While market attention is focused on every move of the Federal Reserve, a subtle adjustment is emerging. Economist Lyn Alden mentions the Fed entering "gradual print" mode: a progressive monetary creation, calibrated to nominal GDP growth. Far from the massive injections of 2020, this subtle strategy could disrupt interest rate expectations, redefine the balance of financial markets, and profoundly influence the evolution of cryptos like bitcoin.

Theme Taxation

Markets are holding their breath ahead of the next Fed meeting with a possible monetary turning point as early as March. As inflation slows and the political context becomes more complex, an unexpected signal is gaining strength. According to CME data, more than 23% of traders are now betting on a rate cut. This shift in sentiment, still a minority but growing, could well reshuffle the cards.

The crypto market enters 2026 in a climate of caution. Despite several rate cuts decided by the Fed in 2025, the expected rebound did not materialize. Bitcoin, Ether, and major assets declined, contrary to expectations. Monetary policy remains unclear, economic data are weakened, and the Fed hints that a pause could occur as early as the first quarter. This context rekindles tensions in an already weakened market.

Italy lights the fuse: its 2026 budget, criticized by the ECB, threatens to explode bank stability and stifle an already weakened economy. Between controversial taxes and risks of rationed credit, Rome is playing a dangerous game. Why is the ECB sounding the alarm? The details shaking Europe.

On December 10, the Fed announced a 25 basis point cut to its key interest rates, confirming market expectations. However, behind this seemingly routine decision lie deep divisions: split votes, unclear economic context, and unprecedented political pressures. In a context marked by the absence of key economic data due to the shutdown, interpreting the U.S. monetary strategy becomes increasingly complex and potentially destabilizing.

The US Federal Reserve could well be starting a decisive turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. A rapid development, which contrasts with the firmness displayed in recent months. If this scenario is confirmed, it will mark the end of an unprecedented monetary tightening cycle and could disrupt the balance of financial markets.

The latest PPI figures for September 2025 have just been released, and they are more alarming than expected. With inflation stubbornly high, the Fed finds itself backed into a corner ahead of its December meeting. A crucial decision is brewing: will it cut rates or risk an economic slowdown?

Are financial markets getting ahead of the Fed? While traders are heavily betting on a rate cut as soon as December, the Federal Reserve remains cautious and divided. This potential mismatch between anticipation and reality could disrupt macroeconomic balances and weigh heavily on risk assets.

While bitcoin continues to decline, a signal from the U.S. Federal Reserve briefly reversed sentiment. Within hours, the odds of a rate cut in December nearly doubled, reigniting hopes of monetary support. In a climate of uncertainty, this reversal fuels speculation of a possible rebound. Investors, until now on the defensive, are now watching the Fed as a key factor for crisis exit.

Markets hate unpredictability. Yet, within a few days, their certainties collapsed. The probability of a rate cut by the Fed in December, previously the majority view, is now below 50%. This abrupt change of direction has revived tensions across all asset classes. In the crypto ecosystem, already severely tested by a corrective phase, this resurgence of uncertainty acts as a catalyst for volatility.

Kalshi and Polymarket record a sharp drop in probabilities in favor of Donald Trump, as the Supreme Court examines the legality of his tariff powers. This turnaround highlights two dynamics: the possible rollback of presidential authority over foreign trade, and the growing role of decentralized platforms as sensors of political anticipation. A case where constitutional law, economic strategy, and technology intersect under the watchful eyes of judges... and investors.

The minutes of the Fed published on October 8 confirm an expected but delicate monetary shift. While the rate cut is now underway, the extent of the move by the end of the year still divides the committee. In a context of slowing employment, contained inflation, and government paralysis, this shift weighs heavily on market expectations. For crypto investors, sensitive to monetary policy signals, every Fed hesitation becomes a factor of volatility.

Markets are almost unanimously betting on a rate cut on October 29. However, a much quieter scenario is starting to worry: that of a Fed status quo. In a context of incomplete economic data and persistent uncertainties about growth, the hypothesis of strategic immobility is gaining ground. What if this scenario, still largely underestimated, triggered the most violent market reaction?

The prospect of increasing the flat tax resurfaces in budget discussions. Ahead of the 2026 finance bill, Bercy would consider raising the single flat tax, set since 2018 at 30%. No decision has been made yet, but the return of this measure, long considered a fiscal marker of Macronism, is already causing tensions. In a context of structural deficit and revenue pressures, the stability of the savings tax framework could be called into question.

