Farage, former Brexiteer, transforms into a crypto-evangelist: bitcoin reserve, digital donations, and futuristic legislation. The United Kingdom, the new paradise for crypto?

Royaume-Uni

As the conflict in Ukraine bogs down, the European Union crosses a strategic threshold. On May 20th, Brussels adopted a 17th round of sanctions targeting previously less exposed entities: the Russian ghost fleet, a logistical pillar of oil evasion. This maneuver, synchronized with London, marks a turning point in the economic war waged against Moscow. By hardening its stance, the EU aims to weaken the opaque circuits financing the Russian military effort and maintain pressure on its foreign supporters.

As cryptocurrencies emerge as a major lever of individual financial sovereignty, the United Kingdom decides to tighten its regulations. Starting in 2026, every transaction will be scrutinized, every user identified. Anonymity, the cornerstone of the crypto ecosystem, falters under the blows of fiscal regulations.

"Kraken and Mastercard are teaming up to launch a crypto debit card in Europe and the UK. This announcement illustrates the willingness of industry giants to make cryptocurrencies a tangible payment tool, beyond speculation. In a market under regulatory pressure, this initiative embodies a new phase: that of usage and the real integration of cryptocurrencies into everyday life. It is a strong signal at a time when the industry is seeking tangible and compliant use cases."

Technologies are evolving at a dizzying pace. However, legislative frameworks sometimes struggle to keep up. Yesterday, Wednesday, September 11, 2024, the crypto sphere was abuzz as the British Parliament reached a decisive milestone with a crypto bill. Titled the Property (Digital Assets etc.) Bill, this proposal aims to clarify the legal status of cryptocurrencies, NFTs, and other digital assets in the United Kingdom. This is a crucial issue for a country that aims to remain at the forefront of cutting-edge technology regulation.

The ECB must manage political and economic uncertainties to adjust interest rates and satisfy European investors.

The British regulator FCA gives the green light to Crypto ETNs! And this, for institutional investors!

While in the United States, the Treasury is advocating for federal regulation of stablecoins, in the United Kingdom, the FCA issues warnings

The crypto industry is rocked by a series of major departures at Binance, one of the key players in the sector. These resignations, including that of the head of Binance UK and the director of Binance France, reflect the turbulence the crypto company is currently facing. Let's delve into the behind-the-scenes of these departures.

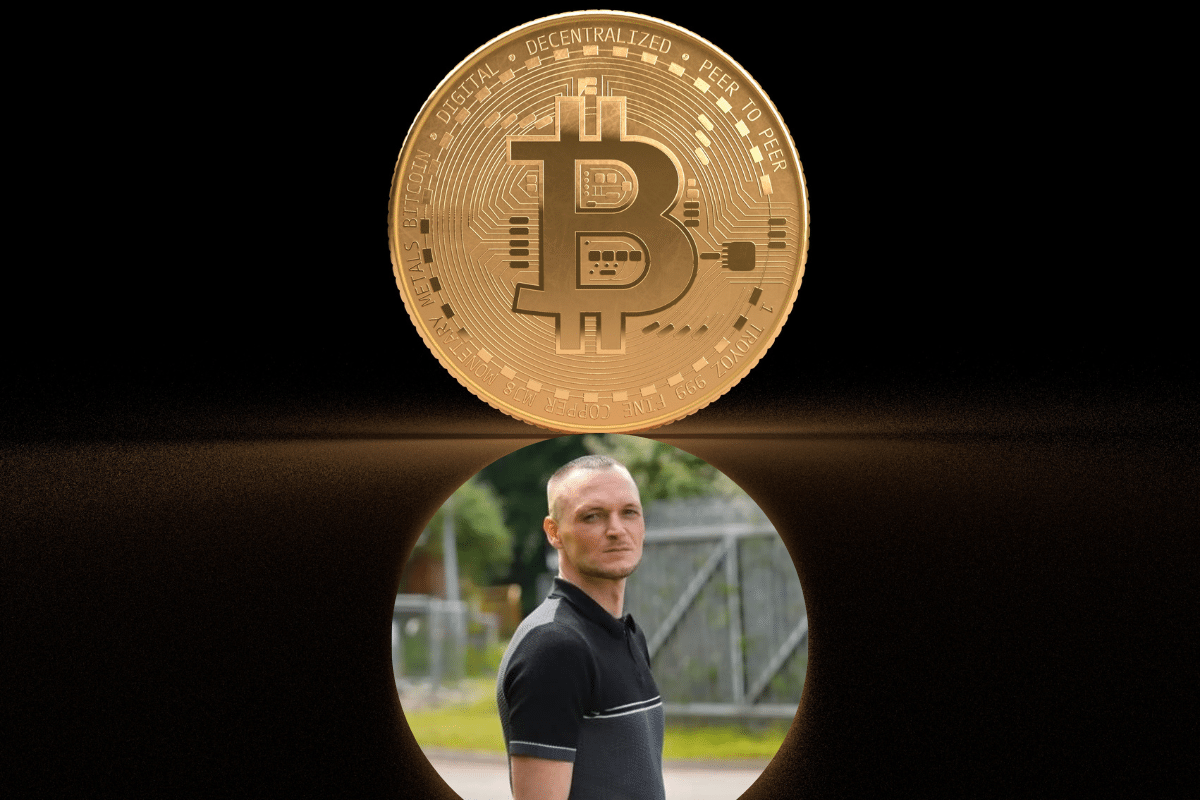

James Howells is a Bitcoin investor who misguidedly misplaced £164 million by throwing a hard drive into a landfill. To this day, he hopes to recover his Bitcoin (BTC) holdings despite a decade-long legal battle.

Cryptos are useful for those who invest funds in them. For some, it's a way of diversifying their asset portfolio. Others, on the other hand, see them as an effective way of disguising the provenance of illicitly earned funds.