Tether, the world’s apex stablecoin issuer, reported a sharp decline in profit in 2025 while continuing to expand its holdings of U.S. government debt. New financial data shows a clear shift toward capital preservation and liquidity as global demand for stablecoins rises. Despite weaker earnings, asset growth remained strong throughout the year. The results confirm Tether’s continued importance to global crypto market activity.

Tether (USDT)

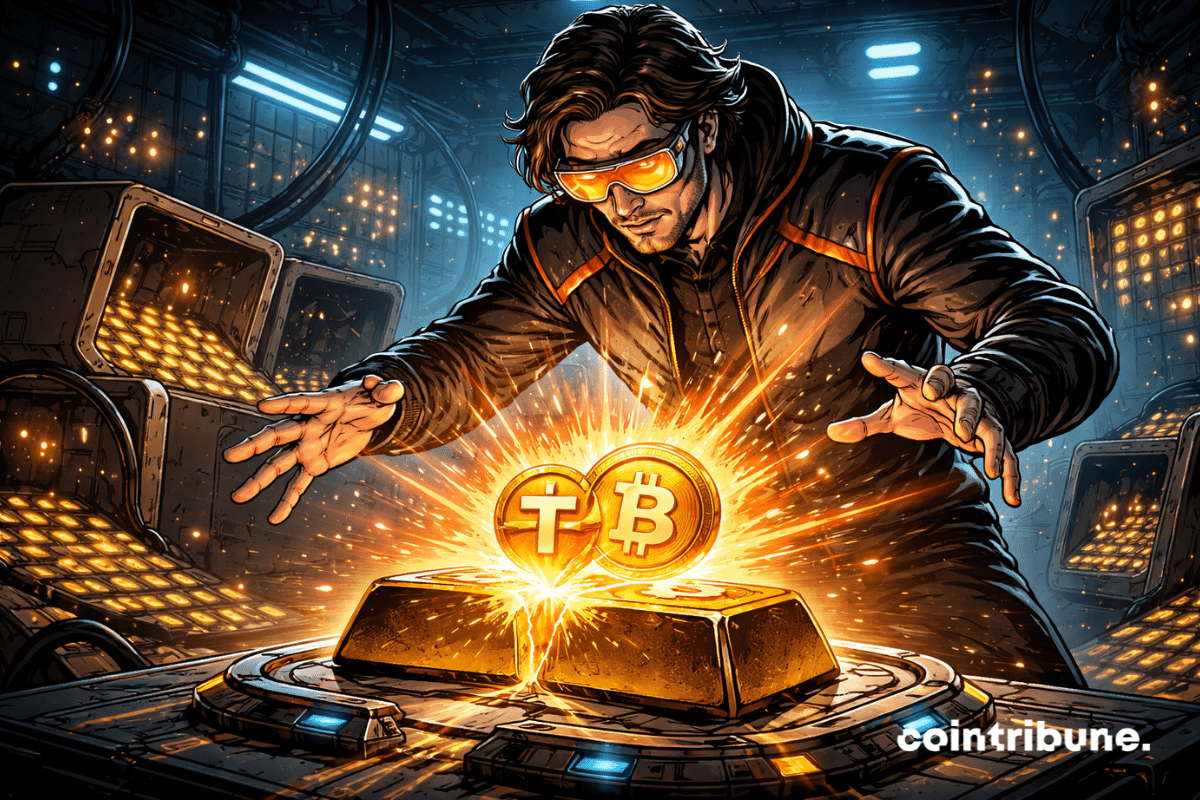

Tether has quietly become one of the world’s largest private holders of physical gold. The issuer of the world’s biggest stablecoin is buying bullion at a pace that now rivals national governments. Executives say the strategy is driven by rising concerns over monetary stability and declining confidence in paper-based assets. The expanding gold reserves also reinforce the backing of Tether’s gold-linked products.

Gold has just crossed 5,311 dollars an ounce, sparking a race to the safe haven. Facing this historic high, two crypto giants adopt opposite strategies. Tether bets on physical gold, Coinbase on derivatives. This divergence is no coincidence. It reveals two visions of the financial future: grounded in the tangible for one, focused on markets for the other. Such a strategic turning point could redefine the balance of power in the crypto ecosystem.

