Crypto in orbit? Not so fast! Three grains of sand could well jam the rocket... What if Wall Street or the US Congress hit pause?

Standard and Poor's 500 (S&P 500)

The stability of the market's largest stablecoin is questioned. On November 29, the S&P agency downgraded USDT's ability to maintain its dollar peg. Tether, through its CEO Paolo Ardoino, denounces a biased analysis and defends its figures. This standoff between a central crypto player and a major financial institution reignites the debate on reserve solidity and trust in the ecosystem.

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

While bitcoin falters, a company makes the opposite bet. Strategy, the largest corporate holder of BTC, continues to buy massively in the midst of turmoil, where others flee. Its radical strategy, often criticized, could nevertheless open the doors of the very selective S&P 500 as early as December. A possibility that, until recently, was still financial science fiction. This scenario, unthinkable a few years ago, crystallizes a major shift between institutional finance and cryptos.

Trump sneezes on tariffs, Wall Street catches a cold, crypto convulses: 1.6 million traders liquidated, 19 billion evaporated. The crash is no longer a threat, it's a slap.

The US markets celebrated Monday the confirmation of a preliminary agreement between Washington and Beijing regarding the future of TikTok. Oracle, the favorite to acquire the Chinese platform, jumped more than 3% while the S&P 500 crossed the symbolic threshold of 6600 points for the first time.

American indices continued their rise, boosted by July inflation below forecasts. This macroeconomic signal propelled expectations of a Fed rate cut as early as September, now almost certain in investors' eyes. Driven by this momentum, optimism also spreads to the crypto market and Asian tech giants, drawing a global movement where macroeconomics, traditional finance, and DeFi advance together.

When Jack Dorsey injects Bitcoin into Wall Street, stock indices tremble... and the bankers, they sweat. Block, a crypto pioneer, enters the S&P 500. Just like that.

While Wall Street counts its points, Bitcoin takes the prize, ridicules the S&P 500, and shoots at full speed into the coffers of a stunned BlackRock. Who would have believed it?

When a crypto company enters the S&P 500 and then joins TIME's list of the 100 most influential companies, it is no longer just recognition: it is a signal of a shift in era. By 2025, Coinbase is no longer just an exchange; it becomes a symbol of the normalization of Web3 within the circles of global economic power. Its rise marks a clear break between the utopian promises of the sector and its integration into traditional structures of influence.

While Wall Street sets more records, the dollar is collapsing at an unprecedented rate since 1973. This wide gap is not trivial. It reflects a global shift fueled by geopolitical tensions, a Federal Reserve under political pressure, and macroeconomic uncertainties. The benchmarks are crumbling, and markets are seeking safe havens. In this silent but brutal reconfiguration, cryptocurrencies are once again asserting themselves in the strategic landscape, propelled by their decentralized logic in the face of state currency instability.

"Driven by an unexpected easing in the Middle East and a resurgence of stock market optimism, the S&P 500 closed this Thursday at 6,141.02 points, nearing its all-time high. Increasing by 0.8%, the benchmark index marks a significant rebound since its low in April, despite ongoing uncertainties regarding trade tariffs and regional stability."