The PCE inflation figures for the month of August, published this Friday, September 27, confirm apparent stability, with progress as expected. A key indicator for the Federal Reserve, the PCE remains above the target, while American consumption continues to surprise with its strength. In a context of monetary tension, these data maintain uncertainty about the future trajectory of interest rates.

The Federal Reserve has made its decision, but without certainty. According to Jerome Powell, no interest rate adjustment will be without consequences. While several central banks have started a cycle of rate cuts, the Fed chairman warns of a strategic deadlock. In a context where inflation remains resilient and employment wavers, every decision becomes risky. A strong signal sent to the markets closely watching every word from the Fed as a decisive monetary turning point approaches.

This Wednesday, September 17, the US central bank is expected to cut its key interest rate by 25 basis points. A decision already priced in by the markets, but far from trivial, as inflation remains above target and employment slows down. Behind this monetary shift, investors are looking for a signal. Temporary shock or catalyst for a new cycle? From bitcoin to gold, through Wall Street, all assets are watching Jerome Powell’s verdict.

The showdown between Donald Trump and the American Federal Reserve reaches an unprecedented threshold. On September 9, the federal court suspended the dismissal of Lisa Cook, Fed governor, decided by the American president. A rare decision that highlights the major stake of this conflict: the independence of the central bank against political pressures. Ahead of a strategic meeting on rates, this judicial halt revives the debate on the limits of executive power in conducting monetary policy.

The hierarchy of European sovereign debts has just shifted. On Tuesday, September 9, France borrows at a higher rate than Italy on ten-year bonds. Less than 24 hours after the fall of the Bayrou government, the markets have decided: the French signature is no longer a refuge. This reversal, unprecedented in over a decade, marks a loss of confidence affecting the State's budgetary credibility.

At this back-to-school period, major banks are revising their outlook. Faced with a clear slowdown in the American economy, the idea of two to three rate cuts this year is gradually taking hold. Investors, hanging on the Fed’s slightest signals, see in this change of course a potential turning point.

Two weeks before a crucial Federal Reserve meeting, the governor, expected to succeed Jerome Powell in 2026, stood out with an unambiguous statement. He wants a rate cut as early as September. In an interview with CNBC, he said the US economy requires an immediate adjustment, breaking with the caution shown by other monetary officials.

The debt is making headlines again on both sides of the Atlantic. Bitcoin is ready to soar if the Fed and the ECB were to bring back the printing press.

In the midst of geopolitical reshuffling, the European Union and the United States have just ratified a trade compromise presented as a bulwark against escalation. Supported by Ursula von der Leyen, but strongly criticized by Mario Draghi, the text crystallizes a European dilemma: guaranteeing transatlantic stability or fully defending the continent's industrial interests. Between diplomatic balance and tariff concessions, this new agreement revives the debate on Europe's economic sovereignty.

A new proposal in the New York State Assembly aims to impose a small tax on cryptocurrency sales and transfers. Assemblymember Phil Steck has introduced legislation seeking a 0.2% excise tax on digital asset transactions, including cryptocurrencies and non-fungible tokens (NFTs). The bill, if passed, could reshape the way the state approaches digital finance while channeling revenue into school-based substance abuse prevention programs.

While the majority anticipated a Fed rate cut in September, a key indicator casts doubt. The latest Producer Price Index (PPI) release rekindles inflation fears and cools hopes for monetary easing. This subtle but meaningful reversal reshuffles the deck in a context where Fed policy dictates the rhythm of risky assets, and more than ever, that of the crypto market.

The U.S. Federal Reserve could initiate a major shift as early as September with a first reduction in its key rates. A scenario now considered by several large banks, including Goldman Sachs, which reshapes the outlook for financial markets. For crypto investors, faced for months with a restrictive monetary context, this expected pivot could rekindle the appetite for risk and serve as a catalyst for a new bullish cycle.

As global trade lines are redrawn under geopolitical pressure, Donald Trump reveals his cards. Before a meeting in Scotland with Ursula von der Leyen, the American president warns: no customs tariff lower than 15% will be granted to the European Union. This firm stance, with direct repercussions on transatlantic flows, could also impact strategic sectors such as digital and blockchain. Behind this maneuver lies an economic showdown between two opposing views of commercial sovereignty.