Tether has introduced USAt, a new U.S. dollar–backed stablecoin designed to comply with U.S. federal regulations. The token marks Tether’s first effort to issue a stablecoin specifically for domestic use under a new legal framework. Additionally, the initial exchange listings represent its first public rollout.

When crypto shakes Wall Street: Standard Chartered fears that stablecoins siphon off bank deposits. Subdued panic in glass towers and bankers' cafes.

Ten banks join forces to create Qivalis, a stablecoin designed for fast crypto payments in euros. Details here!

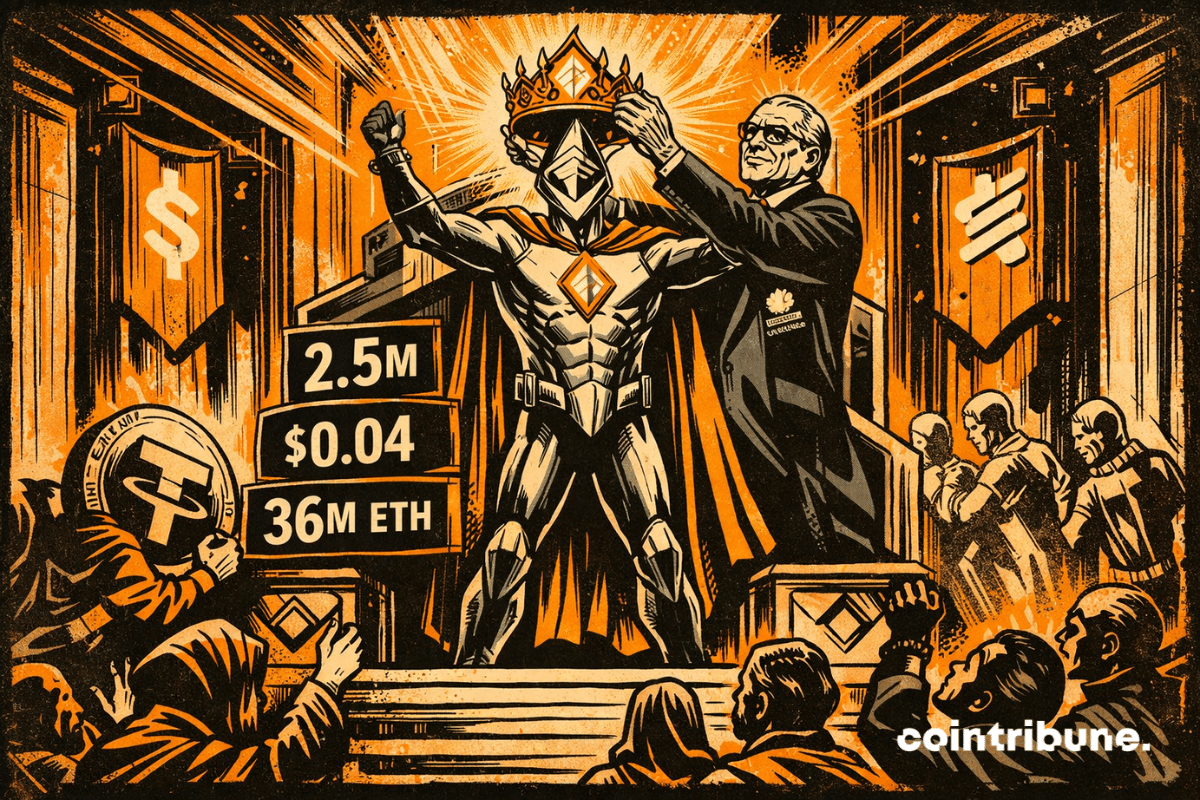

As the year 2026 is just beginning, Ethereum is already breaking transaction records and showing negligible fees. Analysis!

Tether has just launched "Scudo", a tiny unit indexed to its tokenized gold XAUT. The ambition is summed up in one sentence: to make gold as manageable as Bitcoin. Not by changing the nature of the metal, but by changing its mental format.

A stablecoin backed by BlackRock, a crypto ecosystem in superapp mode… what if Jupiter was preparing the discreet invasion of the dollar into our decentralized wallets?

While the market coughs, Tether, on the other hand, is gobbling up bitcoin… A frenzy of crypto-purchasing that intrigues, worries, and could well shake more than one stablecoin in a business suit.