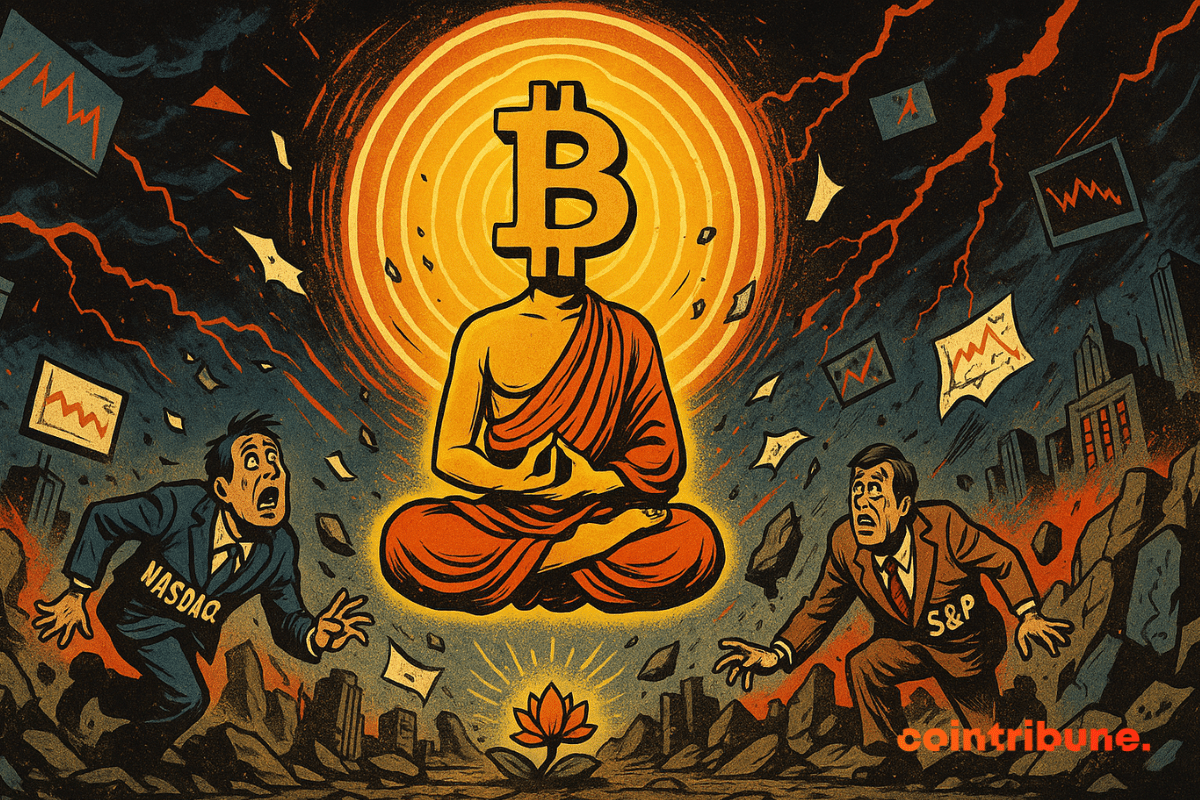

In a crypto market where volatility is the norm, Bitcoin has just reached an unexpected milestone. It is now less unstable than the S&P 500 and the Nasdaq. This discreet yet significant shift, revealed by Galaxy Digital, challenges a decade of perception of an asset deemed too risky for traditional portfolios. More than just a technical indicator, this signal could mark a lasting status change for the first cryptocurrency.

Coinbase is about to potentially capture 9 billion dollars in passive purchases thanks to its entry into the S&P 500. A massive injection that could push the crypto market capitalization towards 8 trillion dollars. But behind this unprecedented institutional influx, a silent trap threatens the strategic freedom of the company...

Coinbase enters the prestigious S&P 500 index, becoming the first crypto company to reach this milestone. This historic integration marks a turning point for the cryptocurrency industry, now integrated into the standards of traditional finance. A strategic evolution that propels Coinbase to the heart of global markets.