In response to the increase in customs duties decreed by Donald Trump, 30% on European imports starting August 1st, Brussels is deploying heavy artillery. The Commission has approved a counter-tariff attack of 93 billion euros, targeting strategic American sectors. An economic escalation is unfolding between two major blocs, against a backdrop of political tensions and fragile global trade.

Brussels holds its breath. As August 1st approaches, the trade dispute with Washington slides into strategic confrontation. In the face of the threat of a 30% surcharge on European imports, Paris and Berlin demand a firm response. Their goal: to push the EU to activate, for the first time, the anti-coercion instrument.

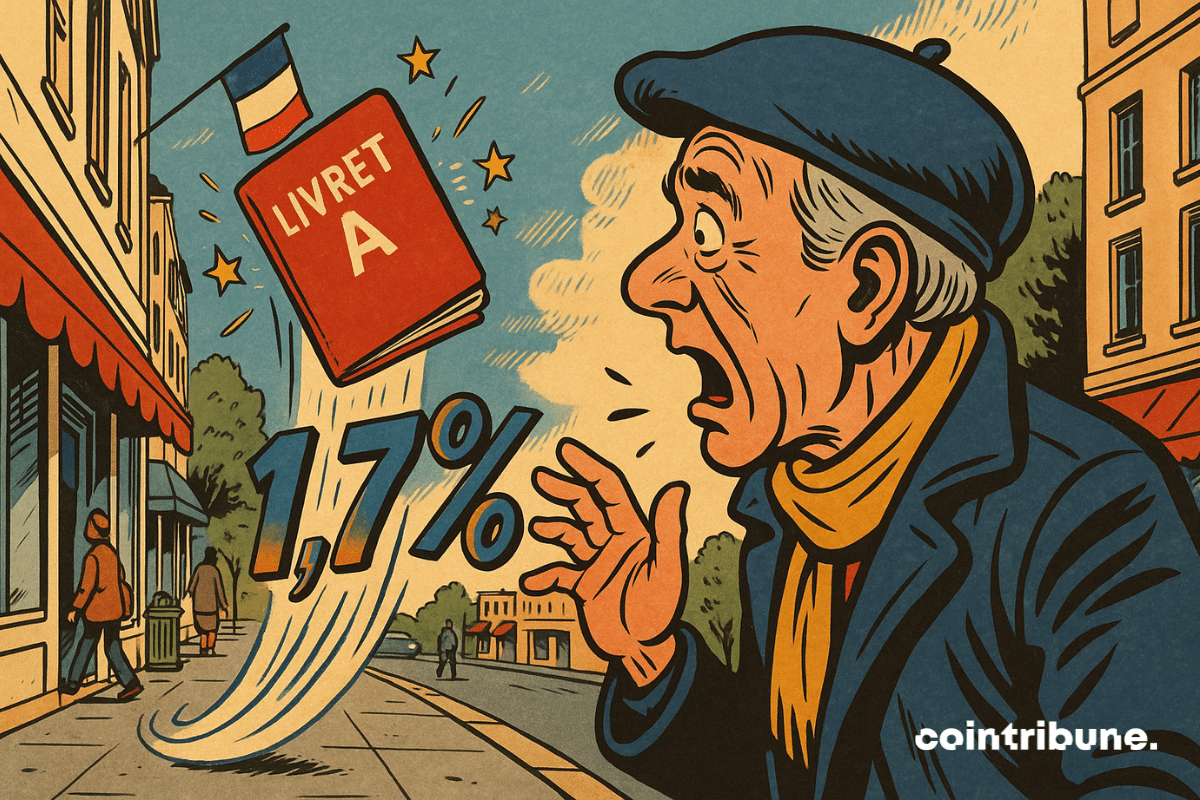

The preferred savings account of the French is about to face a serious setback. The rate of the Livret A, held by more than 55 million people, will drop to 1.7% on August 1, 2025, down from 2.4% today. This is a significant decline, the largest since 2009, validated by the Banque de France and in accordance with the regulatory formula. In an still fragile economic climate, this decision reignites the debate on the profitability of regulated savings and raises questions about the future choices of savers in search of alternative solutions.