Pump.fun raises 500 million in a flash, while denying liking presales. Behind the bots, rug pulls are piling up. But who is really pulling the strings of the great crypto circus?

Memecoin

The founder of Tron announces a purchase of 100 million dollars in TRUMP memecoins. This is not a risky bet. It is a political maneuver and a clear message sent to the crypto ecosystem.

Solana launchpad Pump.fun has taken center stage in the memecoin discourse after LetsBonk, a new market entrant, surpassed the OG memecoin platform in token creation on Sunday. With this remarkable run, LetsBonk has become the first-ever Solana launchpad to outpace Pump.fun in daily tokens launched.

Pump.fun’s token launch plans face uncertainty after Gate quietly removed its PUMP sale notice. The move comes as the platform sees reduced engagement and questions grow around its next steps.

Shiba Inu is burning its tokens by the millions, traders are getting excited, the price is taking a nap: what if this crypto hasn't said its last word yet?

Trump enriched by tokens, his sons in mining, blocked laws: when crypto becomes the secret weapon of a president who loves neither banks nor brakes.

Solana bombards DEXs, Ethereum takes the hit... but behind the sparkle, a network coughs and memecoins tumble. The crypto king trembles, but can the prince reign without an active throne?

The figure is attention-grabbing: 65% of Shiba Inu (SHIB) holders are currently recording losses. This observation, derived from the latest on-chain data, occurs during a marked correction phase for cryptocurrencies with a strong speculative component. Boosted yesterday by the viral excitement of memecoins, SHIB now reflects the uncertainties of a market where the community is no longer enough to support the price.

Mass withdrawals, spontaneous combustion, and the dream of billions: Shiba Inu is playing the big bluff of the memecoin that would like to become a serious crypto… without losing its marketing flair.

Dogecoin has dropped over 5% in the past seven days as bearish signals and political tensions weigh on market sentiment.

Pump.fun, a Solana-based memecoin launchpad, is preparing to launch its own token with a $1 billion raise. The platform has seen significant growth but faces legal challenges and mixed feedback from the crypto community.

A Trump Wallet without Trump inside? Here comes a crypto wallet, loaded with rewards... but the heirs swear they never scanned the QR code.

While it was believed that the memecoin season was over on Solana, a new frenzy of token launches has reignited network activity. Solana is becoming the most active blockchain.

Dogecoin has just experienced a disruption that goes beyond the usual volatility of the crypto market. In one hour, the memecoin faced a liquidation imbalance of 200%, triggering a wave of losses on long positions. This unusual figure reveals far more than erratic movement. It highlights the increasing exposure of traders to relentless market mechanics. This is not an epiphenomenon, but a revealing signal of latent tension, in a climate where consolidation often conceals imminent breakages.

Trump accelerates in crypto: raising $3 billion for bitcoin. Amid scandals and strategy, the Trump saga in blockchain continues to shake Washington.

Crypto, filet mignon, and democracy for sale? Trump treats 220 investors to tokenized wheat while senators shout corruption under the chandeliers of the Trump Golf Club.

Dogecoin rose 3%, causing $5.2M in short liquidations and signaling possible bullish momentum ahead.

Dogecoin is showing strong signs of a potential rally. With rising whale activity, breakout from key technical patterns, and growing investor interest, analysts are setting their sights on $0.40 and beyond as momentum builds.

Active Dogecoin addresses skyrocketed, jumping from 74,640 to 469,477 in just one day. This sudden awakening of the network comes as the SEC examines several Dogecoin ETF applications. But will this surge in interest be enough to propel the price to new heights?

Crypto is about to take a bold turn. PumpSwap, the DEX of Pump.Fun on Solana, is introducing a revenue sharing model that could redefine the rules of the game. Now, 50% of trading fees are returned to token creators. Even better: 0.05% of each swap is directly allocated to developers. An unprecedented model, conducive to innovation... or abuse.

Imagine this: you’re among the 220 lucky winners invited to dine with Donald Trump. The email lands in your inbox. Your heart races. Black tie recommended. You’re in. On the other side, thousands are fuming. Their wallets didn’t make the cut. No dinner. The verdict is in. The $TRUMP memecoin has revealed its winners… and its losers. In the crypto world, this contest marks a turning point—both spectacular and controversial.

Doodles promised mountains and wonders with its airdrop. The result: a free fall worthy of a failed soufflé in the crypto kitchen.

While Solana parades on X with memes, Ethereum, the immovable rock, endures. Institutions, on the other hand, prefer solid ground over buzz: the fortress holds strong, for now.

