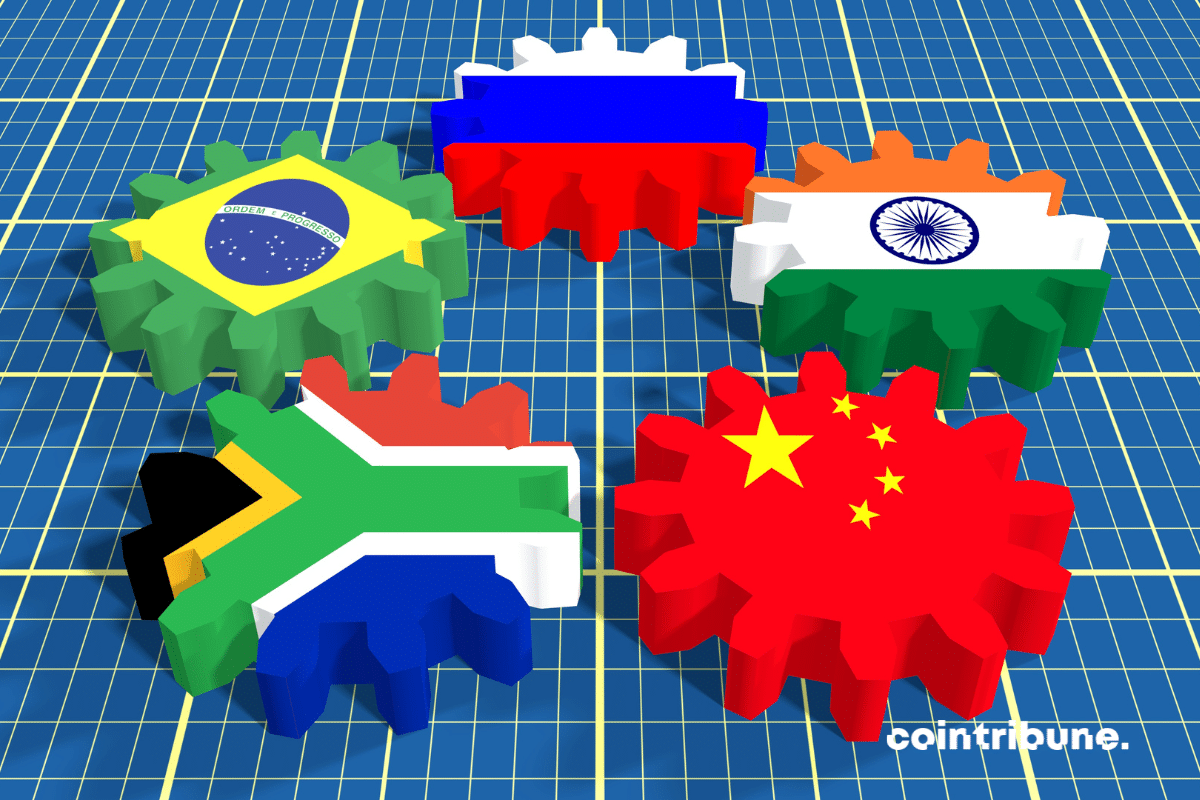

Venezuela is seeking to join the BRICS group by leveraging its vast oil reserves. This move underscores the country's geopolitical ambitions and its aspirations to reshape its international alliances.

Oil

As Maduro seems to have orchestrated a massive election fraud to stay in power, Venezuela tragically marches towards total and imminent collapse.

As Trump is likely to win the American elections, the United States could then disengage from NATO.

The new expansion of BRICS into Southeast Asia could transform the global energy landscape. According to a recent analysis by Rystad Energy, the alliance could trigger a $100 billion increase in the oil industry by 2028. This development is generating a lot of interest in the context of redefining global economic dynamics.

Russia's oil revenues are experiencing a spectacular surge despite severe economic sanctions imposed by the United States. In June, oil and gas revenues soared to $9.4 billion. This unexpected performance highlights Russia's economic resilience and underscores the growing role of the BRICS bloc in the global energy landscape. While the sanctions aimed to weaken Moscow, Russia has adeptly navigated these obstacles to redefine the dynamics of the international oil market.

The world of cryptos has just reached a new milestone: the Industrial and Commercial Bank of China (ICBC), the world's largest bank in terms of assets, recently compared Bitcoin to digital gold and Ethereum to digital oil. This statement, coming from a leading financial institution, marks a significant recognition of the importance and potential of cryptocurrencies in the current global economy. By highlighting the unique qualities and distinctive roles of these two digital assets, the ICBC sheds light on their growing importance in an ever-evolving financial landscape.

Despite American sanctions, Russia distorts calculations and shows even stronger economic health by 2024. Against all odds, the co-founder of the BRICS reveals in April an annual increase of 100% in its oil and gas revenues. From $7 billion last year, its revenue from oil and gas jumps to $14 billion in April 2024. The Russian case now stands as an excellent precedent for the BRICS in their march against the dollar.

The Algerian economy shines on the continent, driven by its oil and gas sector and judicious reforms.

The Iran-Israel tension influences the markets: gold rises, oil fluctuates. What are the repercussions on the stock market and the oil sector?

Is Bitcoin really intended to replace fiat currency? Is it really possible, or even desirable? What is its true primary utility?

Recent data shows that China is strategically strengthening its oil stocks. For several months, the Middle Kingdom has been benefiting from its partnership with Russia for this purpose. Some believe that this is a way for China to expand its influence within the influential BRICS of which it is a member.

Saudi Arabia, like some other Gulf countries including the United Arab Emirates (UAE), has recently been allowed to join the BRICS. With one of its influential members, Russia, the Saudi Kingdom has discussed strategic issues, including the exit from the dollar. But not only that.

Things are heating up between Venezuela and Guyana right now. The reason? Nicolás Maduro wants to reclaim Essequibo, a territory awarded to the British in 1899 following a “partial” decision by the judges of the time. Burdened by massive inflation, Venezuela needs to find other alternatives to get its economy back on track. And if that means the annexation of 2/3 of Guyana, where there are oil and other mineral resources, so be it.

A Chinese multinational has just made its first-ever purchase of oil using the digital yuan (CBDC). The petrodollar is facing challenges.

The 15th BRICS summit ended on Thursday, August 24, with some big news. That of the creation of BRICS+. An expanded version of the organization's membership. Members that include some of the world's biggest crude oil suppliers. Global geopolitics are potentially no longer the same.

Elon Musk, the renowned technologist and futurist, predicts that the dollar will soon be worth next to nothing.