Bitcoin plunges and extreme fear dominates the market. However, institutions are quietly accumulating. Should you buy now?

Investissement

Discover how Metaplanet boosted its revenues by 738% thanks to Bitcoin. An impressive feat in the crypto market!

The Financial Times triggers a tidal wave by claiming that Bitcoin will fall to zero. A statement that divides investors.

Metaplanet continues its Bitcoin purchases and intrigues investors facing a pressured market. More details in this article!

The IBIT ETF records historic losses after Bitcoin's drop. We provide all the details in this article.

A South Dakota bill aims to authorize public funds investment in Bitcoin. All the details in this article.

Bitcoin under pressure, Strategy surprises. This new massive purchase fuels tensions within the crypto community. Details here!

Pump.fun, an iconic memecoin platform, surprises with Pump Fund: a 3 million dollar fund to support 12 startups. A bold transition from speculation to concrete investment. How could this strategic shift redefine the future of startups in the crypto ecosystem?

Despite the frenzy around Bitcoin, some signals cool the optimism of crypto traders. Discover the details in this article.

Is XRP preparing for a spectacular comeback? Patient crypto investors may soon reap the rewards of their wait.

While crypto coughs, SharpLink stacks millions on Ethereum: from staking to restaking, the company turns its digital treasury into a well-oiled cash machine.

BitMine restarts the race to Ethereum with $105M in cash and an explosive treasury of $915M. All the details here!

While the market coughs, Tether, on the other hand, is gobbling up bitcoin… A frenzy of crypto-purchasing that intrigues, worries, and could well shake more than one stablecoin in a business suit.

BitMine bets 97M$ on Ethereum in the middle of a bearish market. A risky bet or a calculated plan? Detailed analysis in this article.

Michael Saylor's company Strategy resumes its weekly bitcoin purchases at a time when the markets are doubtful. Details here!

Bitcoin falls, Saylor buys. Two billion injected in two weeks, while the market panics. What if, after all, the crypto oracle wore a tie and sold shares?

CoinShares reports $716 million in weekly inflows into its digital asset ETPs, marking the second consecutive week of positive flows. This growth brings assets under management to $180 billion, up 7.9% from their November low. Data show increased investor participation, with significant contributions from the United States, Germany, and Canada.

These companies thought they were riding the bitcoin wave, but they are drowning in their own debts. The crypto king is nosediving, and the kings of leverage are getting slapped.

According to a study by the FINRA Investor Education Foundation, enthusiasm for cryptos has cooled. Indeed, only 26% of investors still plan to buy cryptos, compared to 33% in 2021. However, 27% still hold them, an unchanged level. There is less desire to buy more, but not necessarily a massive exit.

