Central bank digital currencies would eliminate all privacy, but few seem to care. Fortunately, there will always be Bitcoin.

Theme Payment

Crypto payments are booming, but a danger persists. Bitget Wallet reveals all in its report! Details in this article.

The European Union is undergoing a discreet yet persistent revolution. A recent report from Oobit, a platform specialized in crypto payments, reveals that 70% of crypto transactions on its network are absorbed by retail, food, and beverages. This figure shatters the clichés about the marginal use of cryptocurrencies. But how can we explain this silent infiltration into the daily lives of Europeans? Between regulatory adoption and economic pragmatism, the landscape is reshaping.

In his recent intervention, Subrahmanyam Jaishankar sought to dispel any ambiguity about India's position regarding the dollar: "there is no policy on our part aimed at replacing the dollar. At the end of the day, the dollar as a reserve currency is a source of international economic stability."

The president of the Russian central bank ridiculed herself by trying to rein in bitcoin.

In the shadow of the economic restrictions imposed by the West, Moscow is charting a new path for its energy trade. In the face of exclusion from the international financial system, Russia has found an alternative solution: the use of Bitcoin (BTC) and Tether (USDt) to bypass sanctions and ensure the continuity of its oil exports.

Alephium, the innovative blockchain project focused on scalability and security, continues its expansion in terms of adoption and compatibility. Users can now securely store and manage their ALPH tokens thanks to the support of Tangem Wallet, a hardware wallet known for its simplicity and unique approach to managing digital assets.

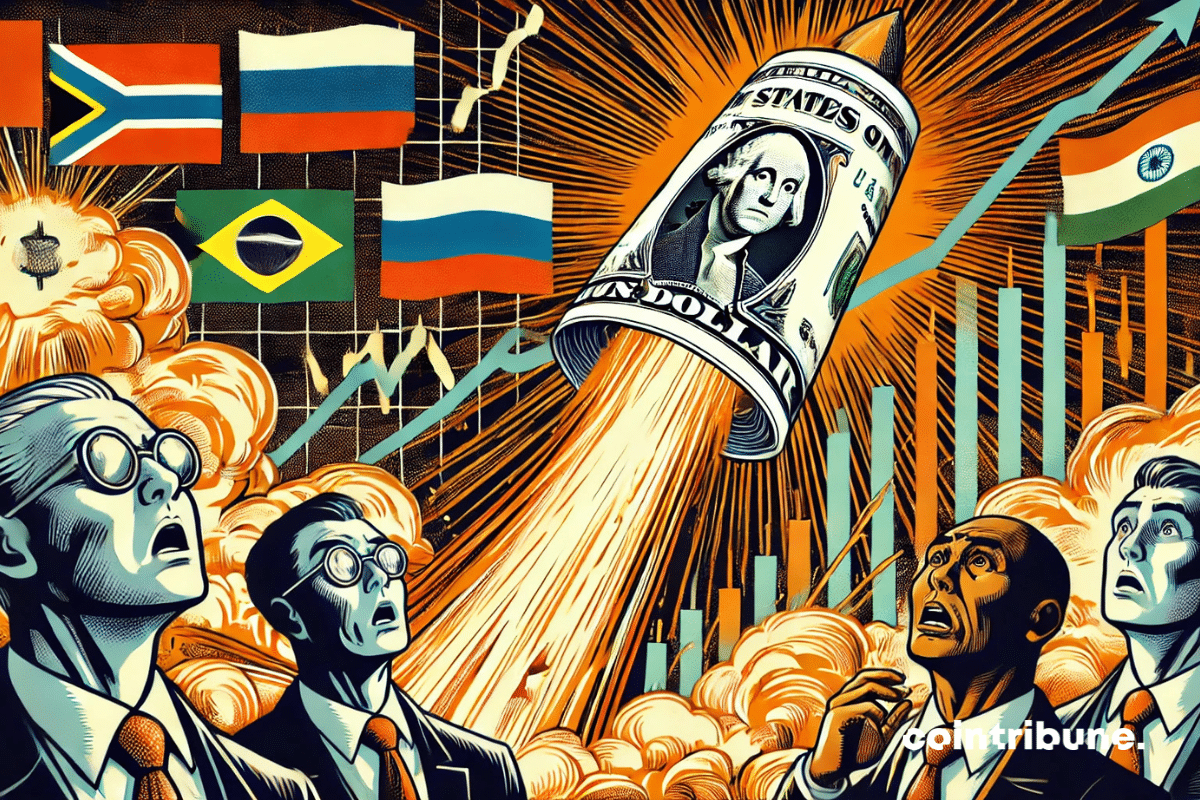

The global economic order is trembling under the impact of protectionist decisions from the United States. While the BRICS aim to reduce their dependence on the dollar, a major upheaval could be on the horizon. The resurgence of American tariffs could fuel a rise in the greenback, threatening to weaken emerging economies and hinder their efforts for dollarization. This potential rise of the dollar, far from being trivial, could mark a turning point for global monetary balance.

