule, not the exception, in the crypto universe.

MicroStrategy continues to surprise. While most companies adjust their cash reserves with cautious investments, the firm led by Michael Saylor continues to forge a radically different path. Staying true to its "Bitcoin first" strategy, MicroStrategy has just announced a $2 billion fundraising, primarily intended for the purchase of new BTC. This is not just a financial operation: it is a manifesto. Behind this decision lies an ideological confrontation between two visions of the monetary world. And MicroStrategy, once again, chooses its side unambiguously.

Faced with the persistent uncertainties of traditional markets, cryptocurrencies are establishing themselves as a strategic refuge. In 2025, flows into these assets reached an unprecedented threshold: 60 billion dollars injected since January, according to JPMorgan. This astonishing 50% increase since May confirms an unprecedented institutional dynamic. Such a turning point redefines the balance of capital and illustrates the increasing normalization of cryptocurrencies in the financial universe.

For several sessions, the bitcoin market has been showing signs of increasing tension. An unusual accumulation of liquidity above the price and a rapid increase in its dominance are reigniting speculation. In the shadows of the charts, short sellers and eager buyers are engaged in a tactical duel. For several technical analysts, the stage is set: a massive short squeeze now seems inevitable.