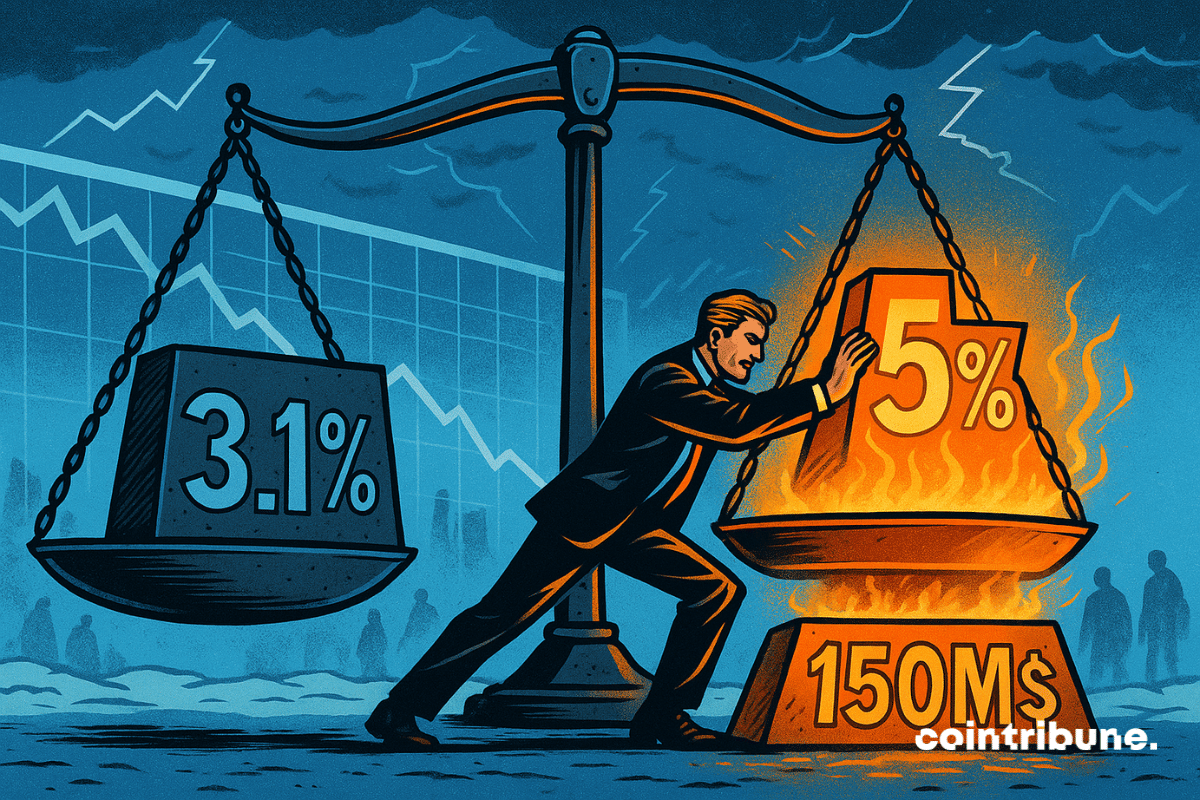

While the small holders sell, BitMine stuffs itself with ether: $150 million at once, aiming for 5%. Soon, Ethereum will be to Tom Lee what Twitter is to Musk.

Strategy launches a giant dollar reserve to support its Bitcoin bet. Discover all the details in this article.

When bricks soar, young people bet on the virtual: crypto becomes their plan B... Or their programmed ruin? A risky bet from a disillusioned and downgraded generation.

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.

After BitMine, SharpLink plays the crypto rentier: a safe filled with Ethereum, dividends pouring... and a strategy that would make many central banks envious.

Government report, Bitcoin reserve, political pressure: Taiwan could surprise the whole world. What the investigation reveals.

Michael Saylor replenishes his Bitcoin treasury, but at a less frantic pace: simple strategy or market warning? Analysis.

A discreet but historic shift has occurred in central bank reserves. For the first time in nearly 30 years, gold surpasses U.S. Treasury bonds. This adjustment, far from trivial, reflects a growing loss of confidence in U.S. sovereign debt. Behind this choice, central banks are reshaping their priorities, betting on the timeless strength of the yellow metal. This signal, almost unnoticed, could redefine the foundations of the global monetary system.

In a crypto sector marked by insolvency scandals, led by FTX, financial transparency has become a decisive criterion for investors. OKX, one of the leading global exchange platforms, has understood this well: since October 2022, it has been publishing its Proof of Reserves (PoR) monthly, a cryptographic report that allows verification that user deposits are actually covered by real assets. With its 29th report published on March 31, 2025, the exchange shows 24.6 billion dollars in primary assets and a reserve ratio above 100%. But what exactly does this proof of reserves mean? And why does OKX stand out in this area?

Vanguard, bastion of financial conservatism, is preparing to take an unexpected step towards cryptos. The asset management giant is considering opening access to crypto ETFs on its brokerage platform. If this development materializes, it would mark a major strategic turning point and strengthen the anchoring of these assets in the institutional financial landscape.

Facing a tense economic context and persistently high rates, some companies are revising their cash management strategies. The latest is the Chinese company Jiuzi Holdings. Listed on Nasdaq but little known to the general public, the Chinese company has just authorized an investment of up to 1 billion dollars in cryptocurrencies. This is an unexpected shift for an actor outside Web3, who is now betting on Bitcoin.