Kalshi saw a sharp rise in trading activity last week, pushing weekly volume to a new high. Data shows the prediction market processed more than $2 billion in trades, placing it well ahead of Polymarket over the same period. Increased demand for sports contracts and broader blockchain access supported the growth.

Venezuela now relies on USDT for most of its oil revenue, helping sustain production and transactions despite ongoing sanctions.

A small test transfer turned disastrous as a user sent nearly $50 million USDT to a scammer in an address poisoning attack.

The Christmas season often raises the same question each year: what gift will have lasting value? For people involved in crypto, interests extend far beyond standard tech gadgets. Crypto users form a global community focused on digital ownership, financial independence, and long-term participation in blockchain networks. And as such, selecting a crypto-related gift shows awareness of these priorities. This article presents practical, beginner-friendly crypto gift ideas suited to different interests while remaining useful long after the holidays.

Cryptos falter, whales buy quietly, and small holders watch their tokens melt away like snow in the sun... Suspense guaranteed until summer 2026?

The stablecoin market hits a historic milestone. For the first time, these fiat-backed cryptos surpass $310 billion in capitalization. A performance that cements their role as an essential pillar in the crypto ecosystem.

Tether, the stablecoin giant, made a staggering $1 billion offer to acquire Juventus. But Exor, the historic shareholder, said no without hesitation. Why this rejection? What consequences for football and crypto? A battle where money isn't everything.

Juventus, a legend of Italian football, could soon change hands for 1.1 billion euros. Behind this crazy offer? Tether, the cryptocurrency giant. A revolution is brewing between sports passion and crypto ambition. Who will emerge victorious from this historic duel between tradition and innovation?

Circle, the issuer of the famous USDC, takes a decisive step by developing USDCx, a stablecoin designed to offer banking privacy to companies and institutions. Developed in partnership with Aleo, this project answers a growing demand: how to benefit from blockchain without exposing transactions to the public?

Tether and other investors provided €70 million to Generative Bionics, helping the startup advance its AI-driven humanoid robots for industrial use.

The International Monetary Fund steps out of its usual reserve and publishes a detailed guide on stablecoins. As the market exceeds 300 billion dollars, the institution believes that regulation alone will not be enough. What strategy does it really advocate?

The European Union wants to entrust ESMA with a key role in crypto supervision. With MiCA, an ambitious reform is taking shape, balancing enhanced security and concerns about innovation. This extension of powers could change everything for investors and platforms. Essential details to know.

While many eyes remain fixed on Bitcoin and Ether, Solana is currently playing a much subtler game. The SOL crypto still holds above the 120 dollar area, but this level is not just a technical support: it is supported by a real shift in liquidity and on-chain supply. However, trader-side demand remains surprisingly timid. And as long as this gap persists, Solana's structural advantage is not fully reflected in the price.

The stability of the market's largest stablecoin is questioned. On November 29, the S&P agency downgraded USDT's ability to maintain its dollar peg. Tether, through its CEO Paolo Ardoino, denounces a biased analysis and defends its figures. This standoff between a central crypto player and a major financial institution reignites the debate on reserve solidity and trust in the ecosystem.

Bitcoin and USDT maintain an inverse relationship that directly influences crypto market movements. According to Glassnode, this negative correlation could well dictate the trends towards the end of 2025. An exclusive analysis that sheds light on investors' strategies and projections for December. Not to be missed.

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

When tokens want to play treasury bonds, the BIS panics. Crypto-confidence or crypto-catastrophe? Finance views stablecoins as a Pandora's box ready to open.

Ripple’s US dollar–pegged stablecoin, RLUSD, has rapidly climbed the ranks to become one of the top ten stablecoins by market capitalization. Less than a year after its December 2024 launch, RLUSD has surpassed the $1 billion mark—a milestone that reflects growing confidence in Ripple’s expanding digital asset ecosystem.

Tether has just crossed a dizzying threshold: more than $10 billion in profit in just nine months. Behind this extraordinary figure lies the rise of a key player in the crypto ecosystem. Issuer of the USDT, the most used stablecoin in the world, Tether impresses as much as it raises questions. This record profitability, revealed in its latest attestation report, triggers as much enthusiasm as concerns, especially in terms of transparency and regulation.

Tether, the world’s largest stablecoin issuer, is poised for another record year of profitability, reinforcing its dominance in the digital dollar market. As the global demand for blockchain-based payment systems accelerates, the company continues to stamp its dominance in the crypto space.