A stunning crypto operation on the memecoin Melania brings in $99.6 million for 24 traders. Spotlight on this case that intrigues investors!

Crypto: despite 59% losses, Shiba Inu retains 78% of loyal holders. In this article, discover why.

The so-called "meme" cryptos never promised the moon, but for a time, they managed to make us believe it. Today, Dogecoin and Shiba Inu are stumbling, out of breath from their own speculative madness. And while the jokes age, the charts are no longer laughing. The time has come to ask: is the market turning the page on these cryptos? Or is it just a simple dip in an increasingly difficult cycle to follow?

Donald Trump finds himself at the center of a new media storm: his memecoin $TRUMP, backed by Solana, is skyrocketing... but the President of the United States claims he is not profiting from it. Amid denials, ethical concerns, and speculative surges, this case reignites the debate over the involvement of political figures in the crypto world.

The crypto market is currently experiencing a notable shift in online discussions, with a growing interest in memecoins rather than bitcoin. According to the analytics platform Santiment, mentions of memes have reached their highest level since the beginning of 2025, revealing a more speculative approach by investors.

Dogecoin is breaking out of its niche and making waves: an ETF rumored, whales in action, and curves skyrocketing... The skeptics are in for a surprise!

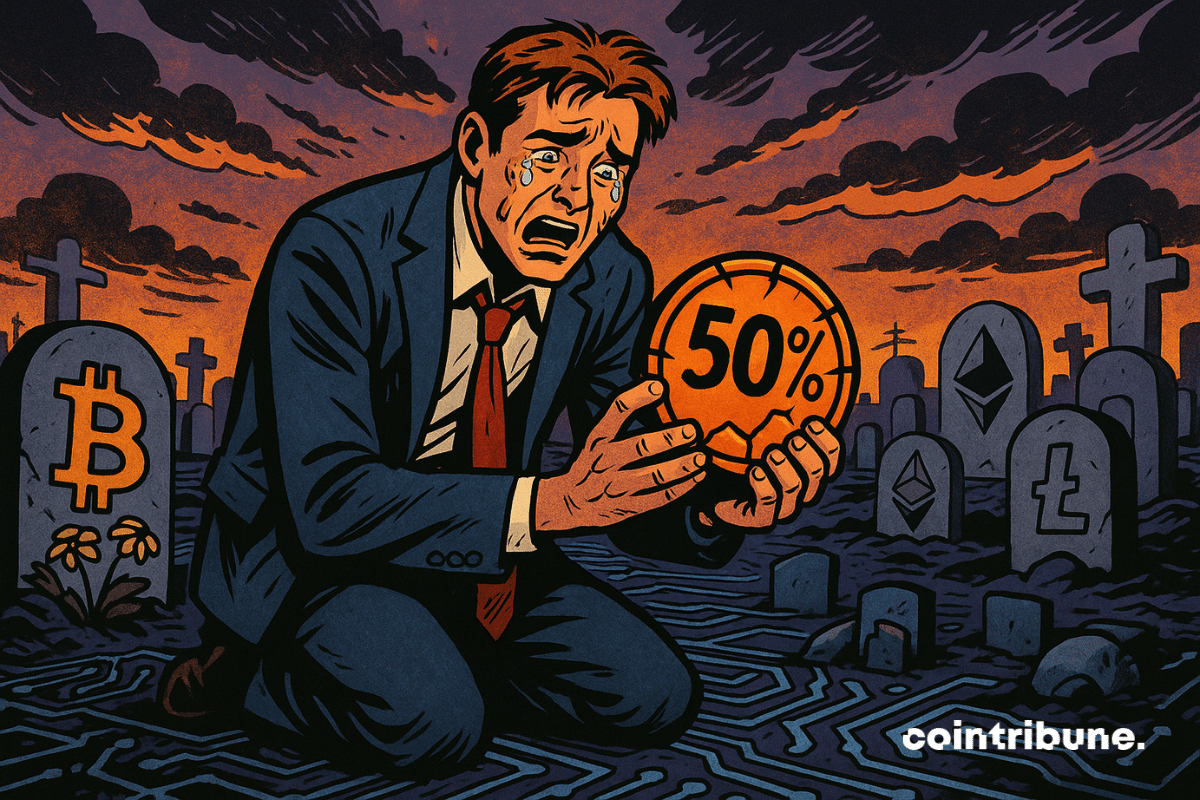

The crypto world is experiencing an unprecedented crisis, with more than half of the digital tokens having ceased all activity. According to data from GeckoTerminal, of nearly 7 million cryptocurrencies listed since 2021, about 3.7 million have gone bankrupt, representing an alarming failure rate of 52.7%.