The economic clash between the Global South and the United States is taking a new turn, with Brazil emerging as a key player in this monetary battle. By opposing the supremacy of the US dollar, the Latin American country is redefining global financial balances and questioning the traditional architecture of international trade. This decision is part of a process of dedollarization, which is gaining momentum within the BRICS and could deeply modify international economic circuits.

The giant Fidelity has published a very interesting report on the Lightning Network, a network that allows for instant and nearly free bitcoin transactions.

In an already geopolitically tense context marked by increasing economic tensions, Donald Trump has rekindled trade hostilities and is once again targeting the BRICS. The American president called the economic alliance "dead" and threatened to hit its members with a 100% tax on their exports to the United States if they continued to challenge the supremacy of the dollar. This statement immediately provoked a diplomatic reaction from China, which condemned a destructive protectionism and affirmed its commitment to strengthening cooperation among emerging economies.

Financial institutions around the world are scrutinizing blockchain technology, oscillating between skepticism and opportunism. Indeed, the European Central Bank (ECB), after years of analysis, is taking a significant step forward with the announcement of a blockchain-based interbank settlement project. This initiative, which aims to enable banks to settle their transactions in central bank money on a blockchain infrastructure, could mark a decisive turning point in the modernization of payments in Europe.

Currency symbols are not just simple coins; they embody eras, values, and habits rooted in a country's culture. However, in the United States, the existence of the penny is once again being questioned. Donald Trump, in search of budgetary rationalization, wishes to eliminate this one-cent coin, which he considers a waste of resources. This decision, far from being trivial, sparks a fundamental debate between economic necessity and attachment to American numismatic heritage. If enacted, the measure could disrupt commercial habits and provoke adjustments in the daily lives of Americans.

The fusion of technology and power is an equation that Elon Musk seems to have made his playground. From controlling Twitter (now X) to space initiatives with SpaceX, the billionaire has made numerous incursions into spheres traditionally reserved for states. His latest initiative, targeting the U.S. Treasury's payment system, has not succeeded this time. What was supposed to be a transparency operation regarding the management of financial flows has turned into an unprecedented legal confrontation, questioning the legality of such control. In light of the controversy and the risks of disclosing sensitive information, the judiciary has ruled and imposed an immediate ban on Musk and his collaborators.

The status of the US dollar in the global economy once again causes tensions. While the BRICS seek to free themselves from its hegemony, Donald Trump brushed aside any possibility of dedollarization. "There is no chance that the BRICS will replace the US dollar in international trade or elsewhere," he stated. This declaration comes at a time when China, Russia, and their allies are intensifying their efforts to limit their dependence on the greenback, particularly through exchanges in local currencies and the establishment of alternative financial infrastructures. Behind this statement from the American president, one question arises: is the dollar really unassailable, or are we witnessing the beginnings of a new monetary order?

The cryptocurrency XRP is making headlines again despite the fact that the Lightning Network has rendered it completely useless for a long time...

Economic tensions between major powers are reaching a new level. The President of the United States, Donald Trump, has issued a direct threat to the member countries of the BRICS alliance, which are seeking to reduce their dependence on the U.S. dollar. In response to these de-dollarization initiatives, he announced 100% tariffs on their exports to the United States. This stance, accompanied by the establishment of a new agency to collect these customs duties, reflects a clear intent to defend the supremacy of the dollar and to counter any challenges to American economic hegemony. As the BRICS explore alternative payment systems, this statement could redefine the power dynamics on the global geopolitical and commercial stage.

The BRICS project to create a common currency is generating growing interest among economists and analysts, as it could redefine global financial balances. For decades, the US dollar has dominated as the main reserve currency, giving the United States substantial economic and geopolitical power. During their summit in 2024 in Kazan, Russia, the leaders of the BRICS intensified their discussions on establishing an alternative called "Unit," designed to facilitate exchanges within the bloc. This project fits into a broader strategy aimed at reducing their dependence on the dollar, in the context of increasing geopolitical tensions and economic sanctions. At a time when many countries are seeking to diversify their reserves and bypass the constraints imposed by the current monetary system, can this initiative truly shake the dollar's supremacy?