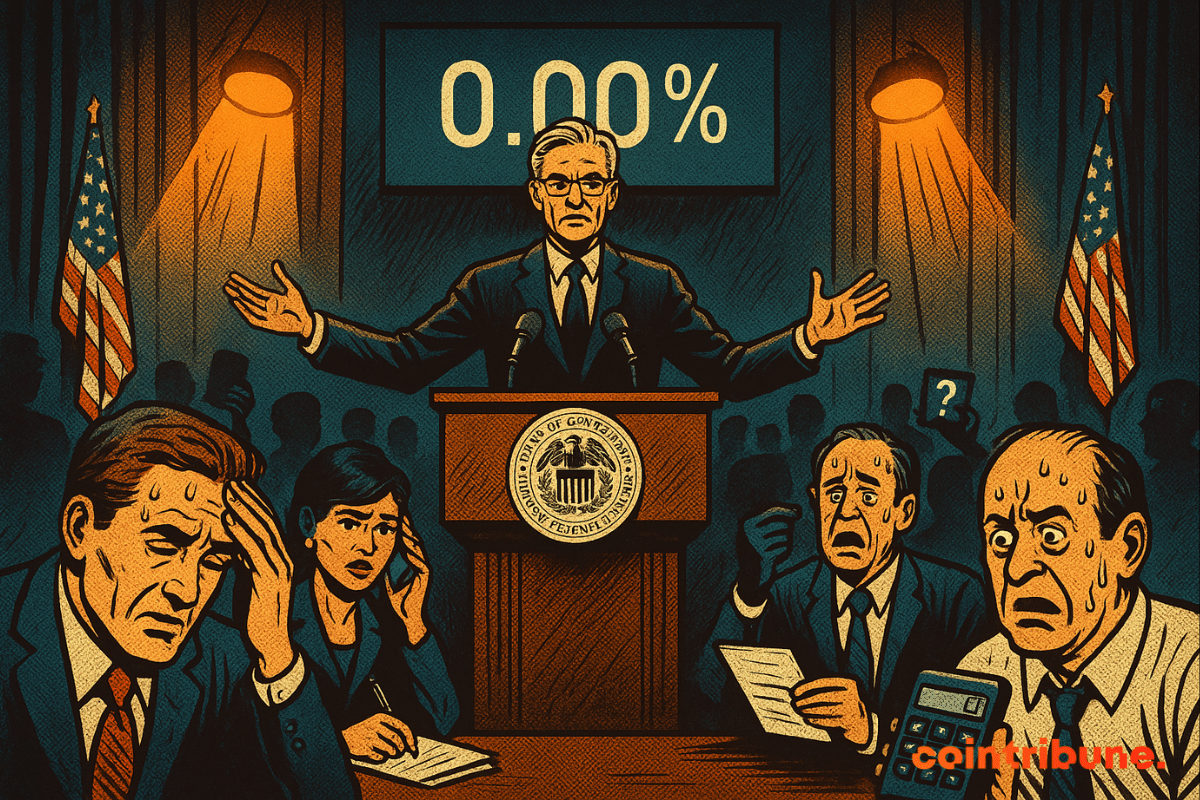

When the Federal Reserve opts for inaction, markets wobble. By keeping its rates unchanged this Wednesday, the world's leading central bank met expectations but did not alleviate tensions. Thus, amid persistent inflation, slowing consumption, and uncertainties about employment, the Fed's message remains deliberately vague. This strategy of waiting increases the nervousness of financial markets and fuels speculation, particularly in the crypto world, where every word of Jerome Powell is scrutinized as a crucial indicator.

What if the markets were following a tempo that escapes economic logic? While the U.S. GDP is declining, the S&P 500 is rebounding after a sharp drop of nearly 20%. This unexpected turnaround, fueled by contradictory signals, intrigues even in trading rooms. Indeed, at BNP Paribas, strategists are wondering: does this sudden correction fit into a global tradition? To understand it, they delve back into a century of stock market crash history.

Is Bitcoin at $80,000 out of reach? For some analysts, it's quite the opposite: this threshold could represent a buying opportunity. While the market oscillates between bullish enthusiasm and fears of a correction, several fundamental indicators suggest it's time to revisit certainties. Behind the numbers, a different underlying dynamic is emerging, one that is quite distinct from past cycles. Far from a peak, Bitcoin may still have room to grow.

Under the neon lights of Wall Street, History seems to stutter. The stock market stumbles, drunk on speculation, while the old crashes smile in the wings, ready to take the stage again.

Money migrates, silent and methodical. Wall Street, once untouchable, sees its throne wobble under the hurried steps of investors, captivated by a Europe shining with trillions.

A bitcoin at $70K? Nothing to faint over! The market dances, retracts, but doesn't stumble. Those who wait will see the next act of the show.

A European stock market in full swing, investors overjoyed, and Wall Street wondering where its crown has gone... Is the stock market history now being written the European way?

Bitcoin, despite its 10% increase since January, could face a major correction as gold outperforms with annual gains of 20%. This inverse dynamic between the two assets raises concerns about an imminent reversal in the crypto market.

In an absurd ballet, Bitcoin slips below $95,000, mirroring the S&P 500, with $88,000 in sight. Bounce or imminent shipwreck?

Wall Street shows a moderate upward trend this Tuesday, as the United States holds its breath for the midterm elections that could reshape the political and economic landscape of the country.

The drop of the S&P 500 triggers massive Bitcoin liquidations! The market could collapse by 75%.

Bitcoin could plunge below $50,000 as the US economy collapses. The 10x Research report sounds the alarm.

The Paris stock exchange begins the week with a gloomy note. It fell by nearly 0.4% this Monday morning. This slight decline is part of a tense context, marked by a flood of upcoming quarterly results and persistent questions about the health of the global economy.

The recent drop in Bitcoin could foreshadow a summer correction in the US stock market, according to analysts at Stifel. While the cryptocurrency struggles to regain its March highs, experts are questioning the implications for the S&P 500 index, a key gauge of the US economy.

Despite massive losses, MicroStrategy is still investing in Bitcoin. Why this bold decision? Crypto analysis.