For several years, the BRICS have been seeking to reduce their dependence on the US dollar by developing a monetary alternative. However, at the beginning of 2025, the reality of the foreign exchange market is slipping away from them. The dollar is asserting itself more than ever and reaching new heights while the currencies of the bloc are collapsing. The Indian rupee has plummeted to a historic low of 85.93, the Chinese yuan is weakening, and other local currencies are struggling to hold on. Despite the BRICS' efforts to counter the hegemony of the greenback, the current dynamics expose the limits of their dedollarization strategy and raise the question of the viability of a credible alternative.

Taiwanese youth are enjoying life as if nothing were happening. Yet, the threat of a Chinese invasion has never been more present. And when the Chinese Communist Party launches the offensive, we will officially enter a 3rd world war.

As digital innovations profoundly transform our habits, Elon Musk is preparing to take a significant step with the launch of X Money. This payment system, directly integrated into the X platform (formerly Twitter), could redefine the standards in the realm of digital payments. A recent code leak, revealed by a researcher, has reignited rumors of an imminent launch, well ahead of the officially announced date for this year, 2025. If this information is confirmed, X Money promises to introduce unprecedented features, particularly the potential support for cryptocurrencies like Bitcoin and Dogecoin. Through this project, the X platform aims to become a key player in digital transactions, raising questions about its economic and regulatory impact.

The US dollar is establishing itself as the leading currency of 2024, dominating the foreign exchange market without competition. While many global economies face challenges such as rapid inflation and geopolitical uncertainties, the greenback is showing its best performance in nearly a decade. This remarkable progress is based on several solid pillars: a robust US economy, attractive bond yields, and a monetary policy skillfully orchestrated by the Federal Reserve. Additionally, there is a global context characterized by the weakening of competing currencies, such as the yen and the euro, which are unable to compete with the supremacy of the dollar. This rise reflects the resilience of the United States but also highlights the economic fractures shaking the rest of the world.

Under the shadow of sanctions, Moscow embraces Bitcoin, the digital gold. Siluanov dreams of free exchanges and a digital empire free from the dollar's grip.

International economic dynamics always attract marked interest, particularly when coalitions like the BRICS are perceived as a threat to the hegemony of the American dollar. However, the recent statements from Russia, India, and South Africa have clarified their position. Indeed, these countries assert that no plan aims to weaken the American currency. They firmly reject the accusations of "de-dollarization" and emphasize their willingness to maintain stable relations with the United States.

While most European bond markets show relative stability, the situation in France raises serious concerns. The yields on 10-year government bonds have reached 3.05%, an exceptionally high level for a major eurozone economy. This dynamic reflects a combination of economic tensions and political dysfunction, which reinforces doubts about the country's budgetary management. With public debt exceeding 112% of GDP and a deficit stagnating above 6%, France stands out as a worrying case within the European Union. These developments signal a loss of investor confidence but also highlight the urgency for structural reforms to prevent an even more marked deterioration of its position in financial markets.

Is El Salvador going to abandon its law requiring all businesses to accept bitcoin? That is what the IMF is demanding in exchange for its loans.

Global economic dynamics are evolving, and the hegemony of the US dollar seems to be wavering. Two influential members of the BRICS alliance, Russia and Iran, have just announced a major change: a complete abandonment of the dollar for their trade exchanges. While this decision reflects a desire for economic sovereignty in the face of external pressures, it could also pave the way for a profound upheaval of international financial balances.

The currency market is experiencing particularly marked turbulence in recent days, as the dollar continues to show spectacular strength against the euro. To the point that some analysts anticipate a critical threshold: parity between the two currencies. This dynamic, which represents a two-year peak, raises concerns among economists, businesses, and investors, with potential repercussions on the European and global economy.

As the world closely watches the BRICS efforts to reshape the global economic order, a new trend seems to undermine their ambitions. Foreign banks, far from aligning with the alliance's de-dollarization agenda, are instead bolstering their reserves in US dollars. This development, in a context where the local currencies of the BRICS are collapsing, raises further questions about the future of economic multipolarity and the resilience of the global financial system.

The 2024 American presidential election resulted in a landslide victory for Donald Trump, who wins the popular vote this time and improves his score from 2020. The Republicans regain control of the Senate and the House of Representatives!